.png)

Wells Fargo's Dividend Looks Increasingly Fragile

In March, we discussed the various financial and political challenges facing Wells Fargo (WFC) and the U.S. banking industry due to the COVID-19 pandemic.

We concluded that the outlook for dividends had become much blurrier, supporting the Borderline Safe Dividend Safety Scores placed on many banks.

Please see our note here for complete background information.

We concluded that the outlook for dividends had become much blurrier, supporting the Borderline Safe Dividend Safety Scores placed on many banks.

Please see our note here for complete background information.

Investing in banks is complicated enough when times are good. Today, investors must grapple with uncertain political and financial pressures that have potential to interfere with dividend payouts.

Banks appear to remain in good shape today, but the environment is evolving quickly. The fate of some of their dividends, at least in the short term, could depend on how much caution and help for the community regulators and management teams deem to be prudent.

The severity and duration of the pandemic remain unknown, but pressure has continued to increase on Wells Fargo's dividend.

Based on our analysis below, we are downgrading Wells Fargo's Dividend Safety Score from Borderline Safe to Unsafe.

From a financial perspective, the biggest question facing banks is how much economic damage this crisis will cause.

It will take time for the credit impact to be known. Interest and loan payments come due over time, and some businesses and households have enough cash to get them through a month or two before they can no longer pay.

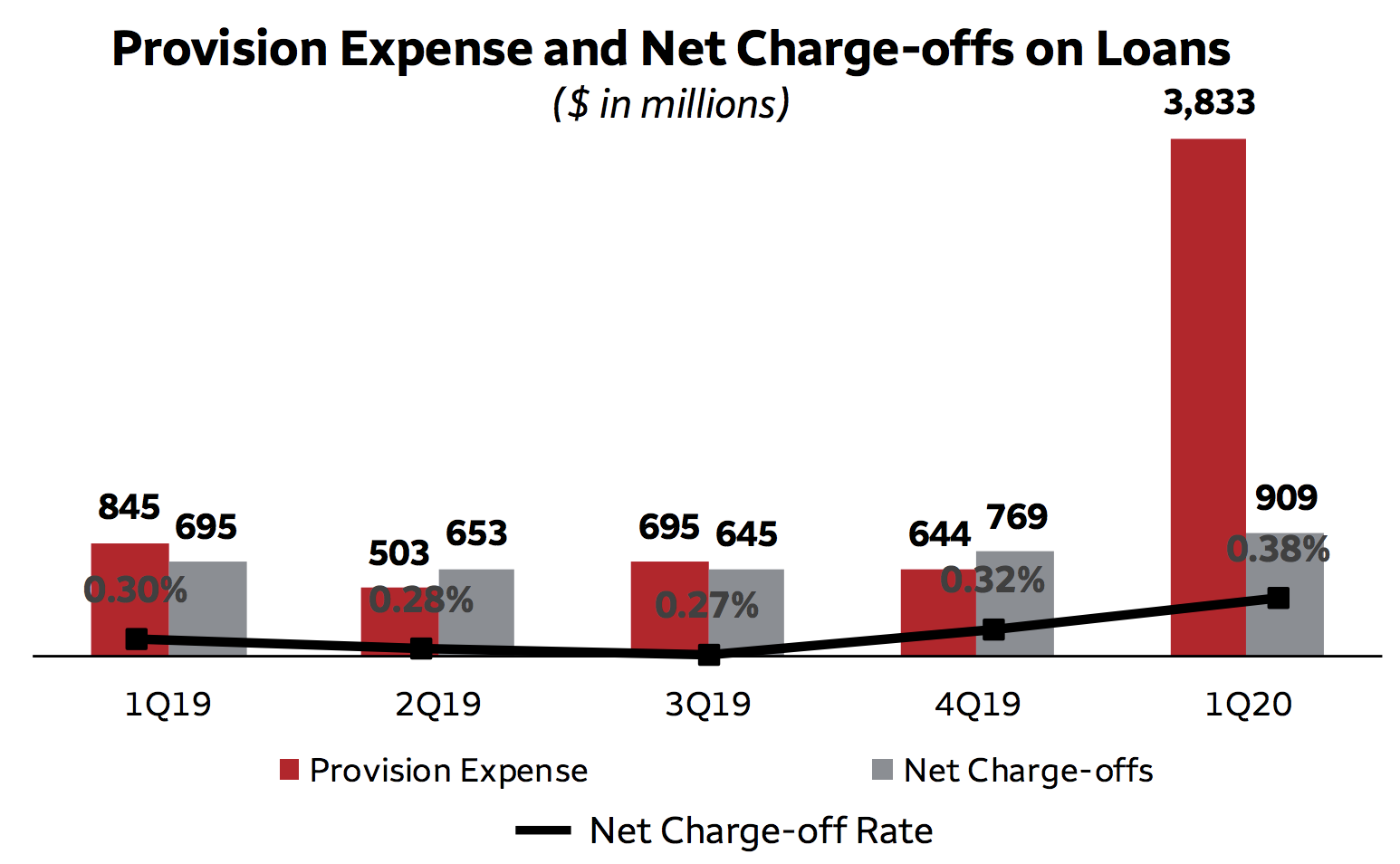

For now, all banks can do is book loan loss provisions (estimates of future uncollectible loans), which decrease current earnings.

As you can see, Wells Fargo booked a $3.8 billion loan loss provision last quarter, up from $845 million in the first quarter of 2019.

Depending on how the future plays out, additional charges may need to be booked, or prior charges could eventually be reversed if damages aren't as bad as feared.

A lot of assumptions about the economy are required to estimate future losses, but Wells Fargo has set aside a much smaller allowance for loan losses compared to its peers.

Each bank's mix of loans is different, but some analysts are concerned that Wells Fargo will need to significantly increase its provision for credit losses.

While the bank has limited exposure to riskier areas such as credit cards (4% of loan portfolio) and auto loans (5%), commercial and industrial loans (37%) have meaningful exposure to the pandemic.

Management said they did not assume losses will be worse than the 2007-09 financial crisis when calculating their provision expense in the first quarter.

If things play out substantially worse, then it's possible that Wells Fargo will need to build up its provisions and experience more charge-offs.

Analysts seem to be expecting that the economic downturn will be much worse than what management assumed in their estimates.

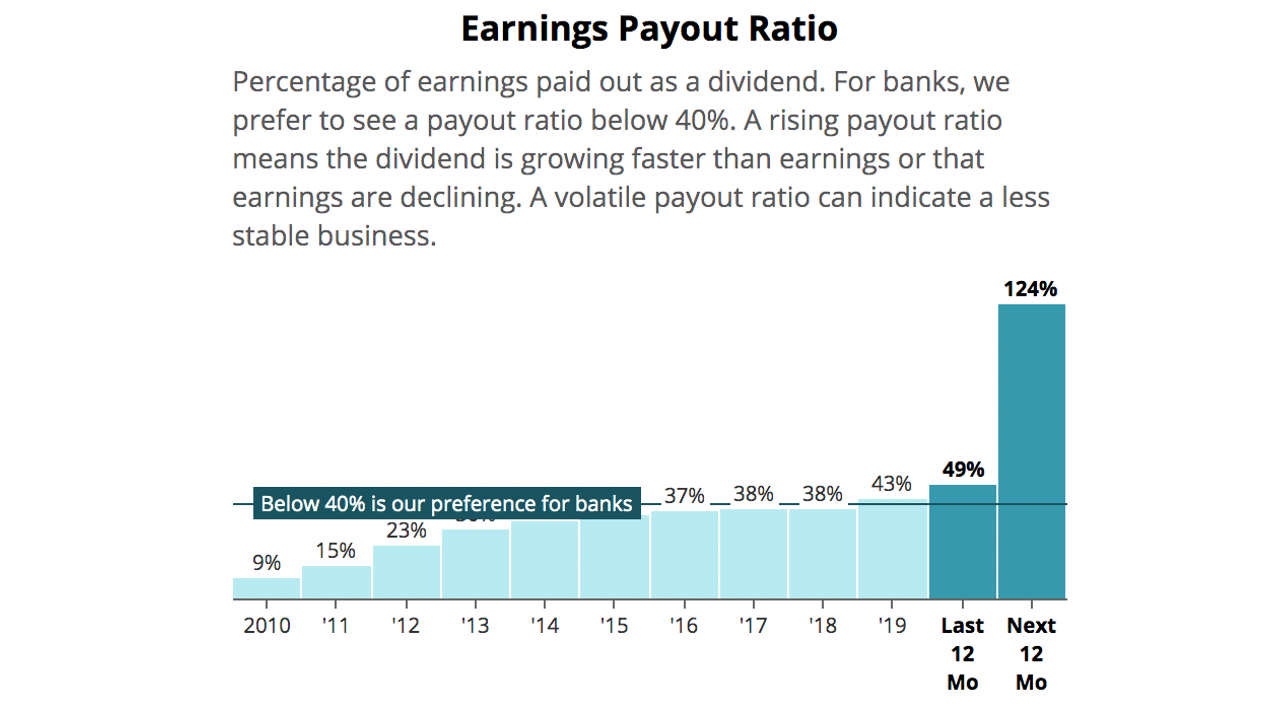

Wells Fargo's earnings are now projected to fall nearly 60% in the year ahead, sending its payout ratio above 120%. That level of deterioration is much worse than the forecasts for America's other large banks.

Wells Fargo's earnings are now projected to fall nearly 60% in the year ahead, sending its payout ratio above 120%. That level of deterioration is much worse than the forecasts for America's other large banks.

For comparison, JPMorgan Chase, Bank of America, Citigroup, Morgan Stanley, and Truist Financial all have projected payout ratios around 40% to 60%.

Falling long-term interest rates have also weighed especially heavy on Wells Fargo's earnings profile.

The Fed placed a cap on Wells Fargo's assets in 2016 following its fake-account scandal. This prevented the firm from making more loans to help offset margin compression in its lending businesses due to lower rates.

Although Wells Fargo was granted approval to lend more money under the Paycheck Protection Program, it can't earn any fees from this business, and its asset cap remains in place.

Weak earnings and a high payout ratio don't necessarily mean the dividend is doomed, though.

Management has emphasized that the dividend should reflect the well-capitalized bank's forward-looking earnings power.

Looking at earnings or payout ratios any single year, especially a year like this one, isn't necessarily helpful.

As the quarters unfold and we figure out how long we're going to be in this economic state and what the path forward looks like and we use that to interpret and estimate what our go-forward earnings trajectory looks like, that's the context for understanding what the steady state dividend should look like.

So in terms of what this year's dividend looks like versus this year's consensus or estimated earnings during a time of stress is less germane, I think, than, a, the fact that we start with ample capital; and b, what we think our run rate, more steady state earnings are on the way out of this and reflect what the dividend is in light of that.

– CFO John Shrewsberry

Dividends and buybacks reduce the amount of capital a bank has available to lend and cover credit losses. Given their importance to the economy, big banks must pass the Fed's annual stress test in order to return money to shareholders.

Wells Fargo submitted its capital plan in April, and the Fed will announce the results of its stress test and whether it has rejected the bank's proposal in June.

Management is optimistic that the current dividend can be maintained despite the financial uncertainties facing banks.

After all, the dividend's $8 billion annual cost isn't tremendous compared to Wells Fargo's $135 billion of capital.

Based upon the assumptions that we've laid out in these very stressed environments, we do feel good about [the dividend]. But ultimately, the timing and the pace of the recovery is going to determine earnings capacity for everyone to be able to continue to support the level of dividends.

– CEO Charlie Scharf

The biggest banks, including Wells Fargo, have capital ratios more than 1 percentage point on average above the levels that would force the Fed to restrict buybacks and dividends, according to The Wall Street Journal.

While this gives them greater flexibility to maintain their dividends, it's hard to say how conservative the Fed will be when evaluating banks' capital plans this year given the unprecedented uncertainty facing the economy.

Wells Fargo could be in a particularly tough spot due to its asset cap (harder to generate more income when you can't lend more and fees are being reduced to help distressed customers) and potential need to substantially increase its provision for credit losses.

If management or regulators believe these factors will suppress the bank's earnings power for the foreseeable future, then it's possible the dividend will need to be lowered.

The way I think we need to think about the dividend is severalfold. As I've said in my prepared remarks, we're going through an unprecedented environment. And so when you go through an unprecedented environment, you need to step back and make sure that your thinking is clearly about what the future could hold and evaluate what that means for the position of the company.

First and foremost, we have an extremely strong capital position. And as we look at that capital position today, that informs us about our ability to use our financial resources to continue the dividend.

Over a period of time beyond the very short term, it really is important that we look at what the earnings capacity of the company is. Because our ability to pay our dividend over an extended period of time isn't supported just by the capital base of the company, it's supported about -- it's supported by the earnings levels of the company.

So we're spending, as you would imagine, as I'm sure all companies in all industries are doing right now, a lot of time looking at what those forecasts can look like, reviewing them with our Board, and that's something that we'll continue to do. And what those forecasts inform us will ultimately inform how we feel about the dividend. And so hopefully, that gives you a context for how we think about the dividend in our discussions.

– CEO Charlie Scharf

Overall, it's very challenging to evaluate the safety of banks' dividends in this environment.

Wells Fargo should have the financial strength to get through this crisis, but the outlook for its dividend has become murkier.

Current shareholders should weigh if they are comfortable owning a stock with such a wide range of outcomes for its dividend.

The results of the Fed's stress test in June will provide more information, and we will continue monitoring the situation.