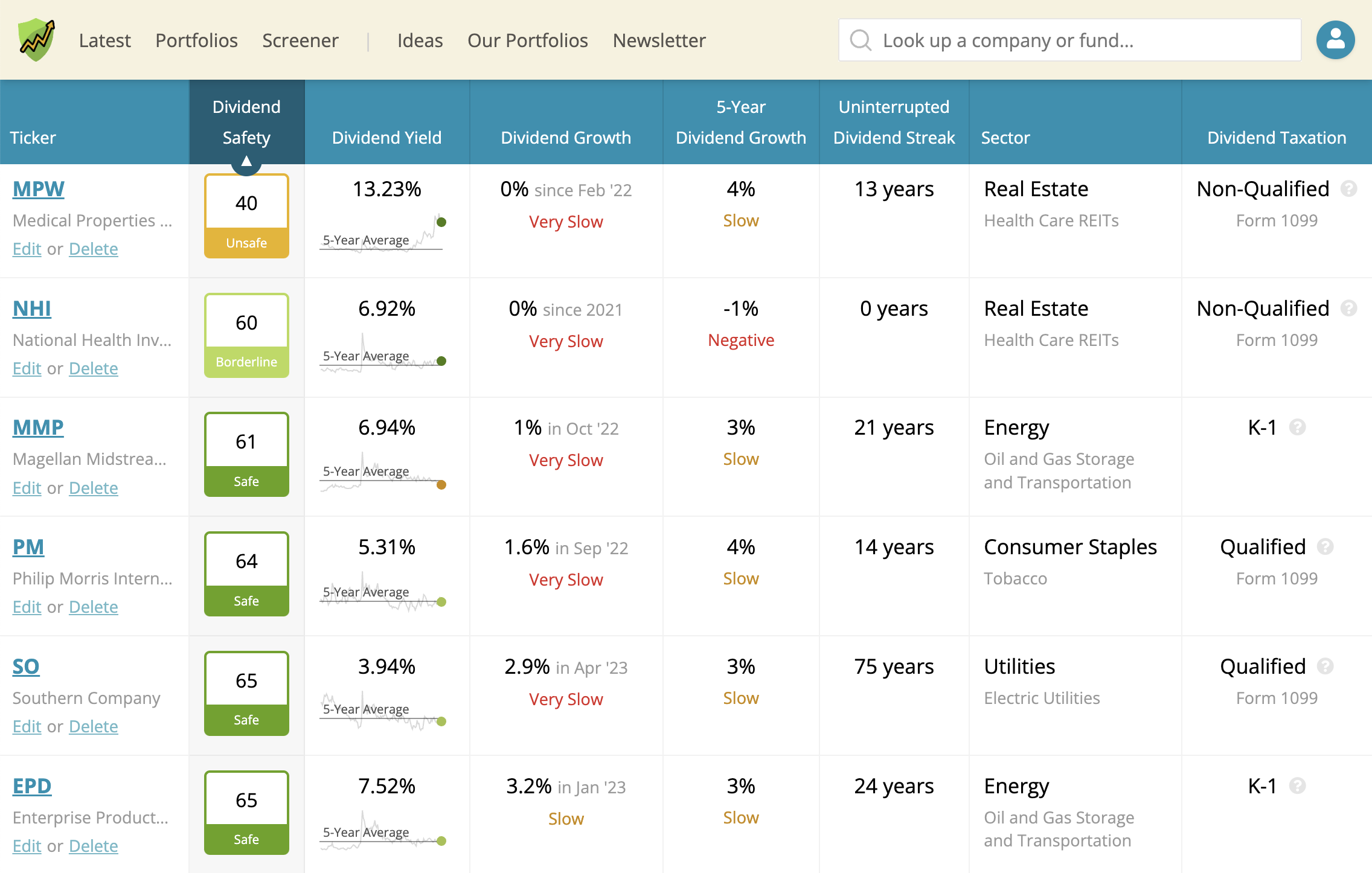

Dividend Safety Scores™

Led by our founder, a CPA and former equity analyst, our scores analyze payout ratios, balance sheets, company news, and more to predict a company's dividend risk. Ratings are available to subscribers.

-

0 - 20Very Unsafe

- High risk of being cut

-

21 - 40Unsafe

- Heightened risk of being cut

-

41 - 60Borderline

- Moderate risk of being cut

-

61 - 80Safe

- Unlikely to be cut

-

81 - 100Very Safe

- Very unlikely to be cut

Our real-time track record

97% of dividend cuts caught in advance

As straight shooters, we maintain a public track record of how our ratings have performed. Since our scoring system's inception in 2015, investors who stuck with companies that scored above 60 (our Safe threshold) would have avoided 97% (886 of 906) of dividend cuts that've occurred.

The scores below reflect our rating before the cut was announced, demonstrating the predictive value of Dividend Safety Scores™.

-

21Unsafe

-

Greystone Housing (GHI) cut its distribution by 17%. The affordable-housing bond investor needed to further realign its payout with what the business was actually earning. The partnership is exiting apartment equity investments and refocusing on its core tax-exempt mortgage revenue bonds, and the lower distribution should better match cash flow going forward.

-

15Very Unsafe

-

Ready Capital (RC) slashed its dividend by 92%. The commercial mortgage REIT's profits were under pressure as its multifamily lending business continued facing challenges from higher interest rates and lower rent growth. Nearly eliminating the dividend will free up capital to strengthen the firm's balance sheet.

-

19Very Unsafe

-

Monroe Capital (MRCC) cut its dividend by 28%. The business development company was preparing to sell substantially all of its investment portfolio as part of a planned asset sale and merger in 2026, leaving it with mostly cash rather than income-producing loans. The lower payout reflected this transition away from being an ongoing lender and helped align distributions with capital expected to be returned to shareholders.

Industry expertise

Overseen by a CPA and former equity analyst

Dividend Safety Scores™ are not some black-box quant metric. Human input is the bedrock for assigning and monitoring our ratings.

Our founder, Brian Bollinger, is a CPA and former equity analyst at a multibillion-dollar investment firm. Brian has spent thousands of hours researching companies and digging into the weeds of financial statements.

In 2015, Brian developed Dividend Safety Scores™ by going through our coverage universe brick-by-brick, studying each industry and business to cement the metrics that matter most. Most of Brian's time is spent monitoring our coverage for material changes in dividend risk.

Rigorous analysis

Every stone is turned over

Dividend Safety Scores™ predict dividend risk over a full economic cycle by analyzing the most important metrics for dividends, including:

- Payout ratios

- Debt levels and coverage metrics

- Recession performance

- Dividend longevity

- Industry cyclicality

- Free cash flow generation

- Forward-looking analyst estimates

Our analysts take all of this information into account as well as the latest company news, industry developments, and key business model drivers to assign Dividend Safety Scores™ between 0 and 100.

All of the financial data we rely on is delivered to us daily by Standard & Poor's (S&P), one of the world's leading financial data vendors.

Up-to-date ratings

Quarterly reviews, continuous monitoring

We're notified internally if a company's fundamentals experience a change that could alter its dividend risk profile. We'll then dive in to investigate. We'll review the latest earnings report, skim call transcripts, and scrutinize the firm's business model to determine whether a score change is prudent.

At a minimum, all ratings are reviewed after quarterly earnings. If material news (e.g. a lawsuit) comes out between earnings, we'll initiate a review. Published review dates make it crystal clear how up-to-date a score is.

Time-tested results

Validated during the pandemic

The pandemic threw a curveball as swaths of the economy shut down and the sharpest economic contraction in U.S. history ensued. An astonishing 25% (334 out of 1,313) of companies we rated cut their dividends in 2020.

Once the pandemic hit, we worked quickly to incorporate new information into our ratings. When the dust settled, our Safe and Very Safe buckets had avoided all but 8 (or 97.6%) of the cuts in 2020.

Moreover, our scores demonstrated their long-term predictive value.

Using our pre-pandemic ratings as of January 2020 and ignoring any score changes we made as new information rolled in, 93% of the 334 dividend cuts would have still come from firms that scored below our Safe threshold.

Here's a breakdown of the 334 cuts by score bucket as of January 2020:

Pre-pandemic ratings

Here's a breakdown of the 334 cuts by score bucket as of January 2020:

| 2020 Performance | Very Unsafe |

Unsafe |

Borderline |

Safe |

Very Safe |

Total |

|---|---|---|---|---|---|---|

| # of Stocks in Bucket | 187 | 179 | 330 | 320 | 297 | 1,313 |

| # of Dividend Cuts | 96 | 91 | 101 | 33 | 13 | 334 |

| % of Stocks That Cut | 51% | 51% | 31% | 10% | 4% | 25% |

For a more thorough analysis, read our full pandemic review.

Time-saving clarity

Interwoven throughout the site

At a glance, you'll be able to identify holdings with heightened dividend risk. Got a new investment idea? Vet the company in seconds by looking up its rating. Need more ideas? Screen our coverage of 1,000 rated companies.

Email notifications

Alerts keep you in the know

If we issue a change to a score in your portfolio, you'll receive an email notification along with our rationale for the change. No surprises or quantitative mumbo-jumbo. Just clear, concise research crafted by real analysts so you'll never feel in the dark.

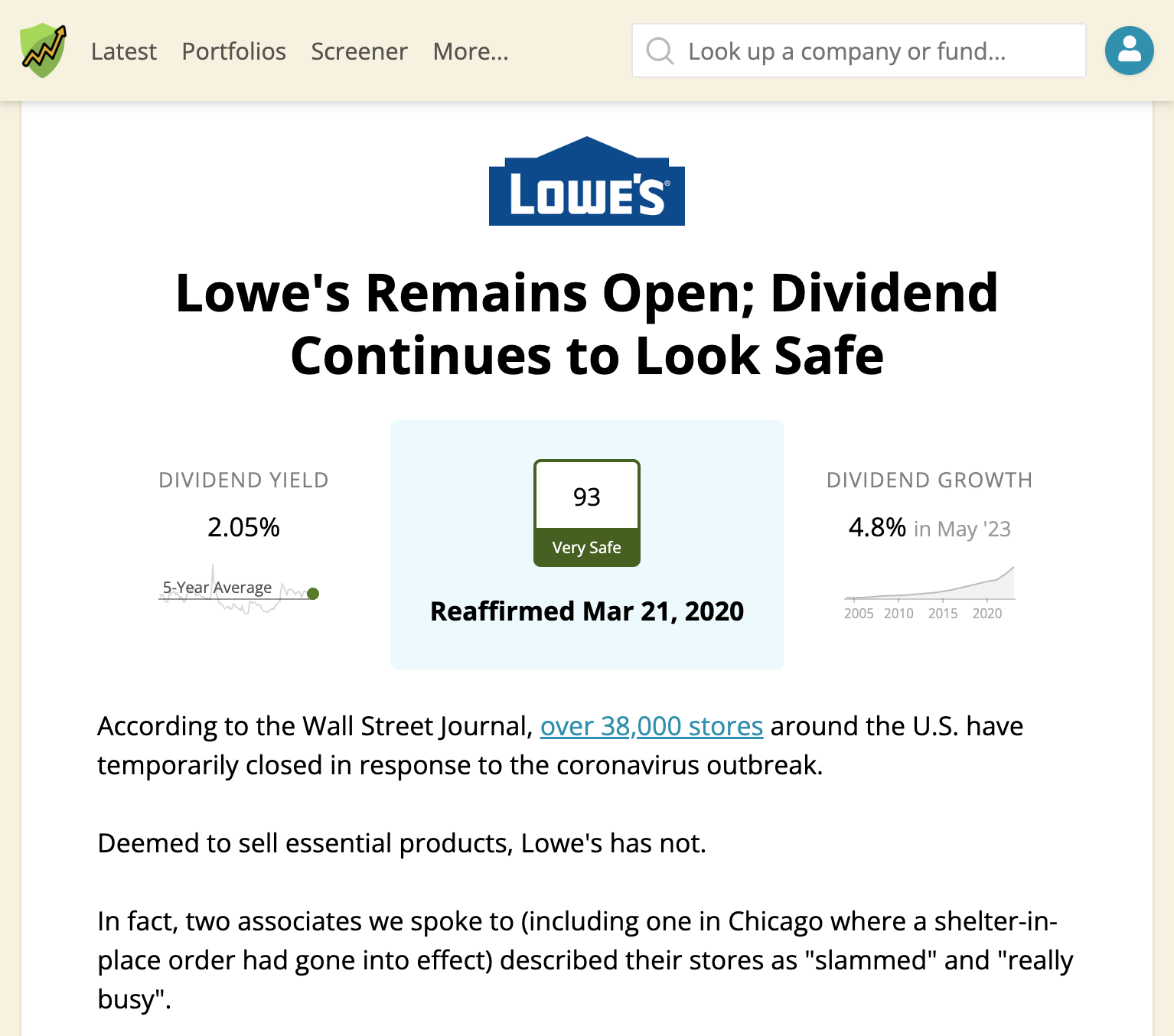

Thorough explanations

Paired with in-depth research

More than just a number, ratings are often published alongside rigorous research reports. That way, you can make informed decisions. Many customers find as much value in our research as in our ratings.

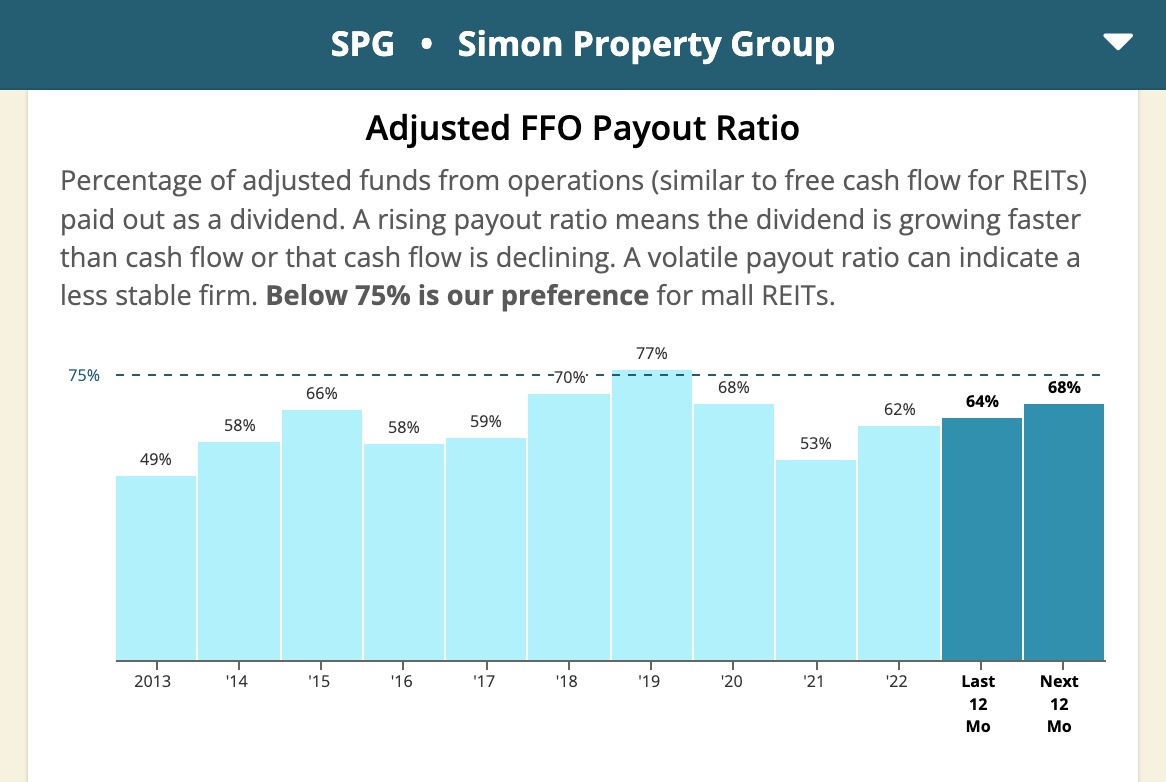

Tailored insights

Industry nuances baked in

Our ratings recognize meaningful differences between industries. For example, a utility company enjoys more stable earnings than a steelmaker, so a utility can afford to maintain a higher payout ratio. We also utilize industry-specific metrics, such as AFFO for REITs and DCF for MLPs.

Ready to analyze your income's safety?

Check out our Dividend Safety Scores™, tracking tools, research, and more with a 2-week free trial. All you need is an email.