Guide to Foreign Tax Withholding on Dividends for U.S. Investors

Investing in foreign dividend-paying stocks can diversify your portfolio and provide access to faster-growing emerging markets.

However, most countries impose a foreign dividend withholding tax on these payouts to ensure they receive their share of the income.

However, most countries impose a foreign dividend withholding tax on these payouts to ensure they receive their share of the income.

Much like navigating U.S. dividend taxes, understanding foreign tax withholding on dividends can be complex and time-consuming. The rates and forms required vary by country, making tax time potentially stressful.

Let’s explore how withholding tax on dividends impacts U.S. investors and what you need to know to manage your overseas dividend income effectively.

What is Withholding Tax on Dividends?

In the U.S., dividends paid by American companies are taxed, but there is no automatic tax withholding for U.S. residents. Investors receive the full dividend amount and report it to the IRS when they file their taxes.

In contrast, many foreign governments apply a dividend withholding tax to nonresident shareholders. This means that when a U.S. investor receives dividends from a foreign company, the broker typically withholds a portion of the payment and sends it to the foreign government.

This deduction represents the foreign tax withholding on dividends, which reduces the amount of overseas dividend income you receive. Understanding these taxes can help with managing your investments and maximizing returns.

Foreign Dividend Withholding Tax Rates by Country

The foreign withholding tax rate on dividends can vary wildly around the world. Here is the foreign tax on dividends by country for some of the largest nations:

- Australia: 30%

- Canada: 25%

- China (Mainland): 10%

- France: 25%

- Germany: 26%

- Ireland: 25%

- Japan: 20%

- Mexico: 10%

- Netherlands: 15%

- Switzerland: 35%

- U.K.: 0%

- U.S.: 30% (for nonresidents)

Some of the most popular foreign dividend companies, including those based in Australia, Canada, and certain European countries, have high withholding rates, between 25% and 35%.

Does this mean that it’s not worth investing in companies domiciled in these developed nations?

Not necessarily. Thanks to tax treaties between the U.S. and many countries around the world, the actual amount of dividends withheld from U.S. investors is often much less than these headline figures.

Tax Treaties Can Help Ease the Pain but Make for Extra Complexity at Tax Time

In order to avoid double taxation, in which dividend investors are taxed by both foreign governments and the IRS, the U.S. has worked out tax treaties with over 60 nations to reduce the foreign tax paid on dividends.

As a result, most major countries have deals with the U.S. to apply only a 15% withholding tax to dividends paid to nonresident shareholders. Some examples include Australia, Canada, France, Germany, Ireland, and Switzerland.

To receive the lower rate, your broker or asset manager needs to have certain information on file, including a W-9 form which contains a U.S. investor's name, address, and Social Security number.

In our experience, major brokerages such as Vanguard and their custodians automatically file the necessary paperwork with foreign governments to enable their verified U.S. investors to obtain the preferential tax treaty rates for dividends. But it may be worth confirming with your broker.

Besides receiving the lower tax treaty rates on dividends paid by foreign companies, U.S. investors have another lever they can pull to reduce their withholding tax burden.

As a result, most major countries have deals with the U.S. to apply only a 15% withholding tax to dividends paid to nonresident shareholders. Some examples include Australia, Canada, France, Germany, Ireland, and Switzerland.

To receive the lower rate, your broker or asset manager needs to have certain information on file, including a W-9 form which contains a U.S. investor's name, address, and Social Security number.

In our experience, major brokerages such as Vanguard and their custodians automatically file the necessary paperwork with foreign governments to enable their verified U.S. investors to obtain the preferential tax treaty rates for dividends. But it may be worth confirming with your broker.

Besides receiving the lower tax treaty rates on dividends paid by foreign companies, U.S. investors have another lever they can pull to reduce their withholding tax burden.

How to Minimize Your Foreign Dividend Tax Burden

To reduce the impact of foreign dividend withholding taxes, U.S. investors can choose between a foreign dividend tax credit or a foreign dividend tax deduction. You must use the same method for all foreign taxes withheld in a given year.

- Foreign Dividend Tax Credit: Reduces your tax liability dollar-for-dollar.

- Foreign Dividend Tax Deduction: Lowers your taxable income, with the reduction based on your marginal tax rate.

The foreign dividend tax credit is typically better since it provides more savings.

The simplest way to obtain this credit is if your foreign tax withholdings are $300 or less per individual (or $600 for joint filers), and you have received a 1099-DIV or 1099-INT form from your broker outlining your total foreign tax withholdings.

In this case, you can claim the entire withholding amount as a tax credit, reducing your U.S. tax burden dollar-for-dollar and effectively eliminating the foreign dividend tax.

In this case, you can claim the entire withholding amount as a tax credit, reducing your U.S. tax burden dollar-for-dollar and effectively eliminating the foreign dividend tax.

The catch is that you can deduct only an amount equal to your total U.S. tax liability in any given year. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings.

In that case, rather than sending you a $5,000 check, the IRS will only let you subtract $10,000 for that year (you owe nothing), and then roll over $5,000 in tax liability reduction into future years, limited to a decade.

Another benefit of this credit is that you can use it in conjunction with your standard deduction, which the majority of Americans take rather than itemizing. In other words, as long as your foreign withholdings aren’t too large, you can use the standard form 1040 to do your taxes.

What if your foreign tax withholdings are above the $300 / $600 level for individuals and couples filing jointly? That’s where things get more complex.

To determine how much of a tax credit you can claim above the $300 / $600 limit you need to fill out form 1116, which gets attached to your form 1040 and has instructions that are 24 pages long.

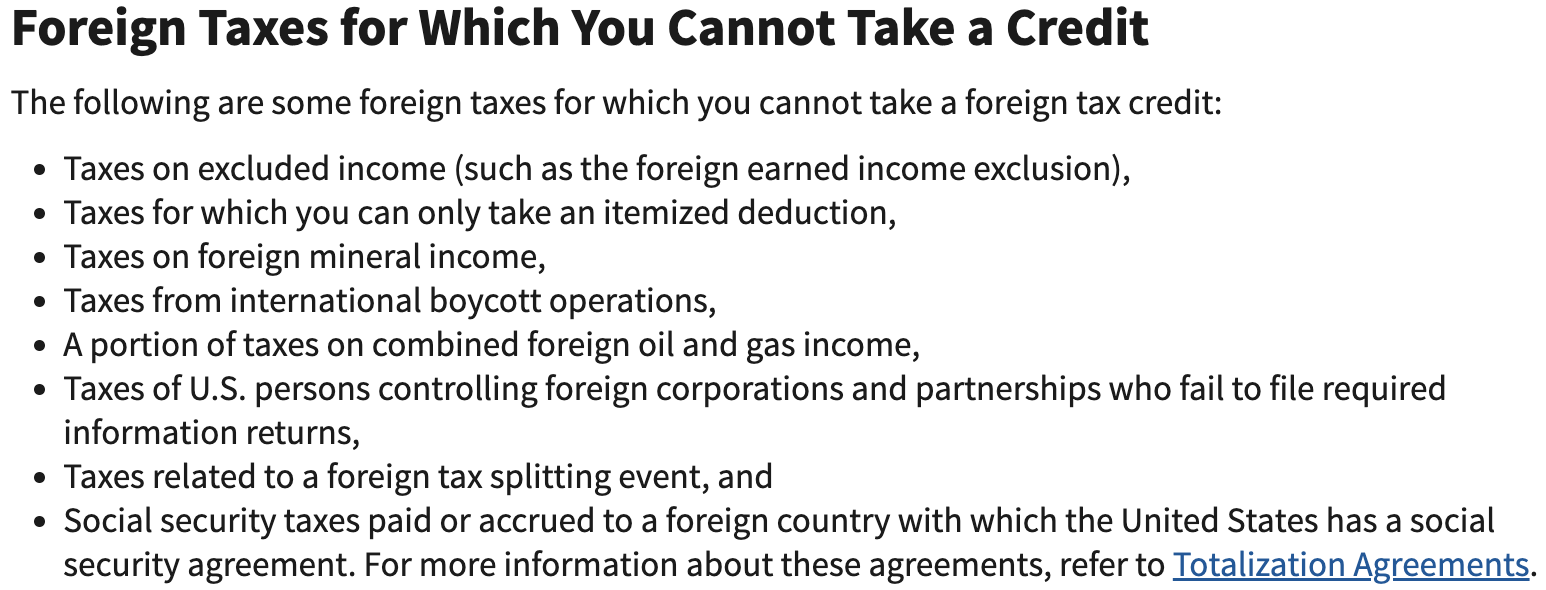

You have to jump through these extra hoops rather than simply obtain a full foreign tax credit because not all foreign dividends qualify for preferential treatment.

Fortunately, many of these exclusions don’t apply to most investors, other than the potential for Puerto Rican stocks, whose dividends aren’t qualified for a credit and must be itemized for a deduction.

However, there is one kind of tax credit disqualification that can affect regular investors and is the main reason why anyone with over $300 / $600 in foreign withholdings must fill out form 1116.

Any withheld dividends on stocks that you held for less than 16 days during the 31-day period that begins 15 days before the ex-dividend date are considered unqualified dividends that will decrease the total amount of foreign tax credit you can claim.

Can Foreign Tax Withholding on Dividends Be Avoided in IRAs and 401Ks?

Given the complexity of foreign withholding taxes, investors might think that owning these shares in a tax-deferred account might be a way to avoid the paperwork hassle.

However, that’s not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts.

Due to the tax-sheltered status of IRAs and 401(k)s, the IRS doesn’t allow you to take any credits or deductions for foreign withholdings for these accounts. In other words, you could be facing the loss of up to 35% of your dividends, with no beneficial U.S. tax liability offset.

The bottom line is that for tax-sheltered accounts, investors may want to make sure they only own U.S. stocks or companies domiciled in nations that have 0% withholding rates.

Closing Thoughts on Dividend Withholding Tax

Owning foreign dividend stocks can provide some benefits for building a diversified portfolio, but larger investors (those who face foreign withholdings above the $300 / $600 limit) will want to do research and be careful about which companies they buy.

We generally prefer to invest in U.S. multinationals to gain exposure to faster-growing international markets and avoid many of the accounting and tax headaches that can come from investing in foreign companies directly.