Falling Occupancy, Rising Expenses Increase Pressure on CoreCivic's Dividend

CoreCivic (CXW) is one of the largest private prison operators in America. The REIT generates 85% of its net operating income (NOI) from managing 50 correctional and detention facilities.

CoreCivic also leases properties to government agencies (10% of NOI) and operates residential reentry facilities (5%).

Though somewhat controversial, managing prisons has historically been a predictable business.

CoreCivic provides an essential service and enjoys contractual cash flow paid by the government, resulting in minimal credit risk and an average contract renewal rate of 94% over the last five years.

However, the COVID-19 crisis is pressuring the U.S. private prison industry in several ways.

First, occupancy is falling. CoreCivic's prison population fell 3% in April, driving a similar decline in management revenues.

The largest impact has come from lower activity at the Immigration and Customs Enforcement (ICE) agency, which accounted for 29% of CoreCivic's 2019 revenue.

On March 31, the federal government closed the Mexican border in an effort to contain the spread of COVID-19.

As a result, ICE's detention population has fallen from 43,000 detainees at the end of 2019 to about 30,000 nationwide, reducing the number of illegal immigrants sent to CoreCivic's facilities.

Meanwhile, the U.S. Marshals Service, a federal law enforcement agency, accounted for 20% of CoreCivic's revenue last year.

Shelter-in-place orders have disrupted the criminal justice system, causing a decline in the number of courts in session. This has resulted in fewer prosecutions and reduced the number of new prisoners arriving at CoreCivic's facilities.

Management also noted that many state and local government agencies have decided to release certain offenders to reduce the risk of COVID-19 transmission.

Many state budgets are hurting as well due to economic shutdowns (lower tax revenue) and extra spending to slow the spread of the virus.

This could cause some states to negotiate lower rates when their prison contracts are up for renewal, though CoreCivic hasn't seen any impact yet.

Overall, credit rating agency Standard & Poor's now expects the industry's revenue to decline 5% to 10% this year.

At the same time, expenses are climbing. Facility staff are being paid bonuses as they work through these challenging conditions.

CoreCivic has also had to provide additional paid time off and faces higher expenses to buy personal protective equipment, testing equipment, and more cleaning supplies. (About 3% of residents have tested positive.)

CoreCivic's pre-pandemic guidance called for about $280 million of adjusted funds from operations (AFFO), which would comfortably cover the REIT's $210 million dividend obligation (a 75% payout ratio).

However, given the company's high fixed costs, we estimate that the dividend would no longer be covered if revenue declined around 7%, which now seems like a realistic possibility this year.

The margin of safety is even lower after incorporating CoreCivic's incremental expenses, which management believes will be about $10 million.

The factors weighing on CoreCivic's dividend coverage won't last forever. Courts will eventually be back in session, and the federal government will lift border restrictions once it's safe to do so.

Over half of the REIT's prison contracts also contain minimum occupancy clauses, which management says will kick in near today's population levels. If occupancy continues to decline, this will help reduce some of the impact.

Regardless, management may not be willing to maintain the current dividend if it results in minimal retained cash flow or would require CoreCivic to increase its leverage to cover any cash flow deficit. Visibility is very low.

CoreCivic also leases properties to government agencies (10% of NOI) and operates residential reentry facilities (5%).

Though somewhat controversial, managing prisons has historically been a predictable business.

CoreCivic provides an essential service and enjoys contractual cash flow paid by the government, resulting in minimal credit risk and an average contract renewal rate of 94% over the last five years.

However, the COVID-19 crisis is pressuring the U.S. private prison industry in several ways.

First, occupancy is falling. CoreCivic's prison population fell 3% in April, driving a similar decline in management revenues.

The largest impact has come from lower activity at the Immigration and Customs Enforcement (ICE) agency, which accounted for 29% of CoreCivic's 2019 revenue.

On March 31, the federal government closed the Mexican border in an effort to contain the spread of COVID-19.

As a result, ICE's detention population has fallen from 43,000 detainees at the end of 2019 to about 30,000 nationwide, reducing the number of illegal immigrants sent to CoreCivic's facilities.

Meanwhile, the U.S. Marshals Service, a federal law enforcement agency, accounted for 20% of CoreCivic's revenue last year.

Shelter-in-place orders have disrupted the criminal justice system, causing a decline in the number of courts in session. This has resulted in fewer prosecutions and reduced the number of new prisoners arriving at CoreCivic's facilities.

Management also noted that many state and local government agencies have decided to release certain offenders to reduce the risk of COVID-19 transmission.

Many state budgets are hurting as well due to economic shutdowns (lower tax revenue) and extra spending to slow the spread of the virus.

This could cause some states to negotiate lower rates when their prison contracts are up for renewal, though CoreCivic hasn't seen any impact yet.

Overall, credit rating agency Standard & Poor's now expects the industry's revenue to decline 5% to 10% this year.

At the same time, expenses are climbing. Facility staff are being paid bonuses as they work through these challenging conditions.

CoreCivic has also had to provide additional paid time off and faces higher expenses to buy personal protective equipment, testing equipment, and more cleaning supplies. (About 3% of residents have tested positive.)

CoreCivic's pre-pandemic guidance called for about $280 million of adjusted funds from operations (AFFO), which would comfortably cover the REIT's $210 million dividend obligation (a 75% payout ratio).

However, given the company's high fixed costs, we estimate that the dividend would no longer be covered if revenue declined around 7%, which now seems like a realistic possibility this year.

The margin of safety is even lower after incorporating CoreCivic's incremental expenses, which management believes will be about $10 million.

The factors weighing on CoreCivic's dividend coverage won't last forever. Courts will eventually be back in session, and the federal government will lift border restrictions once it's safe to do so.

Over half of the REIT's prison contracts also contain minimum occupancy clauses, which management says will kick in near today's population levels. If occupancy continues to decline, this will help reduce some of the impact.

Regardless, management may not be willing to maintain the current dividend if it results in minimal retained cash flow or would require CoreCivic to increase its leverage to cover any cash flow deficit. Visibility is very low.

Although our cash flows have no doubt been impacted by the pandemic, we firmly believe that our cash flows will return to pre-pandemic levels. However, it is difficult to predict how quickly that occurs.

– CFO Dave Garfinkle

CoreCivic's situation is especially complicated. REITs retain little capital and require access to capital markets to expand their businesses, but more lenders are refusing to work with the private prison industry.

In 2019, four of the lead lenders in CoreCivic's credit facility said they will stop servicing the private prison industry, including J.P. Morgan, Bank of America, SunTrust, and PNC.

Other banks such as Wells Fargo and Barclays have announced similar plans, according to ratings agency Fitch.

Fitch believes CoreCivic has adequate liquidity under its $800 million revolver to address its debt maturities through 2022 (less than $400 million), but its credit facility expires in 2023, when $1.2 billion in debt comes due.

With more banks dropping out of servicing the private prison industry, CoreCivic could have a difficult time finding new lenders to refinance its debt on reasonable borrowing terms. And issuing equity at today's valuation would be highly dilutive.

Coupled with the company's weak BB- credit rating, this could make management desire to be even more conservative with preserving liquidity today.

On CoreCivic's earnings call earlier this month, management hinted that the dividend will be scrutinized this summer in light of these developments.

The dividend declaration is a Board decision, and we are meeting with our Board quite frequently during the COVID pandemic. Following our historical calendar, our next dividend would typically be payable in July, and therefore, we have more than a month before the Board would be required to declare the dividend if it was to adhere to our historical calendar, which simply provides more time to assess the operating environment before making any decisions on capital allocation.

– CFO Dave Garfinkle

Reducing the dividend (perhaps by 30% to 50%) to a level that is more comfortably covered by cash flow would be prudent in this uncertain environment.

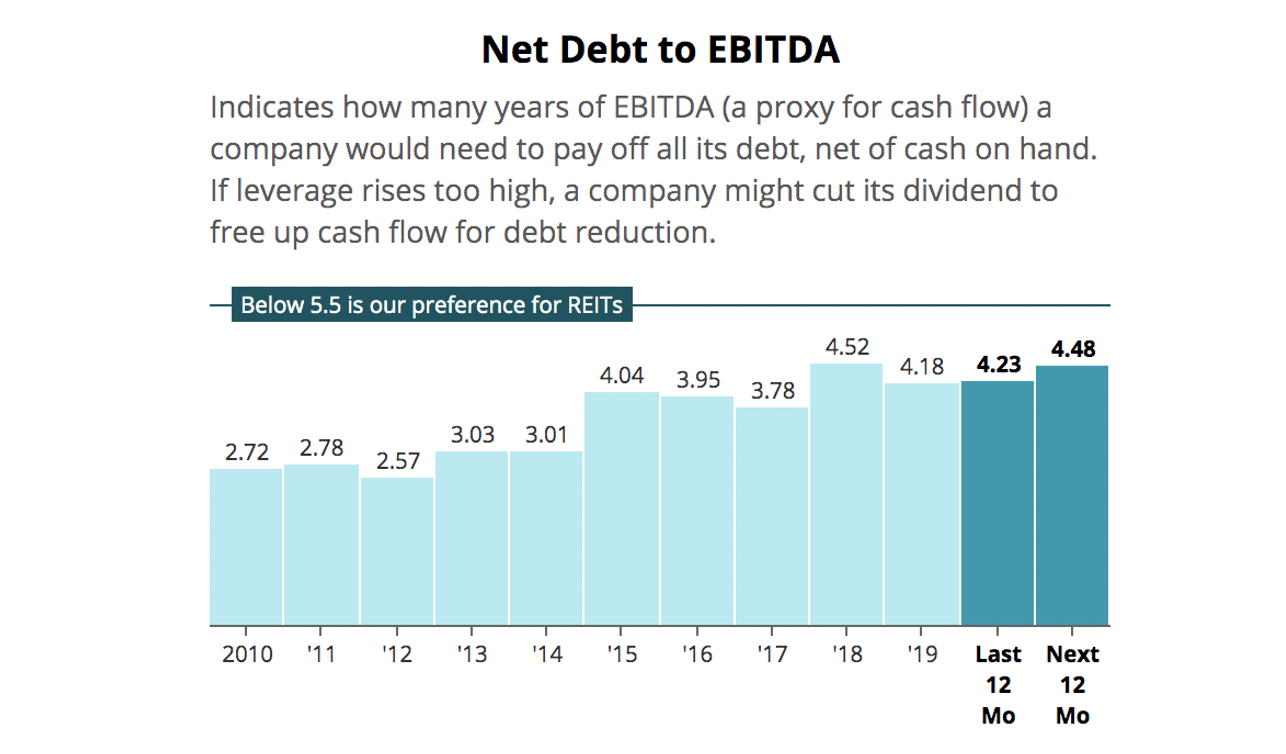

Standard & Poor's believes CoreCivic's leverage ratio could climb to around 5x this year and said it could lower its credit rating on the firm if leverage remains above 4x by the end of 2021.

Retaining more cash flow by cutting the dividend would help ensure that the REIT's leverage doesn't increase to a level that would result in another credit rating downgrade.

Overall, private prisons are complex investments and will likely experience a material cash flow reduction for at least most of this year due to the pandemic.

Based on our expectations that CoreCivic's payout ratio will approach or exceed 100% and access to debt markets could be difficult going forward, we are downgrading the REIT's Dividend Safety Score from Borderline Safe to Unsafe.

Based on our expectations that CoreCivic's payout ratio will approach or exceed 100% and access to debt markets could be difficult going forward, we are downgrading the REIT's Dividend Safety Score from Borderline Safe to Unsafe.

In the short term, the company's performance will depend on how long border traffic restrictions and social distancing measures are kept in place.

The company also faces elevated political risk with the U.S. 2020 election. Private prison stocks tanked more than 30% in a single day in 2016 when the Justice Department said it would phase out using private prisons.

The Trump administration put a stop to those plans, but government policies could change once more if Democrats sweep this year's elections.

A lot of bad news is already reflected in CoreCivic's stock price, but current shareholders should review if they are comfortable with the growing risks faced by the private prison industry.

While CoreCivic has the liquidity to weather this storm, its dividend may need to be reduced, and its longer-term outlook remains somewhat hazy. We will continue monitoring the situation.

The company also faces elevated political risk with the U.S. 2020 election. Private prison stocks tanked more than 30% in a single day in 2016 when the Justice Department said it would phase out using private prisons.

The Trump administration put a stop to those plans, but government policies could change once more if Democrats sweep this year's elections.

A lot of bad news is already reflected in CoreCivic's stock price, but current shareholders should review if they are comfortable with the growing risks faced by the private prison industry.

While CoreCivic has the liquidity to weather this storm, its dividend may need to be reduced, and its longer-term outlook remains somewhat hazy. We will continue monitoring the situation.

.png)