Shell Keeps Dividend Intact For Now

Royal Dutch Shell (RDS.B) announced a series of initiatives this morning to improve its cash flow generation. While management did not comment specifically on the dividend, its lack of inclusion in the firm's new capital preservation measures suggests Shell intends to maintain its payout for now.

Here are the actions Shell plans to take:

Here are the actions Shell plans to take:

- Reduce annual operating costs by $3-4 billion over the next 12 months

- Reduce capital expenditures to $20 billion or below (from a planned level of $25 billion)

- Reduce working capital

- Suspend future share buybacks

- Continue pursuing at least $5 billion of asset divestments

Excluding asset sales and share repurchases, these initiatives are expected to contribute $8-9 billion of free cash flow on a pre-tax basis.

Earlier this month we estimated that an oil price of $35 per barrel would require Shell to borrow upwards of $15 billion, all else equal. Management disclosed previously that Shell needed an oil price above $60 per barrel to cover its capital spending and dividend.

Shell's aggressive actions announced today reduce the amount of debt the firm needs to take on to plug the hole, but the company's leverage will still tick higher.

When we downgraded Shell's Dividend Safety Score to Borderline Safe, a key driver was the firm's reduced balance sheet flexibility heading into this downturn.

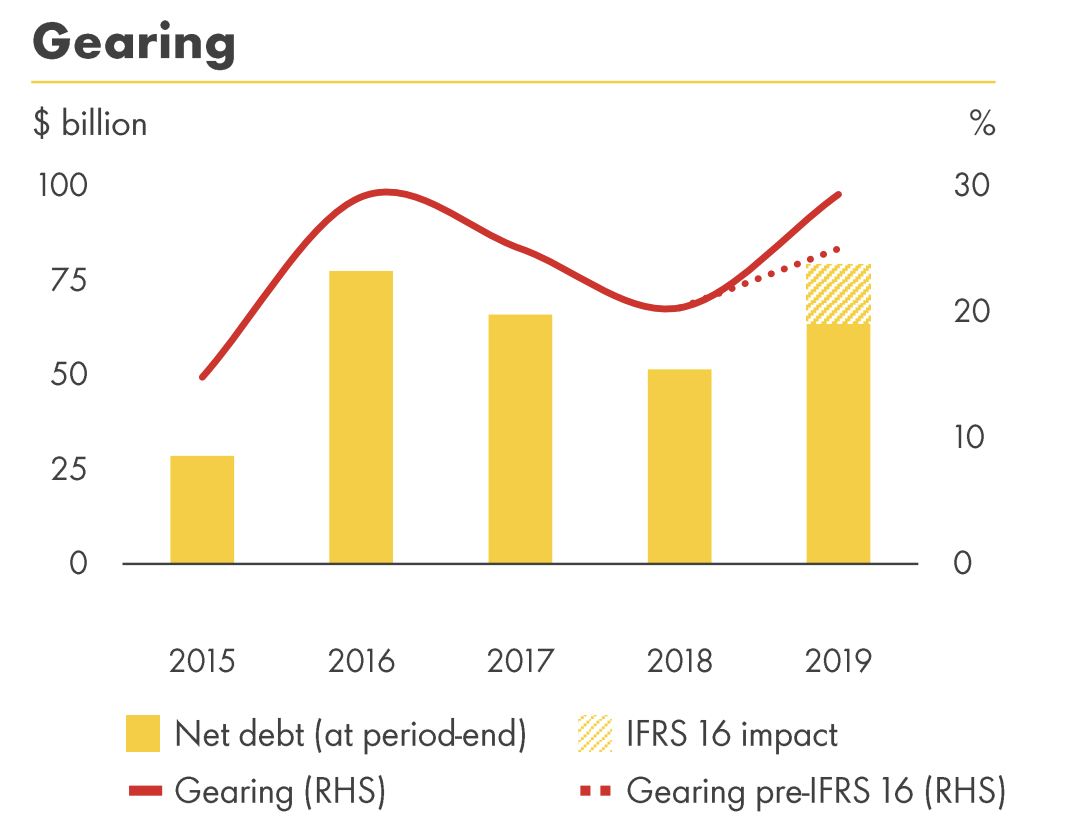

As we previously discussed, leading up to the 2014-16 oil crash Shell maintained a very strong financial profile. By the company's measurement, its net debt to capital ratio, or gearing, was 12.3% at the end of 2014.

Gearing measures the proportion of a company's financing that is from debt (net of cash) rather than equity. Shell's target gearing range through a cycle is 15% to 25%.

The company's gearing spiked to 29.6% in 2016 following its $53 billion acquisition of liquefied natural gas producer BG Group. Despite some progress reducing debt in the years that followed, Shell's gearing remained high at 29.3% at the end of 2019 (25% excluding lease debt).

For comparison, Chevron (CVX), Exxon Mobil (XOM), and Total (TOT) maintain gearing levels below 20%, providing them with greater flexibility to borrow during downturns.

Shell has said previously that the firm is committed to protecting its AA- credit rating (S&P has a negative outlook) and deleveraging its balance sheet to bring gearing down to 25%.

Assuming Shell now only needs to borrow around $7 billion (our $15 billion projected cash flow deficit at $35 per barrel oil less management's announced $8-9 billion of pre-tax free cash flow savings), we estimate its gearing would rise around two percentage points to sit near 31% (27% excluding lease debt).

The company has the liquidity to do it with around $20 billion in cash and $10 billion of undrawn credit lines.

However, it's still unclear how comfortable Shell would be maintaining or certainly increasing its gearing from here if $30 per barrel oil persists beyond several quarters.

Management likely embraces oil major Total's perspective that this pricing environment is unsustainable, making them more willing to hold onto the dividend for now.

Total said recently that global oil demand is likely to fall by 6 million barrels per day (or about 6%) in April due to the spread of the coronavirus. Meanwhile, Saudi Arabia and its partners are increasing production by 3-4 million barrels per day.

Combined, that's an extra 10 million barrels per day on what Total describes as a "zero-demand" market. For context, world oil demand sat near 100 million barrels per day last year. That's why oil prices have collapsed to under $30 per barrel.

We plan to maintain our Borderline Safe rating on Shell since its gearing will remain above management's target level this year and cash flow will fall well short of the dividend.

Protecting the dividend has taken first priority, removing some short-term uncertainty for income investors, but no one knows how long this era of depressed oil prices will last.

Shell has said previously that the firm is committed to protecting its AA- credit rating (S&P has a negative outlook) and deleveraging its balance sheet to bring gearing down to 25%.

Assuming Shell now only needs to borrow around $7 billion (our $15 billion projected cash flow deficit at $35 per barrel oil less management's announced $8-9 billion of pre-tax free cash flow savings), we estimate its gearing would rise around two percentage points to sit near 31% (27% excluding lease debt).

The company has the liquidity to do it with around $20 billion in cash and $10 billion of undrawn credit lines.

However, it's still unclear how comfortable Shell would be maintaining or certainly increasing its gearing from here if $30 per barrel oil persists beyond several quarters.

Management likely embraces oil major Total's perspective that this pricing environment is unsustainable, making them more willing to hold onto the dividend for now.

Total said recently that global oil demand is likely to fall by 6 million barrels per day (or about 6%) in April due to the spread of the coronavirus. Meanwhile, Saudi Arabia and its partners are increasing production by 3-4 million barrels per day.

Combined, that's an extra 10 million barrels per day on what Total describes as a "zero-demand" market. For context, world oil demand sat near 100 million barrels per day last year. That's why oil prices have collapsed to under $30 per barrel.

We plan to maintain our Borderline Safe rating on Shell since its gearing will remain above management's target level this year and cash flow will fall well short of the dividend.

Protecting the dividend has taken first priority, removing some short-term uncertainty for income investors, but no one knows how long this era of depressed oil prices will last.