MPW Provides Additional Support for Steward, Rattling Confidence in Tenant Credit Quality

Shares of Medical Properties Trust (MPW) slumped over 10% on Tuesday following the hospital REIT's second-quarter earnings report.

The company's headline results were roughly in line with analysts' estimates. But investors were spooked by MPW's decision to provide more financial support for Steward, a distressed hospital operator that accounts for around 20% of the REIT's revenue.

Steward's credit facility was set to mature in December 2023. MPW contributed $140 million to a new group of lenders to provide Steward with a bigger asset-backed credit facility good for the next four years.

While this removed near-term refinancing risk for Steward, kicking the can down the road, it begs the question of why MPW needed to be involved – especially after expressing optimism about how much Steward's earnings were set to improve.

The REIT has spent years trying to reduce its exposure to Steward, which has served as a major overhang on MPW's stock. And with a stretched payout ratio and highly leveraged balance sheet, MPW doesn't have much available cash to throw around.

It seems that no other lenders were willing to support Steward, even when offered loans with double-digit interest rates, secured by accounts receivable from government and commercial payors. Otherwise, why would MPW's management choose to take on this negative publicity?

The company's headline results were roughly in line with analysts' estimates. But investors were spooked by MPW's decision to provide more financial support for Steward, a distressed hospital operator that accounts for around 20% of the REIT's revenue.

Steward's credit facility was set to mature in December 2023. MPW contributed $140 million to a new group of lenders to provide Steward with a bigger asset-backed credit facility good for the next four years.

While this removed near-term refinancing risk for Steward, kicking the can down the road, it begs the question of why MPW needed to be involved – especially after expressing optimism about how much Steward's earnings were set to improve.

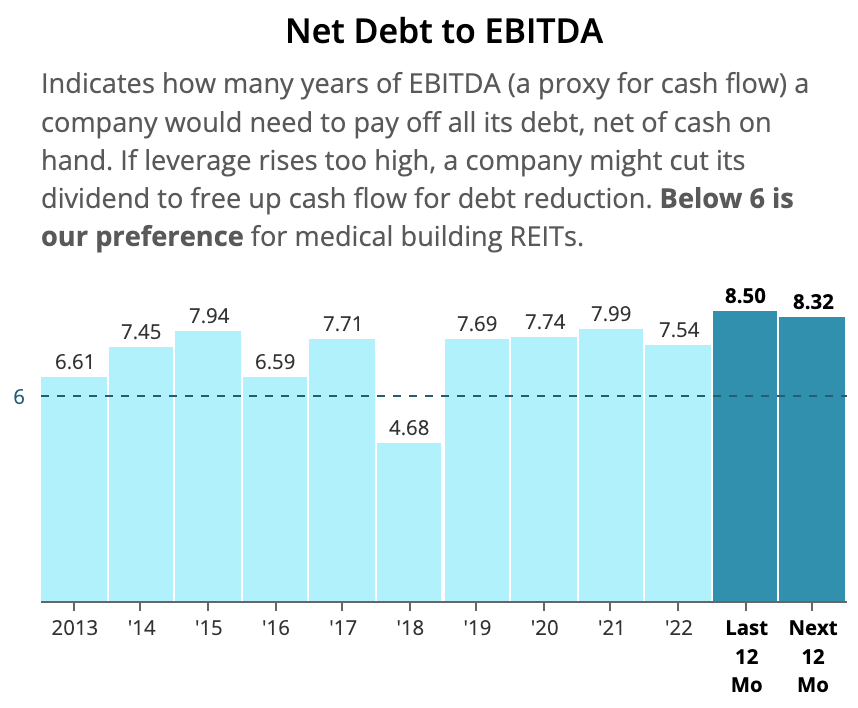

The REIT has spent years trying to reduce its exposure to Steward, which has served as a major overhang on MPW's stock. And with a stretched payout ratio and highly leveraged balance sheet, MPW doesn't have much available cash to throw around.

It seems that no other lenders were willing to support Steward, even when offered loans with double-digit interest rates, secured by accounts receivable from government and commercial payors. Otherwise, why would MPW's management choose to take on this negative publicity?

This development isn't a needle-mover for MPW (the REIT has nearly $20 billion of assets). But it raises doubts about Steward's financial health and deepens the connection between the two businesses (MPW already owns a 9.9% direct equity stake, has about $360 million of loans secured by Steward's equity with value participation, and is the firm's primary landlord).

With investors continuing to worry about this exposure and Steward's end game, MPW seems likely to continue facing a high cost of capital.

As we discussed earlier this year, this is problematic because MPW is projected to retain little cash flow after paying dividends (see below), making the REIT dependent on raising external capital to fund its growth strategy.

With its share price in the dumps, issuing equity isn't an option. Borrowing money is expensive as well given MPW's BB credit rating and interest rates staying higher for longer.

The REIT's stubbornly high leverage magnifies this headwind. While asset sales will cover debt maturities through 2024, MPW has $1.4 billion of loans maturing in early 2025 that carry a fixed interest rate near 2.5%.

If this debt was refinanced at an 8% rate, a generous assumption, MPW would face incremental interest costs of approximately $75 million. For context, that's about 10% of the REIT's adjusted funds from operations (AFFO) projected in 2024.

Paying down its $10 billion pile of debt should be a top priority, but MPW has no easy way to strengthen its balance sheet.

Property sales and joint ventures could be used to raise funds for debt reduction, but this would come at the expense of lower cash flow and even weaker dividend coverage (and perhaps less than ideal property valuations in today's environment).

MPW's $700 million dividend looks like an increasingly attractive source of funds the longer the REIT remains stuck in this high capital cost environment. This week's development with Steward and the perception it carries could prolong these restrictive financing conditions.

Management has begun to sound more open to a dividend cut. On MPW's earnings call, CFO Steve Hamner responded to a question about the REIT's dividend by stating that "everything is on the table" as the board reviews options to enhance liquidity.

Given these developments, we are downgrading MPW's Dividend Safety Score from Unsafe to Very Unsafe.

We expect the REIT to declare its next dividend on Thursday, August 17. While management doesn't face imminent pressure to cut the payout, a 30% to 50% dividend reduction seems prudent to prioritize deleveraging. A suspension can't be ruled out but would surprise us.

So, what should MPW shareholders do from here?

On one hand, a dividend cut is already reflected in the stock price to some degree. And given MPW's depressed valuation and high short interest, it might not take much for the stock to rally hard if investor sentiment shifts.

On the other hand, the majority of hairy turnarounds with high leverage that we've seen have not been long-term investing success stories.

MPW has no quick fixes to diversify its Steward exposure or restore its balance sheet. And management is hard to trust (e.g. MPW last quarter made an aggressive accounting decision to include in AFFO a non-cash receipt of equity in a managed care business, which was received in lieu of unpaid cash rent from that tenant).

Hospitals, especially those run more aggressively by private equity firms, have also proven to be generally weaker tenants compared to other areas in healthcare.

Many of these operators are still struggling to break even as they deal with lingering cost inflation challenges and patient volumes that have yet to fully recover from the effects of the pandemic.

If we held shares of MPW, we would be tempted to throw in the towel rather than hope for a near-term rally or wait out a multiyear turnaround effort.

Regardless of short-term price action, Steward seems likely to remain a large thorn in MPW's side rather than a challenged tenant that will see its financial challenges fade away anytime soon.

Investors looking for replacement ideas with yields near 10% could consider investment-grade-rated business development companies like Ares Capital (ARCC) and Sixth Street Specialty Lending (TSLX). These firms benefit from higher rates and have solid long-term performance track records.

We will continue monitoring MPW's turnaround and provide updates as needed.