Bank of Nova Scotia: Paying Dividends Since 1833

Founded in 1832, Bank of Nova Scotia (BNS) is one of Canada's largest and most diversified banks. The firm provides a broad range of products and services, including personal and commercial banking, wealth management and private banking, corporate and investment banking, and capital markets.

The bank, commonly referred to as Scotiabank, generates about 56% of its revenue from net interest income (i.e. lending operations), with the remaining 44% from non-interest income sources including credit card fees, mutual funds, investment management, underwriting fees, trading revenues, and more.

The bank, commonly referred to as Scotiabank, generates about 56% of its revenue from net interest income (i.e. lending operations), with the remaining 44% from non-interest income sources including credit card fees, mutual funds, investment management, underwriting fees, trading revenues, and more.

Scotiabank has three business units:

- Canadian Banking: (46% of revenue, 50% of earnings): provides residential mortgages, credit and debit cards, checking and savings accounts, business and government loans, personal and auto loans, and wealth management services.

- International Banking (39% of revenue, 30% of earnings): operates primarily in Latin America (Mexico, Colombia, Peru, and Chile), the Caribbean, and Central America with a full range of personal and commercial financial services, as well as wealth products and solutions.

- Global Banking and Markets (15% of revenue, 20% of earnings): serves global capital markets by providing corporate lending, investment banking, debt and equity issuances, M&A and restructuring consulting, trading and research, brokerage services, cash management, and custodial accounts.

Among the major Canadian banks, Scotiabank is among the most internationally-focused. In 2018 Canada accounted for 56% of the firm's earnings, followed by the Pacific Alliance / Latin America (21%), the Caribbean (8%), other international markets (8%), and the U.S. (7%).

Scotiabank declared its initial dividend on July 1, 1833, and payments have been made continuously since.

Business Analysis

Banking is largely a commodity product, with consumers and businesses seeking access to dependable financing at the lowest interest rate possible. Banks with the largest low-cost deposit bases (i.e. cheap sources of funding to use for lending), most efficient operations, and conservative risk management practices tend to be best off.

Scotiabank checks all of these boxes but also benefits from generating close to 60% of its net income in Canada, where the banking sector is especially favorable. Canada's banks are known for their stability, even sailing through the global financial crisis with relative ease (no Canadian banks failed or required government bailouts).

In fact, Canada hasn't had a banking crisis since 1840, largely due to strict regulations that cement the largest banks as an effective oligopoly. According to Department of Finance Canada, the country's six largest banks command more than 90% of market share, resulting in substantial pricing power and a more rational competitive environment.

Scotiabank checks all of these boxes but also benefits from generating close to 60% of its net income in Canada, where the banking sector is especially favorable. Canada's banks are known for their stability, even sailing through the global financial crisis with relative ease (no Canadian banks failed or required government bailouts).

In fact, Canada hasn't had a banking crisis since 1840, largely due to strict regulations that cement the largest banks as an effective oligopoly. According to Department of Finance Canada, the country's six largest banks command more than 90% of market share, resulting in substantial pricing power and a more rational competitive environment.

This concentration of power is partly driven by Canadian regulators who have set strict underwriting and credit standards, while also forcing banks to eat more of their own cooking. For example, Canadian banks are required by law to hold more loans (including mortgages) on their own books, rather than securitize (i.e. sell) them to third parties. As a result, lending practices tend to be more conservative.

Home mortgages, which account for over 40% of Scotiabank's total loans, also require a minimum downpayment of 5%, and any mortgage without at least 20% down payment requires default insurance. Mortgage interest is also not tax deductible in Canada, reducing the incentive for consumers to borrow and delay repayments.

Besides mortgage rules, stricter credit score lending standards are also in place because the Canadian government requires mortgage loan insurance when a home buyer has less than a 20% downpayment. These conservative practices are one reason why Canadian banks suffered far less than many other financial institutions in 2008-2009.

Besides mortgage rules, stricter credit score lending standards are also in place because the Canadian government requires mortgage loan insurance when a home buyer has less than a 20% downpayment. These conservative practices are one reason why Canadian banks suffered far less than many other financial institutions in 2008-2009.

When combined with their impressive scale and geographic diversification across the country, Canada's largest banks enjoy durable competitive advantages, despite offering similar products and prices.

These behemoths enjoy some of the lowest cost sources of funding (massive deposit bases paying little interest), have thousands of retail locations across the country to cheaply acquire new customers, and have expanded their operations into hundreds of different product lines to continue growing. Smaller rivals struggle to compete with the giants' prices, services breadth, and reputation.

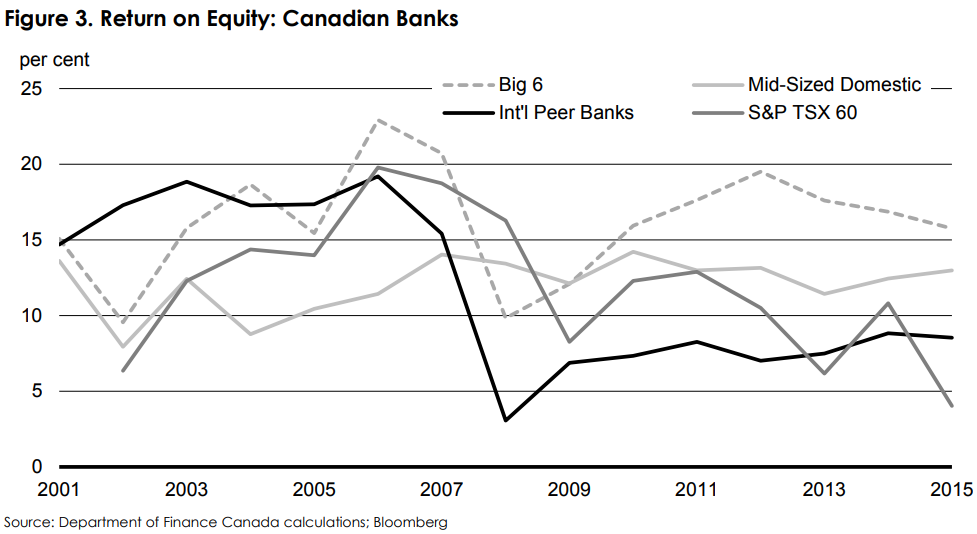

As you can see below, Canada's big six banks (the dashed line) have generated solid profitability throughout all types of economic environments for many years. They have also earned a superior return on equity compared to smaller Canadian banks, international peers, and the corporate sector overall.

Given the greater number of U.S. banks competing with each other, plus the onerous regulations that were implemented following the financial crisis to reduce risk, most American banks earn a much lower return on equity (the key banking profitability metric) than their Canadian counterparts.

In addition to enjoying strong profitability, Scotiabank is run very conservatively. The bank's capital levels are maintained well above minimum regulatory requirements to ensure the firm can weather any economic storm and remain solvent (i.e. not need a bailout). Scotiabank also earns an A- credit rating from Standard & Poor's.

One of the biggest differences between Scotiabank and the other major Canadian banks is the firm's diversified earnings profile. About 40% of Scotiabank's profits are generated outside of Canada and the U.S.

Scotiabank is the only global bank with a major presence in all of the so-called Pacific Alliance Countries: Mexico, Peru, Chile, and Colombia. Together, these countries account for roughly a quarter of the bank's total earnings, and Scotiabank has had a presence in this region for nearly 30 years.

Management is optimistic about the long-term growth Scotiabank can achieve in the Pacific Alliance Countries given their large and growing populations, low banking penetration rates, and expanding economies.

However, international banking, especially in emerging markets, has an elevated risk profile. For example, loan losses are much higher in these regions compared to in Canada and the U.S. But management believes the company achieves good risk-adjusted profitability in these markets because lending operations enjoy a much higher net interest margin compared to developed nations.

With CEO Brian Porter having spent most of his time in emerging market banking (about 20 years worth of experience), Scotiabank is arguably the best positioned of any Canadian bank to grow profitably and safely in the world's fastest-growing markets.

Going forward, management thinks the bank can achieve 7% annual earnings growth, which means the company's long-term dividend growth potential is also about 7% since Scotiabank's payout ratio sits within management's 40% to 50% target range.

Overall, Scotiabank, like its large Canadian peers, is a very well-managed company that has delivered predictable returns and dividends for shareholders for more than a century. Combined with its high exposure to international banking, Scotiabank has one of the longest growth runways of any Canadian bank.

Key Risks

First, note that as a Canadian company, Scotiabank pays its dividend in Canadian dollars. This creates some currency risk in that a stronger U.S. dollar might decrease the effective dividend amount for American shareholders, at least in the short term (each quarterly dividend is converted from Canadian dollars to U.S. dollars when it is paid, based on prevailing exchange rates).

In addition, like all Canadian stocks, U.S. Scotiabank investors face a 15% foreign dividend tax withholding. Tax treaties between the U.S. and Canada allow U.S. investors to potentially recoup this withholding, but it can be a complicated and lengthy amount of paperwork at tax time.

As for risks to the bank itself, there are several to consider. First, like all banks, the company's profits are largely tied to the health of the economies in which it operates. While Scotiabank is the most diversified of Canada's big banks, its revenue and earnings can still be negatively affected by global downturns.

For example, during the global financial crisis the company's sales and earnings fell by 6% and 19%, respectively. This caused the bank to freeze its dividend. However, the dividend was safely maintained as the company remained highly profitable and the dividend payout ratio was just 48% in 2009.

Scotiabank's strong balance sheet, culture of conservatism, and diversified business mix suggest the bank is prepared to ride out the next downturn, whenever it happens. However, investors considering owing any bank must be comfortable with their sensitivity to economic cycles. These can be volatile stocks.

Scotiabank's strong balance sheet, culture of conservatism, and diversified business mix suggest the bank is prepared to ride out the next downturn, whenever it happens. However, investors considering owing any bank must be comfortable with their sensitivity to economic cycles. These can be volatile stocks.

Economic downturns in Latin America may become a bigger concern for the bank as well, given its large growth ambitions in that region. In the past decade, Latin America has enjoyed relatively calm and stable politics, as well as economic growth. However, the region can be rocked by commodity price declines and significant political turmoil, which can result in loan losses.

Management has done a good job of disciplined underwriting and maintained a stable and relatively low (for the region) loan loss ratio over time. However, the bank's loss ratio might rise significantly during the next economic downturn, though it seems unlikely to threaten the dividend.

The other major risk all banks face is regulatory in nature. Canadian regulators can raise banks' capital requirements, potentially lowering their profitability in an effort to reduce systemic risk. While such actions could slow the bank's earnings growth, it would likely further improve its fundamental risk profile.

Closing Thoughts on Bank of Nova Scotia

Canadian banks have proven to be some of the safest in the world over the years. Virtually all banks are complex financial institutions with cyclical earnings and murky balance sheets, but Canadian banking culture is very conservative, which should help Scotiabank's dividend profile remain relatively strong even during a global economic downturn.

While Scotiabank's industry-leading exposure to emerging markets creates risks investors need to keep in mind, it also potentially gives the firm one of the best long-term growth runways of any major Canadian bank.

Combined with management's disciplined approach to safe banking practices, Scotiabank could be an interesting income growth idea for investors who are comfortable investing in this complex industry.

While Scotiabank's industry-leading exposure to emerging markets creates risks investors need to keep in mind, it also potentially gives the firm one of the best long-term growth runways of any major Canadian bank.

Combined with management's disciplined approach to safe banking practices, Scotiabank could be an interesting income growth idea for investors who are comfortable investing in this complex industry.