Proven dividend tools and research

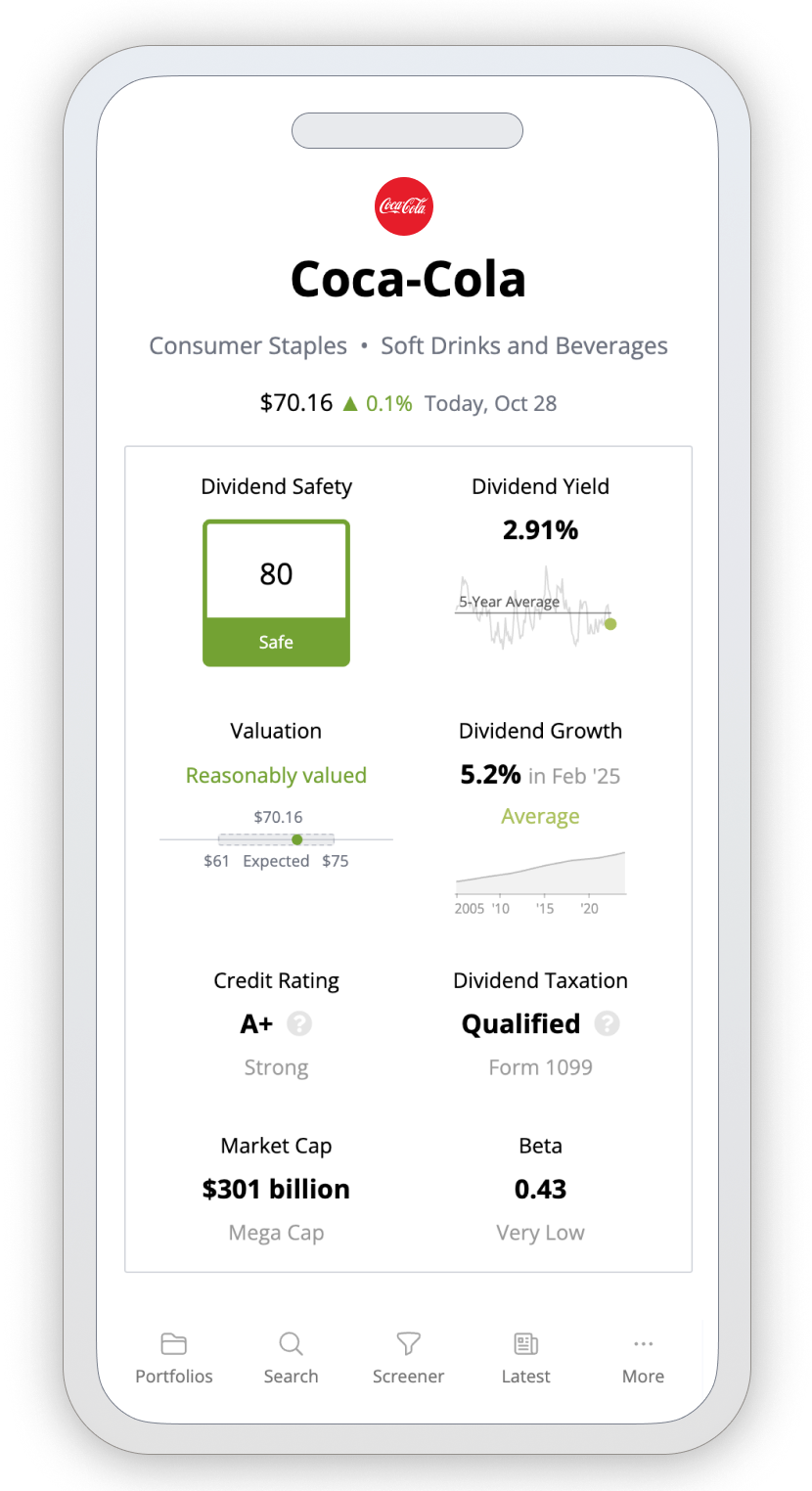

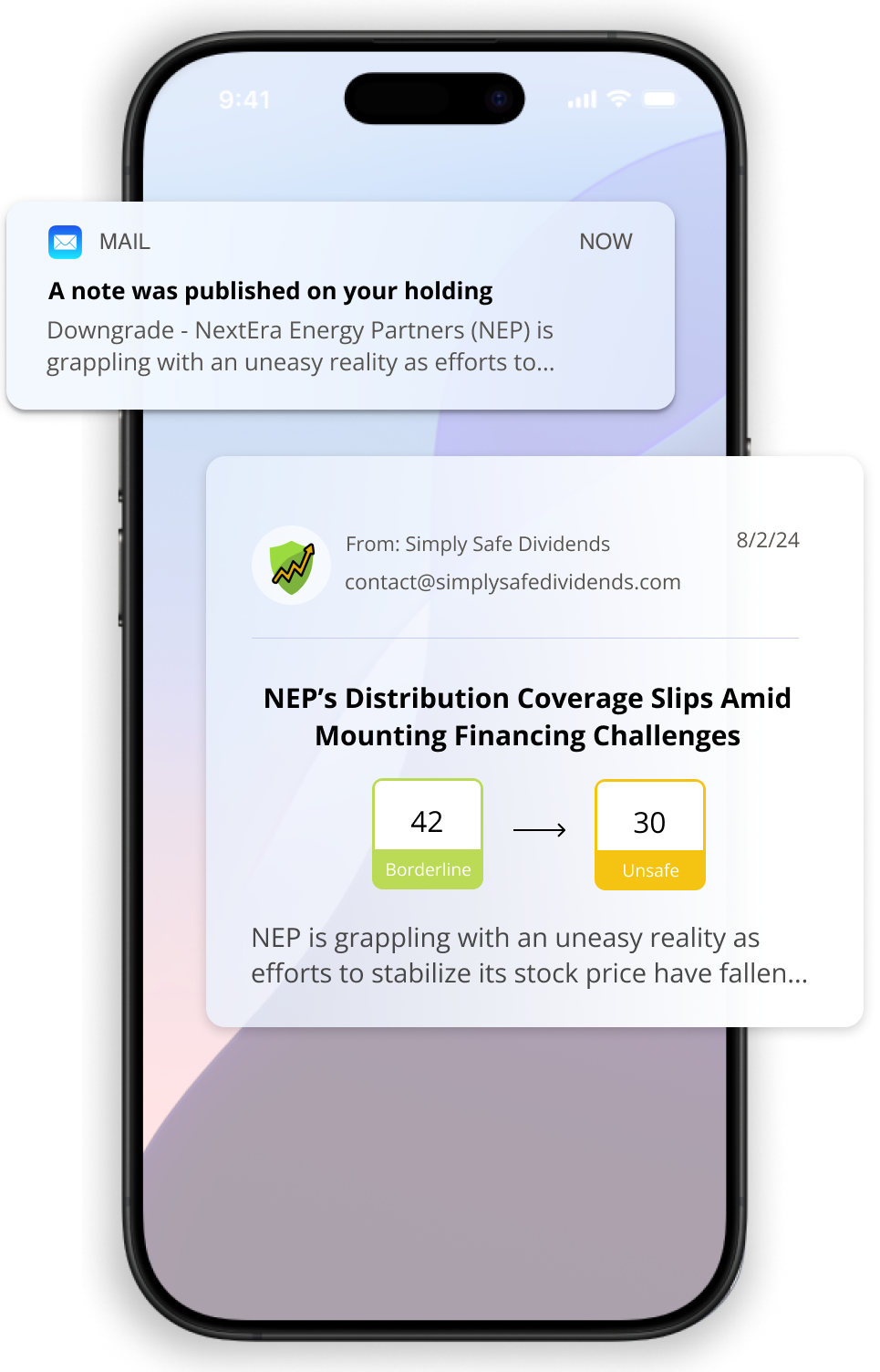

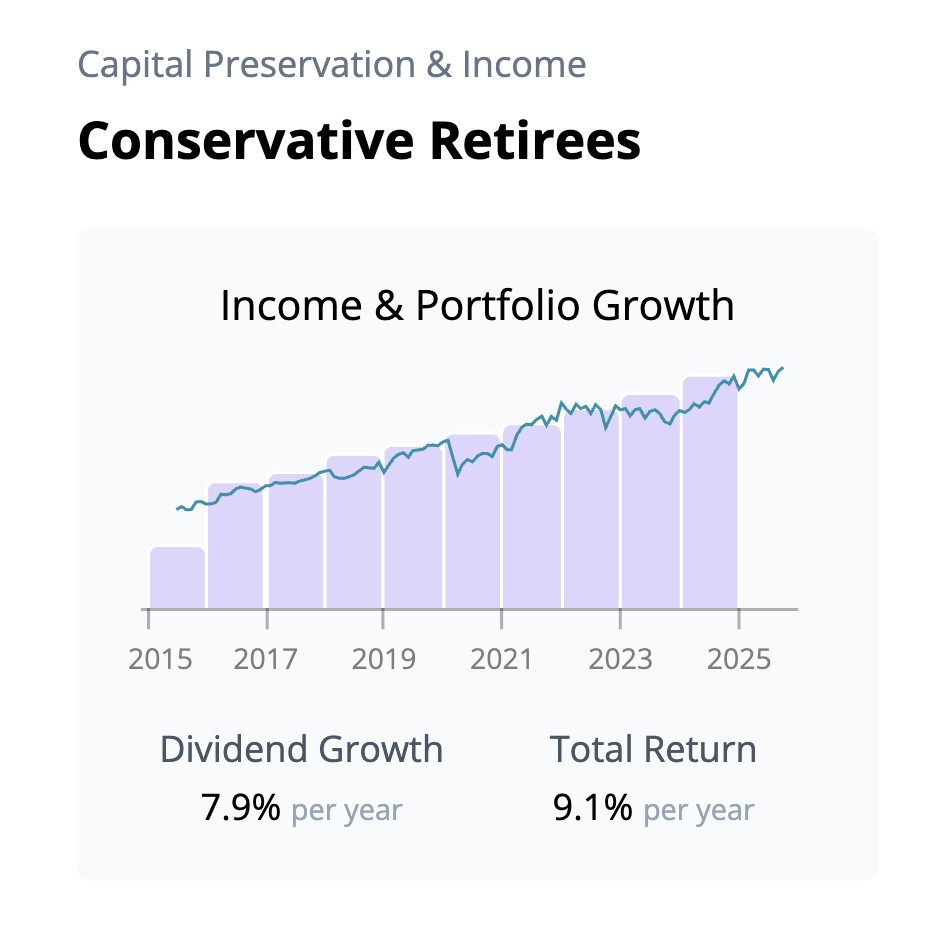

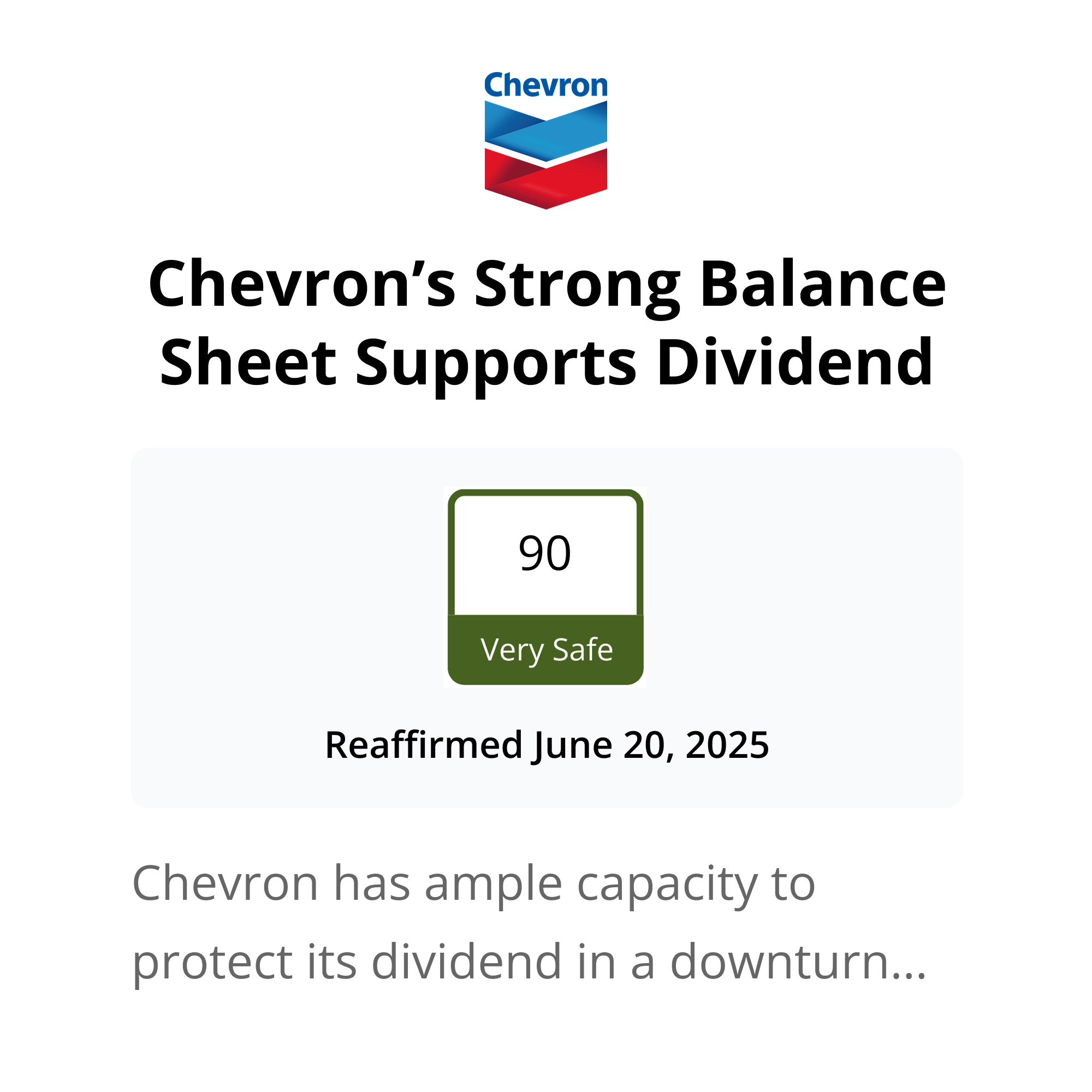

Since 2015, our Dividend Safety Scores™ (97% of cuts avoided), elegant portfolio tracker, and in-house research have served as a trusted one-stop shop for thousands of income investors.

Since 2015, our Dividend Safety Scores™ (97% of cuts avoided), elegant portfolio tracker, and in-house research have served as a trusted one-stop shop for thousands of income investors.

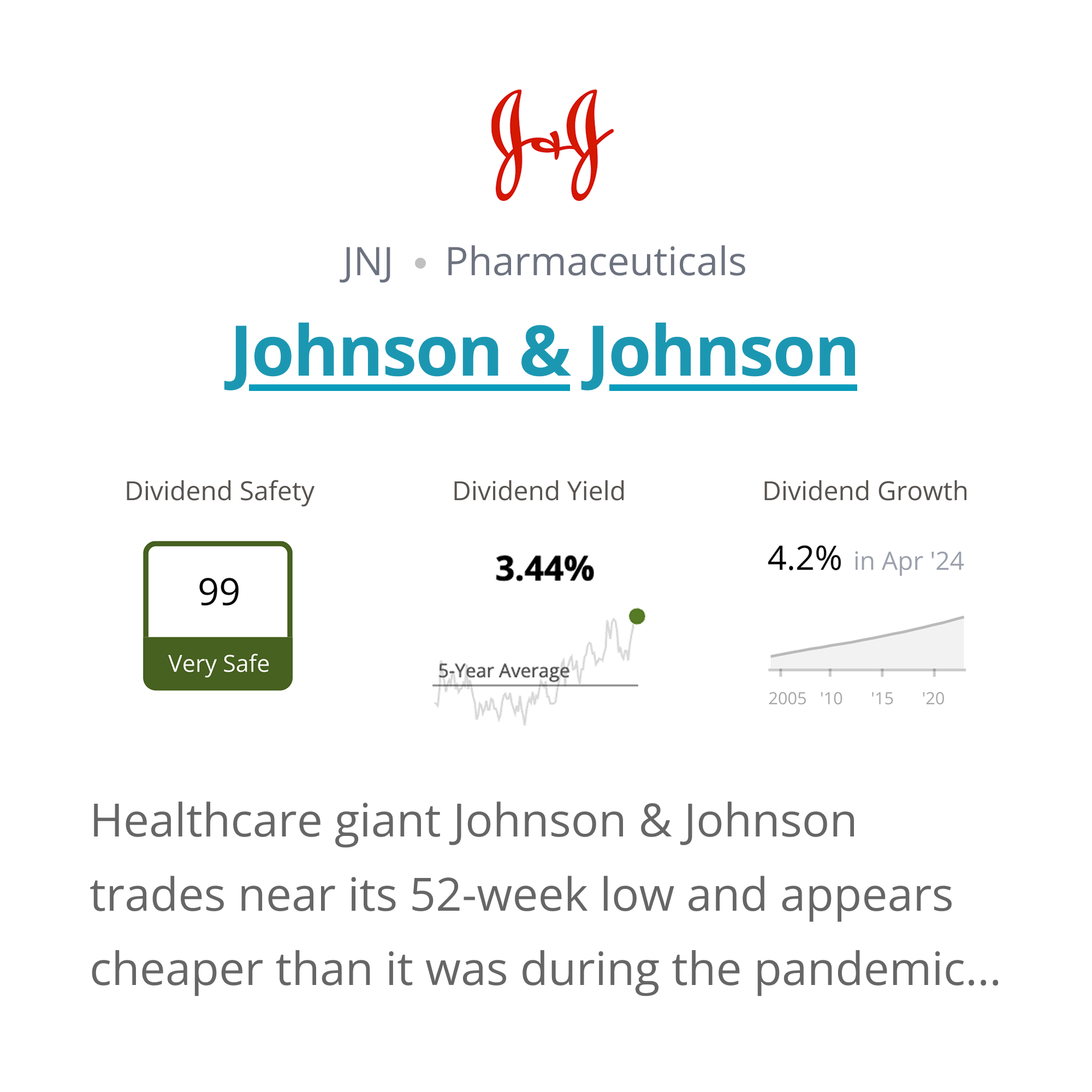

Our analysts rate the payout strength of companies and closed-end funds to help you avoid dividend cuts and stay confident in your income.

Learn more about our scores

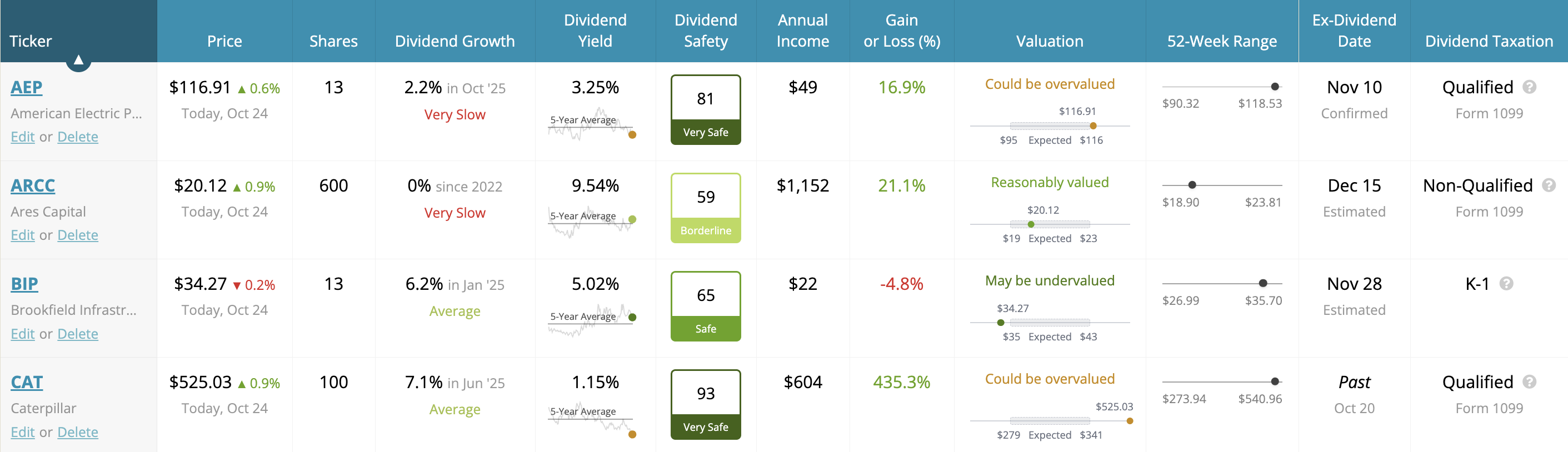

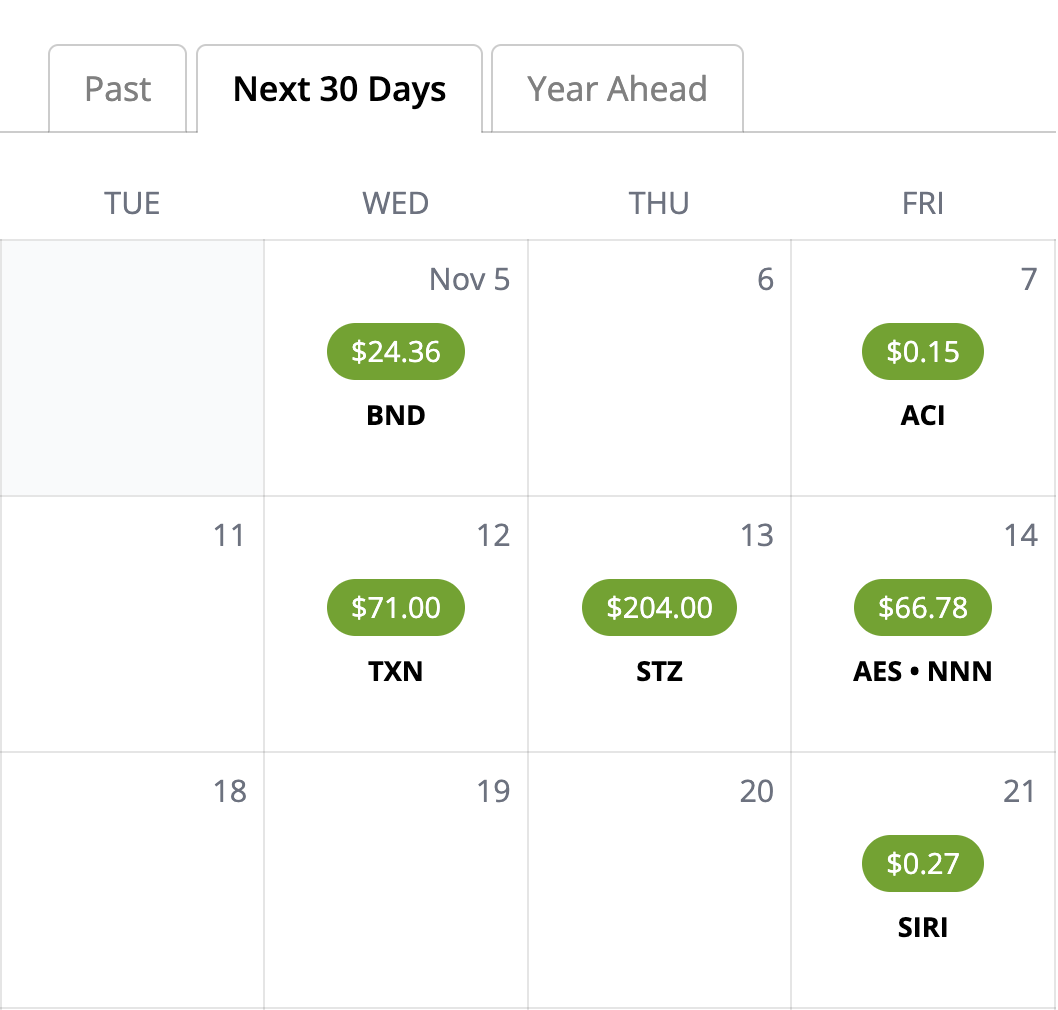

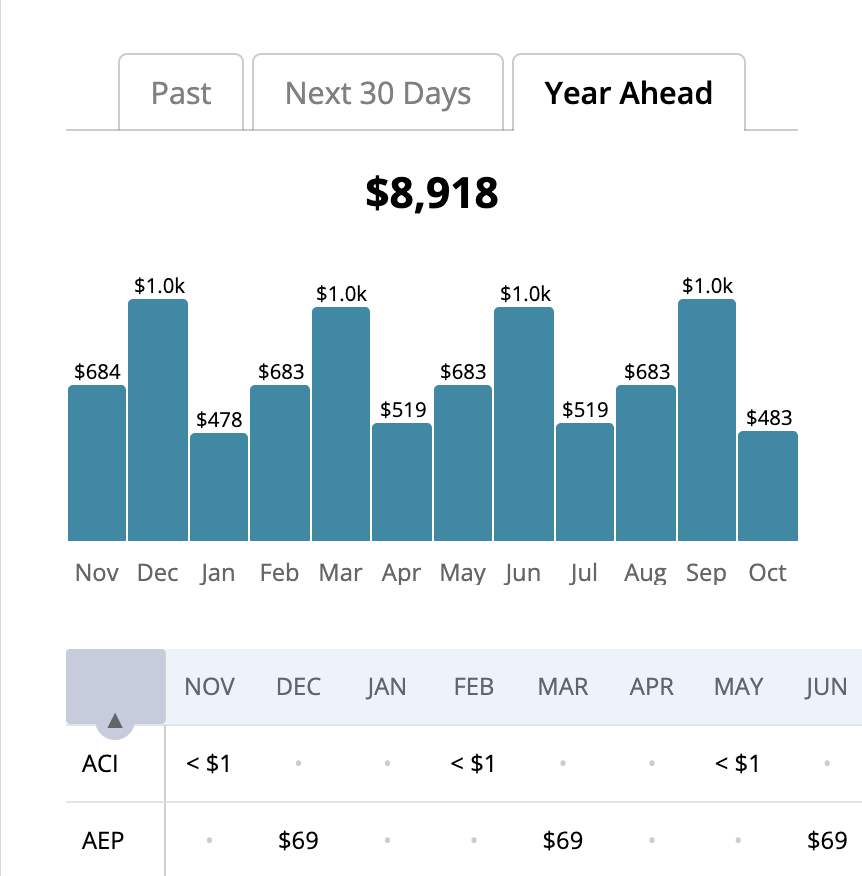

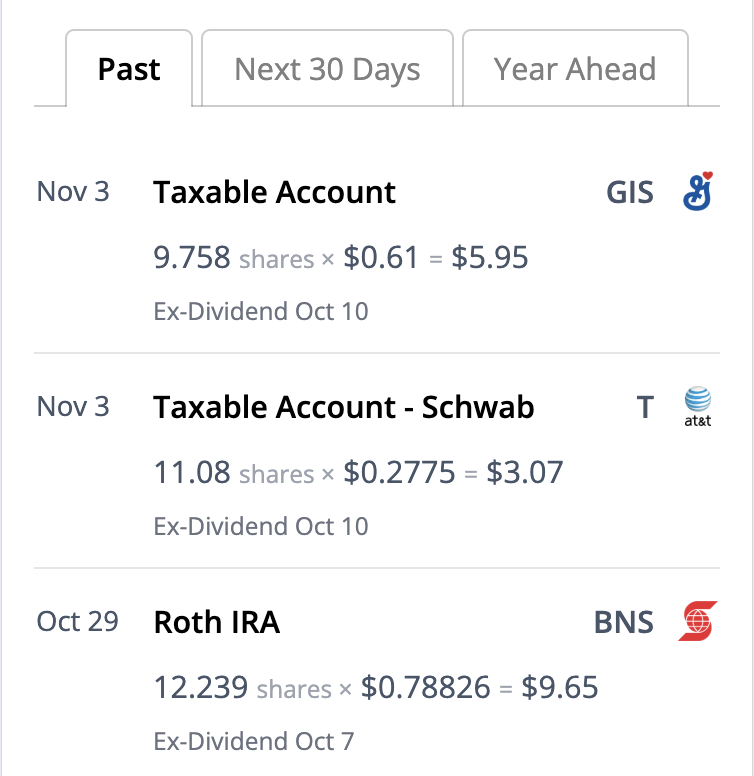

Get a complete view of every account and holding — updated in near real time.

Customize columns to analyze your U.S. stocks, funds, bonds, and CDs.

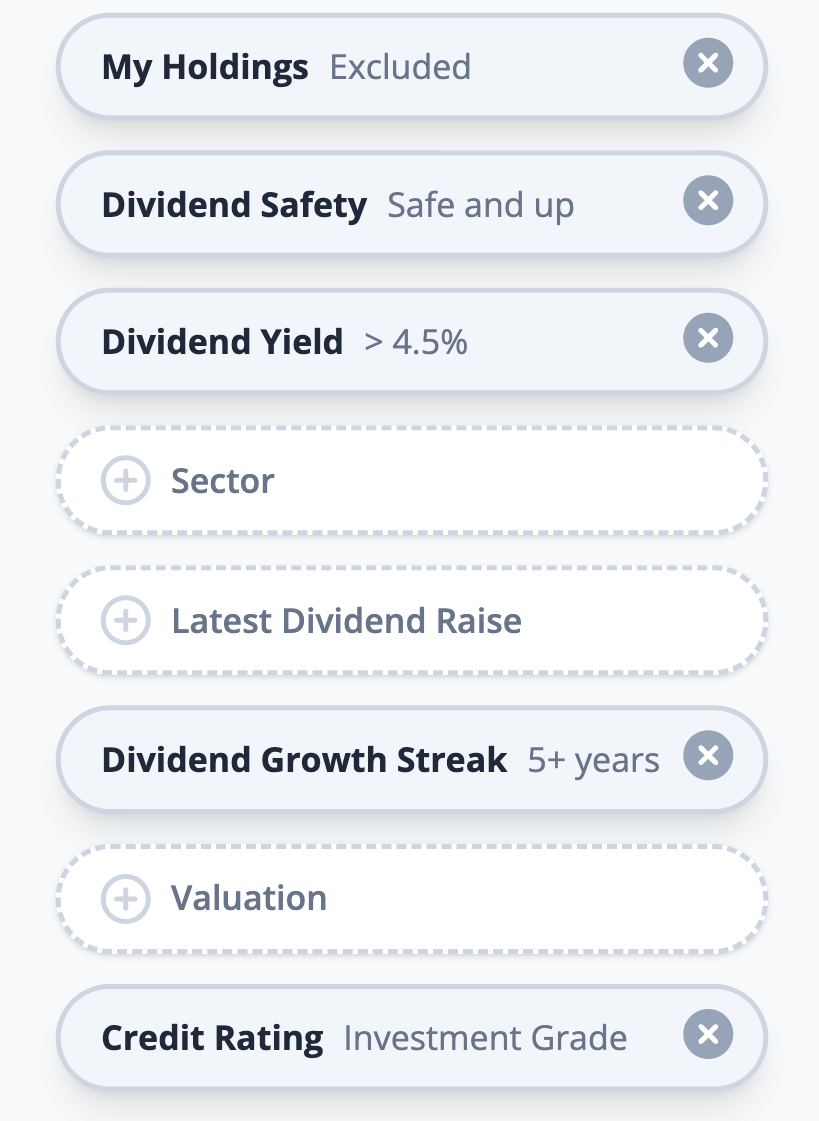

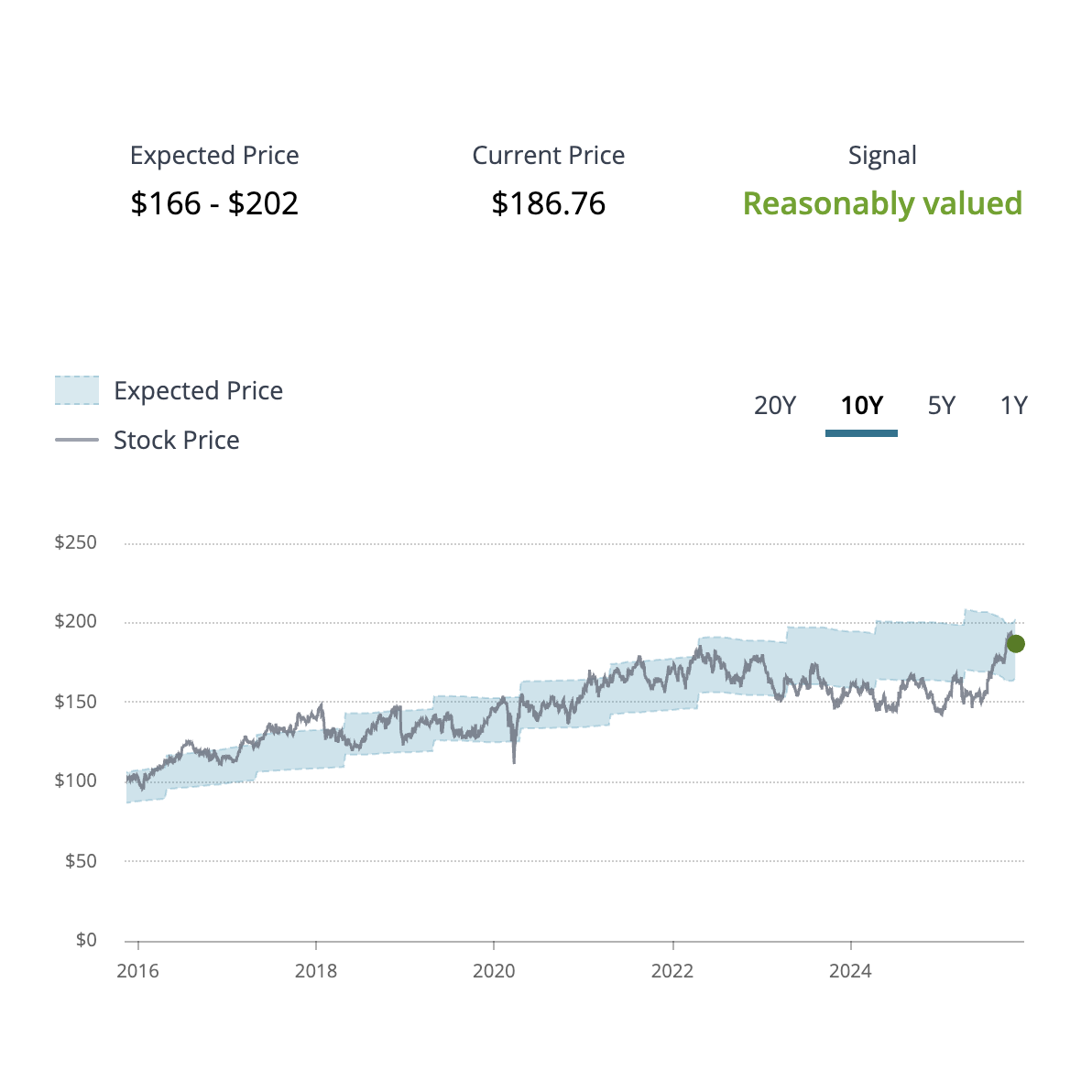

Whether you’re building a dividend portfolio from scratch, replacing a holding, or just looking to put some cash to work, we've got you covered.

Make confident, well-informed decisions using our clear metrics and research.

Brian Bollinger started Simply Safe Dividends in 2015 after working as an equity analyst at a multibillion-dollar investment firm near Chicago. Brian’s a straight shooter and sets the tone for everything we do.

Learn more about our teamMany services tout market-crushing stock picks and stuff that yields 10%. That’s not us. We maintain realistic expectations, encourage minimal trading activity, and keep investors focused on safe income and capital preservation.

We've received countless unsolicited emails from customers with stories of how our service has helped them. Here are just a few of their notes:

"Three years ago I discovered your service and used it to restructure my portfolio for retirement. It allowed me to confidently focus on buying high quality dividend paying stocks while understanding the return and risk of each. Features like your research alerts, notification of dividend increases and cuts, monthly summaries of changes to my stocks, and the new sections that summarize "My Shares" and "Research Metrics" make it even easier to stay on top of the market.

As a result, I retired last year confident that we could fund our retirement from dividends and other investments without having to touch principal. When the market dropped [in March 2020], we didn't panic. I continue to work with my full service broker of 20 years and he marvels at the research and wealth of information at my fingertips. When my 88-year-old mother decided to drop her fee-based advisor and make her own investing choices, I bought her a Simply Safe Dividends subscription. It's a service and peace of mind we both could not do without."

"Brian,

I just wanted to comment on the quality and effectiveness of the Simply Safe Dividends Portfolio Tool. After 33 years and now retired as a stock broker from the financial services industry, this tool is the best I have seen and used.

Thanks for all of your outstanding work and effort you bring in your newsletter and your straight forward stock/company research."

Your service is the most incredible value I have ever experienced. No one else comes in even close. If I was not a subscriber in these interesting times there would be many, many sleepless nights. Since subscribing I have been able to reallocate my stock investments to safer waters and have definitely been spared from "hitting a reef" with several of my previous choices. I will undoubtedly have a better retirement because of your in depth analysis as well as the education you have provided."

"Brian,

I am so pleased to have found your company. Leading up to my retirement in 2018, I liquidated all of my non-stock investments and wanted to set up a retirement plan that revolved around dividend paying stocks.

I almost placed my money in a Fidelity Managed account with a goal of a 3% dividend return. This managed account had an almost 1% management fee. I started searching for a tool that would allow me to search for dividend paying stocks that were safe and had prospects for growth, that I could manage myself and save on the management fee.

Initially I had anticipated about a 3% dividend return, but your matrix has allowed me to build a portfolio that I feel is safe and at the same time is returning a dividend of about 4.5% Your analysis is thorough and exhaustive. I love being in control and making my own decisions based upon good analysis.

Thanks to your service, I am funding our retirement without having to touch any principal, at a rate that is still allowing me to add to my savings. I used to live and die daily on the ups and downs of the market. Now I just smile, knowing that my dividends keep pouring in no matter what the market does."

"I'm a long-time investor with a goal of dividend income. Over the last several years I've paid a fee to an advisor to manage about half our assets. I've been a subscriber to Simply Safe Dividends for several months. Recently I had the confidence to leave my advisor because of the superb analysis, research and tracking tools that you provide. I recommend Simply Safe Dividends all the time."

"Hi Brian

Just a short note of introduction and to say thank you for the work that you do. I’ve been an avid follower and subscriber to your site for the past 2 years or so and it has changed my (investing) life. I’m 56 years old, married to my wife of 32 years and our kids are on their own. We are looking forward to an early retirement and are fortunate enough to have amassed a nice nest egg to enable this.

I could write volumes about the benefits I’ve reaped and the control with which I’ve been empowered – I’m sure you hear this from many of your subscribers. Your research and articles are top notch and the tools are not only invaluable, but noticeably improving all the time. I’ve found nothing that comes even close.

I’m not one who usually writes notes like this or even does reviews, but I’ve often thought of your work with gratitude and wanted to let you know. And the greatest compliment I can give you are the many referrals to my friends, relatives and just about anyone who has a shared interest in dividend income investing.

Thank you and keep up the great work!"

"Brian, I just wanted to let you know your website has been invaluable in managing my retirement portfolio. The recent market decline has clearly proven the value of dividend investing. People are quick to complain but sometimes fail to provide feedback on a great product. I can truthfully say that I have made a significant amount of money, thanks to the data and narratives on your website and for that I thank you. I did a lot of research before subscribing to your service and nothing comes close to the quality and comprehensiveness of your service.

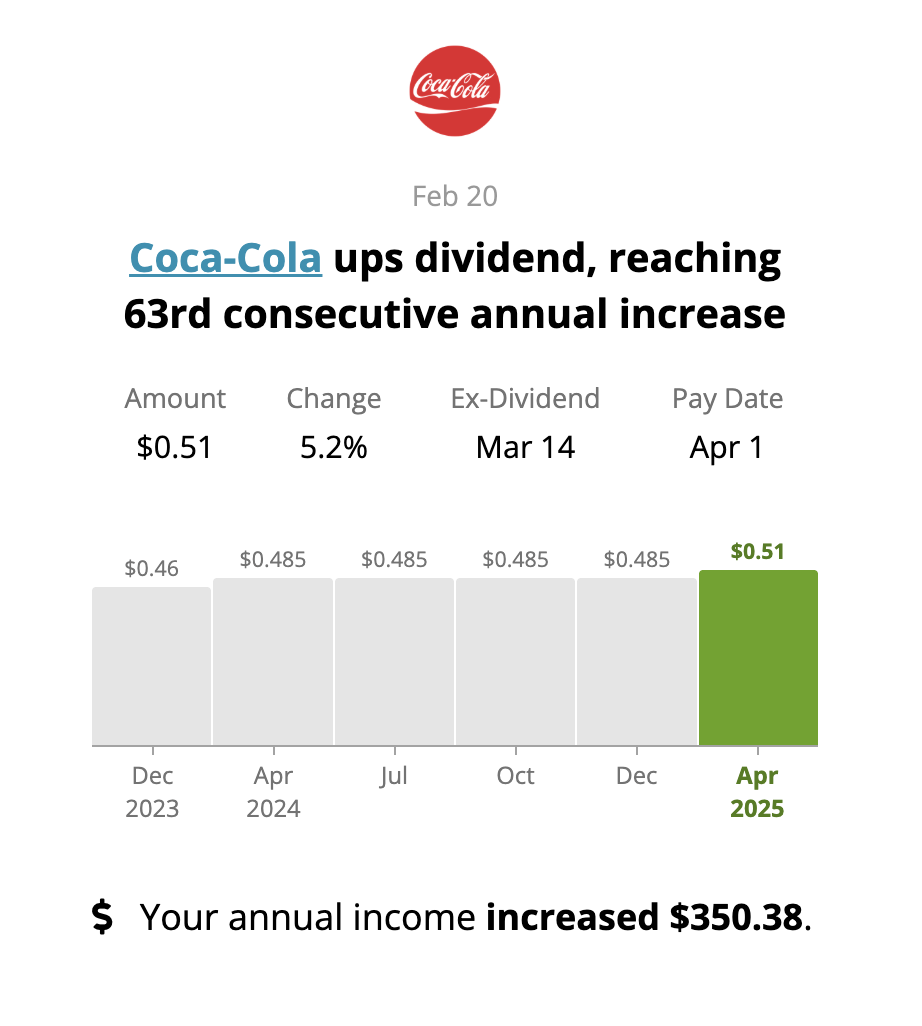

Like everyone I like the market to go up but since I have become a dividend investor I find myself focusing on when/how much the next dividend increase will be for my portfolio.

I have proven to myself that the 4% withdrawal rule makes no sense as I have constructed a portfolio that has a yield on cost of 4% with an average dividend increase of over 8%/year with good safety ratings.

You really have a great product that your recent enhancements have made even better. Furthermore, your customer service is exceptional."

"Brian,

First of all, I want to thank you for your response.

I told you in a previous email that I have been a dividend investor for over 50 years. Over the course of the last several years, I have tried and paid for (unfortunately) multiple online so-called dividend websites for appropriate dividend information for investing purposes. Simply Safe Dividends is the first site that actually fulfills my needs as well as shows honesty and integrity.

You and your associates should be complimented.

Keep up the good work."

"I have seen (and used some) many investment services the last 25 years. Your site is the best I have ever seen. I am so glad I found 'Simply Safe Dividends.' It offers everything I need. Keep up the great work.”

"We are retired, for the most part. Investing guidance has been a challenge, in which trust is not wisely handed out willy, nilly. For years past we have searched and searched, while making as educated choices as we could given what was available to maintain dividend income.

And then, Simply Safe Dividends, we are so grateful to find we can safely repose that trust in you. Our deep gratitude to you, for your pragmatic, focused efforts and advices. It is a tough time, with so many uncertainties. God bless you all and keep you safe."

"Hi Brian,

As a potential new retiree in 2019 who is very concerned about dividend safety, this month's newsletter hits the mark. I think it's one of the most important and on-point newsletters you have released! Dividend safety is critical to a retiree and I can sense by reading this newsletter it is an imperative metric in your methodology in evaluating companies. I greatly appreciate this.

Also important to me in selecting an investment newsletter is the tone set by the publisher. I will not hesitate to drop a newsletter if I feel there is a lean to over-marketing with all types of emails, alerts and use of fancy text fonts and colors to market stocks in attempts to snag unwary potential subscribers. Please don't do this.

Right now, for me personally, your newsletter strikes a perfect balance in holdings information, new investment advisement, very limited marketing to build a client base (yes, rely on referrals!) and most importantly, tone of approach and delivery.

Keep up the great work."

"Dear Simply Safe Dividends,

I simply love your program. It helps me easily pick the best dividend stocks and balance the yield, growth and safety to match my needs. I finally feel comfortable with my portfolio knowing that my dividend picks are safe. I can now sleep comfortably at night without worrying about my portfolio."

“SSD Team,

First off, I love your service, it has really helped prepare me for these trying times [during the 2020 pandemic]. I didn't even realize that several companies were already cutting or suspending dividends because - thanks to you - those are not the companies I've invested in! So, I don't know if you get a lot of positive feedback, but thanks for all that you are doing!"

"Matt/Brian,

Usually we customers only ping you when we need something or have a problem. Not this time. I would like to extend my gratitude and say thank you again for investing in the business and providing your customers with excellent service. The ability to connect to our brokerage agencies is a game changer that allows a one-stop shop approach to account balances and saves us time. Keep up the great work - I tell every person I can about Simply Safe Dividends!"

"Brian,

I am constantly amazed with all the data you have provided me since I've been onboard with you. I feel lucky being an early client. It feels like I get a dividend raise each time you offer new data or services.

Thanks so much and keep doing what you do best."

No credit card or surprise charges. Immediate access to our tools and research.

Sign up for free