How Inflation and Fed Rate Hikes are Impacting Dividend Stocks

The S&P 500 slumped 4.1% in August, widening its year-to-date loss to 16.2%. Recession fears reignited near the end of the month after Federal Reserve Chair Jay Powell warned in a short speech that rate hikes intended to slow inflation will not stop anytime soon.

Powell even cautioned that efforts to tame inflation will “bring some pain to households and businesses” as economic growth slows, and labor market conditions soften.

Investors who expected the Fed to slow its pace of tightening and even reduce rates next year in response to potentially peaking inflation had their hopes dashed, removing some of the euphoria that had reentered the market since mid-July.

Unlike the easy-money years following the 2008-09 financial crisis, the Fed insists it will not be quick to reverse policy in the face of weakening economic growth until inflation is definitively tamed.

Now, the anxious wait continues to see whether the Fed will engineer a mild slowdown or a deeper recession. And if efforts to cool inflation by reducing demand will even be sufficient given the many supply shocks, such as war in Ukraine, pushing prices higher.

These unsettling times may not be resolved soon. Inflation readings come in just once a month, and the Fed’s tightening efforts take time to ripple through the economy in expected and unexpected ways.

That said, an environment of slowing growth, elevated inflation, and higher-for-longer interest rates will have more consequences for some types of businesses than others.

That said, an environment of slowing growth, elevated inflation, and higher-for-longer interest rates will have more consequences for some types of businesses than others.

The tech sector has felt the some of the biggest impact from tightening financial conditions, delivering the second-worst performance of any sector this year with a 22% loss.

Many growth stocks in this space are valued primarily on expected profits many years out. Higher interest rates reduce the present value of those distant profits, lowering valuations more severely compared to mature companies generating substantial cash flow today.

Coupled with the pandemic-driven boom in growth stock valuations fueled by rock-bottom rates and skyrocketing demand for digital products and services during lockdowns, the tech sector’s perfect storm of excesses could be far from finished unwinding as the Fed presses on.

Companies burning through cash, whether moonshot startups or distressed firms like movie theater chain AMC and home goods retailer Bed Bath & Beyond, get pinched disproportionately by tighter financial conditions, too.

Higher risk-free rates available (e.g. the 2-year Treasury yields 3.5% today versus 0.2% a year ago) and rising economic uncertainty make investors stingier with their capital.

With less funding available on favorable terms, unprofitable businesses face shorter runways to survive and must take actions to preserve cash – most commonly in the form of layoffs.

Fortunately, most of the dividend stocks popular in retirement portfolios do not fall into either of these buckets. Paying a reliable dividend requires consistent profits over time. And consistent profits often indicate a mature business that is past its growth-intensive investment phase.

However, inflation and higher borrowing costs are causing stress for companies with high debt loads, little pricing power, capital-intensive operations, and discretionary products and services. Companies checking several of these boxes have underperformed this year.

Retailers of non-essential goods such as Kohl’s and Best Buy have seen consumers pull back on spending after enjoying a surge of stimulus dollars during the pandemic. Left with too much inventory and high fixed-cost storefronts to maintain, many retailers have seen their profits plunge.

Verizon and AT&T provide essential wireless services but have faced stiff price competition for subscribers in this saturated market along with rising operating costs. The large piles of debt taken on to build out and maintain their 5G networks will become costlier, too.

Certain real estate investment trusts, or REITs, have felt pressure as well due to the capital-intensive sector’s high debt loads and concerns about the underlying resilience of tenants.

Office REITs, such as SL Green Realty, face a challenging leasing environment as tenants in once prominent business districts mull their needs for space under new hybrid working models. The industry’s leverage may become problematic if occupancy rates and property values decline.

REITs with financially weaker tenants, including hospital owner Medical Properties Trust and cannabis-focused Innovative Industrial Properties, have also been hit hard as investors worry about their ability to continue collecting all their rent. Visibility is admittedly low as many tenants are private businesses with minimal financial disclosures.

Meanwhile, residential mortgage REITs and levered closed-end funds (especially those focused on long-duration bonds) face a squeeze in earnings as their variable borrowing costs rise faster than they can reinvest their portfolios in higher-yielding securities with mostly fixed rates.

Ultra-low rates and, in many cases, strong demand for goods during the pandemic helped a lot of these businesses refinance their debt on attractive terms and shore up their liquidity positions. But we are watching these areas closely given the unique combination of economic factors at work.

Fortunately, many dividend stocks have proven resilient in the face of these challenges. Here are some examples of industries and companies in our three model portfolios that have significantly outperformed the S&P 500 in 2022:

- Self-storage (Public Storage)

- Tobacco (Altria, Philip Morris International)

- Fast food franchises (McDonald's)

- Regulated utilities (Southern Company, Duke Energy, Dominion, Con Edison)

- Food and beverages (Coca-Cola, General Mills)

- Pharmaceuticals (Johnson & Johnson)

- Trash collection (Waste Management)

These businesses possess at least some of the following qualities: recession-resistant products and services, strong balance sheets, capital-light operations, and an ability pass through higher costs.

Owning these companies has helped our three model portfolios overcome some lumps this year.

Fast-growing consulting firm Accenture has seen its stock price correct 30%. Industrial conglomerate 3M is off a similar amount as legal woes mount. Verizon and AT&T are down 15% to 25% due to previously mentioned growth struggles. And apparel retailer V.F. Corp has shed over 40% due to the softer consumer environment.

Fast-growing consulting firm Accenture has seen its stock price correct 30%. Industrial conglomerate 3M is off a similar amount as legal woes mount. Verizon and AT&T are down 15% to 25% due to previously mentioned growth struggles. And apparel retailer V.F. Corp has shed over 40% due to the softer consumer environment.

We will always have our fair share of losers. That is the nature of investing in a mostly efficient market. But owning a diverse mix of quality, defensive businesses can help buoy our overall performance, especially during periods of rising uncertainty about the economy.

Through the first eight months of 2022, the S&P 500 shed over 16%, and many bonds lost around 10%. During the same period, our defensive-oriented Top 20 and Conservative Retirees portfolios fell about 7% and 3%, respectively. Our portfolios’ dividend income grew steadily, too.

Looking ahead, we aren’t in the business of forecasting stock returns or the path of inflation and interest rates. A simple strategy focused on stable dividend stocks doesn’t require such activity.

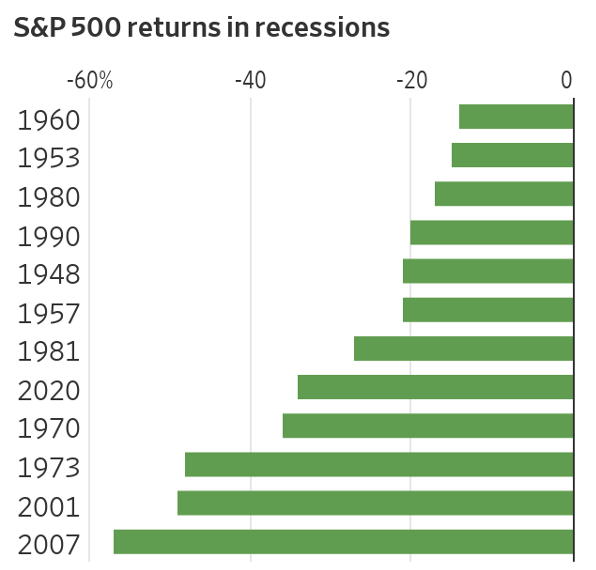

And a wide range of outcomes always exists. For investors worried about a sharp downturn, the S&P 500 has lost between 14% and 57% in the 12 U.S. recessions since World War II.

We never know when a recession will hit, so we account for this ever-present possibility upfront when designing a portfolio and assigning Dividend Safety Scores™ to companies and closed-end funds in our coverage universe.

Fear is quickly getting baked into asset prices, but corporate profits and dividends have broadly held their ground so far.

Fear is quickly getting baked into asset prices, but corporate profits and dividends have broadly held their ground so far.

That could change in the year ahead. But either way, we will be here doing our best to help investors keep their dividend portfolios between the guardrails.

In case you are interested, we offer a suite of portfolio tools, Dividend Safety Scores™, and research for dividend investors you can learn more about here.

In case you are interested, we offer a suite of portfolio tools, Dividend Safety Scores™, and research for dividend investors you can learn more about here.