NHI Will Decide Dividend's Fate in June as Largest Tenants Work Through COVID-19 Headwinds

On April 13, we discussed the challenges facing National Health Investors (NHI) due to the COVID-19 crisis:

Overall, the pandemic has increased NHI's risk profile. The REIT has some of the highest exposure to senior housing and skilled nursing, two areas of healthcare that could face the most pressure from the coronavirus outbreak.

Coupled with NHI's small scale and its growing number of communities reporting positive COVID-19 tests, some of its weaker tenants may eventually need NHI to reduce their rent if these headwinds intensify or persist.

Since then, conditions in the senior housing industry (nearly 70% of revenues) have continued deteriorating.

Based on our analysis below, we believe there is increased risk that NHI could reduce its dividend this summer as pressure builds on its largest tenants' ability to pay their full rent.

Therefore, we are downgrading NHI's Dividend Safety Score from Borderline Safe to Unsafe.

Diversified healthcare REIT Ventas (VTR) recently said April move-ins fell 75% across its senior housing operating properties due to admissions restrictions intended to slow the spread of the virus.

As a result, Ventas' occupancy declined from 84% in early April to 80.7% as of May 1. The firm's operating expenses also jumped around 10% due to higher labor and preventative costs.

Looking ahead, rival senior housing REIT Welltower (WELL), which reduced its dividend by 30% in May, projects its occupancy could fall to around 79% to 80% by the end of June, down from 82.7% as of May 1.

For perspective, the senior housing industry has never seen occupancy dip below 80%.

NHI reported earnings on May 11, and its senior housing tenants experienced similar headwinds as COVID-19 risk continued spreading.

As of May 19, approximately 17% of NHI's properties had at least one COVID-19 case, up from about 10% on April 7. This is hurting business for NHI's key tenants.

Bickford, Senior Living Communities, and Holiday are NHI's three largest senior housing tenants and account for about 44% of the REIT's revenue.

Management said that these operators have seen their occupancy fall by around 2% a month, in line with broader industry trends (and the rest of NHI's senior housing portfolio).

On the cost side of the equation, NHI said its operators are spending more on labor and personal protective equipment, pressuring their margins.

Despite these mounting headwinds, NHI received 99.7% of its April rent. And as of May 11, the firm had collected 94% of this month's rent, in line with expectations since a portion of collections take place through the 15th of the month.

But falling occupancy and rising costs will probably make it harder for NHI's largest tenants to continue meeting their obligations.

These trends reduce tenants' rent coverage ratios (i.e. cash flow, or EBITDARM, to rent expense), which were already somewhat fragile before the pandemic.

At the end of 2019, for example, Bickford (17% of rent) and Senior Living Communities (16%) had rent coverage ratios of 1.12x and 1.07x, respectively.

For perspective, in 2018 NHI had to renegotiate unsustainable master leases with Holiday (11% of revenue) when its rent coverage was about 1.16x. Holiday's rent was lowered by 20%, improving its coverage (1.22x at the end of 2019).

We estimate occupancy would only need to drop by a couple of percentage points before Bickford and Senior Living Communities could no longer cover their rent obligations with cash flow.

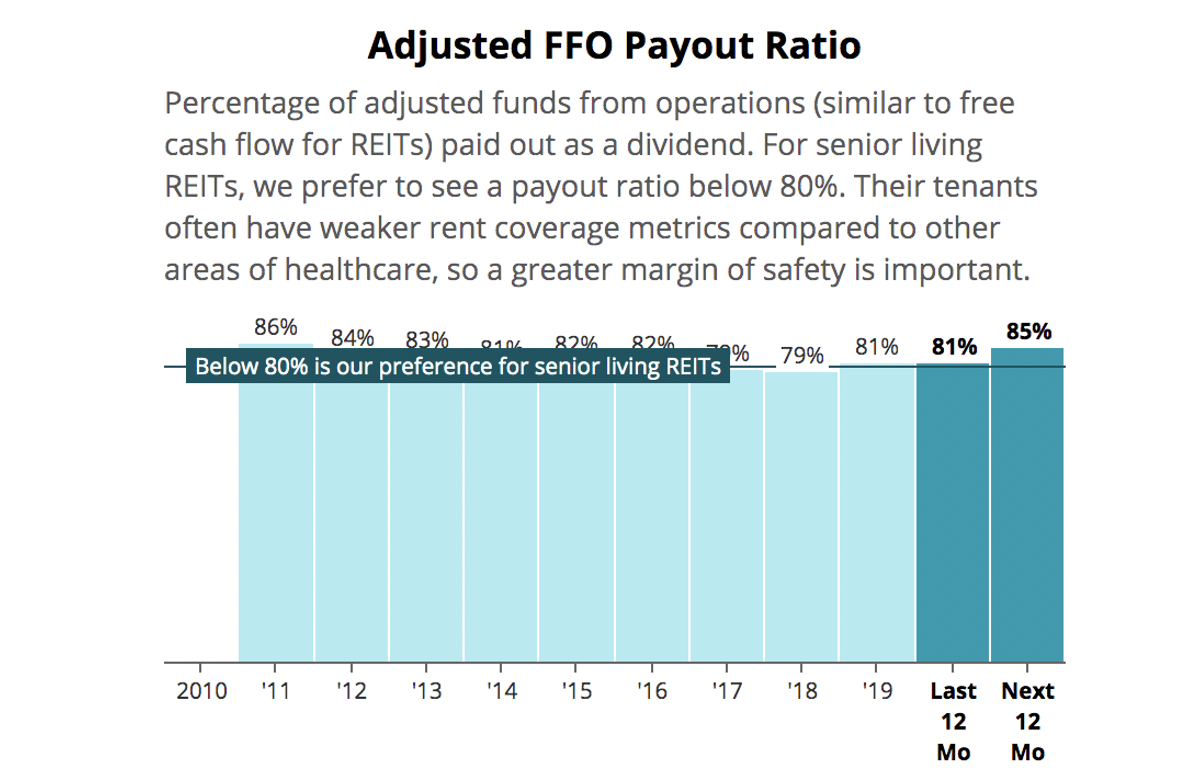

In this scenario, NHI would need to provide these operators with rent relief. Depending on the level of financial assistance required, we estimate NHI's payout ratio could top 90%.

NHI seems concerned about this possibility as well. On the REIT's May 12 earnings call, management said they will make a decision on NHI's next dividend payment in mid-June.

The outcome will depend on NHI's assessment of future rent collections and the level of assistance its tenants may need going forward.

It's all a function of how rent collections go at this point moving forward. And so it just -- you can see some coverage ratios are pretty low. And you can see that, that must mean that tenants are -- have some stress from cash flow. We just have no idea whether we're at the bottom yet, and we have no idea how long this is going to last. And so we just don't know, and that includes June.

So I would just say that as a triple net REIT, we have a lot of tools at our disposal, probably more tools than some of our other peers. And if someone needs help and if someone's doing the right thing and a good communicator and coming to us with full transparency, then we're going to be willing to help.

And frankly, that's why we wanted to consider our June dividend. We haven't had any kind of needle-moving event yet. But in this type of environment, one has to be extra vigilant.

– CEO Eric Mendelsohn

NHI also said it is unlikely to fund its dividend using debt, suggesting that management needs to have confidence that the firm's payout ratio will remain comfortably below 100% to continue supporting the current payout.

A recovery in senior housing fundamentals seems unlikely to be swift, so we wouldn't be surprised if NHI's largest tenants need to restructure their leases later this year.

If management expects sustained lower occupancy and higher operating expenses for its tenants going forward, then NHI's dividend may need to be lowered to keep it more comfortably aligned with future cash flow.

On the bright side, NHI's skilled nursing portfolio (nearly 30% of revenue) is benefiting from government financial support for the industry. Management feels "very comfortable" with the credit profile of these tenants.

However, private-pay senior living operators haven't received substantial support from federal COVID-19 relief packages.

American Seniors Housing Association is urging lawmakers to allocate some money to support hazard pay for senior living workers. But it's hard to say how likely this is to happen and if it would make much of a difference for NHI's tenants.

Overall, NHI's dividend cut risk has increased over the past month as senior housing fundamentals have materially weakened.

If management opts to reduce the dividend in June, a major cut (50%+) would be surprising given NHI's reasonable pre-pandemic payout ratio, healthy liquidity, and moderate leverage profile.

Unlike Ventas and Welltower, NHI also does not operate any of its own senior housing properties.

Instead of being directly impacted by changes in occupancy and operating expenses, NHI's cash flow depends solely on its tenants' ability to pay rent, providing some insulation from industry trends.

As we said in April, NHI's stock price already reflects at least some of these coronavirus-related risks.

Current shareholders should review whether they are comfortable with their positions given the growing uncertainty (and likely multiyear recovery period) facing the industry.