V.F. Corp Remains Committed to Dividend Despite Sales Plunge

In March, we discussed the pandemic-related challenges facing V.F. Corp (VFC) and the uncertainty they created for the global apparel company's dividend.

V.F. Corp reported earnings on May 15 and reassured its shareholders that the dividend remains a priority, even though free cash flow is no longer expected to cover the payout this year.

V.F. Corp reported earnings on May 15 and reassured its shareholders that the dividend remains a priority, even though free cash flow is no longer expected to cover the payout this year.

We do, however, remain committed to our dividend, of course, subject to Board approval. Our dividend has and will remain an integral part of our [total shareholder return] algorithm over the long-term, and the recent actions we've taken to shore up liquidity give testament to our ability to continue to support the dividend.

– CFO Scott Roe

The COVID-19 crisis has forced V.F. Corp and most of its customers (other retailers) to temporarily close their stores, causing revenue to evaporate overnight.

In fact, V.F. Corp expects its sales to fall by at least 50% this quarter and doesn't project a return to more normalized growth for at least a year.

The company is burning through cash right now, but management's confidence in the dividend reflects the strong balance sheet V.F. Corp had entering this crisis.

Specifically, the firm had $2.4 billion of total liquidity at the end of March and maintained an A credit rating from Standard & Poor's, reflecting its low leverage.

Out of an abundance of caution, V.F. Corp also recently issued $3 billion of debt to further bolster its cash hoard.

For perspective, the company's dividend costs $750 million annually.

Despite the steep revenue decline, V.F. Corp still sees a path to generating $600 million of free cash flow this year thanks to capital spending reductions and aggressive inventory management.

This will offset most of the dividend's cost, keeping V.F. Corp's leverage low enough to ensure the company maintains an investment-grade credit rating.

Management also believes that V.F. Corp will have enough liquidity to pivot to making acquisitions once its base business stabilizes.

The company has historically grown through sizable brand acquisitions and expects the disruption underway across the industry to provide "ample opportunities" to create value.

Looking ahead, management expects the retail environment to be challenging. Weaker stores will close, online sales will accelerate, and the marketplace will be highly promotional as excess inventories are worked through.

There is no question that the COVID-19 disruption will have lasting impacts on our sector. There will be retail casualties. This will accelerate industry consolidation. This will likely accelerate category trends, which we believe will benefit from activity-based lifestyle brands. We are witnessing the acceleration of digital commerce and the critical importance of direct consumer engagement.

– CFO Scott Roe

V.F. Corp believes that many of these trends will play to its advantages over time.

For example, its own websites that sell directly to shoppers account for about 12% of revenue, helping the company continue engaging with consumers during this lockdown period.

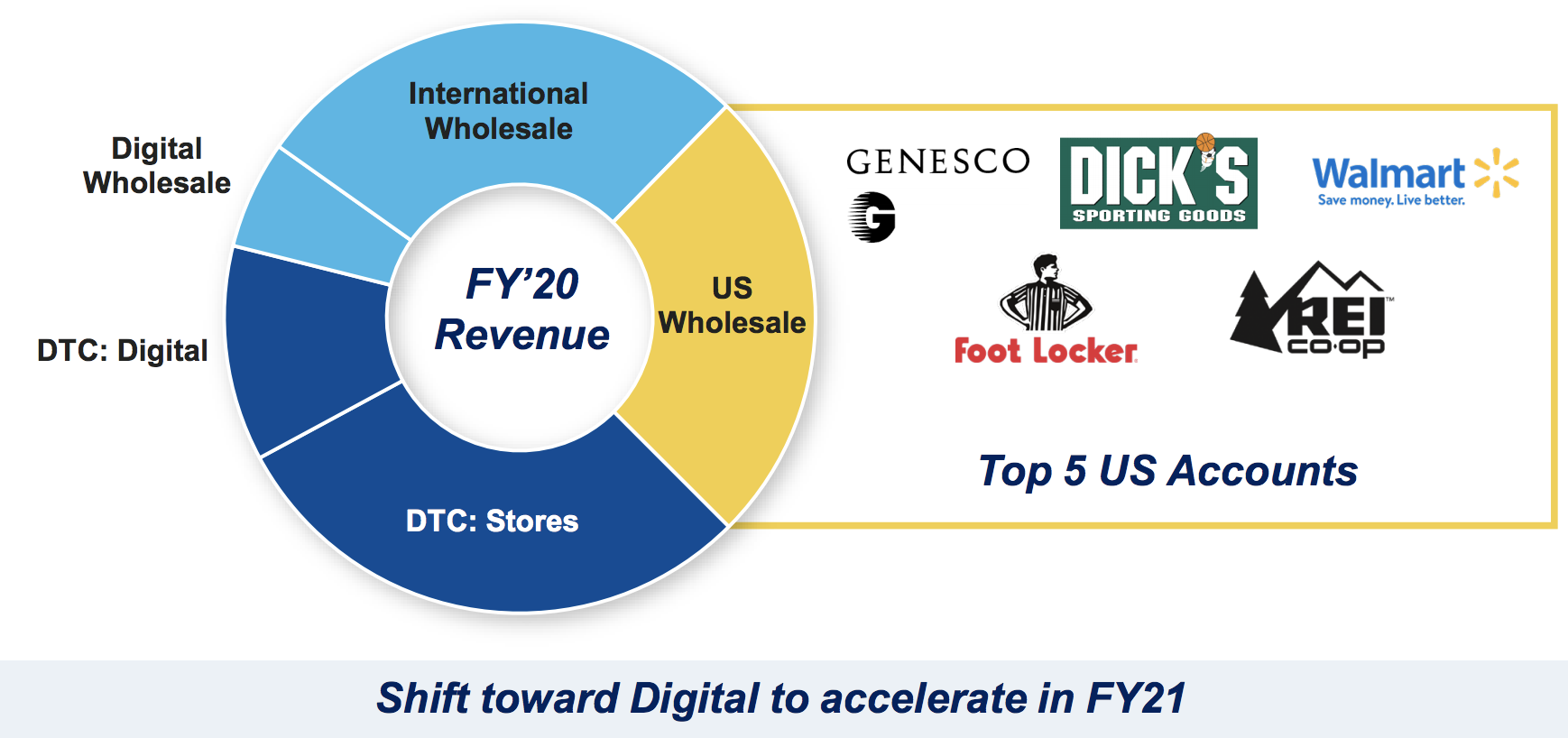

V.F. Corp's total digital footprint, including online sales made by its wholesale customers, is closer to 20% of its overall business. Compared to its brick-and-mortar stores, the company says digital is its most profitable channel.

The company isn't overly exposed to distressed retailers either. U.S. wholesale, which is under some of the most pressure from the pandemic, accounts for only 25% of total revenue, and department stores represent less than 5% of sales.

V.F. Corp does have a significant footprint of company-operated stores (30% of revenue) which are mostly still closed.

However, on the earnings call management noted that about 25% of its leases are up for renewal every year. This provides some flexibility to adjust the firm's footprint as the retail world evolves.

The apparel industry's path to recovery seems likely to be gradual and bumpy. Retail stores are slowly reopening, consumer confidence appears fragile given the unemployment backdrop, and inventory levels are elevated.

Most of the company's products command premium prices, so one of the most important factors to monitor going forward is V.F. Corp's ability to keep its brands relevant as it works through this crisis.

Although the firm owns about 20 well-known brands, it derives the vast majority of its revenue from only four: Vans (34% of sales), The North Face (24%), Timberland (17%), and Dickies (7%).

It's too soon to say how these key brands will be impacted by the crisis, but as we discussed in our thesis, this dependence acts as a double-edged sword:

Not unlike a concentrated stock portfolio, the future could work out very well for V.F. Corp if its powerhouse brands continue their strong growth. However, investors could also be left disappointed if consumers lose some interest in the outdoor and action sports apparel categories.

While these certainly seem like clothing mainstays, consumer preferences could still evolve within these categories and favor new brands or styles that emerge.

Overall, V.F. Corp's online presence, low exposure to department stores, and participation in growing categories such as activewear (47% of sales) and outdoor apparel (44%) seem to position it relatively well for the long road ahead.

We will continue monitoring the situation and expect V.F. Corp to retain its Borderline Safe Dividend Safety Score until the company's payout ratio improves.

.png)