Tanger's Dividend Looks Increasingly Fragile as Retail Headwinds Mount

With disruption (and rising store closures) looking more permanent, Tanger's occupancy level, rent rates, and cash flow could come under even greater pressure, and potentially for much longer than management and analysts currently expect...

As conservative investors, we prefer to own businesses that have more in their control and are better aligned with secular themes working in their favor. The apparel retail space does not meet those objectives given its fast pace of change and the rise of online shopping.

At the time, Tanger's dividend did not look at risk of an imminent cut. We stated that "outside of a wave of store closures or a potential desire to maintain a higher credit rating...for now there is no obvious or pressing need to reduce the dividend in order to free up cash."

However, the coronavirus pandemic has potential to be the nail in the coffin for some of Tanger's tenants and its dividend. We are therefore downgrading the REIT's Dividend Safety Score to Very Unsafe and believe the stock is a long-term value trap.

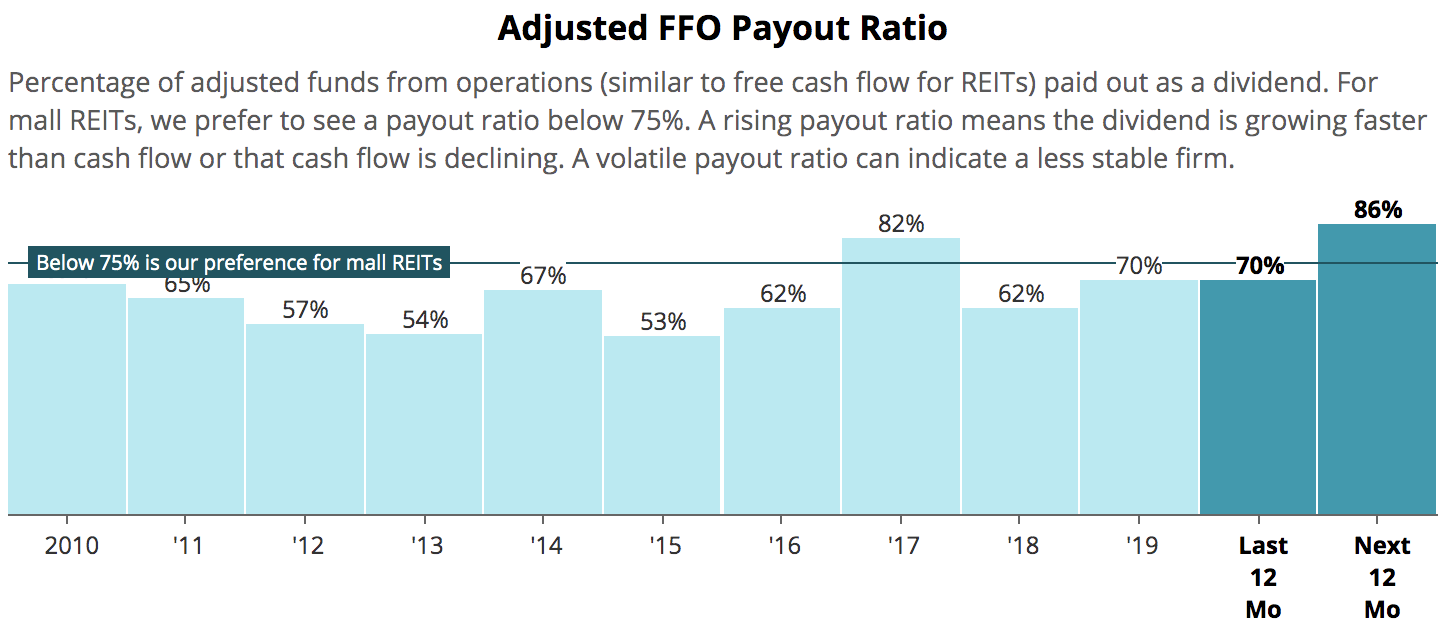

Tanger came into the year expecting its dividend to be covered by cash flow. Analysts expected Tanger's adjusted funds from operations (AFFO) payout ratio to be about 86% this year.

However, analysts' estimates haven't budged since the beginning of March to incorporate the substantial headwinds facing many of Tanger's tenants as more governments order non-essential businesses to temporarily close.

Tanger's customer base was suffering before the coronavirus hit. In January, management guided for occupancy to fall from 97% in 2019 to as low as 92% this year as the firm worked through a number retailer bankruptcies at its outlet malls.

That trend will only accelerate with store closures, and major retailers are already telling landlords they will withhold or slash the rent they pay.

It's also unclear how quickly consumers will return to crowded areas such as malls once stores reopen. With close to 60% of its square footage in tourism locations, demand could be slow to recover for Tanger's tenants.

Making matters worse, in recent years Tanger has boosted its occupancy by signing short-term, discounted lease agreements with temporary stores. Management says these tenants account for about 6% of its square footage.

Additionally, leases representing 10% of rent expire this year, and another 14% of rent expires in 2021. Renewal rates had already been falling from around 85% a couple of years ago to 77% in 2019.

Given the current backdrop for retailers and the extreme uncertainty they face, Tanger will likely have a challenging time filling this space.

If occupancy continues to fall, so will the appeal of Tanger's properties. Fewer filled storefronts makes a trip to the outlets less worthwhile. And less traffic reduces revenue for existing tenants while also making its vacant properties less desirable to new retailers. This could become a downward spiral if trends are not reversed soon.

Based on management's guidance in January, Tanger's dividend commitment of about $135 million would've been covered while leaving around $30 million of excess free cash flow after maintaining its properties.

With the storm facing Tanger from the coronavirus, we believe it would take only a 5% to 10% fall in the firm's revenue for its excess cash flow to evaporate. The REIT's slate of expiring leases and the fragile state of its tenants who are now temporarily closing locations could make that revenue drop a reality.

Even if the dividend remains covered, the clock is ticking to preserve capital. Tanger ended the year with only $18 million in cash. The good news is that the REIT has no debt maturities until the end of 2023, when $250 million is due.

The bad news is that Tanger stands no chance of building up enough cash to pay down that debt with its $135 million annual dividend soaking up nearly all of its free cash flow. In other words, the company will need to hope it can refinance the debt.

Tanger has a $600 million line of credit with a one-year extension option that may extend the maturity to 2022, but that won't take the company through its 2023 debt maturity. In other words, the company could find itself at the mercy of credit markets to refinance its debt when the time comes.

Mall retail is a tough sell to debt investors right now, and that seems unlikely to change given the industry's secular headwinds from e-commerce.

The company does have a Baa2 investment grade credit rating from Moody's, which lowered its rating in January 2020. However, Moody's maintains a negative outlook on Tanger, and a downgrade to junk would not be surprising given the substantial headwinds facing the business this year.

Finally, it's worth noting that Tanger is looking for a new COO, with plans of promoting that person to CEO at the beginning of 2021. Steve B. Tanger, the current CEO and the son of Tanger's founder, hopes to move to the role of Executive Chairman at that time, if the board wants him to.

He may try to maintain the dividend during his last year as CEO, but a reset of the dividend policy seems almost inevitable at some point. Tanger's current valuation discounts a lot of bad news already, but the worst of it could still be ahead of the company.