Cummins: Paying Higher Dividends Since 2006

Founded in 1919 in Columbus, Indiana, Cummins (CMI) is the largest dedicated global industrial diesel and natural gas engine manufacturer.

The company’s primary markets are highway and heavy-duty vehicles, construction, and general industrial markets, where it serves customers such as Chrysler, Daimler, Volvo, PACCAR, Navistar, CNH Global, Komatsu, and Ford.

PACCAR is the largest customer accounting for 15% of 2018 sales. Daimler and Navistar are the next largest customers, and collectively its four largest OEM clients accounted for 35% of last year's revenue. Most of this business is secured under long-term supply deals.

The company's products are sold in more than 190 countries via its network of 600 company-owned and independent distributor locations and over 7,600 dealers.

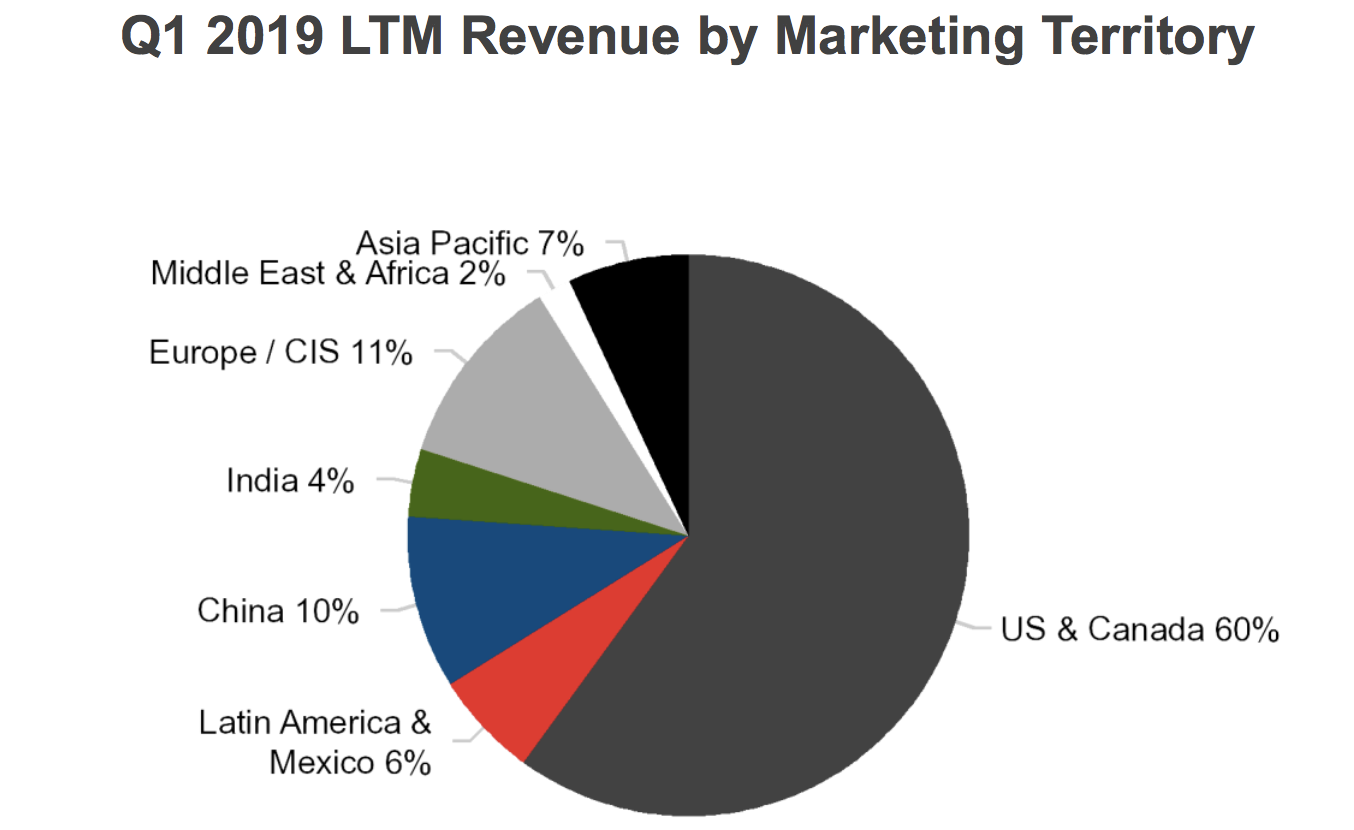

About 60% of Cummins’ revenue is generated in North America, but China (10%) and India (4%) are also meaningful markets. In fact, Cummins has had a presence in China and India for more than 40 years and 50 years, respectively.

Cummins reports results in five segments, but its largest driver is its engines division:

- Engines (35% of revenue, 41% of operating profit): builds diesel and natural gas engines for heavy and medium-duty truck, buses, recreational vehicles, as well as light-duty automotive, agricultural, construction, mining, marine, oil and gas, rail, and governmental vehicle markets.

- Distribution (26% of sales, 16% of operating profit): distributes parts and filtration products as well as maintenance, engineering, and product integration services to end-users around the world.

- Components (24% of sales, 39% of operating profit): supplies products which complement Cummins' Engine and Power Systems segments, including after treatment systems (used to convert engine emissions of criteria pollutants into harmless emissions), turbochargers, transmissions, filtration products, and fuel systems to help customers meet regulatory emission requirements.

- Power Systems (15% of sales, 17% of operating profit): sells power generators and systems (including controls, alternators, switches) for a diverse array of end markets, as well as high-horsepower engines for industrial applications.

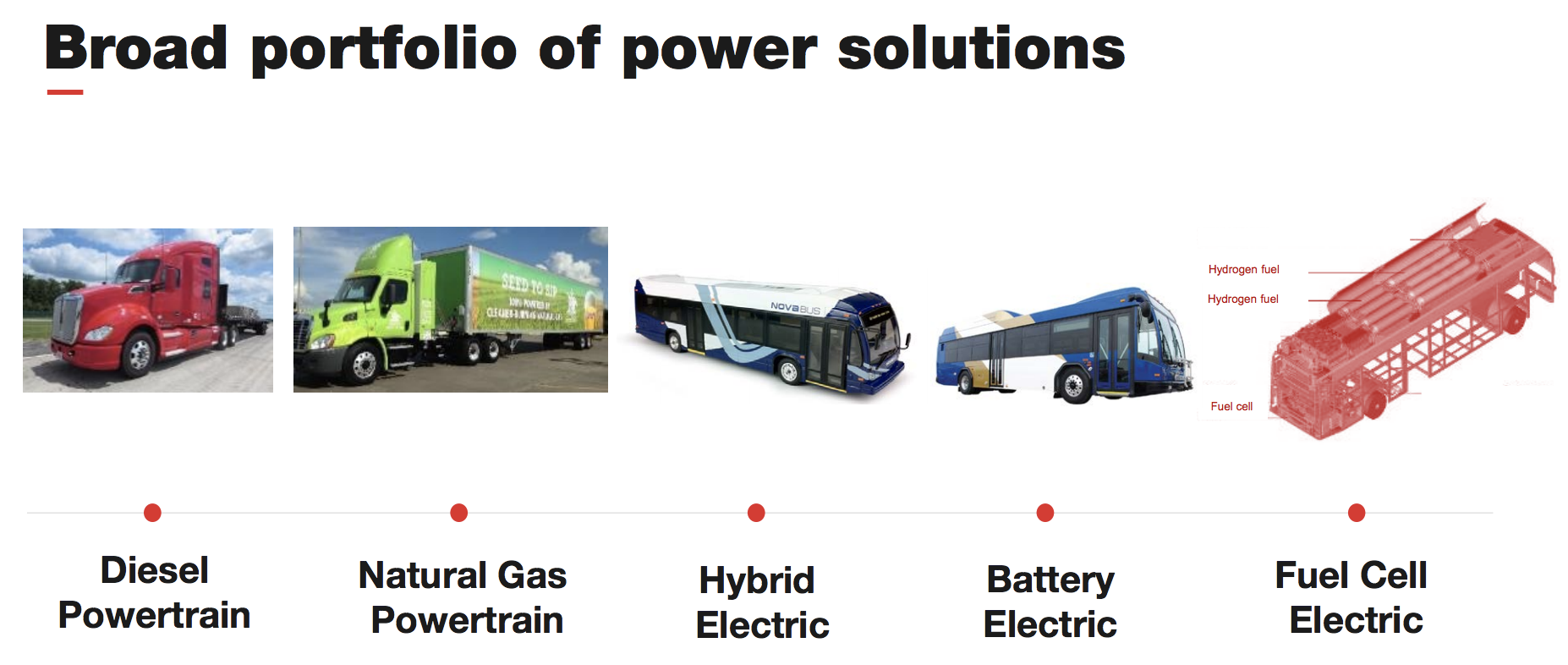

- Electrified Power (less than 0.1% of sales and 0% of EBITDA): sells and electrified power systems ranging from fully electric to hybrid systems for Class 4-8 commercial vehicles. First products are expected to launch in 2019 and 2020 (just $7 million in sales in 2018).

Cummins has paid uninterrupted dividends since 1993 and increased its dividend every year since 2006.

Business Analysis

Cummins has built itself into the dominant truck and bus engine maker thanks to its expertise in meeting mandated emission requirements (the EPA has forced a 90% reduction in emissions in the past decade) through innovations such as natural gas engines, hybrid buses, turbochargers, and advanced catalytic systems.

The company typically spends about 3% to 4% of its sales on R&D ($900 million in 2018), with much of its investment focused on improving the efficiency and emissions of its engines. This has led to dominating the market for diesel engines used in Class 8 trucks, where the company has about 38% market share and does business with every truck maker.

The engine market has several barriers to entry that have helped Cummins build strong market share positions around the world. Extensive regulations have resulted in strict standards governing emission and noise, for example.

The engines Cummins manufactures need to comply with emission standards established by the European Union, EPA, the California Resources Board, and other agencies. In 2007 and 2008 Cummins spent more than $170 million on research and development in order to comply with 2010 EPA emissions standards in the U.S.

Notably, several of Cummins’ competitors opted to exit certain markets rather than pony up the cash required to remain compliant with their technologies. For example, Caterpillar exited the on-highway truck engine market in 2009, reinforcing Cummins’ technological lead.

Gaining entry to the engine business is very difficult. For example, PACCAR (PAC) launched its first line of engines less than a decade ago after spending around 10 years of time and more than $1 billion developing it. The finished engine even used some of Cummins’ own engine components.

Over the last decade, more than half of the $2 billion to $3 billion Cummins has spent on research and development has been invested in technologies that reduce emissions. When it comes to fuel-efficient technology, Cummins has established itself as the clear manufacturer of choice.

Beyond its engine intellectual property and economies of scale, Cummins’ moat is also formed from the way its business is operated. The company generally maintains long-term price and engine supply agreements with core customers. For example, Cummins' relationship with PACCAR has existed for over 70 years, creating a level of trust that few rivals can hope to match.

The customer benefits from knowing Cummins’ products will be available, and OEM customers can collaborate with Cummins to jointly engineer future vehicles (including electric ones). In other words, switching costs are created that make it more difficult for new entrants to steal market share away from Cummins.

Engines are extremely important systems to keep heavy vehicles and equipment running, too. Idled trucks or heavy equipment can cause significant losses for their operators, so buying big-ticket items like engines from a reputable vendor is critical. In most cases, it’s not worth the risk of switching suppliers for a customer to save a little bit of money.

Simply put, machine downtime from a faulty engine is extremely costly, reinforcing Cummins’ value as a premium engine supplier. Besides its technology advantages, Cummins' large dealer network is especially important for its core customer base of medium and heavy-duty truck drivers, who travel long distances across the country each day.

Cummins’ vast network of dealer locations (over 7,600 across 190+ countries and territories) means it can provide timely aftermarket repair services, further gaining customers’ trust and creating a reputation for offering speedy replacements that can keep expensive machinery running and reduce costly downtime.

The more engines it has running in the field, the more higher-margin aftermarket parts and services revenue Cummins can enjoy, too.

It’s also worth noting the complementary nature of Cummins’ technologies and distribution channels, which seem likely to continue unlocking growth opportunities for the business.

For example, Cummins was able to apply its base technologies to enter the light-duty engine market in the mid-2000s. On the other end of the spectrum, Cummins developed a 4,000 horsepower “Hedgehog” engine a few years ago that is designed to serve the locomotive market.

Through continuous innovation and growth of its distribution and dealer networks, Cummins can continue maintaining its market share and expanding into adjacent markets for long-term growth.

Despite Cummins’ strengths, industrial companies are typically cyclical. Cummins is no exception and is very sensitive to new truck orders and the health of the global economy. When sales volumes drop, the high fixed costs required to run Cummins' factories quickly eat into the company's profit margins.

Fortunately, management's restructuring initiatives, cost management, and manufacturing footprint adjustments over the years have helped the company improve its performance during the inevitable industry troughs.

Management noted that the firm's operating margin at trough demand was -0.8% in 2001, but improved to 6.3% in 2009 and sits above 10% today. However, investors should note that this can be a very volatile business.

Despite the cyclical nature of this industry, Cummins has done a great job conservatively managing its business. For example, management maintains a very safe balance sheet, earning the company an A+ credit rating, and the firm's free cash flow payout ratio has remained below 50% each year for over a decade.

As a result, the firm has paid uninterrupted dividends for more than 25 years, including 13 consecutive years of dividend growth. However, there are still a number of risks to consider before investing in this company.

Key Risks

Like all multi-global corporations, Cummins faces the threat of a strong dollar. Negative currency effects reduce the sales and profits Cummins reports for accounting purposes and can create a growth headwind as the company attempts to gain more market share overseas. However, exchange rate volatility tends to cancel out over time.

As previously mentioned, the cyclical nature of the truck market can also cause short-term challenges for the company. Many industrial markets that depend on favorable commodity prices (mining, energy, etc.) are also big users of Cummins' engines and experience peaks and troughs in demand.

During the financial crisis, for example, Cummins' sales declined 25%, and its earnings fell 40%, highlighting how sensitive its top and bottom lines are to the health of the U.S. and global economies.

The escalating trade war between the U.S. and China serves as another short-term risk. With 10% of its business coming from China, plus many of its inputs tied to the prices of steel and aluminum, Cummins' margins could come under pressure. Management expects Chinese medium and heavy-duty truck sales to fall 10% this year, and business disruption could escalate until an agreement has been reached.

While cyclical end markets, currency volatility, and trade tensions ultimately seem unlikely to threaten Cummins' long-term earning power, increasing competition could.

For example, Volkswagen took a 17% stake in competitor Navistar (NAV) in 2016 as it attempted to appease global regulators after its recent emission scandal by investing in low emissions vehicles. Navistar and Volkswagen are investing to develop new engines and electric trucks, which are expected to launch by early 2020.

Additionally, PACCAR, a major customer (for more than 70 years), announced its entrance into the Class 8 engine market in 2010. Investors should continue watching Cummins’ cost-conscious truck manufacturers and OEM customers, who have historically outsourced certain types of engine production to Cummins but might look to vertically integrate more in the future to save money.

These aren't necessarily new developments, as Brett Merritt, Cummins' vice president of on-highway engine business, told Transport Topics:

“It’s long been said that Cummins competes against all of its customers. We know they can make diesel engines. Our job is to scale them better, to provide a broad product breadth that they may not have, to give the end customer a choice, and to help our OEM customers continue to sell trucks. Our goal at the end of the day is sell trucks."

Cummins' long-term supply agreements with its customers, the industry's high level of emissions regulations, the importance of a big dealer network, and the costly and lengthy time required to develop an engine reduce the likelihood of this becoming an issue.

Up until now, Cummins has benefited from the fact that increasing regulatory pressure to cut truck emissions has resulted in increasing design costs that potential rivals, such as Caterpillar (CAT), which used to have 35% of the market, chose to forgo by conceding the market to Cummins.

But those same regulations that have helped it secure its moat could also prove to be a double-edged sword. For one thing, stricter regulations could force Cummins to spend more to maintain compliance, potentially squeezing short- to medium-term margins.

In addition, momentum seems to be building to ban or reduce the use of diesel-powered vehicles. Mayors of Athens, Madrid, Paris, and Mexico City have already announced they plan to implement a ban on the use of these vehicles in their cities by 2025.

Germany has also adopted legislation to ban new internal combustion engine vehicles by 2030, and China is considering adopting a ban on the production and sale of diesel-powered vehicles as well. Meanwhile, California government officials are calling for the state to phase out sales of diesel-powered vehicles by 2040.

In other words, it's not out of the question that Cummins will need to meaningfully evolve its business mix over the next decade or two. Fortunately, Cummins has not been resting on its laurels and has been working on natural gas, hybrid, and electric engines for many years.

But those same regulations that have helped it secure its moat could also prove to be a double-edged sword. For one thing, stricter regulations could force Cummins to spend more to maintain compliance, potentially squeezing short- to medium-term margins.

In addition, momentum seems to be building to ban or reduce the use of diesel-powered vehicles. Mayors of Athens, Madrid, Paris, and Mexico City have already announced they plan to implement a ban on the use of these vehicles in their cities by 2025.

Germany has also adopted legislation to ban new internal combustion engine vehicles by 2030, and China is considering adopting a ban on the production and sale of diesel-powered vehicles as well. Meanwhile, California government officials are calling for the state to phase out sales of diesel-powered vehicles by 2040.

In other words, it's not out of the question that Cummins will need to meaningfully evolve its business mix over the next decade or two. Fortunately, Cummins has not been resting on its laurels and has been working on natural gas, hybrid, and electric engines for many years.

The company plans to invest another $500 million over the next several years to develop an electrified powertrain product line, along with key component technologies and service offerings to support electrification.

However, companies such as Tesla (TSLA), Mercedes, and others have announced that they are working on electric semi-trucks as well. Tesla officially unveiled its all-electric truck in November 2017.

Tesla’s truck is expected to hit the market in 2019 (though the firm frequently misses its deadlines) and have enough range to cover most regional freight deliveries while being cheaper to operate than diesel trucks. Cummins announced its own electric truck (the company would primarily provide the battery and driveline system) in 2017 as well and doesn’t believe Tesla’s truck is suitable for long-haul trucking.

Tesla’s truck is expected to hit the market in 2019 (though the firm frequently misses its deadlines) and have enough range to cover most regional freight deliveries while being cheaper to operate than diesel trucks. Cummins announced its own electric truck (the company would primarily provide the battery and driveline system) in 2017 as well and doesn’t believe Tesla’s truck is suitable for long-haul trucking.

While the technology to create economical long-haul electric semis is probably still at least a decade or two away (mostly limited by batteries), investors need to keep in mind that electric trucks could potentially impact Cummins’ business model.

At the very least, the company's electrified power segment is likely to generate losses for the next few years as it works on scaling up. In the first quarter of 2019, EBITDA for that segment was -$130 million on an annualized basis due to heavier R&D spending that isn't expected to start paying off for another year or two.

At the very least, the company's electrified power segment is likely to generate losses for the next few years as it works on scaling up. In the first quarter of 2019, EBITDA for that segment was -$130 million on an annualized basis due to heavier R&D spending that isn't expected to start paying off for another year or two.

Also be aware that electric vehicle engines are far more reliable, longer-lasting, and have very few moving parts. This makes for far less frequent maintenance requirements and would reduce demand for most of the equipment Cummins has spent the last century perfecting. Investors need to continue monitoring developments in this area.

Closing Thoughts on Cummins

Cummins is a cyclical but solid blue-chip dividend growth stock with an excellent record of rewarding income investors with secure and growing payouts.

Over the short term, investors need to remain mindful of the company's volatile end markets, which can create attractive buying opportunities when times are tough. The current uncertainties surrounding global trade also might lead to heightened volatility as 2019 progresses.

Overall, Cummins' markets should continue growing over long-term periods, though the rise of electric vehicles and new rivals could alter the industry's competitive dynamics.

For now, Cummins' key competitive advantages (long-standing industry relationships, massive dealer network, economies of scale, technology investments) seem likely to ensure that the company adapts as needed and continues to capture a meaningful part of the market.