McDonald's Dividend Remains a Priority as Sales Trends Improve

McDonald's (MCD) provided a business update yesterday which showed continued improvement in sales trends from late March through May.

In the U.S. (36% of total revenue), comparable sales were down only 5.1% in May, a meaningful improvement compared to a 19.2% decline in April.

Overall, comparable sales worldwide fell about 21% in May, improving from a 39% drop in April.

As lockdowns continue lifting, additional stores reopening will hopefully drive a continuation of these trends.

As of June 15, approximately 95% of McDonald's 38,000-plus locations were open. That's up from 75% at the end of April.

Franchisees are requiring less financial assistance from McDonald's as a result.

In March, when a lot of markets were immediately shut down, McDonald's felt greater urgency to quickly provide broad-based support for franchisees by deferring some rent and royalties.

With more stores reopening and government aid programs kicking in (especially in Europe where social assistance programs are more popular), McDonald's said the assistance it's providing now is much more targeted to address individual circumstances by country or franchisee.

Thankfully, McDonald's and its franchisees came into this crisis with strong cash flow generation and healthy balance sheets, making it easier to survive a few months of closures without a severe financial impact.

Management said guest traffic is still down in the mid-teens (breakfast is the most challenged part of the business, perhaps due to fewer commuters), so it won't feel like the company is truly back to business as usual until traffic numbers get closer to pre-COVID numbers.

That could take some time, but hopefully the worst of the impact is behind the company, especially in terms of the amount of financial assistance required by franchisees.

Management also took the opportunity to reaffirm the company's capital allocation priorities.

After investing to maintain and grow the business, including near-term assistance for franchisees, the dividend remains the next highest priority.

In the U.S. (36% of total revenue), comparable sales were down only 5.1% in May, a meaningful improvement compared to a 19.2% decline in April.

Overall, comparable sales worldwide fell about 21% in May, improving from a 39% drop in April.

As lockdowns continue lifting, additional stores reopening will hopefully drive a continuation of these trends.

As of June 15, approximately 95% of McDonald's 38,000-plus locations were open. That's up from 75% at the end of April.

Franchisees are requiring less financial assistance from McDonald's as a result.

In March, when a lot of markets were immediately shut down, McDonald's felt greater urgency to quickly provide broad-based support for franchisees by deferring some rent and royalties.

With more stores reopening and government aid programs kicking in (especially in Europe where social assistance programs are more popular), McDonald's said the assistance it's providing now is much more targeted to address individual circumstances by country or franchisee.

Thankfully, McDonald's and its franchisees came into this crisis with strong cash flow generation and healthy balance sheets, making it easier to survive a few months of closures without a severe financial impact.

Management said guest traffic is still down in the mid-teens (breakfast is the most challenged part of the business, perhaps due to fewer commuters), so it won't feel like the company is truly back to business as usual until traffic numbers get closer to pre-COVID numbers.

That could take some time, but hopefully the worst of the impact is behind the company, especially in terms of the amount of financial assistance required by franchisees.

Management also took the opportunity to reaffirm the company's capital allocation priorities.

After investing to maintain and grow the business, including near-term assistance for franchisees, the dividend remains the next highest priority.

"We've paid dividends for the last 40-plus years. We know that a lot of our investors highly value dividends. We have a higher percentage of retail shareholders than a lot of companies. We know those folks specifically count on those dividends. So dividends are important, and those continue to be the second priority."

– CFO Kevin Ozan

McDonald's historically increased its dividend each September, including a 7.8% raise last year.

Due to the financial impact of the pandemic on McDonald's business, investors should probably expect a more modest increase this year, perhaps in the low-single digits.

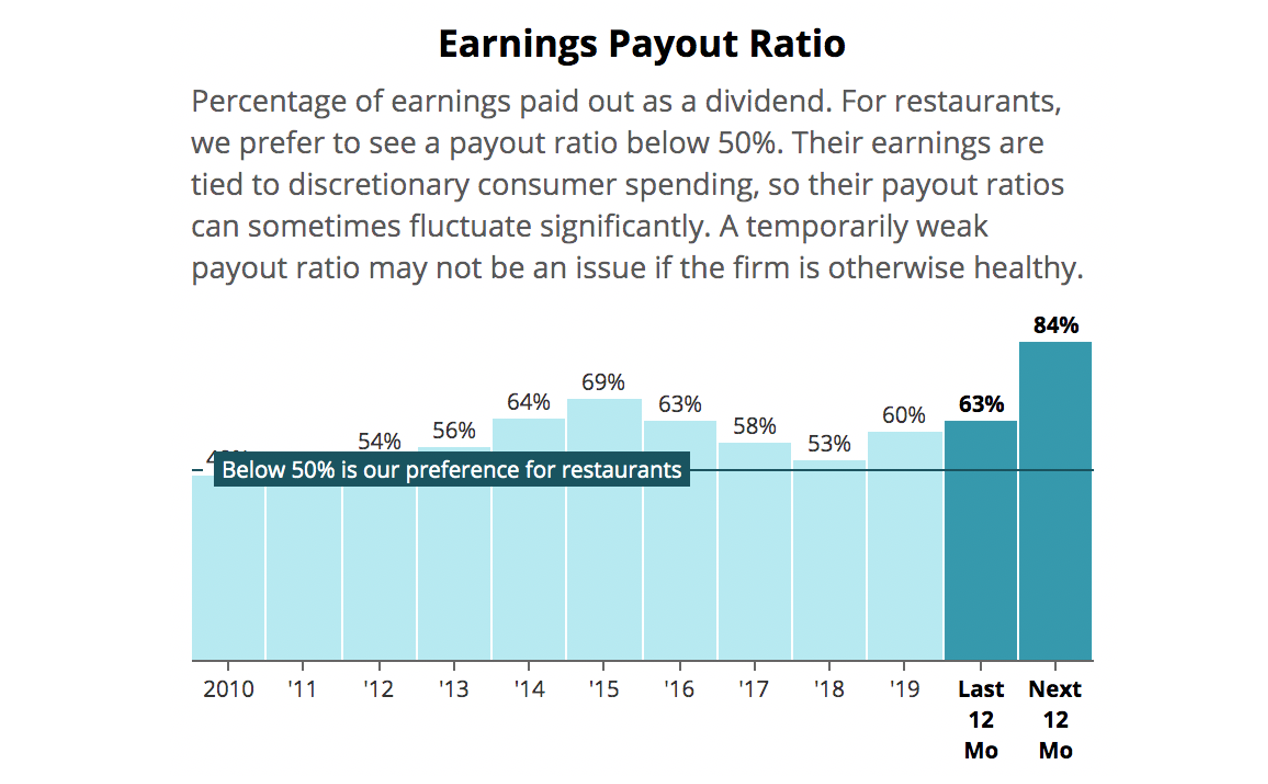

As you can see, McDonald's payout ratio is expected to remain elevated in the year ahead due to the sharp decline in revenue experienced in recent months.

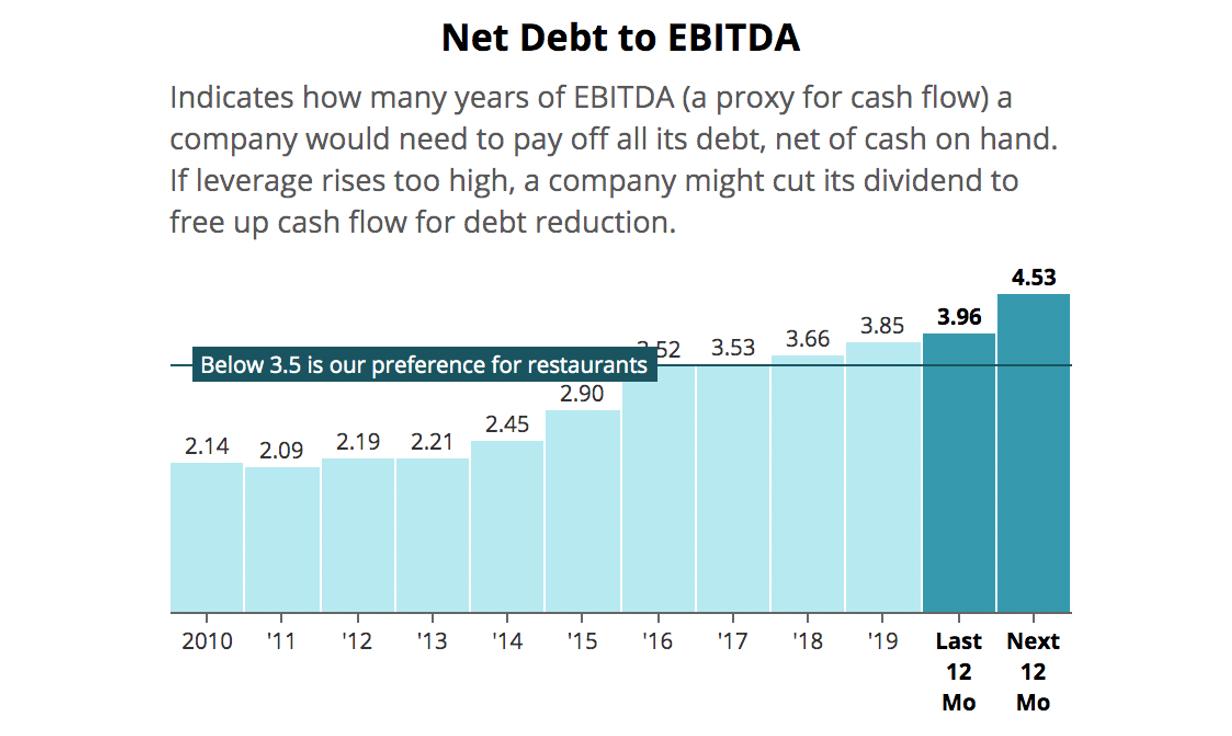

Leverage is also elevated right now because McDonald's took on additional debt in March to ensure it was well capitalized for the pandemic and EBITDA is down due to restaurant closures and lower demand.

Management said they would like to return the business to a 3.0x to 3.5x leverage ratio and will refrain from buying back stock in order to use excess cash to pay down debt. A more modest dividend increase would help retain cash, too.

Overall, with the majority of its business through drive-thru, delivery, and curbside pick-up, McDonald's remains arguably one of the best positioned restaurants to manage through the pandemic without jeopardizing its dividend.

We expect to maintain the company's Safe Dividend Safety Score, especially with sales trends improving and management sticking to their capital allocation priorities.