.png)

ONEOK Holds Dividend Steady For Now

ONEOK (OKE) on Thursday declared its regular quarterly dividend payable in May, maintaining its existing payout despite the uncertainty facing the midstream services industry.

"ONEOK's dividend payout is supported by our strong balance sheet and healthy dividend coverage. Holding the dividend at its current level is the prudent financial decision for ONEOK during this time of market uncertainty. Our integrated and extensive assets and financial strength position us well for an industry recovery once energy markets stabilize." – CEO Terry Spencer

Previously, on March 11, ONEOK reaffirmed its 2020 guidance for the year despite the plunge in commodity prices and the impact that will have on producer activity.

Management also reduced the firm's 2020 capital spending plans from $2.5 billion to $2 billion and noted ONEOK's strong liquidity, which consists of $600 million of cash on hand and a $2.5 billion credit facility with no borrowings outstanding.

For context, ONEOK expected to generate $2.4 billion of distributable cash flow this year (nearly 20% growth), and its dividend costs about $1.6 billion.

All things equal, ONEOK's retained cash flow after paying dividends ($800 million per year), cash on hand ($600 million), and available borrowing capacity ($2.5 billion) could cover its $2 billion in growth spending (peaks in 2020) and the $1.5 billion loan it has coming due in late 2021 without a need to issue equity.

However, investors are concerned that ONEOK's cash flow will take a hit, reducing dividend coverage and making it harder for the business to fund expansion projects without further stretching its balance sheet or increasing refinancing risk.

In 2019, approximately 90% of ONEOK's earnings were fee-based. But its natural gas liquids (57% of EBITDA) and natural gas gathering and processing (27%) segments still have volumetric risk.

These businesses charge fixed fees primarily tied to the amount of commodities flowing through their pipelines and processing plants. Volumes may be impacted if producers curtail production activities.

The recent crash in oil prices has sent a shockwave throughout the energy industry, resulting in a plunge in drilling activity as producers shut in unprofitable wells and hunker down to preserve liquidity.

Meanwhile, downstream consumers (petrochemical companies, refineries, etc.) who purchase ONEOK's fractionated natural gas liquids are experiencing much lower demand since the coronavirus has sapped demand for fuel.

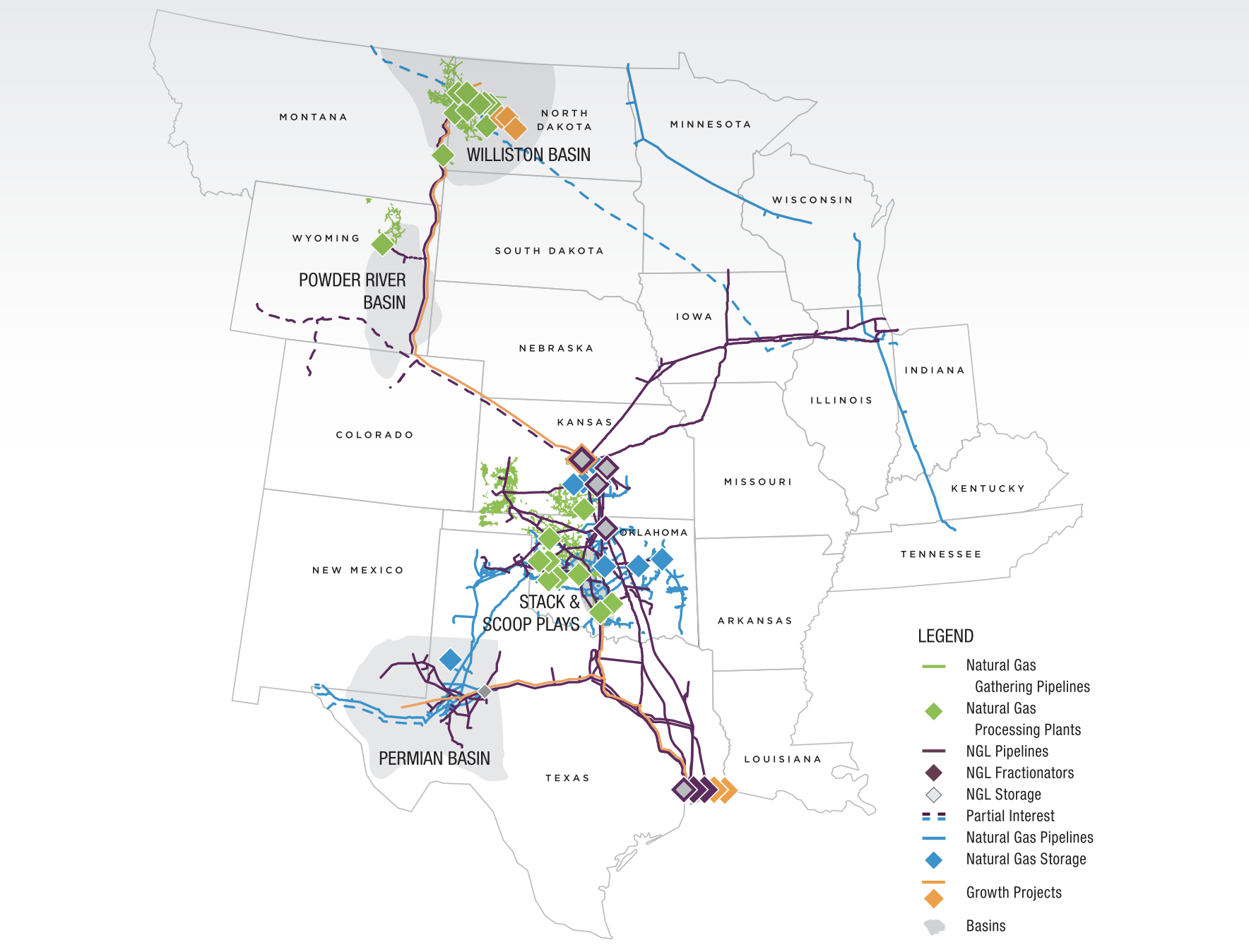

ONEOK's gathering and processing businesses are concentrated in the Williston Basin in North Dakota and the STACK and SCOOP plays in Oklahoma.

The Williston Basin continues to be a primary contributor to ONEOK's growth (including the majority of its growth capex), underscored by the fact that volume growth in the region is at higher margins relative to its other regions.

However, the number of active drilling rigs in the Williston has plunged in recent weeks and sits slightly above its 2016 low.

It's hard to say how this will impact the amount of natural gas that ONEOK can gather and process.

Natural gas production increased 4% in 2015-16 despite a 12% decrease in crude oil production, and management points out that 15% of gas produced here is still being flared, suggesting that more takeaway infrastructure is needed.

The impact on ONEOK's business may not be known for several quarters. It takes time for producers to adjust their plans, and some of them are hedged for most of 2020.

The good news is that ONEOK is not overly dependent on any single producer (no customer represents more than 10% of revenue), and most of its customers are major oil & gas producers and leading petrochemical firms with investment-grade credit.

Regardless, the macro factors at work today make ONEOK's situation a little uncomfortable. It will take time to see if its key regions can remain competitive and keep producing through this volatile commodity price environment.

Current shareholders should weigh if they are comfortable with the wide range of outcomes and elevated uncertainty facing parts of the midstream industry.

ONEOK remains committed to its dividend (uninterrupted payouts since 1989), but that commitment could be tested if demand slumps in its key basins and fails to recover in a reasonable amount of time.

The company next reports results on April 28, and we will continue monitoring the situation. We expect to maintain ONEOK's Borderline Safe Dividend Safety Score for now.

.png)