Shell Reduces Dividend in Response to Unprecedented Uncertainty Facing Oil Market

Royal Dutch Shell (RDS.B) announced plans to reduce its dividend by 66%, marking its first cut since World War II.

Shares of Shell are down about 13% in early trading. Based on their current price and the new payout, shares have a dividend yield near 4%.

Shell had a low (45) Borderline Safe Dividend Safety Score prior to this announcement.

The company's murky score reflected Shell's elevated leverage and poor dividend coverage in the short term, partially offset by management's past commitment to the payout and the firm's ability to borrow for a period of time until prices improved.

On March 11, we wrote:

Shares of Shell are down about 13% in early trading. Based on their current price and the new payout, shares have a dividend yield near 4%.

Shell had a low (45) Borderline Safe Dividend Safety Score prior to this announcement.

The company's murky score reflected Shell's elevated leverage and poor dividend coverage in the short term, partially offset by management's past commitment to the payout and the firm's ability to borrow for a period of time until prices improved.

On March 11, we wrote:

Shell faces a tough decision if oil prices remain depressed for the foreseeable future. The company may have to decide between lowering its sacrosanct dividend or risking its credit rating by stretching its balance sheet even further while hoping for better market conditions sooner rather than later.

Shell's dividend has been a safe bet for more than 70 years, but this time could be different, depending on how conservative management wants to be given the uncertainty facing the energy market.

With that said, it's somewhat surprising management decided to throw in the towel this soon.

Rival oil producers Chevron (CVX), Exxon (XOM), and ConocoPhillips (COP) have maintained their payouts, and even BP (BP), which has a worse balance sheet, kept its regular dividend on Wednesday.

Shell said that it didn't have to reset the dividend now. However, the board felt it would be irresponsible not to in this environment given the unprecedented uncertainty facing the oil market due to the coronavirus pandemic.

Management questioned when, if ever, oil demand would return to 2019 levels and did not expect to have better visibility on the future if they had waited until June or July to make a decision.

Shell believes it is most prudent to preserve its resiliency while it still has it. Slashing the dividend will save the company about $10 billion annually going forward, providing more room to maneuver the business as needed.

With "no visibility going forward" and the potential for additional "exogenous" shocks, Shell said it would rather face a difficult day today then run into bigger consequences down the road if conditions don't improve.

Shell's CEO also said that he was "balancing short-term needs with long-term goals" to become a net-zero emissions business by 2050.

Lowering the dividend provides more flexibility to invest in renewables, even though some investors on the earnings call questioned the return this capital will ultimately earn.

Regardless, Shell's dividend reduction and cost cuts will save the company around $20 billion annually. Shell also holds around $20 billion in cash and has $22 billion of undrawn credit facilities.

It will weather this storm and has a shot at preserving its AA- credit rating from Standard & Poor's as a result of these actions.

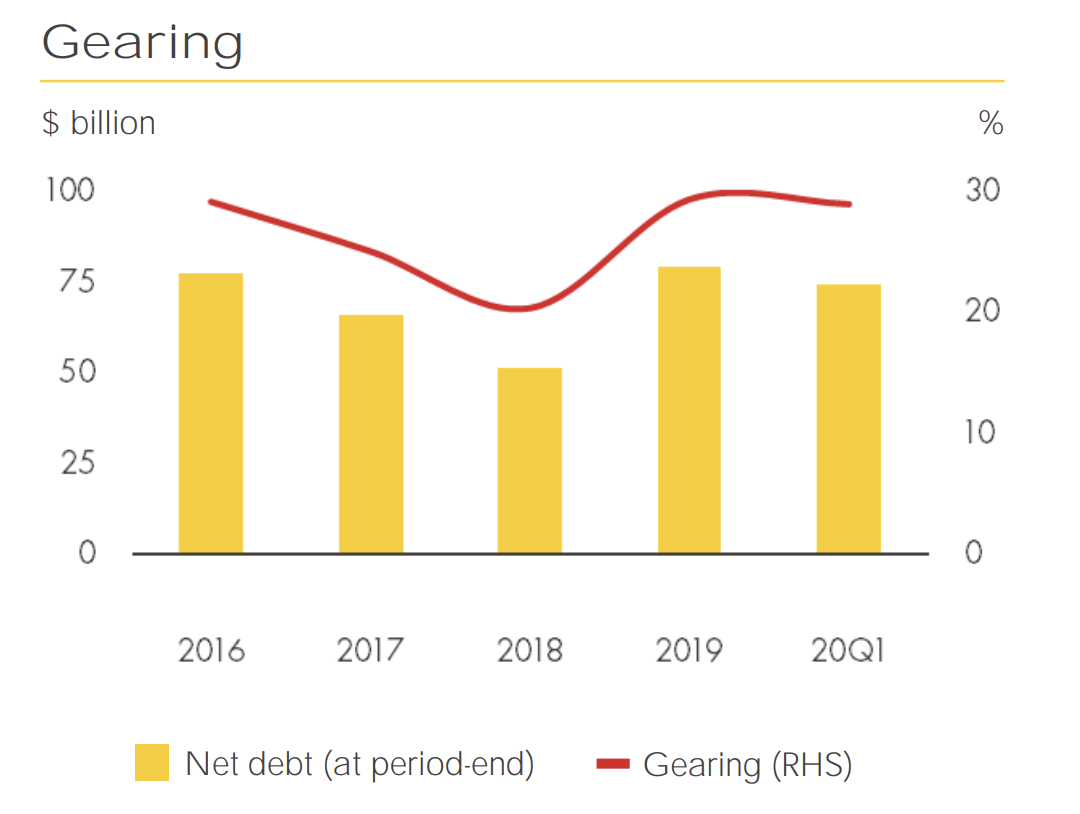

Gearing (net debt as a percentage of total capital) will remain somewhat above management's 25% target level in the current environment. But improvement should be much more achievable going forward, even if oil fails to return to $60 per barrel.

Overall, it's hard to fault Shell for reducing its dividend. While some investors would have preferred management wait longer to see how the coronavirus recovery plays out, it's hard to gauge how different companies will respond to this unprecedented environment.

As for the other oil majors, this news could make it more forgivable for them to lower their dividends if weak conditions persist.

We believe Unsafe-rated BP, which has the weakest balance sheet in the group, remains the most vulnerable to a dividend cut, perhaps as early as next quarter.

Borderline Safe-rated Total (TOT) could be next in line as it maintains leverage at the high end of management's target. The company also shares Shell's ambitions to reduce emissions and has said it desires to maintain its A+ credit rating.

Exxon also has a Borderline Safe rating but maintains greater borrowing capacity than Shell, BP, and Total due to its scale and lower leverage heading in.

Exxon declared a regular dividend payment on Wednesday, and as we discussed on April 7, the current dividend seems likely to be sustained for at least a couple more quarters before Exxon might capitulate.

Chevron has a low Safe rating for now, reflecting the strength of its balance sheet and dividend commitment. Similar to Exxon, we would be surprised if the company didn't wait at least a few quarters to change its stance on the dividend.

Shell shareholders should weigh if they want to stay invested for the 4% yield, look outside of the energy sector for a business with more in its control, or consider alternative oil stocks that have a chance at preserving their higher yields.

However, if oil prices remain near $20 per barrel for the foreseeable future, the outlook for virtually all oil dividends will become even darker.