AT&T Reports Initial Impact from COVID-19, Expects to Maintain Healthy Dividend Coverage

AT&T (T) reported earnings on April 22 and reiterated confidence in its dividend despite the uncertainty caused by COVID-19:

No one knows the full duration and magnitude of the situation, but we have been running several different stress test scenarios with varying degrees of severity. Through it all, we expect to come through this healthy and expect that our cash flow will allow us to continue to invest in growth areas, to provide ample dividend coverage, and allow us to retire debt...

We remain committed to our dividend. In fact, we finished last year with our dividend as a percent of free cash flow a little over 50%. And even with the current economic crisis, we expect the payout ratio in 2020 to be in the 60s, and we're targeting the low end of that range, which is a very comfortable level for us.

Prior to the pandemic, AT&T expected to generate $28 billion of free cash flow this year, easily covering its $15 billion dividend and providing excess cash flow for deleveraging.

Based on management's payout ratio commentary above, AT&T's free cash flow is now expected to come in between $23 billion and $25 billion in 2020, a number CEO Randall Stephenson said he feels "very, very comfortable" they can achieve.

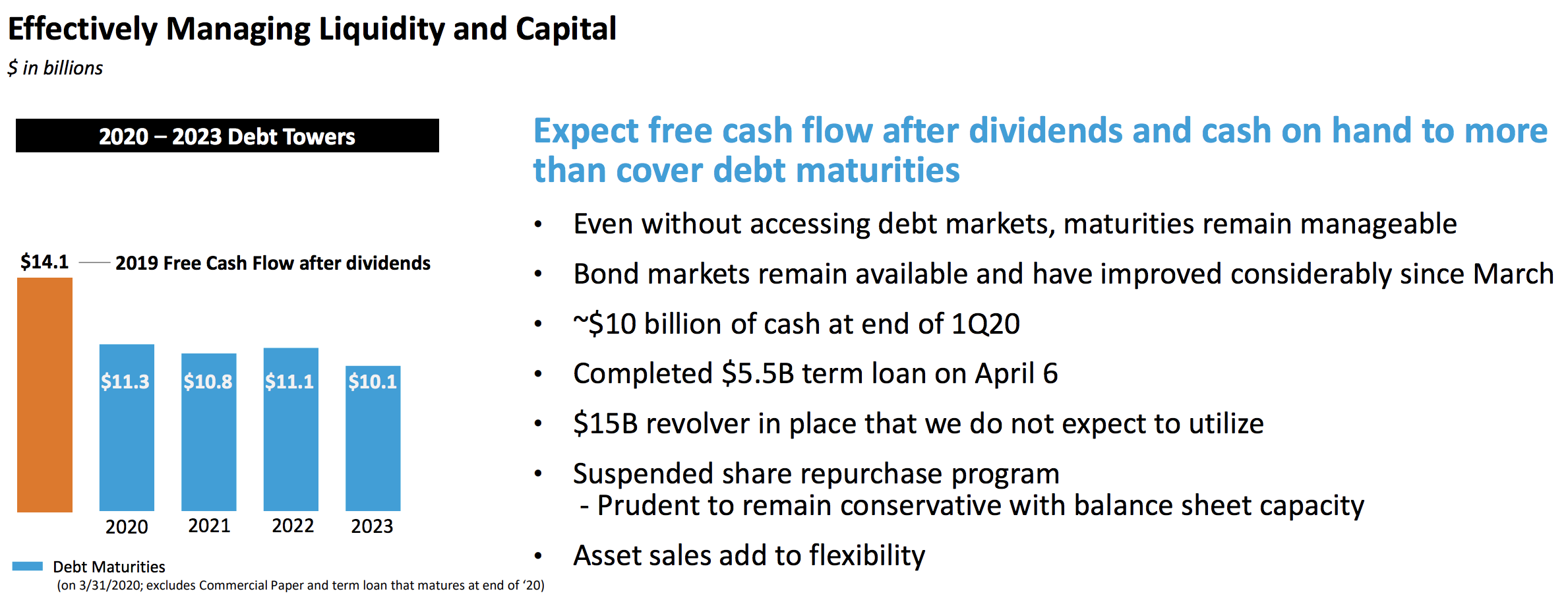

While no one knows how the economy will trend from here, management expects free cash flow after dividends and AT&T's cash on hand to more than cover its debt maturities this year and through 2023 even in this current environment.

AT&T also has an untapped $15 billion revolver in place and said that credit markets remain open and stable. Simply put, the company's liquidity appears sound and unlikely to threaten the dividend for now.

But as we discussed in our April 8 note, some investors worry about how AT&T's business will perform in a recession (the worst of the economic downturn is likely ahead of us) and the impact that could have on the company's deleveraging goal.

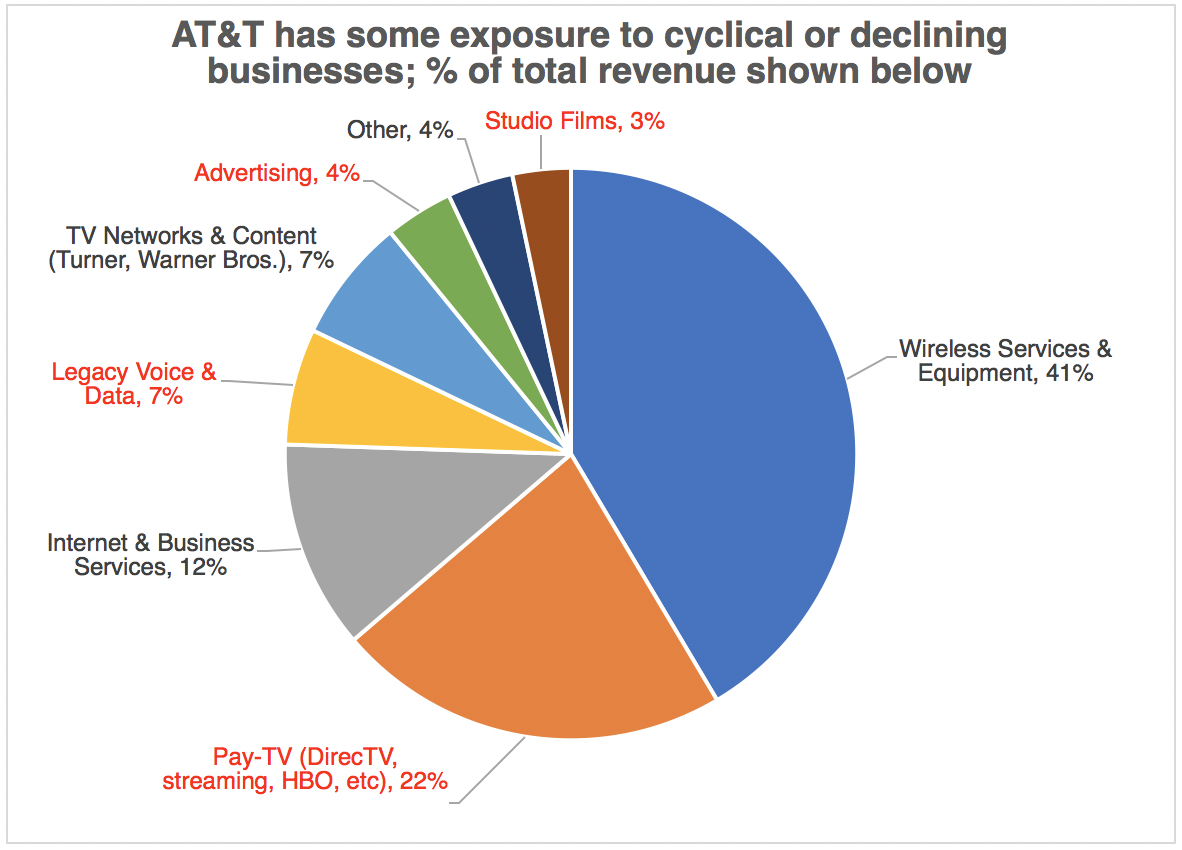

After all, AT&T's acquisitions of DirecTV and Time Warner expanded its operations into cyclical businesses such as advertising (4% of revenue) and studio films (3%) while also deepening its exposure to the declining pay-TV market (22%).

While weakness is to be expected in some of these areas, the bulk of AT&T's earnings continue to be generated from recession-resistant businesses that should continue generating predictable cash flow:

Our core subscription-based businesses – wireless, broadband, and enterprise networks – are critical and valued services in these times. They connect, inform, and entertain our customers. And for our business, they represent more than 60% of revenues and more than 70% of EBITDA.

These businesses have proven to be resilient, and they help provide a recurring stream of revenue and solid cash flows even in times of economic stress. They also provide a foundation that can absorb pressure from the other parts of the business that are facing headwinds because of COVID-19.

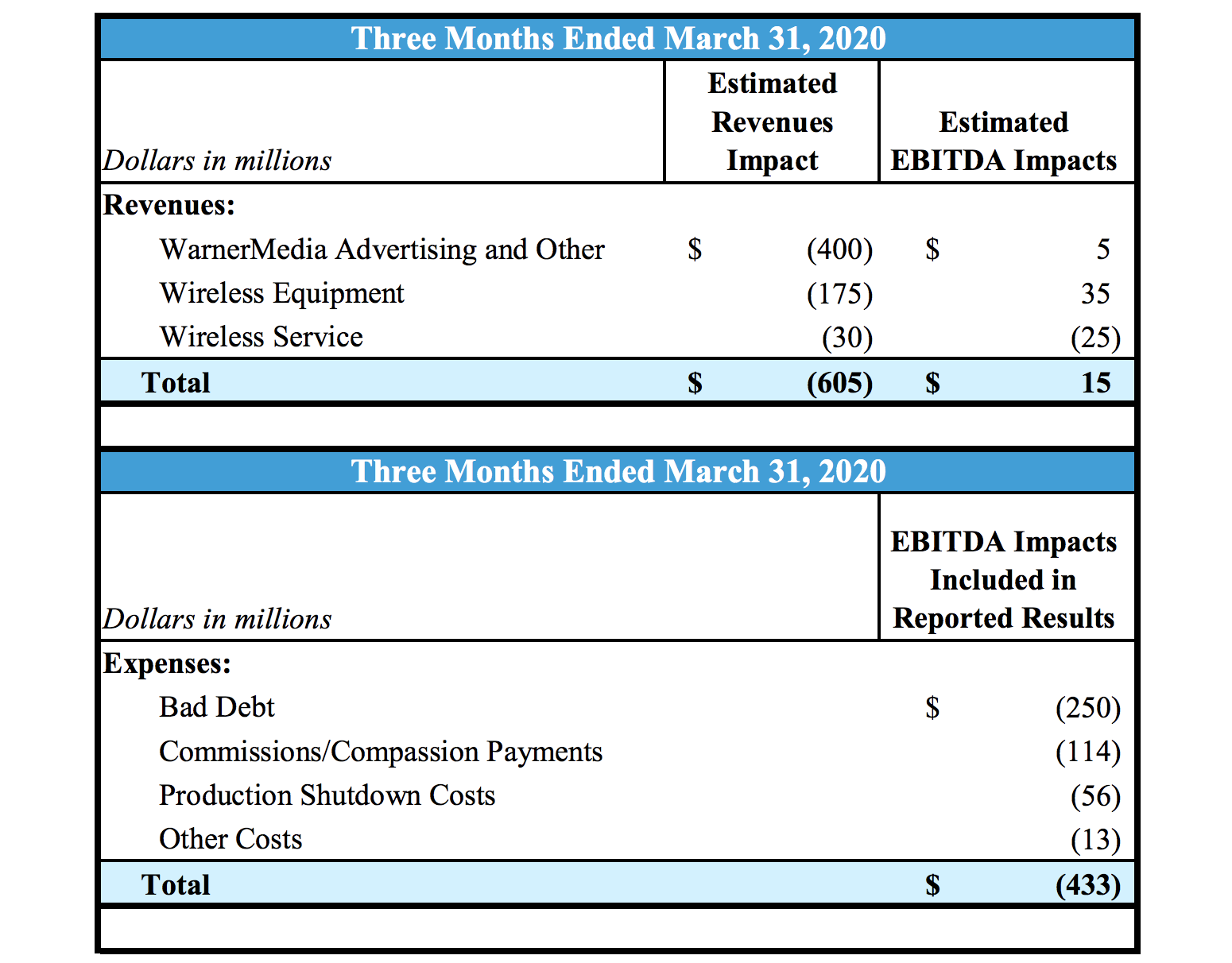

As you can see below, the coronavirus reduced AT&T's revenue and increased its costs in the first quarter, resulting in about a $400 million hit to EBITDA. For context, AT&T's 2019 EBITDA totaled $56 billion.

At WarnerMedia, content production has been placed on hiatus, theatrical releases have been postponed, and advertising revenue is falling, including a hit due to the cancellation of the NCAA basketball tournament. Fortunately, much of this impact was offset by lower expenses.

Meanwhile, closures of retail stores reduced wireless equipment and service sales. Late fees were also waived to help customers during these tough economic times, and roaming revenue fell with fewer people traveling.

AT&T took a $250 million bad debt charge as well, recognizing future risk of non-payment across its businesses, and pay was temporarily increased for its frontline workers such as technicians.

The company's pay-TV business is also expected to face future pressure as consumers reduce their spending and commercial clients such as hotels and restaurants remain temporarily closed.

Assuming no additional bad debt charges are needed, coronavirus-related headwinds from the last two weeks of March annualize out to around $4 billion per year (about 7% of AT&T's 2019 EBITDA), and most of these headwinds seem unlikely to have a lasting effect on the firm's earnings power.

This is obviously a very fluid situation and could get worse, but based on what we know today, AT&T's position continues to look manageable and supportive of its dividend given its diversified operations, scale, and liquidity.

AT&T also announced today that CEO Randall Stephenson, who has led the company since 2007, will retire on July 1.

He will be replaced by John Stankey, who serves as AT&T's chief operating officer and previously headed its media division.

Mr. Stankey has been with AT&T since 1985, so it seems unlikely he will deviate from the firm's current strategic path and capital allocation priorities, including its commitment to the dividend.

Overall, AT&T's first-quarter earnings report didn't change our thoughts on the company. AT&T accounts for 1.7% of our Conservative Retirees portfolio, and we plan to continue holding our shares.

Going forward, it's important that AT&T's free cash flow outlook doesn't deteriorate further. Deleveraging needs to remain the top priority, and maintaining a moderate payout ratio is key.

We will provide updates as new information becomes available in the months ahead.

.png)