Accenture: A Fast-Growing IT Consulting Business

With roots dating back to 1951, Accenture (ACN) is one of the largest professional services companies in the world and provides a range of end-to-end services and solutions in strategy, consulting, digital (marketing, analytics, mobility), technology infrastructure, and operations. Accenture essentially develops and implements technology-driven solutions to improve its clients’ productivity and efficiency.

Serving more than 40 industries, Accenture delivers virtually every business function needed by its customers. The company's clients include 92 of the Fortune Global 100 and over 75% of the Fortune Global 500.

Approximately 55% of Accenture’s revenue is generated from consulting (strategy, management and technology consulting and systems integration) with the remaining 45% from outsourcing activities (ongoing, repeatable services provided to transition, run, and maintain operations of client systems).

Digital, cloud, and security services account for about 60% of sales and are growing at a double-digit clip (including a 25% increase in fiscal year 2018).

By geography, North America is the company’s largest region and accounts for 46% of total revenue. Europe generates another 34% of revenue, and the remaining 20% is from growth markets such as Brazil.

Accenture is also well-diversified by the industries it serves, generating 28% of sales from product companies (consumer goods, retail, travel services, industrial, life sciences); 20% from the financial services sector (banking, capital markets, insurance); 20% from communications, media, and tech firms; 17% from the healthcare space; and 14% from the chemicals, energy, utilities, natural resources industries.

Business Analysis

Accenture’s competitive advantages begin with the firm's long operating history, wide range of services, and focus on developing its people.

The company has been in business for more than 60 years, which has given it the time needed to establish long-lasting customer relationships and build out its portfolio of skills and services.

The longer Accenture works with a client, the more ingrained it becomes in the client’s business processes and key strategic issues. As a result, switching costs are created that help with client retention. For example, 97 of the firm's top 100 clients have worked with the company for 10 years or more.

Few companies can match the breadth and reach of Accenture’s services, which is a requirement to serve large multinational clients. The company has offices in 53 countries around the world and is able to deliver end-to-end solutions virtually anywhere. Accenture also consistently acquires smaller rivals to round out its services.

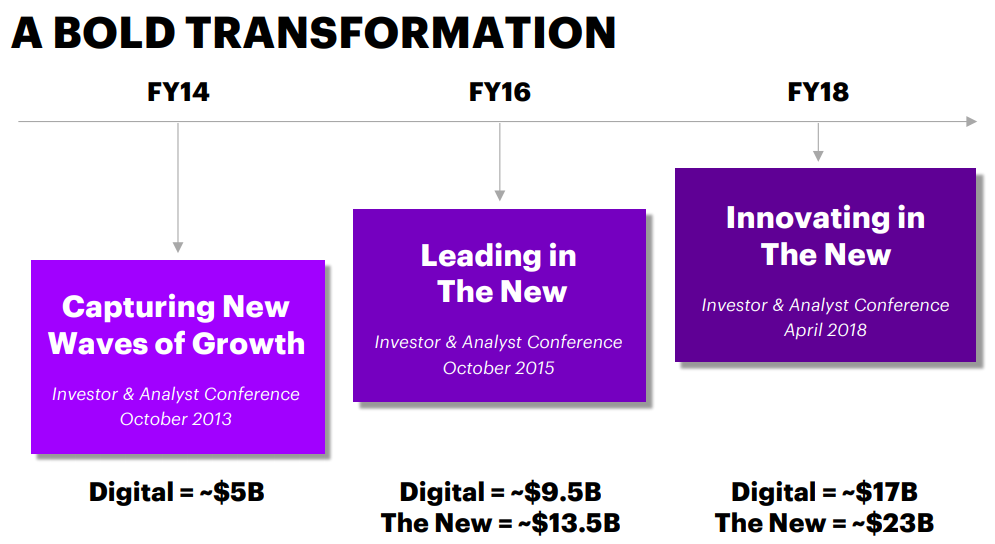

As the pace of technological advancements accelerates, Accenture is becoming an even more important partner for its clients because it helps them be the digital disruptors rather than the disrupted. As you can see, the company's digital business has more than tripled in size in just four years.

From 3D printing, cloud computing, data analytics, artificial intelligence, blockchain and security, to virtual reality and robotics, Accenture plays a leading role in helping its clients go more digital with their products and services.

Digital-related, cloud-related, and security-related services now represent about 60% of Accenture’s revenue and are growing at a strong double-digit clip. Their share has continued to gain sharply from 40% of total revenues in 2016 and 30% the year before that.

Accenture seems to have a clear lead in the digital arena, which is fueling a lot of the company’s growth. For example, Accenture is the number one enterprise services provider for the cloud. HFS Research also named Accenture the overall leader in innovation in artificial intelligence in 2018, ahead of 17 other competitors.

The company provides cloud services for more than 90% of the Fortune Global 100 and is the number one provider to all of the leading players in the ecosystem today such as Oracle, Microsoft, SAP, and Salesforce.

Above all else, Accenture is a human capital business. The firm’s services are provided by its people, and the company must differentiate based on its expertise and trust accumulated with clients.

To stay ahead of the pack, Accenture spends heavily on its employees. The company invested $927 million in learning and development in fiscal year 2018, including substantial spending to help its employees stay relevant in key areas such as cloud, artificial intelligence, and robotics. This is much more than Accenture invests in property and equipment and represents more than $1,900 per employee.

With over 482,000 employees, including thousands of PhDs, web developers, data scientists, digital marketers, and big data specialists, Accenture’s skilled workforce would be very hard to replicate – especially on a global scale.

As a capital-light business, Accenture also benefits from being able to adapt its business model somewhat more easily to changing conditions. The company can hire, train, or acquire new personnel to fill holes in its services portfolio and stay ahead of trends. This is much easier than retooling a large manufacturing factory.

Headcount can be adjusted up or down based on the economy’s strength as well, helping Accenture better manage its profitability throughout economic cycles. Accenture also performed relatively well throughout the financial crisis because its services are needed by businesses through each stage of the economic cycle.

As technology continues advancing, companies must continue investing in innovation and productivity to remain competitive. Accenture can also help companies reduce their spending, save costs, and better align their operations with future opportunities.

Simply put, Accenture is a very durable business with numerous intangible assets (brand recognition, skilled workforce, long-term client relationships, etc.) that make it hard to disrupt.

With that said, every business still faces risks.

Key Risks

While the ongoing shift to a digital economy is helping a large chunk of Accenture’s business today, it goes without saying that the digital revolution is causing many companies to face an unprecedented amount of change – including Accenture.

One example would be the rise of software-as-a-service (SaaS), which is taking market share from on-premise deployments of software.

SaaS deployments are smaller in size, resulting in less revenue available for parts of Accenture’s outsourcing business, which also faces stiff competition from the likes of Indian outsourcers such as Cognizant and Infosys.

IBM has certainly been caught off guard by a number of technological advancements (e.g. cloud computing), which have hurt its business in recent years.

While Accenture has arguably been a first mover in the digital space, other companies are fast catching up and making major investments in this area. Accenture also faces competition in its consulting area from the Big 4 consulting and audit firms Deloitte, KPMG, PricewaterhouseCoopers, and Ernst & Young.

These companies have similar industry capabilities and are making huge investments into digital areas such as analytics, cybersecurity, and automation.

Companies such as Facebook and Alphabet could also emerge as more meaningful rivals as they continue to control an increasingly massive pool of valuable data for businesses and consumers.

For now, however, Accenture’s core businesses have continued to grow. The company’s digital offerings have also done extremely well, but it’s worth keeping an eye on the impact technology changes could have on Accenture’s business model and long-term earnings power.

Besides technological changes, most of Accenture’s markets are extremely competitive. The company’s long-term future could be hurt if cheaper overseas competitors begin to pressure the industry’s pricing model or if clients move some of Accenture’s services in-house.

For now, Accenture’s favorable competitive positioning appears to be on solid ground.

Closing Thoughts on Accenture

Accenture provides timeless services (consulting and outsourcing), benefits from its brand recognition and breadth of services, participates in large and fragmented markets, and has a long runway for earnings and dividend growth thanks to its exposure to digital, cloud, and security-related services.

Thanks to its numerous advantages, the company has raised its dividend every year since it began paying one in 2005. While the continued rise of the digital age is creating challenges for many companies, Accenture stands to be a beneficiary of many of these trends. As a result, the firm should continue rewarding its shareholders with strong dividend growth for many years to come.