NHI Reduces Dividend to Provide Operators with More Assistance

National Health Investors (NHI) on June 3 cut its dividend by 18%. This was in line with the expectation we shared in May that NHI may lower its dividend by up to 25%, reflecting the challenging environment faced by its senior housing and skilled nursing tenants.

NHI's dividend cut will save the REIT nearly $40 million annually (about 12% of revenue), providing more flexibility to adjust lease terms for distressed tenants until the industry has seen occupancy levels recover from the pandemic.

Management also noted the potential for asset sales and acquisitions to improve the portfolio's quality.

NHI's dividend cut will save the REIT nearly $40 million annually (about 12% of revenue), providing more flexibility to adjust lease terms for distressed tenants until the industry has seen occupancy levels recover from the pandemic.

Management also noted the potential for asset sales and acquisitions to improve the portfolio's quality.

"We believe this action puts NHI in a better position to significantly improve the quality of our real estate portfolio through lease restructurings, asset sales, and accretive acquisitions while still being committed to a sustainable dividend to our shareholders."

– President and CEO Eric Mendelsohn

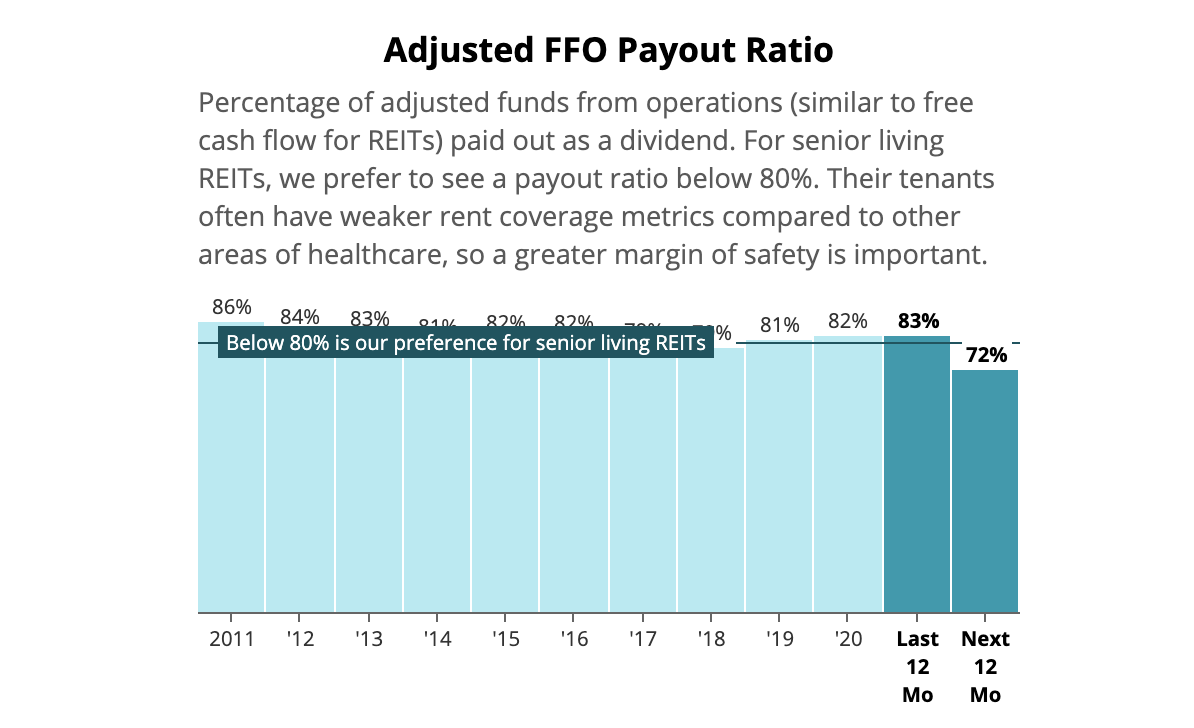

Following the dividend reduction, NHI's adjusted funds from operations (AFFO) payout ratio is projected to be 72% in the year ahead, marking its lowest level in at least a decade.

NHI's payout ratio seems likely to face upward pressure as management mulls asset sales and takes more actions to support struggling tenants.

As we discussed in our May note, 97 of NHI's 215 leased properties had an average rent coverage ratio of 0.95x at the end of 2020. Ratios near or below 1.0x suggest operators have insufficient cash flow to cover rent and may require deferrals or other lease adjustments.

NHI last week noted it reached an agreement with Holiday (11% of rent) to defer about one fourth of its rent due in May, June, and July. We wouldn't be surprised if additional deals are struck with Holiday and other tenants in the quarters ahead.

Despite this lingering uncertainty, which could weigh on NHI's short-term cash flow, we believe the firm now has a reasonable margin of safety to support its payout. As a result, we are upgrading NHI's Dividend Safety Score from Unsafe to Borderline Safe.

Another score upgrade is unlikely until NHI has finished pruning its portfolio and seen its tenants return to stronger rent coverage ratios as the industry recovers.

This would give us more confidence in NHI's ability to maintain its BBB- investment grade credit rating, which sits only one notch above junk status, and keep its rebased dividend well covered by cash flow.

As always, we will continue monitoring developments across NHI's portfolio and provide updates as needed.