Omnicom Plans to Maintain Dividend

Omnicom (OMC) reported earnings this morning. Despite unprecedented headwinds facing the advertising market due to the coronavirus pandemic, management reaffirmed the company's commitment to its dividend:

Our liquidity, balance sheet, and credit ratings remain very strong, and we have no plans to change our dividend policy.

Omnicom recorded 3% organic revenue growth in January and February, but revenue declined by 3% in March as global shutdowns caused companies to slash their marketing expenditures.

The advertising agency expects a severe double-digit decline in sales in the second quarter, and while visibility remains extremely limited, management believes trends in the second half of the year won't be as bad since economies will continue reopening.

Omnicom's management team was with the company during the 2007-09 financial crisis and is taking an even more proactive approach to this downturn given its severity, saying that "the actions that we've put in place so far exceed those that we took in 2009."

Salary and service costs account for nearly 75% of Omnicom's cost structure and will be adjusted as needed. Thanks to this variable cost structure, the firm can offset some of its lost revenue, protecting profits.

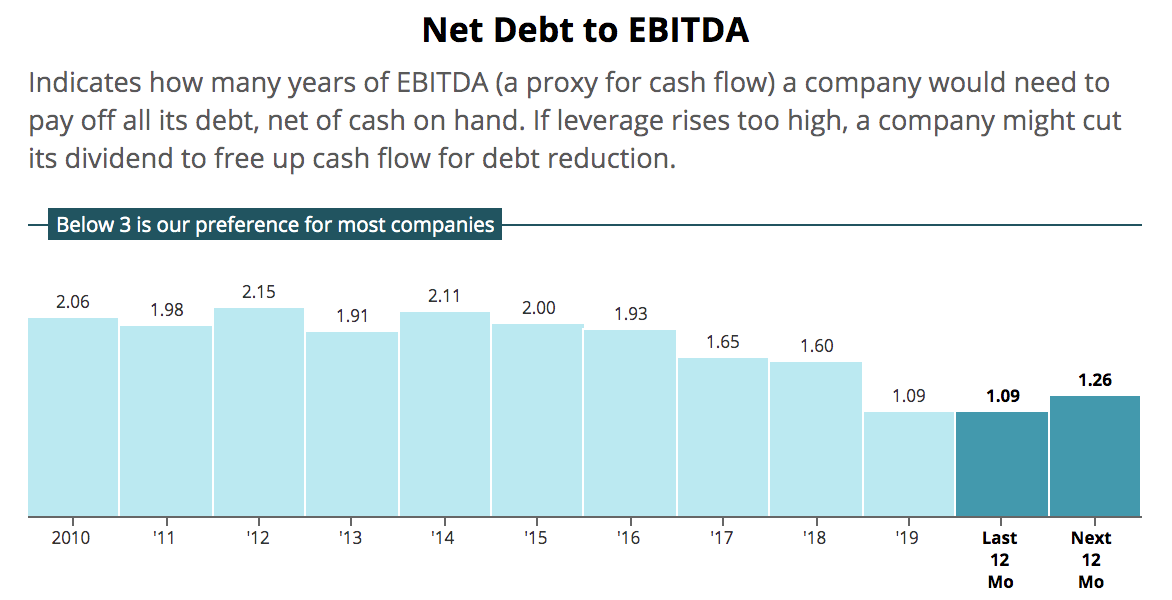

Perhaps most importantly for the dividend, Omnicom entered this crisis in great financial shape. As you can see, the firm's leverage was at its lowest level in at least a decade, supporting its BBB+ credit rating from Standard & Poor's.

Omnicom also ended March with $2.7 billion in cash and had $2.9 billion of available borrowing capacity under its credit lines. No long-term debt matures until May 2022 either. The company's liquidity position is healthy and supportive of its $575 million dividend.

Looking ahead, management didn't provide any specifics with the magnitude of revenue declines that investors should expect, other than saying that they believe the slump in the second quarter will be "a little deeper than it was back in '08, '09, initially."

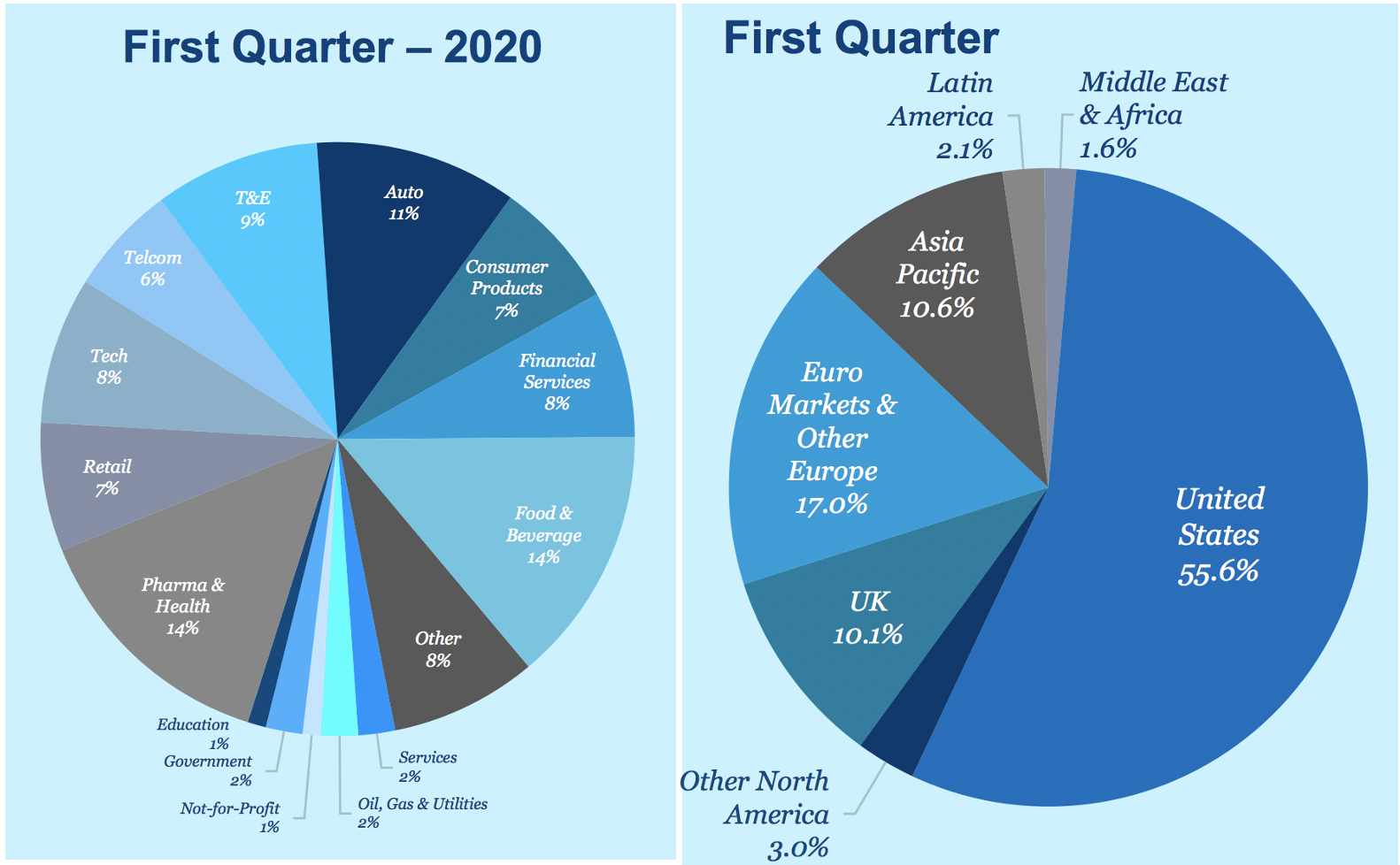

Despite the demand challenges facing advertising agencies, Omnicom's geographical and industry diversification provides some help. For example, management noted that its healthcare business is growing.

Overall, it will take time for advertising budgets to recover. But Omnicom has the financial strength and variable cost structure to weather this storm and continue protecting its dividend for the foreseeable future.

Coupled with the stock's undemanding valuation, we plan to continue holding our shares in our Top 20 Dividend Stocks portfolio.