Our Most Valuable and Popular Blog Posts of All Time

In more than eight years of regular blogging about dividends, we've had a handful of posts stand out above the rest.

We compiled our most popular and valuable posts of all time to help new and experienced dividend investors better manage their portfolios.

The posts on this list will arm you with actionable research tips, stretch your thinking about the power of dividends, and cut through the noise that unfortunately fills the financial sector.

We compiled our most popular and valuable posts of all time to help new and experienced dividend investors better manage their portfolios.

The posts on this list will arm you with actionable research tips, stretch your thinking about the power of dividends, and cut through the noise that unfortunately fills the financial sector.

If you're wanting even more content, we recommend checking out our complete library of investment guides.

It was fun looking back and putting this list together, and we hope it’s as helpful for you as it was for us...

Top 10 Pieces of Investment Advice from Warren Buffett

Warren Buffett's timeless wisdom applies perfectly to a long-term dividend growth strategy. This isn't a no-frills list of Buffett quotes but a guide filled with practical tips on how to apply our 10 favorite investment principles rooted in concepts shared by the Oracle of Omaha.

How to Build a Dividend Portfolio

Follow these simple, practical guidelines to assemble a quality dividend growth portfolio that should require little ongoing tinkering. We even provide an example portfolio you can download.

How to Live Off Dividends and How Much You Need to Retire

Warren Buffett said that you will work until you die if you don't find a way to make money while you sleep. Dividends are one way to do this. If you're wondering how this simple strategy can help you retire, this article is for you.

2023 Monthly Dividend Stocks: All 66 Ranked and Analyzed

Most stocks pay dividends quarterly. These companies pay every month. We analyzed every monthly dividend stock and share our favorites, in addition to providing up-to-date Dividend Safety Scores so you can find the most secure income investments.

Top 25 High Dividend Stocks Yielding 4% to 10%

If you're thinking about using dividends to generate retirement income, higher yields can increase your spending power. But only if they are safe.

We did the heavy lifting here to share research on 25 dividend stocks that yield over 4% and appear positioned to protect their payouts.

We did the heavy lifting here to share research on 25 dividend stocks that yield over 4% and appear positioned to protect their payouts.

2023 Dividend Aristocrats: All 67 + Our Top 5 Picks

Dividend aristocrats are iconic S&P 500 companies that have paid higher dividends for at least 25 consecutive years. Grab the entire list of aristocrats and read analysis on our five favorites.

2023 Dividend Kings: All 50 + Our Top 5 Picks

Only 50 companies have paid higher dividends for 50 straight years or longer. Known as dividend kings, we take a closer look at these resilient businesses including our five favorites. You can also download a spreadsheet containing up-to-date information on all 50 kings.

Retirement Planning Strategies: 4% Rule vs. Dividend Stocks

Investors have choices when it comes to generating income in retirement. The 4% withdrawal rule is one option. But leaning on dividend stocks instead can provide some unique benefits.

Learn about these two approaches from Dave Van Knapp, who has been retired and cashing dividend checks for over two decades.

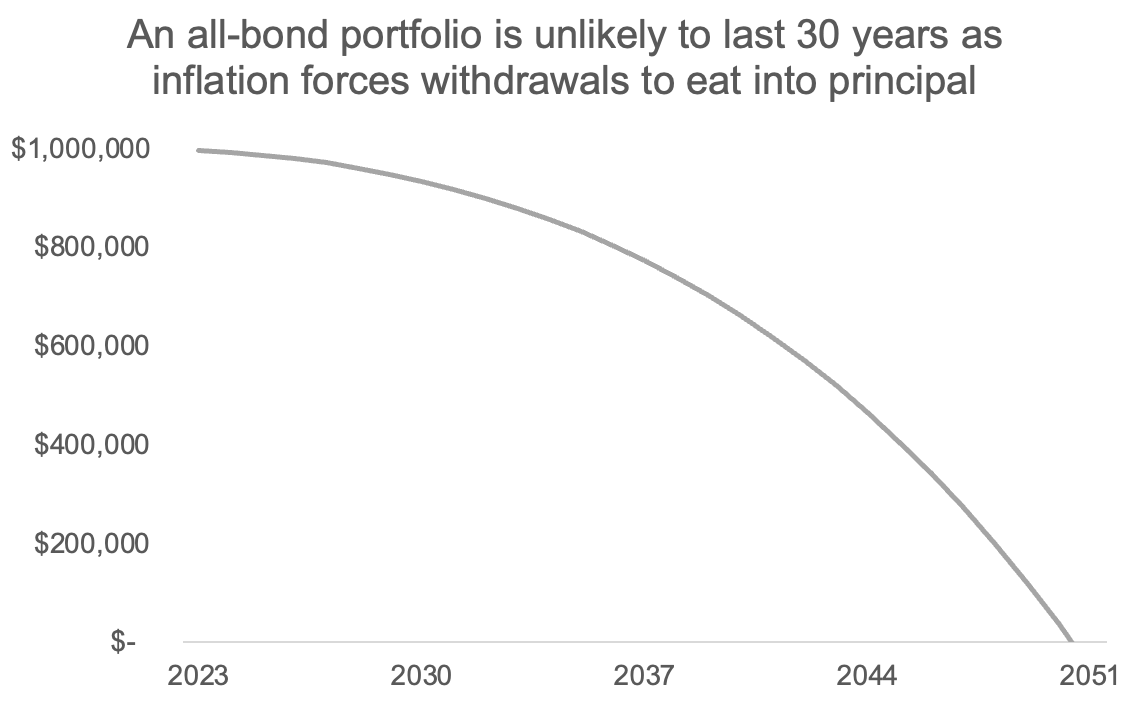

Dividend Stocks vs. Bonds for Retirement Income

Interest rates are the highest they have been in over two decades. Why not move to an all-bond portfolio to grab 4% to 6% risk-free rates?

There is more to this strategy than meets the eyes. But higher rates have made a bond-and-dividend stock portfolio a lot more appealing. We explain how these asset classes can be used together for a low-stress retirement.

2023 Best Dividend ETFs: Top 10 Income Funds Ranked

The best dividend ETFs charge low fees, maintain healthy diversification, keep turnover low, and track benchmarks that apply some filters for business quality and dividend safety. We share analysis on our 10 favorite dividend funds that meet this set of criteria.

I Hope These Posts Are Valuable To You

It's been an incredible journey helping so many dividend investors since I stepped away from my comfortable investment management career in 2015.

I'm excited to continue working on Simply Safe Dividends for years to come and couldn't do it without the support of our members and readers.

I hope this post helps you become a better dividend investor, and feel free to reach out if we can ever help you with anything.

I'm excited to continue working on Simply Safe Dividends for years to come and couldn't do it without the support of our members and readers.

I hope this post helps you become a better dividend investor, and feel free to reach out if we can ever help you with anything.

Thanks for reading!

Brian Bollinger

President, Simply Safe Dividends

Brian Bollinger

President, Simply Safe Dividends