What is Timeliness?

Many dividend stocks trade within a certain dividend yield range. Timeliness measures how far above or below a stock’s current yield is compared to its five-year average yield, with the idea being that yields tend to revert to their long-term averages over time.

Since 1970, dividends have made up 40% of total returns for stocks in the U.S. and Europe, per data from JPMorgan cited by The Wall Street Journal. (Total return measures capital gains, plus dividends received.)

Given the importance of dividends to a portfolio’s returns, evaluating a stock’s historical dividend yield range can help gauge whether or not a stock’s current price appears reasonable.

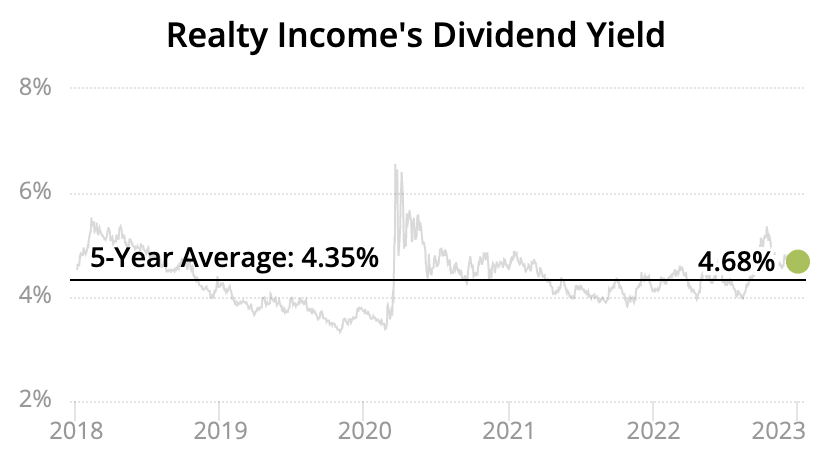

Here’s a look at Realty Income's (O) dividend yield over the last five years. You can see that the stock’s yield has ranged from a low near 3.5% to a high of about 5%. Income investors evaluating Realty Income might consider buying the stock when its yield is near its five-year average or higher.

There are many reasons why yields fall above or below their historical averages. In most cases, investors overreact to company-specific news (e.g. a poor quarterly earnings report) or a macroeconomic development (e.g. a spike in interest rates), bidding the stock higher or lower based on a short-term development.

“Remember that the stock market is a manic depressive.” – Warren Buffett

As time marches on and long-term business prospects come back in focus, a stock’s yield often reverts back to its norm.

With that said, a relatively high or low yield compared to history can be the “new norm” for a stock, potentially providing a misleading signal of value. While this doesn’t happen often, sometimes a company’s long-term outlook has structurally changed.

If a company’s long-term growth prospects have improved, its stock will likely trade at a relatively low yield compared to history, reflecting its stronger growth profile. I will rarely, if ever, sell my winners, so I typically do not think about selling a holding just because its yield is relatively low.

On the other hand, if a company’s long-term prospects have dimmed, its dividend yield could remain at a higher level than it has in the past.

In situations where a stock’s yield is relatively high or low compared to its long-term average, investors should search for recent news on the business. The idea is to identify any material events that could strengthen or weaken the company’s moat and long-term outlook (not just its next few quarters of results), as well as the safety of its dividend.

If a company’s long-term growth prospects have improved, its stock will likely trade at a relatively low yield compared to history, reflecting its stronger growth profile. I will rarely, if ever, sell my winners, so I typically do not think about selling a holding just because its yield is relatively low.

On the other hand, if a company’s long-term prospects have dimmed, its dividend yield could remain at a higher level than it has in the past.

In situations where a stock’s yield is relatively high or low compared to its long-term average, investors should search for recent news on the business. The idea is to identify any material events that could strengthen or weaken the company’s moat and long-term outlook (not just its next few quarters of results), as well as the safety of its dividend.

These can be difficult judgment calls to make, so maintaining a well-diversified portfolio is critical. I also want to emphasize the importance of targeting the right type of company for most conservative dividend growth portfolios.

I prefer to invest in companies that possess the following characteristics:

- Simple, easy-to-understand business models that have withstood the test of time

- Reasonably diversified by products / customers / end markets

- Large end markets with moderate long-term growth potential

- Consistent free cash flow generation (i.e. money is left over after reinvesting in the business)

- Healthy credit metrics

- A proven commitment to paying and growing dividends

- Several enduring competitive advantages that I understand and believe in for the long term

- These factors typically combine for a strong Dividend Safety Score (61+)

By putting business quality first, rather than focusing on “cheap” stocks, I reduce a lot of the risk in my diversified portfolio and improve my chances of generating safe, growing income.

Using historical dividend yield charts as a valuation guide is most effective for the types of companies I like to invest in – mature, stable businesses that generate cash and have long histories of paying consistent dividends.

Using yield charts certainly isn’t perfect (no valuation approach is), especially for businesses that have a wider range of potential outcomes or very low payouts, but I’ve found its simplicity and ease of application to be very valuable for my overall portfolio management process.

At the end of the day, valuation is part art, part science. Fundamentals will ultimately drive long-term stock performance, which is why I personally place the most weight on evaluating a company’s business quality and long-term outlook before making any decision.