Pfizer Decides to Maintain Full Dividend Despite Spin-off as Covid Vaccine Demand Boosts Earnings

Since announcing in July 2019 plans to spin off its established drug business, Pfizer has communicated it would lower its dividend to reflect its reduced standalone cash flow. However, income investors were expected to be kept whole after accounting for the new dividend to be paid by the spinoff, Viatris.

This dividend adjustment was expected to occur during the second quarter when Viatris declared its first dividend. But Pfizer on Thursday announced that it will now keep its full dividend intact going forward, resulting in an effective raise for shareholders:

This dividend adjustment was expected to occur during the second quarter when Viatris declared its first dividend. But Pfizer on Thursday announced that it will now keep its full dividend intact going forward, resulting in an effective raise for shareholders:

"The board has decided to maintain Pfizer’s quarterly dividend at its current rate despite the planned declaration of a dividend payment by Viatris Inc. that would be payable to those Pfizer shareholders that have elected to continue holding Viatris shares received from the combination of Upjohn and Mylan. This decision results in an increased dividend income to those shareholders continuing to own shares of both Pfizer and Viatris."

This decision could be driven by expectations that Viatris's yet-to-be-declared dividend will be lower than initially hoped, giving Pfizer less room to reduce its payout while still honoring its word to keep income investors whole.

We discussed Viatris's disappointing cash flow and dividend guidance in February and guessed that Pfizer's dividend reduction would be less than 5% as a result.

Maintaining the full dividend isn't a major difference from that forecast, but it could still suggest that Pfizer's outlook is trending better than expected as vaccine demand rises.

In early February, management projected that Pfizer's Covid-19 vaccine could account for around 20% to 25% of the firm's 2021 sales and earnings. It's unclear how sticky these profits may be as the virus evolves and the long-term effectiveness of vaccines remains unknown.

However, with more contagious Covid variants emerging and global cases hitting a weekly record, demand for Pfizer's vaccine could be sustained at high levels for a long time to come.

Earlier this month, Pfizer's CEO said that people will "likely" need a third dose of the firm's vaccine within 12 months of getting fully vaccinated. He also believes people may need to get vaccinated against Covid-19 annually.

These factors could make Pfizer's Covid vaccine revenue stickier than some analysts expect, supporting a higher base of earnings beyond 2021.

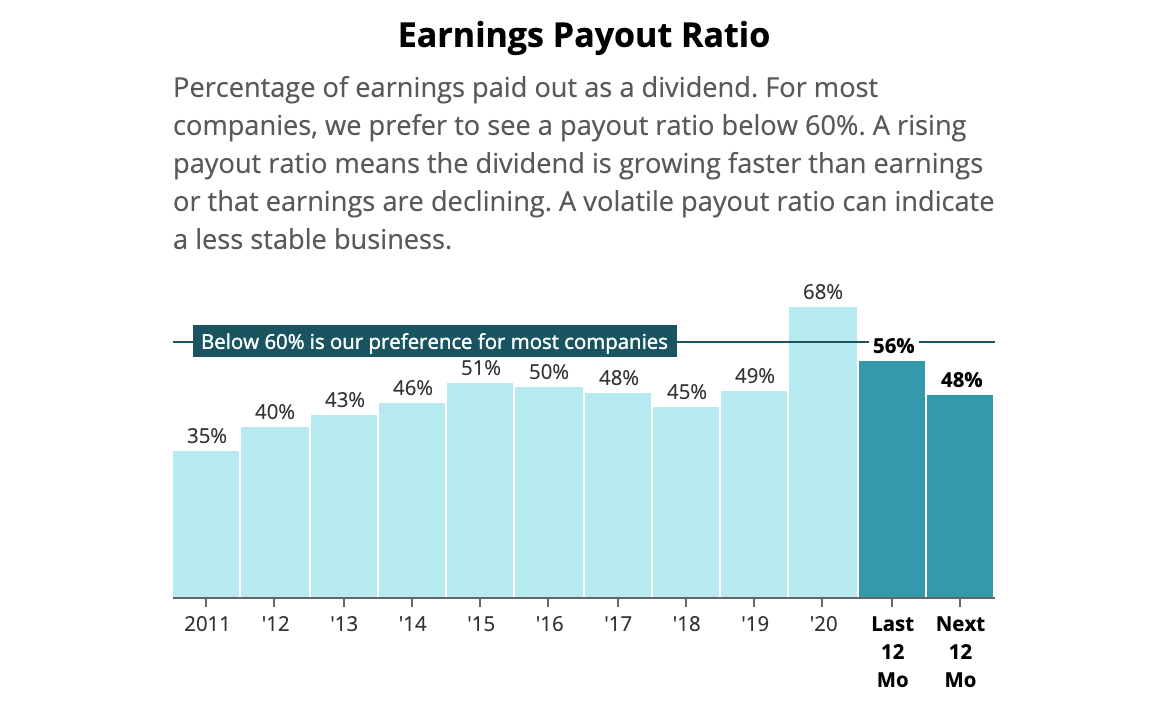

With vaccine profits expected to surge this year, Pfizer's payout ratio is on track to fall below 50%. That would mark Pfizer's lowest payout ratio since 2018 despite losing nearly 20% of its profits last year after spinning off its established drugs business.

Excluding Covid vaccine earnings, Pfizer's payout ratio this year would be around 60% based on management's guidance provided in February.

The company's peers generally maintain payout ratios between 40% and 50%, but Pfizer could return to that safer range faster if a portion of its vaccine earnings prove to be recurring with annual shots required.

Even without contributions from its coronavirus vaccine, Pfizer this year expects its revenue and adjusted earnings to grow 6% and 11%, respectively. This pace of growth will help Pfizer's underlying payout ratio return to more normal levels over the next couple years while global vaccine rollouts buoy total profits.

Overall, we remain optimistic about Pfizer's long-term future and like the firm's focus on higher-margin, faster-growing prescription drugs without betting its future on any single product.

Depending on how conservatively management views Pfizer's payout ratio (with or without Covid vaccine profits), the company's dividend could grow at a much slower pace than underlying earnings the next few years.

However, income investors can feel good knowing that Pfizer's existing dividend will be maintained in full and is well supported by the firm's cash flow generation, drug pipeline, and investment-grade balance sheet.