Johnson & Johnson Loses $4.7 Billion Lawsuit: What Dividend Investors Need To Know

On July 12, 2018, a Missouri jury ordered Johnson & Johnson (JNJ) to pay $4.7 billion to 22 women who had accused it of giving them ovarian cancer due to asbestos in its name-brand talcum powders.

With over 9,000 additional talcum powder cases pending, some investors are worried that this beloved dividend king (55 straight years of rising dividends) might be facing monstrous legal bills that could potentially put its dividend at risk of a cut or suspension.

With over 9,000 additional talcum powder cases pending, some investors are worried that this beloved dividend king (55 straight years of rising dividends) might be facing monstrous legal bills that could potentially put its dividend at risk of a cut or suspension.

Let’s take a look at what dividend investors in Johnson & Johnson need to know about this looming liability.

Johnson & Johnson Has Been Dealing With This Issue For Years

The first talcum powder related lawsuit against Johnson & Johnson came in 2013 in South Dakota. Since then the company has faced thousands of claims, mostly bundled into smaller group lawsuits, that state that J&J knew its talcum powder contained asbestos and didn’t warn consumers. Asbestos is a proven carcinogen that women are now claiming has given them ovarian cancer (vast majority of these cases).

The large size of the such rulings is due to punitive damages ($4.15 billion in this case) that juries award to punish companies for evil actions such as covering up large consumer risks for 40 years, as was claimed in this case.

The jury deliberated for just 45 minutes when deciding on one of the largest punitive awards ever awarded in a product liability lawsuit. Johnson & Johnson said it was “deeply disappointed” in the outcome of the suit, which it called “the product of a fundamentally unfair process” and remains confident that “its products do not contain asbestos and do not cause ovarian cancer and intends to pursue all available appellate remedies.”

The jury deliberated for just 45 minutes when deciding on one of the largest punitive awards ever awarded in a product liability lawsuit. Johnson & Johnson said it was “deeply disappointed” in the outcome of the suit, which it called “the product of a fundamentally unfair process” and remains confident that “its products do not contain asbestos and do not cause ovarian cancer and intends to pursue all available appellate remedies.”

While sometimes companies do knowingly harm consumers via coverups, in this case J&J is likely to be proven right and wins its appeal.

Such Cases Are Almost Always Thrown Out

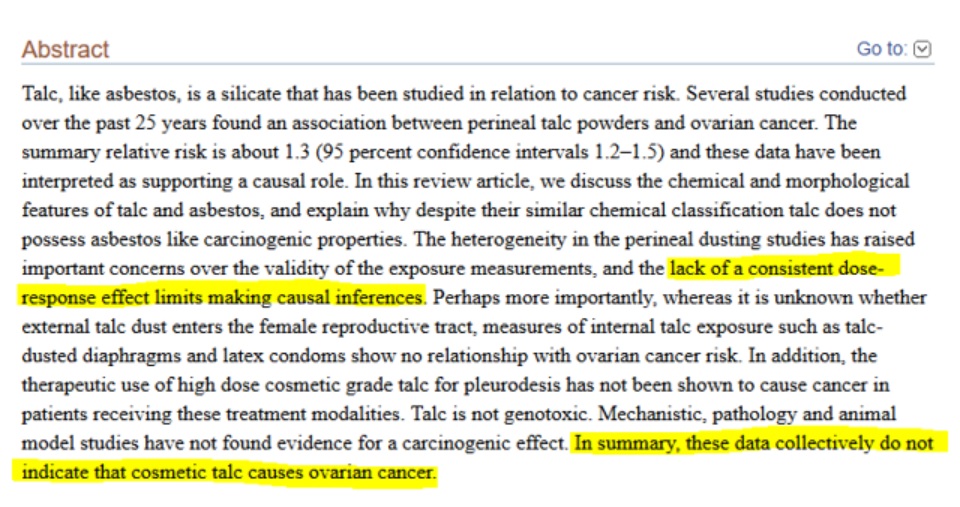

The theory underpinning these lawsuits is that talc, from which talcum powder is made, sometimes contains small amounts of asbestos. Plaintiffs claim that years of using talcum powder has led to their bodies absorbing asbestos which builds up in the ovaries and causes ovarian cancer.

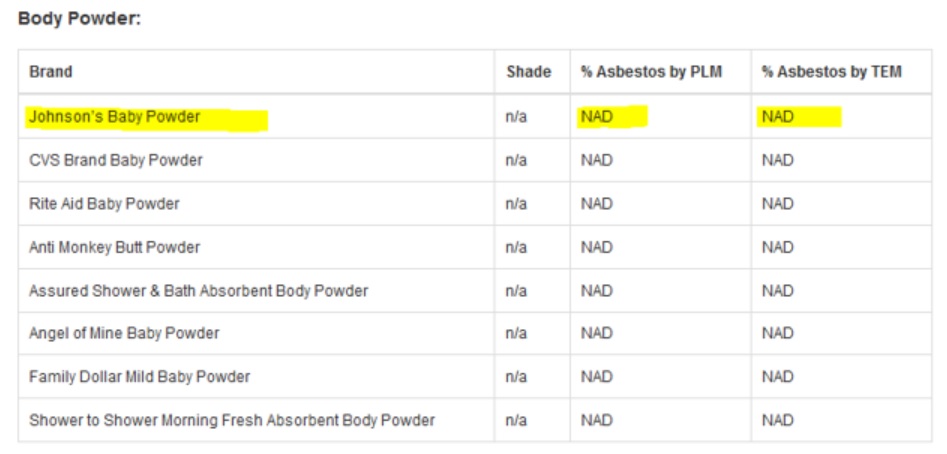

According to the American Cancer Society, U.S. talcum producers began stripping asbestos from their products in the 1970’s. And the FDA, in highly sensitive studies, has indeed confirmed that neither J&J’s, nor any major rivals, talcum powder contains any detectable levels of the carcinogen.

According to a study by the National Cancer Institute, talcum powder causing incidents of ovarian cancer “are not supported by the weight of evidence.” Another study by the National Institute of Health found the same thing.

Because of such overwhelming scientific evidence, Johnson & Johnson has been winning its appeals. For example, in July 2018 an appeals court overturned a $55 million award for a South Dakota women who also won in front of a Missouri jury.

According to Lars Noah, a law professor at the University of Florida, the reason so many of these cases are filed in Missouri is that the state has historically applied a lower standard for admitting scientific evidence. In 2017 the state passed a law requiring courts to adopt stricter federal standards of scientific evidence, but it could take several years for courts to interpret what that law means.

According to Lars Noah, a law professor at the University of Florida, the reason so many of these cases are filed in Missouri is that the state has historically applied a lower standard for admitting scientific evidence. In 2017 the state passed a law requiring courts to adopt stricter federal standards of scientific evidence, but it could take several years for courts to interpret what that law means.

Meanwhile, J&J continues to win its appeals including in 2017 when a California Judge overturned a $417 million case against the company. Los Angeles Superior Court Judge Maren Nelson cited the lack of scientific evidence as the reason for the overturning and ordered a new trial. Also in 2017 J&J won when a St. Louis appeals court overturned a $72 million case against it.

The bottom line is that the evidence appears to be firmly on J&J’s side, and these legal losses are mostly cases in which sympathetic juries ignore scientific facts in order to try to force a large pharmaceutical company to pay large sums to tragic victims of cancer (even if it wasn't likely to have been the cause).

While there is always a risk that J&J might end up losing some of its appeals, thus far appeals court judges have set a clear precedent that the scientific facts matter far more than an emotional tail of alleged victims badly wronged by a heartless international conglomerate.

Johnson & Johnson’s Dividend Is Almost Certainly Safe And Will Continue Growing Steadily For The Foreseeable Future

The financial media loves to trumpet expensive legal battles, and speculate about how this $4.7 billion judgement might extrapolate into potentially tens of billions in legal costs that could crush the company.

However, investors need to remember that the truth is far less sensational. Johnson & Johnson appears to have the scientific facts on its side, and the years of legal battles it’s been facing, and will continue to face, are mostly driven by class action lawyers hoping to extract a large settlement from the company.

However, investors need to remember that the truth is far less sensational. Johnson & Johnson appears to have the scientific facts on its side, and the years of legal battles it’s been facing, and will continue to face, are mostly driven by class action lawyers hoping to extract a large settlement from the company.

Johnson & Johnson is the world’s largest medical conglomerate and has a very sizable legal department whose full-time job is to deal with such cases. The expenses of dealing with such legal risks are firmly baked into its business model.

Even in an unfavorable outcome, however unlikely that may be, J&J is sitting on $15 billion of cash and generated about $17 billion in free cash flow over the past year, well above the $9 billion in dividends it paid. Simply put, it would take a lot to bring down such a financially healthy company.

All things considered, there is very little risk to the dividend, now or in the future, when other cases are decided. Therefore, J&J likely remains one of the best low-risk dividend growth stocks you can own.

Even in an unfavorable outcome, however unlikely that may be, J&J is sitting on $15 billion of cash and generated about $17 billion in free cash flow over the past year, well above the $9 billion in dividends it paid. Simply put, it would take a lot to bring down such a financially healthy company.

All things considered, there is very little risk to the dividend, now or in the future, when other cases are decided. Therefore, J&J likely remains one of the best low-risk dividend growth stocks you can own.