How Dividend Reinvestments are Taxed

One appeal of long-term dividend growth investing is the ability to increase your share count by reinvesting dividends. As companies continue growing their dividends and the number of shares you own rises, you can achieve exponential income growth over time.

Dividend reinvestment plans, or DRIPs, are the easiest way for hands-off investors to execute this simple strategy because they allow your dividends to be paid in partial shares each quarter (or month).

Dividend reinvestment plans, or DRIPs, are the easiest way for hands-off investors to execute this simple strategy because they allow your dividends to be paid in partial shares each quarter (or month).

However, like with all investment tools, taxes are an important consideration. Let's take a look at what you need to know about DRIP taxes, including ways to minimize how much you'll have to pay to the IRS each year.

How are Dividend Reinvestments Taxed?

Some investors have the mistaken idea that because a DRIP plan pays you in shares instead of cash that they don't have to pay taxes on these dividends.

Unfortunately, Uncle Sam doesn't care what you do with your dividends; the IRS will treat both cash dividends and DRIP plans the same for tax purposes. As a result, there are two important factors that determine your tax bill from reinvesting dividends.

Unfortunately, Uncle Sam doesn't care what you do with your dividends; the IRS will treat both cash dividends and DRIP plans the same for tax purposes. As a result, there are two important factors that determine your tax bill from reinvesting dividends.

The first is the nature of the investment itself. For example, most dividends paid by corporations, such as Johnson & Johnson (JNJ), are considered qualified dividends. Qualified dividends are taxed at the same rate as long-term capital gains (profits on shares sold).

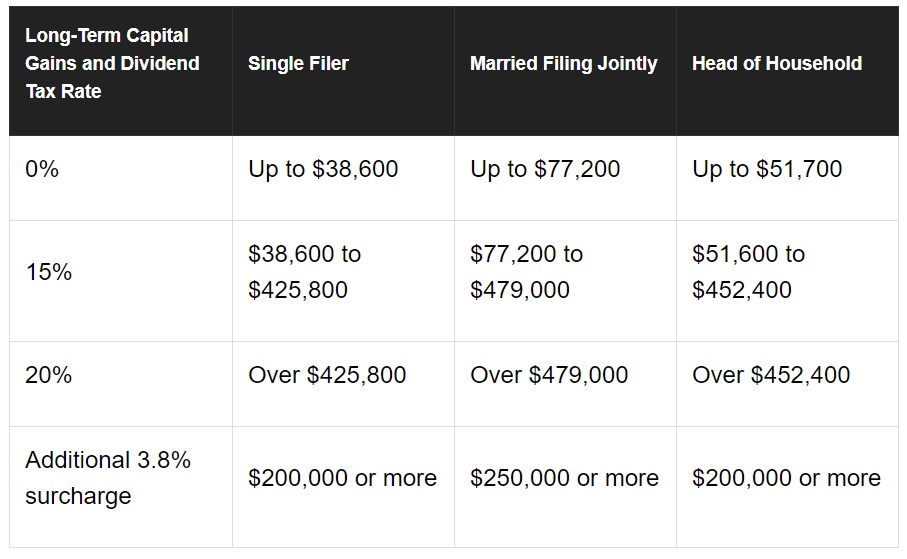

The tax rate for reinvested dividends (and qualified dividends) is based on your adjusted gross income and under current tax law looks like this.

The tax rate for reinvested dividends (and qualified dividends) is based on your adjusted gross income and under current tax law looks like this.

Note that for wealthier investors, such as households earning adjusted gross incomes over $250,000, there is a 3.8% Affordable Care Act (Obamacare) surcharge. If your income qualifies you for this added tax, then your qualified dividend tax rate (including DRIPs) is 18.8%. And for the wealthiest Americans dividend tax rates top out at 23.8%.

Fortunately, no matter your income qualified dividend tax rates are still far below the top marginal tax rates that most people would pay if dividend reinvestments were taxed as ordinary income.

Fortunately, no matter your income qualified dividend tax rates are still far below the top marginal tax rates that most people would pay if dividend reinvestments were taxed as ordinary income.

Dividend taxes, including for reinvested dividends, can potentially be higher for investors in pass-through businesses such as REITs, master limited partnerships (MLPs), and business development companies (BDCs). These entities' dividends and distributions are taxed differently.

Specifically, dividends paid by REITs and BDCs are taxed as non-qualified dividends at your marginal tax rate. Meanwhile, most MLP distributions are taxed as a return of capital, meaning that MLP distributions lower your cost basis over time and thus defer taxes until you sell your units. MLPs have important pros and cons when it comes to tax planning.

Specifically, dividends paid by REITs and BDCs are taxed as non-qualified dividends at your marginal tax rate. Meanwhile, most MLP distributions are taxed as a return of capital, meaning that MLP distributions lower your cost basis over time and thus defer taxes until you sell your units. MLPs have important pros and cons when it comes to tax planning.

Under the 2017 Tax Cut and Jobs Act (tax reform), the first 20% of any dividend or distribution from a pass-through stock such as these is not taxable. However, the remaining 80% is taxed under the same provisions as before: as a return of capital for MLPs, and as a non-qualified dividend for REITs and BDCs.

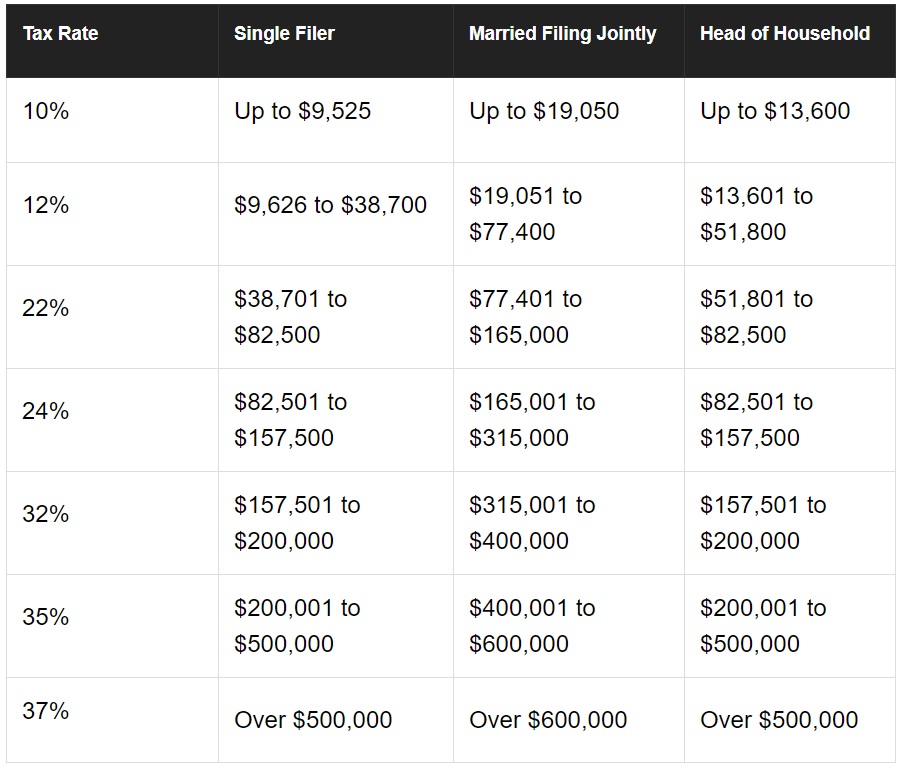

Non-qualified dividends are taxed as ordinary income, and thus at your top marginal tax rate. For most Americans that equates to a 10%, 12%, or 22% dividend tax rate, which is also the rate at which reinvested dividends are taxed.

For the top earners dividend tax rates can be as high as 37%. Depending on your income level, taxes can significantly lower your long-term total returns over time for REIT and BDC investments.

These types of stocks are primarily owned for their income and typically have relatively slow dividend growth. Fortunately, there is a way to minimize your dividend and dividend reinvestment taxes.

Non-qualified dividends are taxed as ordinary income, and thus at your top marginal tax rate. For most Americans that equates to a 10%, 12%, or 22% dividend tax rate, which is also the rate at which reinvested dividends are taxed.

For the top earners dividend tax rates can be as high as 37%. Depending on your income level, taxes can significantly lower your long-term total returns over time for REIT and BDC investments.

These types of stocks are primarily owned for their income and typically have relatively slow dividend growth. Fortunately, there is a way to minimize your dividend and dividend reinvestment taxes.

How to Minimize Dividend Reinvestment Taxes

The dividend and DRIP taxes mentioned above apply to taxable accounts. However, tax deferred accounts such as IRAs, 401(k)s, 403(b)s, and 457s are exempt from immediate dividend taxation.

Here are the maximum annual contributions you can make to such programs based on age:

Here are the maximum annual contributions you can make to such programs based on age:

Fortunately, you can contribute to both an IRA and a 401(k), 403(b), or 457 plan simultaneously. In fact, workers under and over 50 can potentially contribute a maximum of $24,000 and $31,000 per year, respectively. This potentially allows you to establish a sizable nest egg to provide for your retirement.

But there is a catch with such plans. They are tax deferred and not tax exempt. When you eventually withdraw funds from these accounts (starting at age 59.5 or later) you will be taxed on all your dividends and capital gains at your top marginal tax rate.

What if you don't need your retirement account funds to pay your bills? Well, the IRS has thought of that, and starting at age 70.5 the government requires you to take out a required minimum distribution, or RMDs, from tax deferred accounts.

Due to their tax deferred nature (and something called unrelated business taxable incomeI) it's generally recommended you own MLPs in taxable accounts, rather than tax deferred ones. REITs and BDCs can be owned in retirement accounts and thus put off non-qualified dividend taxes for years or even decades. However, in order to avoid dividend taxes entirely, there is just one legal option: the Roth IRA.

What if you don't need your retirement account funds to pay your bills? Well, the IRS has thought of that, and starting at age 70.5 the government requires you to take out a required minimum distribution, or RMDs, from tax deferred accounts.

Due to their tax deferred nature (and something called unrelated business taxable incomeI) it's generally recommended you own MLPs in taxable accounts, rather than tax deferred ones. REITs and BDCs can be owned in retirement accounts and thus put off non-qualified dividend taxes for years or even decades. However, in order to avoid dividend taxes entirely, there is just one legal option: the Roth IRA.

Roth IRAs are permanently tax exempt, because unlike IRAs or 401(k)s, you can't deduct contributions from your income. In other words, you have already paid taxes on the money that you put into a Roth IRA. The upside is that Roth accounts have no RMDs, nor do you ever pay any taxes on either dividends, dividend reinvestments, or capital gains generated in these accounts.

Here's a detailed guide to the differences between a Roth IRA and a traditional IRA as they pertain to dividend investing.

Here's a detailed guide to the differences between a Roth IRA and a traditional IRA as they pertain to dividend investing.

Concluding Thoughts on Dividend Reinvestment Taxes

No one likes paying taxes, especially given the complexity of the modern tax code. However, don't let worries over dividend reinvestment taxes deter you.

Dividend reinvestments are taxed the same as cash dividends. While they don't have any unique tax advantages, qualified dividend reinvestments still benefit from being taxed at the lower long-term capital gains rate.

Dividend growth investing can be a great way for investors to compound their income and wealth over time, and DRIPs can help speed up that process. Like with all investments, just be aware of the important tax implications that come with this strategy.

Dividend reinvestments are taxed the same as cash dividends. While they don't have any unique tax advantages, qualified dividend reinvestments still benefit from being taxed at the lower long-term capital gains rate.

Dividend growth investing can be a great way for investors to compound their income and wealth over time, and DRIPs can help speed up that process. Like with all investments, just be aware of the important tax implications that come with this strategy.