.png)

ONEOK Retains "Borderline Safe" Dividend Safety Score Following Stock Sale Announcement

On June 11, ONEOK (OKE) announced it would sell 26 million shares of common stock, increasing its shares outstanding by about 6.3%.

The offering was priced at $32 per share, well below the stock's $42 closing price the previous day.

As a result, ONEOK's stock slumped about 16% on Thursday and 4% on Friday, finishing the week near $34 per share.

With ONEOK's dividend yield shooting back above 10%, income investors are left wondering how this action could affect the firm's dividend safety.

For now, we are maintaining ONEOK's Borderline Safe Dividend Safety Score.

On one hand, ONEOK's capital raise improves its cash on hand and helps reduce leverage.

However, it also sends concerning signals about management's outlook for the business and ONEOK's ability to access capital markets on reasonable terms.

Debt markets had already become less favorable for the company.

On March 5, before COVID-19's full disruption was realized by the market, ONEOK sold $1.65 billion of senior debt with interest rates of 2.2% for 5-year notes and 4.5% for 30-year notes.

ONEOK was able to sell another $1.5 billion of senior debt on May 4, but interest rates jumped to 5.85% for 5-year notes and 7.15% for 30-year notes.

Those rates don't look so bad after considering the cost of ONEOK's stock offering, though.

ONEOK's current dividend of $3.74 per share represents an 11.7% annual cost for stock issued at $32 per share ($3.74 / $32 = 11.7%).

That's a high cost of capital, double the interest rate attached to ONEOK's 5-year notes issued last month.

So why would management issue dilutive equity at such a steep cost?

In some cases, a company could desperately need cash to make ends meet. But liquidity doesn't appear to be a concern for ONEOK.

ONEOK ended March with over $530 million of cash. Last week's stock offering will net $815 million, bringing pro forma cash on hand to over $1.3 billion.

ONEOK also has $2.5 billion of available borrowing capacity under its credit facility, which doesn't expire until June 2024.

And after refinancing some debt earlier this year, ONEOK shouldn't have any debt coming due until 2022 when about $1.5 billion matures.

In total, ONEOK has close to $4 billion of liquidity. These funds appear to be enough to cover the firm's near-term cash flow needs.

Analysts expect ONEOK to generate $1.9 billion of distributable cash flow in the year ahead.

After paying dividends of $1.65 billion and executing about $1.6 billion of growth projects this year, ONEOK's projected cash flow deficit is about $1.4 billion.

Even if ONEOK's distributable cash flow came in 25% lower than expected ($1.4 billion versus $1.9 billion), its cash flow deficit would be less than $2 billion.

And capital spending is expected to peak in 2020 before scaling back considerably, reducing or eliminating the cash flow deficit in future years.

On ONEOK's earnings call in April, management said that if commodity prices remain depressed and producer activity remains low, ONEOK could operate in a $300 million to $400 million annual capital expenditure range (including maintenance and growth spending).

Assuming ONEOK's distributable cash flow remained at $1.9 billion (or hopefully increased as a result of the firm's growth spending), it would be enough to cover dividends and capital spending going forward.

But ONEOK's stock sale suggests management might feel less comfortable with the company's cash flow trajectory and the impact that could have on the firm's leverage and access to debt markets.

ONEOK's untapped $2.5 billion credit facility contains a covenant requiring the company to maintain a ratio of debt to adjusted EBITDA of no more than 5.0x.

This metric is difficult to calculate as an outsider since the credit agreement's definition of adjusted EBITDA includes projected EBITDA from certain lender-approved growth projects.

However, ONEOK disclosed that this leverage ratio was 4.5x at the end of March.

If adjusted EBITDA declined by 10%, then we estimate ONEOK's leverage would hit the 5.0x limit allowed under its credit facility.

Alternatively, if adjusted EBITDA held steady, ONEOK's debt could increase by only about $1.5 billion (not far from our projected cash flow deficit for the firm) before reaching the leverage limit.

Many companies have managed to amend their credit covenants to create more headroom, but capital for the energy industry is drying up.

Perhaps ONEOK's lenders weren't willing to flex the agreement in this uncertain environment, forcing management to issue dilutive equity instead.

If ONEOK used all of the proceeds from its stock sale to pay down debt and its EBITDA remained steady, we estimate its leverage ratio would decline by about 0.3x.

This provides some breathing room to continue executing on its plans this year. But ONEOK ultimately needs producer activity to improve so its EBITDA can grow.

Otherwise, the company risks not retaining enough cash flow (after paying dividends) that can be used to reduce debt, further slowing its deleveraging plans.

The offering was priced at $32 per share, well below the stock's $42 closing price the previous day.

As a result, ONEOK's stock slumped about 16% on Thursday and 4% on Friday, finishing the week near $34 per share.

With ONEOK's dividend yield shooting back above 10%, income investors are left wondering how this action could affect the firm's dividend safety.

For now, we are maintaining ONEOK's Borderline Safe Dividend Safety Score.

On one hand, ONEOK's capital raise improves its cash on hand and helps reduce leverage.

However, it also sends concerning signals about management's outlook for the business and ONEOK's ability to access capital markets on reasonable terms.

Debt markets had already become less favorable for the company.

On March 5, before COVID-19's full disruption was realized by the market, ONEOK sold $1.65 billion of senior debt with interest rates of 2.2% for 5-year notes and 4.5% for 30-year notes.

ONEOK was able to sell another $1.5 billion of senior debt on May 4, but interest rates jumped to 5.85% for 5-year notes and 7.15% for 30-year notes.

Those rates don't look so bad after considering the cost of ONEOK's stock offering, though.

ONEOK's current dividend of $3.74 per share represents an 11.7% annual cost for stock issued at $32 per share ($3.74 / $32 = 11.7%).

That's a high cost of capital, double the interest rate attached to ONEOK's 5-year notes issued last month.

So why would management issue dilutive equity at such a steep cost?

In some cases, a company could desperately need cash to make ends meet. But liquidity doesn't appear to be a concern for ONEOK.

ONEOK ended March with over $530 million of cash. Last week's stock offering will net $815 million, bringing pro forma cash on hand to over $1.3 billion.

ONEOK also has $2.5 billion of available borrowing capacity under its credit facility, which doesn't expire until June 2024.

And after refinancing some debt earlier this year, ONEOK shouldn't have any debt coming due until 2022 when about $1.5 billion matures.

In total, ONEOK has close to $4 billion of liquidity. These funds appear to be enough to cover the firm's near-term cash flow needs.

Analysts expect ONEOK to generate $1.9 billion of distributable cash flow in the year ahead.

After paying dividends of $1.65 billion and executing about $1.6 billion of growth projects this year, ONEOK's projected cash flow deficit is about $1.4 billion.

Even if ONEOK's distributable cash flow came in 25% lower than expected ($1.4 billion versus $1.9 billion), its cash flow deficit would be less than $2 billion.

And capital spending is expected to peak in 2020 before scaling back considerably, reducing or eliminating the cash flow deficit in future years.

On ONEOK's earnings call in April, management said that if commodity prices remain depressed and producer activity remains low, ONEOK could operate in a $300 million to $400 million annual capital expenditure range (including maintenance and growth spending).

Assuming ONEOK's distributable cash flow remained at $1.9 billion (or hopefully increased as a result of the firm's growth spending), it would be enough to cover dividends and capital spending going forward.

But ONEOK's stock sale suggests management might feel less comfortable with the company's cash flow trajectory and the impact that could have on the firm's leverage and access to debt markets.

ONEOK's untapped $2.5 billion credit facility contains a covenant requiring the company to maintain a ratio of debt to adjusted EBITDA of no more than 5.0x.

This metric is difficult to calculate as an outsider since the credit agreement's definition of adjusted EBITDA includes projected EBITDA from certain lender-approved growth projects.

However, ONEOK disclosed that this leverage ratio was 4.5x at the end of March.

If adjusted EBITDA declined by 10%, then we estimate ONEOK's leverage would hit the 5.0x limit allowed under its credit facility.

Alternatively, if adjusted EBITDA held steady, ONEOK's debt could increase by only about $1.5 billion (not far from our projected cash flow deficit for the firm) before reaching the leverage limit.

Many companies have managed to amend their credit covenants to create more headroom, but capital for the energy industry is drying up.

Perhaps ONEOK's lenders weren't willing to flex the agreement in this uncertain environment, forcing management to issue dilutive equity instead.

If ONEOK used all of the proceeds from its stock sale to pay down debt and its EBITDA remained steady, we estimate its leverage ratio would decline by about 0.3x.

This provides some breathing room to continue executing on its plans this year. But ONEOK ultimately needs producer activity to improve so its EBITDA can grow.

Otherwise, the company risks not retaining enough cash flow (after paying dividends) that can be used to reduce debt, further slowing its deleveraging plans.

"We are still targeting leverage of 4x or less, but due to the current environment, the time line for reaching target leverage from operating cash flows has been pushed out."

– CFO Walt Hulse, Q1 Earnings Call

If management were to believe that ONEOK's long-term earnings power was no longer as strong as they expected due to a lower-for-longer production environment, a dividend cut could be considered to reduce the firm's leverage.

"As we look to the future, we expect our business to generate sufficient cash flow to pay the dividend. Our decision to significantly reduce capital spending until growth opportunities return puts us in a good position to continue returning value to our shareholders.

"As we always do, each quarter, we'll work with our Board to assess our forward views of future cash flows and the dividend as appropriate."

– CEO Terry Spencer, Q1 Earnings Call

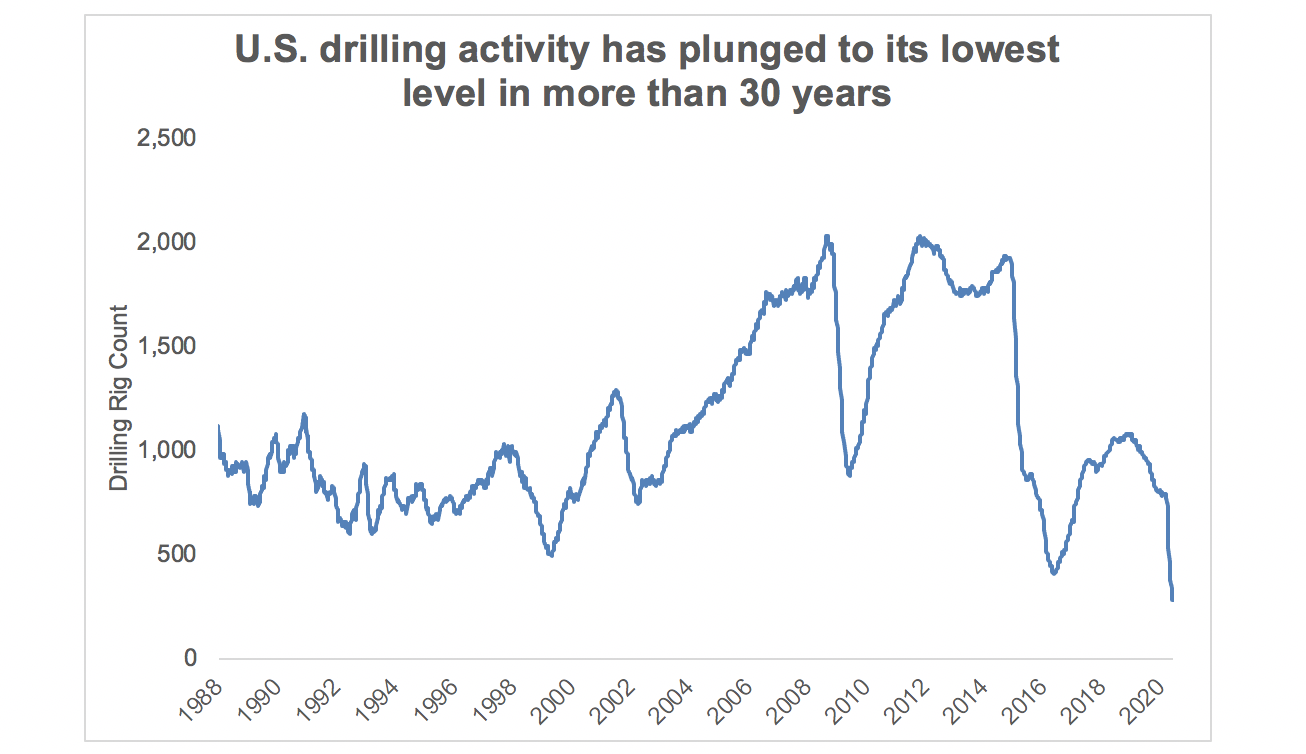

ONEOK has paid uninterrupted dividends since 1989, but today's drilling backdrop is unlike any the industry has seen in decades.

Based on the latest data through June 12, U.S. drilling activity (as measured by rig count) has fallen to its lowest level in more than 30 years, per Baker Hughes.

As we discussed in our April 17 note, ONEOK's natural gas liquids (57% of EBITDA) and natural gas gathering and processing (27%) segments have volumetric risk (i.e. no minimum volume commitments).

These businesses charge fixed fees primarily tied to the amount of commodities flowing through their pipelines and processing plants. Volumes may be impacted if producers curtail production activities, reducing fee income.

In the prospectus ONEOK filed last week as part of its stock sale, the firm noted that its infrastructure system has experienced "meaningfully reduced volumes" during the second quarter.

With more producers shutting in unprofitable wells and pulling back on spending to preserve liquidity, ONEOK needs to be prepared for a period of lower throughput.

ONEOK has the liquidity to continue paying its current dividend if it wants to, but the payout's safety hinges on the industry's pace of recovery.

Asset utilization needs to show signs of improvement later this year, especially in North Dakota's Williston Basin which is a primary contributor to ONEOK's growth plans (and carries higher margins relative to other regions).

Should production headwinds persist or accelerate, management will need to decide how long they are willing or able to run the business with elevated leverage until operating conditions hopefully improve.

Slashing the $1.65 billion dividend is the easiest lever the company has to retain more cash flow for debt reduction if shut-in volumes don't come back online in a reasonable amount of time.

Based on past announcements, we expect ONEOK to declare its next dividend payment on July 22.

Is that enough time since ONEOK's April 28 earnings report for management's longer-term view of industry fundamentals to have soured and result in a dividend cut?

It's hard to say, but if we had to guess management would wait longer to consider adjusting ONEOK's long-term capital allocation plans, especially if conditions haven't gotten worse.

After all, ONEOK's distributable cash flow still has a path to covering its dividend this year (projected payout ratio of 87% after factoring in higher dividends from the stock sale), with coverage improving in 2021 and beyond.

And the firm is not at risk of losing its BBB investment-grade rating, which Standard & Poor's reaffirmed with a stable outlook on April 30.

As the ratings firm explained below, a downgrade is unlikely for now. ONEOK's equity raise, while costly, further supports that outlook.

"We could lower our rating on ONEOK if we believe leverage will remain above 4.5x beyond 2020, and we do not see a clear path for the company to improve its balance sheet before the end of 2021. This could occur if lower commodity prices persist through 2021 and hinder an uptick in drilling activity, such that the company's volumes become materially weaker than we had forecast and ONEOK does not employ the levers it has at its disposal--reduced capex spending or a dividend cut--expeditiously."

– Standard & Poor's

ONEOK is also not overly dependent on any single producer (no customer represents over 10% of revenue) or basin, and most of its customers are major oil & gas producers and leading petrochemical firms with investment-grade credit.

These factors reduce the risk of ONEOK's business experiencing a sudden, major shock in this difficult environment.

Overall, we are maintaining ONEOK's Borderline Safe Dividend Safety Score, which indicates low to moderate risk of a dividend cut over a full economic cycle.

The stock sale helps ONEOK's liquidity and balance sheet in the short term, but our concluding thoughts haven't changed much since our April note:

Current shareholders should weigh if they are comfortable with the wide range of outcomes and elevated uncertainty facing parts of the midstream industry.

ONEOK remains committed to its dividend (uninterrupted payouts since 1989), but that commitment could be tested if demand slumps in its key basins and fails to recover in a reasonable amount of time.

Like so many other high dividend stocks in the energy sector, the fate of ONEOK's dividend will depend on how quickly the industry rebounds, which is difficult to predict. We will continue monitoring the company's situation.