NNN Strikes a More Optimistic Tone About the Dividend as Outlook for Rent Collection Improves

After cautioning in early May that "by no means is the dividend untouchable," National Retail Properties (NNN) appears to feel more confident that its payout will remain secure as lockdown measures continue easing.

In April, NNN's 52% rent collection rate was among the weakest of any retail REIT. But at an investor conference on June 8, management said they "feel very good about the trajectory of rent for May and for the rest of the second quarter."

When asked if NNN would extend its 30-year dividend growth streak in mid-July (when NNN historically announces its annual increases), management expressed much greater optimism:

In April, NNN's 52% rent collection rate was among the weakest of any retail REIT. But at an investor conference on June 8, management said they "feel very good about the trajectory of rent for May and for the rest of the second quarter."

When asked if NNN would extend its 30-year dividend growth streak in mid-July (when NNN historically announces its annual increases), management expressed much greater optimism:

"We're firmly committed to that. As Jay mentioned, we've got a long record in place. This team has been in place for virtually all those years. And so we're not inclined to make any knee-jerk reactions to 1 or 2 quarters of rough sailing as it relates to our dividend.

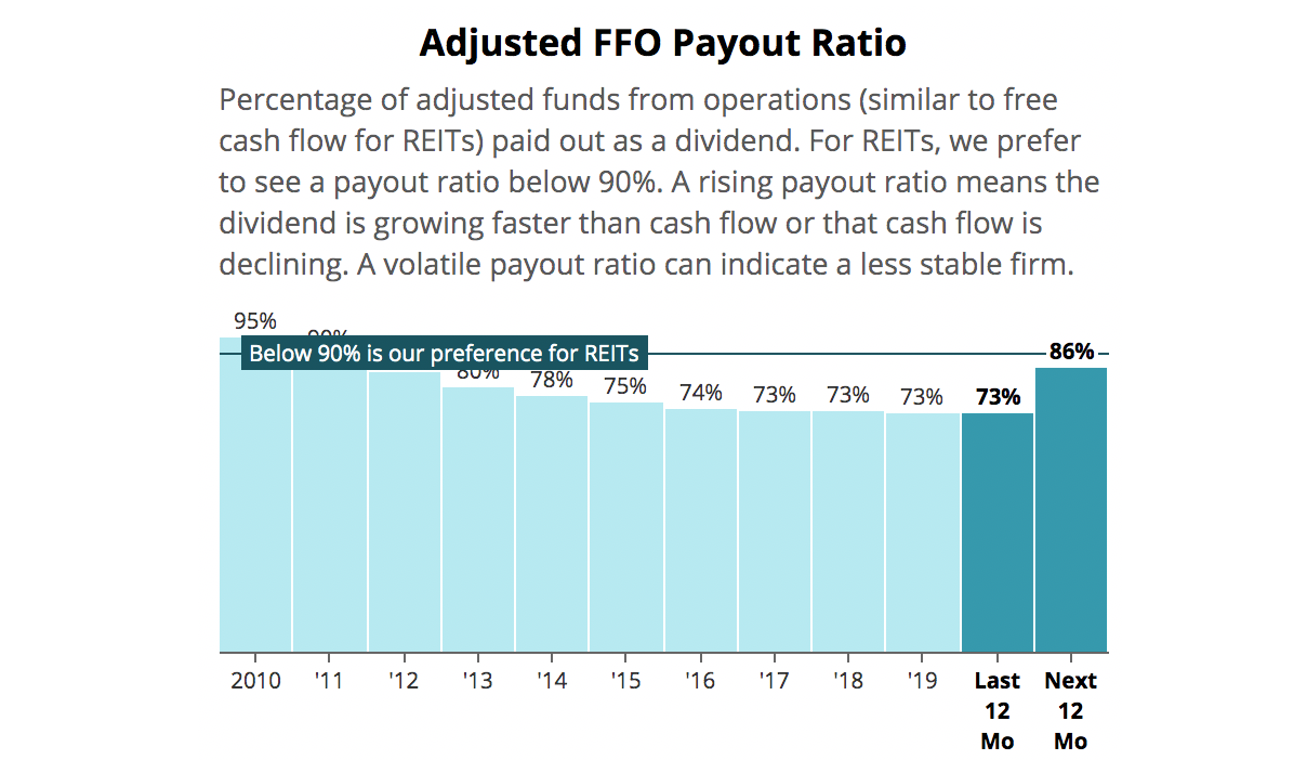

"It's why you go into -- why you carry a 72% dividend payout ratio, it's why you carry a balance sheet that's moderate leverage with lots of liquidity to let us kind of muddle through a soft patch and get to the other side and see how things shake out.

"Like in 2008, '09, when things got messy, we continued the dividend increasing, albeit not a lot, but some and always the right direction and continue to pay it in cash.

"And so that's the track we remain on until we have a lot of evidence that tells us otherwise, which we don't see today. We just have a lot of capacity and in terms of our payout as well as our balance sheet to allow us to continue to pay the dividend."

– CFO Kevin Habicht, 6/8/20 Investor Conference

While talk is cheap and it's still early days in the pandemic, signs have emerged that the retail industry could be bouncing back at a healthy pace.

U.S. retail sales recovered faster than expected in May, and STORE Capital (STOR), another retail REIT, provided a business update on June 15 that showed its rent collection improved from 67% in May to 76% in June.

STORE noted that the increase was led by full-service restaurants (11.1% of NNN's rent), family entertainment centers (6.7%), and health clubs (5.2%). Movie theaters (4.7%) are also expected to reopen in July.

Those are the industries (nearly 30% of total rent) that weighed on NNN the most, so the REIT's rent collection prospects have presumably improved since April.

STORE also said that 91% of its properties are now open or partially open, up from just 65% in April.

NNN said most of its properties are located in suburban areas and in states that "are a little farther along the reopening curve." So NNN's tenants have hopefully seen a similar boost in reopening trends as lockdowns lifted.

Rent collection improvement is very important for NNN's dividend safety since we previously estimated that rent revenue could only decline between 15% and 20% before cash flow (i.e. AFFO) would fall short of covering the dividend.

For now, the retail environment appears to be trending better than expected, taking some pressure off of NNN's dividend.

Based on the latest information available, analysts expect the dividend to remain covered by AFFO in the year ahead.

That said, NNN's retail tenants still face risk from a new spike in infections that could cause certain places such as Texas (18% of rent) and Florida (9%) to go back into lockdown. We will probably know more about that over the next month.

Less than 20% of NNN's tenants have investment-grade ratings as well, perhaps putting some of them at greater risk of closing permanently.

Unsurprisingly, NNN said it will remain in a defensive stance (probably minimal dividend growth, no material acquisitions, etc.) until it gets "a better feel for kind of stability of cost of capital and stability of the retailers able to stay open."

Overall, though, it's encouraging to see signs of improvement. The industry appears to be in a better spot compared to where it was a couple of months ago.

However, we are maintaining NNN's Borderline Safe Dividend Safety Score until more time passes to ensure that retailers remain open and cash flow can cover the dividend.

We plan to keep holding our shares of NNN in our Conservative Retirees portfolio and will continue monitoring this fluid situation.