Enterprise Remains one of the Strongest MLPs as Lower Volume and Contract Default Fears Rise

The price of oil plummeted as much as 30% last weekend as Saudi Arabia and Russia engaged in a price war that threatens to take market share from higher-cost U.S. shale producers.

We analyzed this event in a note here, but the bottom line is that we believe oil prices could now remain at historically weak levels (i.e. $35 per barrel or lower) for at least a few quarters, if not for more than a year.

Many oil producers are unprofitable at prices this low. Even the largest energy companies will likely further reduce their planned spending in this environment, painting a rather bleak outlook for the firms that do business with them.

Some analysts expect upstream capital expenditure budgets to be cut in half following the oil price shock earlier this week.

Pioneer Natural Resources (PXD) CEO Scott Sheffield even believes it's possible that about 50% of the publicly-trade shale exploration-and-production companies will go bankrupt over the next two years.

Given this backdrop, we are downgrading Enterprise Products Partners' (EPD) Dividend Safety Score from Very Safe to Safe.

The plunge in oil has a number of implications for midstream services providers. Their revenue is primarily dependent upon the fees charged for such activities and the volume of oil and gas gathered, treated, transported, or stored.

The oil price war is intended to take market share from U.S. shale producers, a core customer group for many midstream companies. As a result, the market is bracing for a decline in U.S. oil output and fearing the impact that could have on these businesses.

Enterprise generates 25% of its operating profit from crude oil pipelines, storage and marine terminals, and marketing activities. This part of its business saw throughput decline by 6% during the 2014-16 oil crash, when American oil production fell by about 12%.

As we noted in our thesis, lower volumes hurt the economics of pipelines:

We analyzed this event in a note here, but the bottom line is that we believe oil prices could now remain at historically weak levels (i.e. $35 per barrel or lower) for at least a few quarters, if not for more than a year.

Many oil producers are unprofitable at prices this low. Even the largest energy companies will likely further reduce their planned spending in this environment, painting a rather bleak outlook for the firms that do business with them.

Some analysts expect upstream capital expenditure budgets to be cut in half following the oil price shock earlier this week.

Pioneer Natural Resources (PXD) CEO Scott Sheffield even believes it's possible that about 50% of the publicly-trade shale exploration-and-production companies will go bankrupt over the next two years.

Given this backdrop, we are downgrading Enterprise Products Partners' (EPD) Dividend Safety Score from Very Safe to Safe.

The plunge in oil has a number of implications for midstream services providers. Their revenue is primarily dependent upon the fees charged for such activities and the volume of oil and gas gathered, treated, transported, or stored.

The oil price war is intended to take market share from U.S. shale producers, a core customer group for many midstream companies. As a result, the market is bracing for a decline in U.S. oil output and fearing the impact that could have on these businesses.

Enterprise generates 25% of its operating profit from crude oil pipelines, storage and marine terminals, and marketing activities. This part of its business saw throughput decline by 6% during the 2014-16 oil crash, when American oil production fell by about 12%.

As we noted in our thesis, lower volumes hurt the economics of pipelines:

"Since pipelines have fixed costs, their profitability is sensitive to the amount of fees they charge and how much product volume they are able to move. If energy production were to fall and remain depressed for a prolonged period of time, the need for pipelines could theoretically decline and dent the economics of Enterprise's growth projects."

Lower volumes can result in excess capacity, pressuring fees as Enterprise stated in its 2019 10-K:

"If either our investments or construction by competitors in the markets we serve result in excess capacity, our facilities and assets could be underutilized, which could cause us to reduce rates for our services. A reduction in rates may result in lower returns on our investments and, as a result, lower the value of our assets."

Fortunately, the gas-driven parts of Enterprise's business continued enjoying volume growth during the 2014-16 energy downturn, and the firm's customers remained in good health overall.

As a result, the firm's cash flow from operations remained between $4 billion and $4.2 billion in each of those years, and operational distributable cash flow (DCF) per unit only fell about 6% from 2014 through 2016.

Will this time be different? It's too soon to say, but Enterprise's financial health at least remains solid going into the storm.

Starting with distribution coverage, Enterprise generated $6.5 billion of operating cash flow in 2019. The company's sustaining capital expenditures total $400 million annually, leaving around $6 billion in cash flow to cover the firm's $3.9 billion distribution and growth projects.

Enterprise's guidance calls for $3 billion to $4 billion of growth spending in 2020 and another $2 billion to $3 billion in 2021. Management has said that these are mostly two-year construction projects, suggesting that the firm has flexibility to pull back on future spending levels if needed.

Regardless, let's suppose Enterprise continued ahead with its planned spending and its operating cash flow fell 20% this year to reach $5.2 billion. After sustaining capex ($400 million) and distributions ($3.9 billion), the firm would have $900 million of retained cash flow to support $3 billion to $4 billion of projects.

In other words, Enterprise would need to borrow $2 billion to $3 billion this year, and another $1 billion to $2 billion in 2021 to cover its growth capital assuming cash flow didn't improve.

The company's balance sheet could handle this possibility. If forward EBITDA estimates are slashed by 20%, Enterprise's net debt to EBITDA leverage ratio would rise to about 4.2x. Adding another $5 billion of debt to the balance sheet would raise leverage to 4.9x, about where it peaked during the 2014-16 oil crash.

If energy market fundamentals don't improve within a couple of years, it's possible to see Enterprise facing more financial stress along with the rest of the sector.

Another concern is that many shale producers will go bust during this shakeout, perhaps causing an even more significant decline in cash flow for midstream companies as contracts face defaults and excess capacity results in lower fees as other contracts roll off.

Once again, it's very difficult to assess the likelihood and magnitude of such an event at this stage. Enterprise discloses that of the revenue generated by its top 200 customers (96% of the firm's total revenue), 79% is from customers with an investment grade credit rating or backed by a letter of credit.

Less than 5% of revenue is from non-rated or sub-investment grade independent E&P's. In other words, Enterprise's cash flow doesn't appear to hinge on the solvency of any single customer, nor has the firm chased much business with more suspect operators.

From a liquidity perspective, Enterprise looks healthy as well. At the end of 2019, the firm had $4.5 billion of available borrowing capacity under its credit revolver and about $330 million of cash on hand. Debt maturities total less than $1.5 billion annually in each of the next five years as well, reducing refinancing risk.

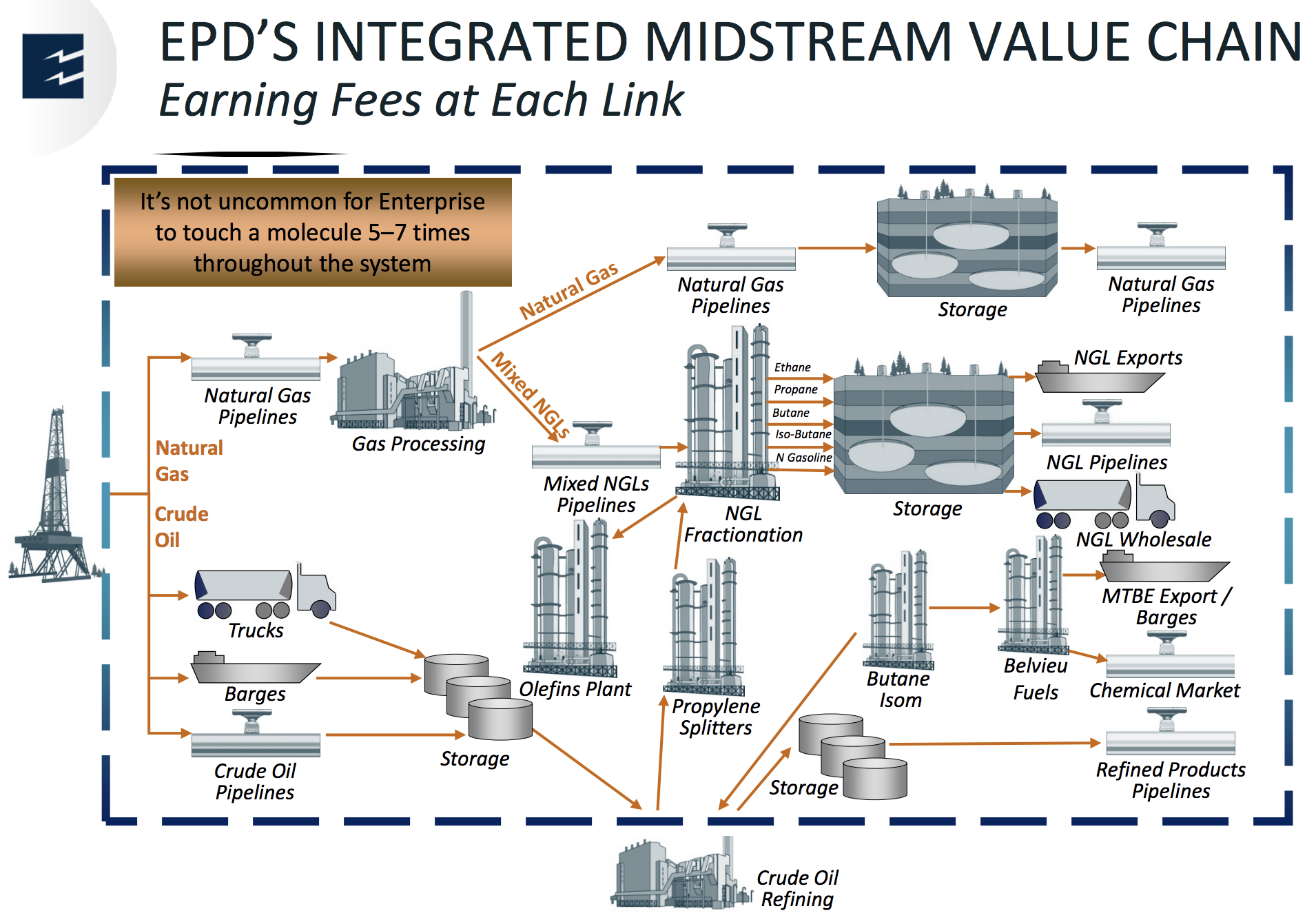

Finally, it's worth noting that Enterprise's diversified operations and scale provide it with some advantages when energy markets are weak. The firm's network of assets is connected to nearly every major U.S. shale basin and provides services across the midstream value chain.

During the last downturn in 2014-16, management explained the firm's approach:

"We are being extremely aggressive using our value chain to fill up capacity that we have available because of throughput going down. When you have a value chain, you can give guys aggressive deals in one part of the value chain and make your money in the other part. There's very few companies that have that capability, but we use the entirety of the value chain in order to get more volume through our plants...

But we are pretty aggressive in going out and grabbing incremental volumes, like I said, using the strength of our value chain, be that in natural gas processing, or gathering or crude oil. And we see that working in two ways.

Number one, you get more volume through your system. You may not make as much money as you made in the first quarter of 2014 when anybody could make money, but you're making more money than anyone else. The other thing it does for you is it puts you in a position as contracts roll off to be able to renew more contracts and get more market share."

Barring unprecedented bankruptcies in the oil patch and an extreme and sustained downturn in U.S. energy production, Enterprise appears to have the balance sheet, distribution coverage, and scale to weather most storms.

We will continue monitoring the situation and provide updates as needed.