Stepan Company (SCL)

Founded in 1932, Stepan Company (SCL) produces and sells specialty and intermediate chemicals to other manufacturers for use in various end products around the world. The company operates in three segments:

- Surfactants (67% of sales, 56% of profits): offers surfactants that are used as principal ingredients in consumer and industrial cleaning products, such as detergents for washing clothes, dishes, carpets, floors, and walls, as well as shampoos and body washes. They are also used in lubricants, latex systems, plastics, and composites.

- Polymers (28% of sales, 39% of profits): provides polyurethane polyols that are used in the manufacture of rigid foam for thermal insulation in the construction industry, as well as a base raw material for coatings, adhesives, sealants and flexible foams. These are used in house applications as well as construction materials and components of automotive, boating, and other consumer products.

- Specialty Products (5% of sales, 5% of profits): offers flavors, emulsifiers, and nutritional oils for use in the food, flavoring, nutritional supplement, and pharmaceutical industries.

The company does not sell directly to the retail market, but sells to a wide range of manufacturers in many industries ranging from personal care products and construction to industrial cleaning and laundry applications. Stepan is highly diversified with no single customer making up over 10% of revenue.

By geography, the U.S. is Stepan's largest market (60% of revenue), followed by Poland (10%), France (9%), Brazil (6%), the U.K. (5%), and the rest of the world (10%).

With 50 consecutive years of dividend increases, Stepan is a dividend king.

Business Analysis

The specialty chemical industry isn't known for stable cash flow and consistent dividend growth because it serves cyclical industrial industries such as: mining, energy, agriculture, and construction. All of these end markets are closely tied to health of the global economy.

However, Stepan has been able to achieve 50 consecutive years of dividend growth thanks to generating cash flow that is far more stable than most of its rivals. This is because 60% of the company's sales are to more defensive industries (such as consumer staples and the healthcare sector) that usually hold up well throughout the entire economic cycle.

Due to its small size, Stepan lacks the economies of scale of many of its larger rivals. However, thanks to its strong focus on efficiency the company still manages to obtain admirable profitability with a mid-teens return on invested capital (measures how efficiently management spends shareholder capital).

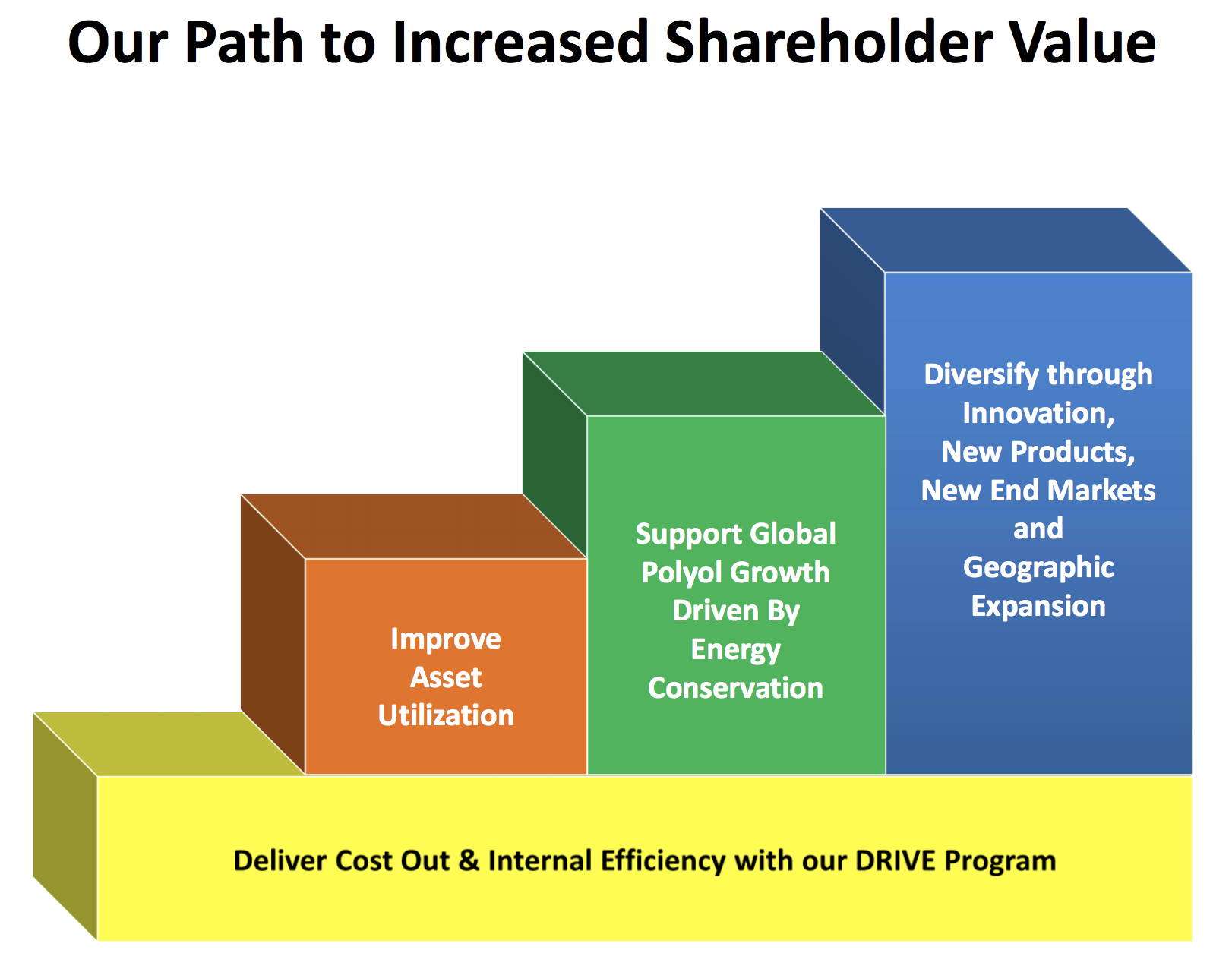

Stepan's decent profitability is driven by the company's DRIVE program, a continuous corporate cost cutting strategy that uses advanced data analysis to determine how best to optimize its factories and supply chain over time. In 2016 and 2017, DRIVE helped to cut Stepan's annual costs by a total of $30 million. For a company with $142 million in operating income in 2017, this is a very significant amount.

Management's operational discipline is also demonstrated by Stepan's conservative use of debt. The company maintains very low leverage ratios, and you can see that Stepan's balance sheet has been getting even stronger in recent years.

As a result, Stepan has the financial flexibility it needs to execute on its four-part growth plan.

- Research and development by creating a continuous stream of higher, value-added product applications, improving existing processes, and developing new processes for known products.

- Acquisitions in surfactants, polyols, and urethane systems.

- Globalization by establishing manufacturing locations, sales offices, and product development laboratories to supply its customers in their global expansion.

- Strategic alliances by leveraging its core technologies in world markets with joint ventures where it adds know-how, technology, capital, and customers to complement resources of local partners with raw material supplies, plant sites, regional know-how, and connections.

The company's R&D efforts (developing new and improved products) consumed $54 million in the past 12 months, or about 3% of revenue. Stepan focuses on expanding its mix of higher-margin products in more profitable areas such as the agriculture and oilfield markets. These areas tend to be more technically demanding and require more intimate customer collaboration to develop the right chemical formulas and applications.

Stepan is also investing to expand its reach overseas, especially in key emerging markets such as Asia and Latin America. Capital spending on capacity and distribution expansion made up about 4.4% of revenue over the past year. In total, R&D and capex spending consumes around 7% of the company's revenue.

Stepan is also investing to expand its reach overseas, especially in key emerging markets such as Asia and Latin America. Capital spending on capacity and distribution expansion made up about 4.4% of revenue over the past year. In total, R&D and capex spending consumes around 7% of the company's revenue.

Historically, Stepan has been very conservative when it comes to growth through acquisitions. However, the company has been more aggressive with acquisitions in the past few years, especially when it comes to breaking into emerging markets.

For example, Stepan made several bolt-on acquisitions over the years including:

- 2011: 100,000 ton-per-year methyl ester plant in Singapore

- 2011: state-of-the-art polyol chemical manufacturing facility in Brzeg Dolny, Poland, with 25,000 metric tons of blending capacity.

- 2013: Bayer MaterialScience's North American Polyester Resins business. This acquisition provided a significant line extension to its core business and the acquired Columbus, Georgia, USA facility provided 20,000 metric tons of capacity.

Then, in October 2016, Stepan bought two Brazilian specialty chemical companies, Tebras and PBC. The deal was a small bolt-on, adding about 2% to the company's annual sales. In March 2018, the company closed on a deal to acquire a 50,000 ton per year capacity surfactant plant in Mexico from BASF Mexicana.

Such acquisitions, of both outright commercial businesses in other countries, as well as manufacturing facilities, demonstrate Stepan's disciplined approach to gradually expanding its global footprint. That in turn helps it reap the benefits of faster economic growth in the most important international markets of the future.

Such acquisitions, of both outright commercial businesses in other countries, as well as manufacturing facilities, demonstrate Stepan's disciplined approach to gradually expanding its global footprint. That in turn helps it reap the benefits of faster economic growth in the most important international markets of the future.

Stepan is mostly focused on organic growth, via expansion of its existing facilities. In the past five years, the company has expanded six of its facilities which has resulted in annual polymer capacity growth of 8% annually.

Today the company is investing in a new R&D facility in China, while also building a new R&D and sales office in Houston, Texas. These facilities are designed to increase organic growth in the company's agricultural and oil services businesses.

Stepan plans to cash in on the estimated growth in global population (2 billion more people by 2040), which is expected to increase the need for crop production (which its products support) by 70%.

Meanwhile, 70% of the products Stepan produces are used in the oil industry, especially as part of fracking fluids. Stepan is working on chemicals that can reduce the use of fresh water in fracking (a major bottleneck) by up to 50%. As U.S. oil production continues rising thanks to the country's major shale formations, Stepan's business should benefit from the rising tide.

The bottom line is that Stepan produces highly specialized chemicals essential to many of the most important industries serving global economic growth. As a result, the company enjoys a handful of long-term growth catalysts. Thanks to lower tax rates, ongoing cost cutting, capacity expansions, and continued growth in its end markets, Stepan has the potential to continue generating close to double-digit annual growth in its earnings.

Stepan has managed to grow its adjusted net income by 22% annually for the past decade, so it doesn't seem unreasonable for the business to continue on a similar path in the years ahead. If successful, the firm's dividend seems very likely to continue increasing at a high single-digit to low double-digit annual pace.

However, there are several risks facing the company that could cause its future growth to come in below expectations.

Key Risks

While Stepan enjoys relatively solid cash flow stability due to its high mix of defensive end markets, 40% of its sales are still made to cyclical industries such as: energy, construction, automotive, and industrial. As a result, the company's sales, earnings, and cash flow will rise and fall with the global economy over the short term.

And because 40% of Stepan's sales come from overseas, including substantial exposure to emerging markets like Brazil, the company also faces significant currency risk. Specifically, if the U.S. dollar appreciates against local currencies, then its reported sales and earnings growth can materially decrease.

Another short-term risk to keep in mind is that Stepan's margins are highly effected by raw material costs which consume 60% of its annual revenues. These mostly include natural gas (powers its facilities and electric generators) and petroleum-based products (petrochemicals). In other words, Stepan's margins are somewhat at the mercy of volatile energy prices which have been rising in recent years. For example, rising oil prices were partially responsible for Stepan's Polymers segment seeing operating margin decline by 21% in the first quarter of 2018.

Finally, investors should realize that accelerating trade conflicts between the U.S., China, and U.S. allies (EU, Canada, Mexico) could materially impact the company's growth potential overseas. In response to U.S. tariffs, these nations have retaliated with countervailing duties of their own, including on petrochemical products that Stepan makes. If these 25% tariffs go into effect and remain in place for a long time, they will likely reduce Stepan's competitiveness in its key foreign markets.

Overall, Stepan seems like a stodgy business that will continue playing a role in the world's economy for many years to come. The business produces many essential chemicals used in a wide variety of industries. By focusing on the most demanding applications that require innovation and specialized formulations, and directing more of its products into large markets with strong long-term growth potential, Stepan should have no problem continuing its dividend growth streak.

Meanwhile, management's focus on operating efficiency and maintaining a conservative balance sheet reduce the company's risk profile, especially during recessions.

Overall, Stepan seems like a stodgy business that will continue playing a role in the world's economy for many years to come. The business produces many essential chemicals used in a wide variety of industries. By focusing on the most demanding applications that require innovation and specialized formulations, and directing more of its products into large markets with strong long-term growth potential, Stepan should have no problem continuing its dividend growth streak.

Meanwhile, management's focus on operating efficiency and maintaining a conservative balance sheet reduce the company's risk profile, especially during recessions.

Closing Thoughts on Stepan Company

Despite operating in a cyclical and price-sensitive industry, Stepan has proven itself to be a disciplined steward of shareholder capital. The company's rock solid balance sheet, solid growth drivers, and very low payout ratio have allowed it to deliver one of the most impressive dividend growth records of any company.

Going forward, Stepan's improving economies of scale (rising margins), growing end markets, and disciplined expansion into emerging markets should allow it to continue increasing its secure dividend at a strong rate. Simply put, this small cap dividend king could be a decent choice for most long-term dividend growth portfolios.