Caterpillar's Solid Liquidity Expected to Support Dividend

Caterpillar (CAT) reported earnings on Tuesday, and the coronavirus pandemic's impact was already evident in its results; sales fell 21% and profits tumbled 39%.

Management said that the impact of COVID-19 on Caterpillar's business "has been significantly more severe and chaotic than any cyclical downturn we had envisioned."

But this isn't Caterpillar's first rodeo, and the company enters this downturn with the financial and operational strength necessary to continue supporting its dividend:

Management said that the impact of COVID-19 on Caterpillar's business "has been significantly more severe and chaotic than any cyclical downturn we had envisioned."

But this isn't Caterpillar's first rodeo, and the company enters this downturn with the financial and operational strength necessary to continue supporting its dividend:

"We continue to expect our strong financial position to support the dividend. As a reminder, Caterpillar has paid a quarterly dividend every year since 1933 through a variety of challenging business conditions. We remain committed to returning substantially all our free cash flow to shareholders through the cycles." – CEO Jim Umpleby

In recent years, Caterpillar has undertaken substantial restructuring activities, including reducing its manufacturing footprint by nearly 30% since 2014.

Since 2016, the company has also held most of its operating expenses and headcount flat, even though sales increased 40% during that period.

Thanks to these actions, Caterpillar enters this downturn with a lower cost base and should require significantly less restructuring costs, resulting in stronger cash flow performance compared to past cycles.

Caterpillar has also focused on expanding its aftermarket parts and services business, which now accounts for over 30% of sales. Management hoped to double the size of this business between 2016 and 2026.

Not only do services carry higher margins compared to original equipment sales, but they also provide a more stable cash flow stream since maintenance work is less discretionary in nature.

As a result of these structural improvements to the business, management in 2019 said they expected Caterpillar to generate an operating margin between 10% and 21% throughout a cycle, up from its historical range of 7% to 15%.

The company still anticipates its absolute margins and cash flow to be higher but said it will be challenging to achieve those new targets due to the unusual nature of this downturn.

More specifically, Caterpillar has encountered operational inefficiencies with its production output since governments have forced some of its suppliers to temporarily close due to the virus outbreak.

Even if performance during this downturn is worse than management anticipates, Caterpillar's solid liquidity and balance sheet position it to ride out the storm and preserve its dividend.

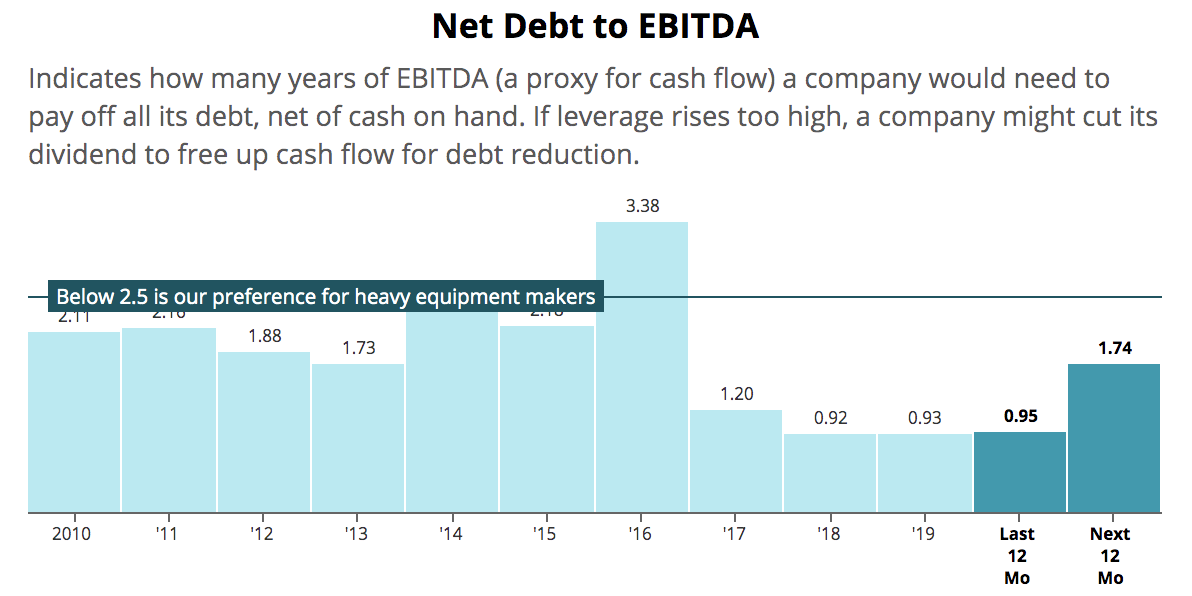

The company maintained an A credit rating from Standard & Poor's heading into the crisis, and its leverage ratio was near its lowest level in at least a decade.

Caterpillar also ended March with $7.1 billion in cash on hand and $20.5 billion of available liquidity. For context, Caterpillar had $11.2 billion in long-term debt, with no maturities until 2021.

Although management suggested that free cash flow will more than cover Caterpillar's $2.3 billion dividend this year, the company's liquidity provides extra financial flexibility in the event of any surprises.

It also adds a margin of safety in case Caterpillar's financing arm runs into any challenges with credit quality declining. Fortunately, this business is starting from a healthy position.

Past dues, or late payments as a percentage of overall loans, were 1.3% last year in North America, compared to 4.3% prior to the 2007-09 financial crisis. And in China, past dues were 1.3% last year versus 8.3% in the financial crisis.

Given the mission-critical nature of Caterpillar's machinery, which backs the loans, customers will hopefully continue prioritizing these payments.

It will take time to gauge the performance of this lending business, but it doesn't seem like a threat to the dividend based on what we know today.

Overall, Caterpillar's business appears well positioned heading into this unprecedented downturn.

Depending on the severity and duration of these unusual circumstances, management may not meet their guidance for high-single digit annual dividend growth through 2023. However, we expect the dividend to remain safe.