The Fate of MPLX's Distribution Remains in Marathon's Hands

In August 2019, we published a note about MPLX (MPLX) and some of the challenges weighing on the stock, including low natural gas prices, questionable acquisition decisions, and Marathon Petroleum's (MPC) control over MPLX.

One month after our note was published, activist investor Elliott Management pressured Marathon Petroleum to split its conglomerate business up with hopes of unlocking value.

As we recently discussed here, Marathon's management team then announced plans to spin off its Speedway convenience stores and review strategic alternatives for its midstream business, which primarily consists of its 63% stake in MPLX's limited partner units and ownership of MPLX's general partner interest.

MPLX unitholders are understandably nervous about Marathon's reevaluation of its relationship with MPLX. Marathon expects to provide an update by the end of March.

In October 2019, Gary Heminger, CEO of Marathon and MPLX, explained that the review was a complicated process with no silver bullet:

One month after our note was published, activist investor Elliott Management pressured Marathon Petroleum to split its conglomerate business up with hopes of unlocking value.

As we recently discussed here, Marathon's management team then announced plans to spin off its Speedway convenience stores and review strategic alternatives for its midstream business, which primarily consists of its 63% stake in MPLX's limited partner units and ownership of MPLX's general partner interest.

MPLX unitholders are understandably nervous about Marathon's reevaluation of its relationship with MPLX. Marathon expects to provide an update by the end of March.

In October 2019, Gary Heminger, CEO of Marathon and MPLX, explained that the review was a complicated process with no silver bullet:

"We have evaluated over 25 different scenarios to optimize MPLX's structure, including asset and business divestitures that we discussed on our second quarter earnings call, as well as potential separation alternatives for MPLX, including the creation of an Up-C or conversion to a C-Corp, among other structures."

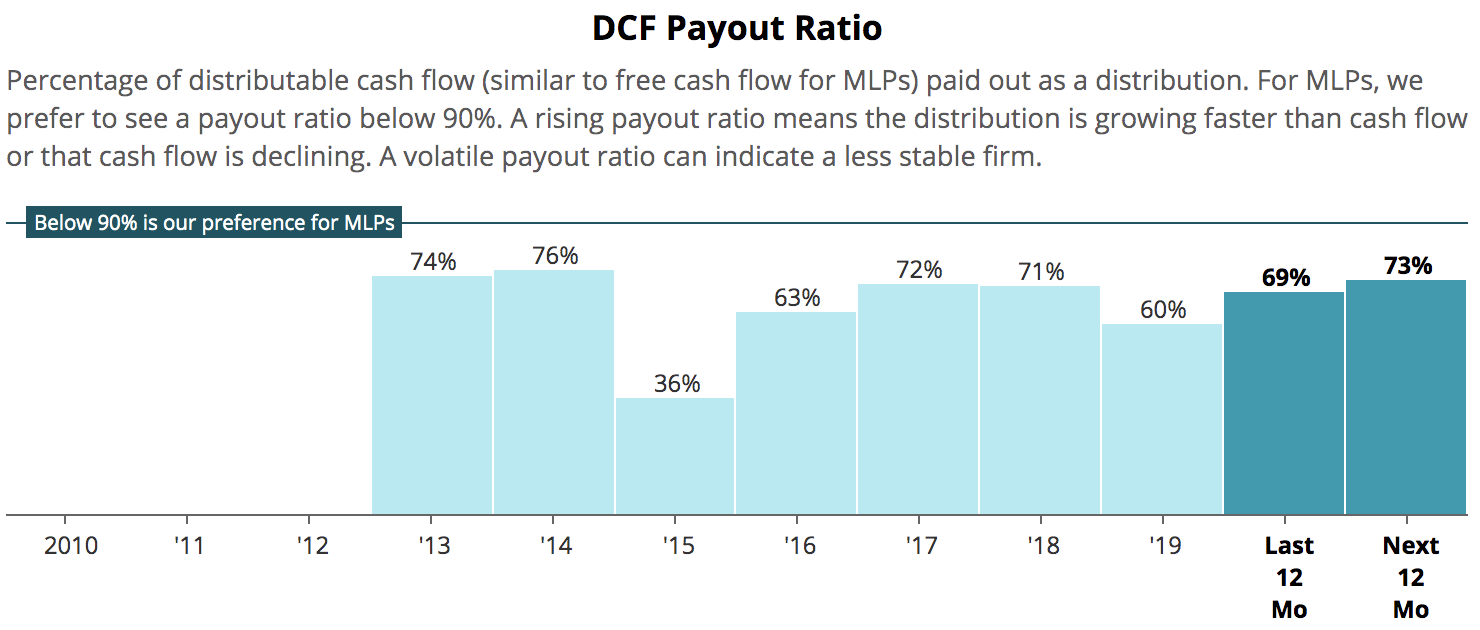

Without any interference from Marathon, MPLX's fundamentals appear supportive of its current distribution. As you can see, the firm's distributable cash flow (DCF) payout ratio sit at a reasonable level near 70%.

MPLX also maintains a reasonable leverage ratio near 4x, helping the firm earn a BBB investment-grade credit rating from Standard & Poor's. Management hopes to reduce MPLX's leverage in 2021 and beyond.

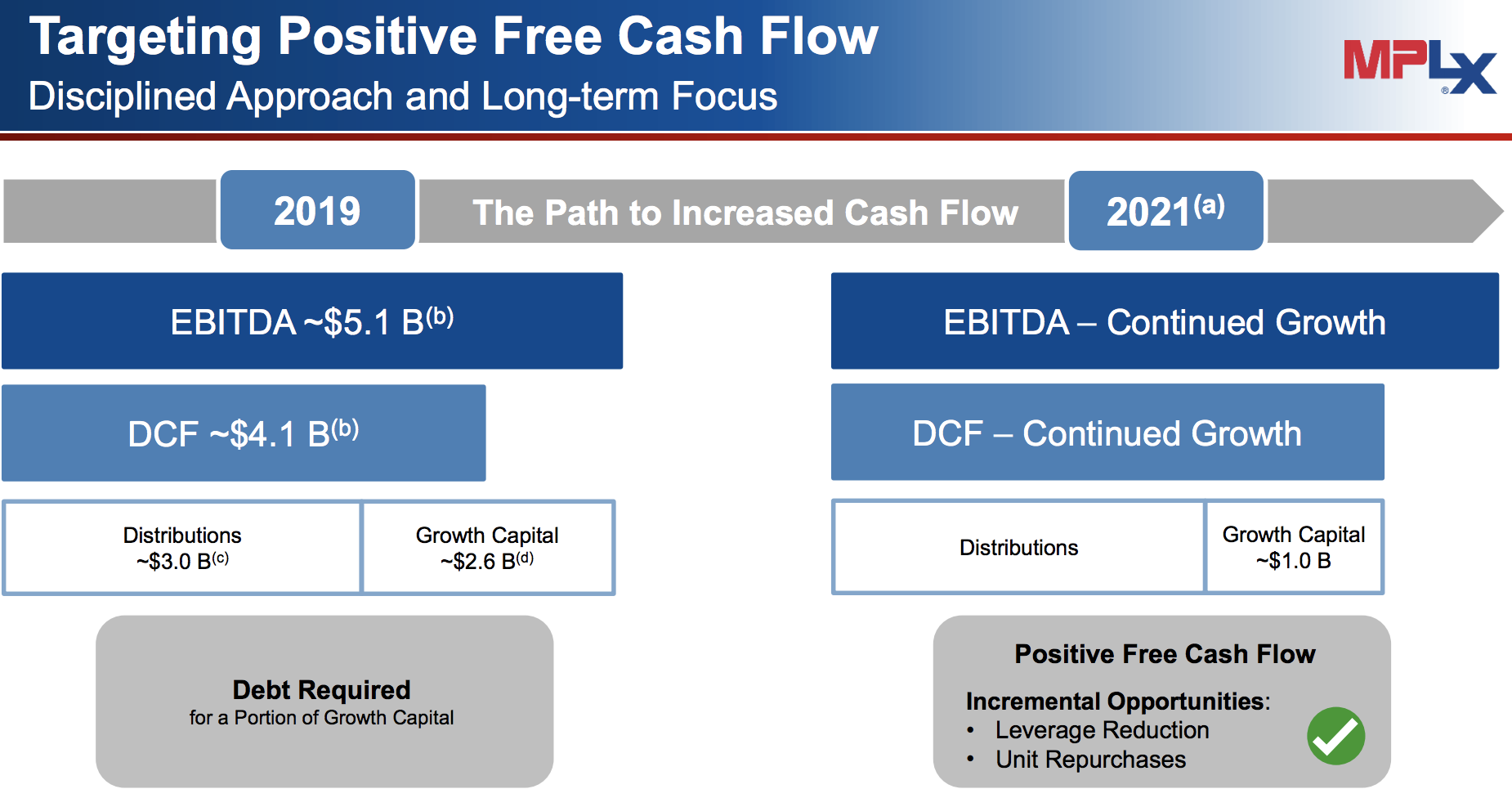

By lowering its growth spending from $2.6 billion in 2019 to $1 billion in 2021, MPLX expects its distributable cash flow (about $4 billion today) to cover all of its distributions ($3 billion) and capital expenditures without needing to issue new debt (or equity).

Excess free cash flow can be used to pay down debt, and the firm's growing earnings as projects come online (2019 adjusted EBITDA grew over 30%) will further reduce its leverage ratio if everything goes according to plan.

The problem is, no one knows Marathon's plan for MPLX. The company could work out a fair deal for MPLX unitholders, but Marathon has historically received preferential treatment.

Like other corporate sponsors, Marathon owned MPLX's general partner interest and incentive distribution rights, or IDRs, until they were eliminated in 2017. IDRs entitled Marathon to receive an increasing percentage of the cash distributed to common unitholders, creating an incentive to rapidly expand MPLX.

This presumably helped drive MPLX's decision to acquire MarkWest Energy Partners, a natural gas processor and transporter, for $15.6 billion in 2015.

Then, after Marathon acquired rival refiner Andeavor, management decided in 2018 to merge MPLX with Andeavor's MLP, Andeavor Logistics LP, to simplify its midstream business in a $14 billion deal.

MPLX has since recorded impairment charges related to both deals, acknowledging it paid too much for these assets given their performance (particularly in natural gas gathering and processing where low prices have reduced drilling activity).

Even in Elliott Management's proposal to unlock value at Marathon, MPLX's estimated "pro forma" valuation was only about 5% above its unit price at the time, while Marathon's stock price was shown as having 60% upside.

With this backdrop, it's fair to wonder how Marathon will treat MPLX unitholders this time. Management is evaluating a range of ideas, some of which could pressure the distribution.

Here are a few possibilities:

1) Acquire the rest of MPLX

The drop-down business model, in which MLPs sell new shares to buy assets from their corporate sponsors, has broken down in recent years. The 2014-16 oil crash caused a bear market in the MLP industry, making it uneconomical for many MLPs to issue new units.

Coupled with corporate tax reform reducing the relative appeal of the partnership business structure, numerous corporate sponsors have since rolled up the MLPs they created. For example, Marathon's rival refiner Valero (VLO) acquired Valero Energy Partners LP (VLP) in October 2018.

Marathon could consider buying out the remaining 37% of MPLX's units that it does not already own. With rumors suggesting that Speedway could fetch more than $20 billion in a sale, Marathon could afford such a deal.

However, in a stock-based merger (rather than an all-cash deal), stealth distribution cuts can occur for MLP unitholders as higher-yielding units are exchanged for shares with a lower payout. Unfortunately, the vast majority of MLP conversions announced have also been treated as a taxable sale for unitholders.

Along with MPLX's depressed valuation and Marathon's lack of incentive to make a generous offer, this scenario probably wouldn't be great for unitholders. However, it seems unlikely that Marathon would choose to roll up MPLX since activist investors are pushing for the company to separate and simplify its operations.

2) Convert MPLX to a corporation

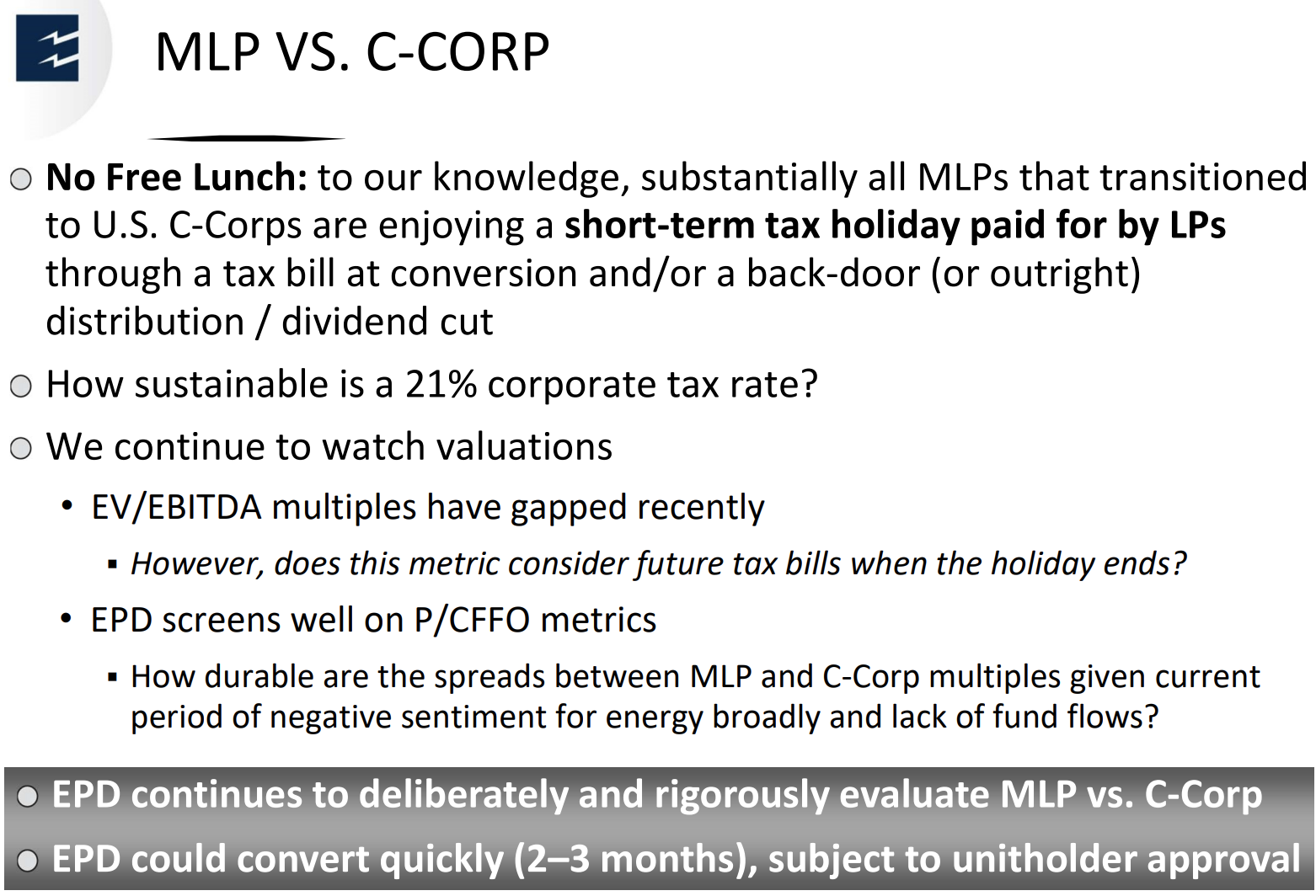

Converting MPLX from a partnership to a corporation seems more likely. A number of MLPs have already made this move, and even larger players such as Enterprise Products Partners (EPD) are considering a conversion.

This idea here is that the partnership business structure is no longer being fully rewarded by investors. C-Corp pipelines have outperformed midstream MLPs in recent years, and most ETFs can't own MLPs. Becoming a corporation has potential to increase the size of MPLX's investor base.

It's hard to say what would happen to the distribution in this case, as well as what tax implications MPLX unitholders would face. Once again, it's really up to how Marathon would structure the transaction.

Enterprise Products Partners provided a relevant slide below. As a corporation, MPLX would need to begin paying income taxes, which would potentially reduce the company's internally generated cash flow.

Thanks to tax reform enacting more generous bonus depreciation rules for capital spending, Enterprise surmised that "you can keep your income taxes negligible for quite a while just depending on what your growth rate is."

However, Enterprise also noted that that most MLPs that have transitioned to C-Corps have either opted to step up the value of their assets at the time of conversion, triggering a tax liability for unitholders, or reduced their distributions, likely to fund more growth capital.

Otherwise, when a pass-through entity converts to a C-Corp (rather than being bought out by a C-Corp), negative capital accounts are the main issue that can trigger a potential gain for unitholders upon conversion. You can check your K-1 to see the last balance of your capital account, and it's unlikely to be negative.

MPLX's distribution would likely still be covered by the firm's distributable cash flow if the firm began paying corporate income taxes. However, less money would be leftover to fund growth projects, perhaps stopping MPLX short of its "positive free cash flow" goal in 2021.

Depending on management's confidence in future cash flow growth, MPLX could lean more on debt capital until its earnings increased. Reducing the distribution would provide greater flexibility, though.

3) Spin off MPLX stake

Whether or not MPLX converts to a partnership, Marathon could look to spin off its MPLX stake into a new entity, distributing shares to existing investors in a tax-free transaction.

Marathon is currently required to consolidate MPLX's financial statements in its results, making the firm's leverage and capital intensity appear even higher. Spinning out MPLX would simplify Marathon's financial reporting and business complexity for investors. This is what Elliott Management has pushed the company to do.

Like converting to a corporation, a spin-out of MPLX has potential to broaden the potential investor base and eliminate the overhang of a controlling corporate sponsor.

It's difficult to say what would happen to MPLX's distribution in this case. As a standalone business with independent management, MPLX could decide it wants to pursue more growth opportunities that have opened up. Its payout ratio and balance sheet provide some capacity, but would it be enough to satisfy management's new capital allocation plans?

4) More drop-downs or MPLX divestitures

Management has suggested that Marathon has several more assets it would like to drop down to MPLX. Elliott Management estimated the value of these assets at about $1.2 billion in its presentation.

For context, that would represent all of the retained distributable cash flow MPLX generates in a year, before accounting for its growth capital expenditures ($1.5 billion in 2020, $1 billion in 2021).

In other words, MPLX would presumably need to take on incremental debt to fund additional drop-downs. Depending on the price and how much cash flow these assets are generating, that could put pressure on MPLX's leverage ratio, which is already at the high end of management's preferred level.

Asset sales could go the other way, too. One concern investors have about an independent Marathon is that its refining-driven earnings stream will be too volatile after shedding Speedway's retail operations. Marathon could decide it wants to keep some of the logistics assets it previously dropped to MPLX.

If MPLX transferred certain assets back to Marathon, then its distributable cash flow per share could potentially decline, reducing its distribution coverage ratio.

The firm's earnings mix would become even more heavily weighted towards natural gas processing and gathering activities as well, which have weaker contracts and less certain growth prospects. In other words, the remaining MPLX would not deserve a very compelling valuation.

Overall, MPLX's adequate financial health is offset by Marathon's continued control over the firm, supporting the stock's low Borderline Safe Dividend Safety Score.

Some outcomes from Marathon's strategic review could improve MPLX's long-term outlook (independent management team, broader investor base) while maintaining its distribution.

However, there are also paths that could presumably lead to a distribution cut (perhaps 25% to 50%) or trigger a taxable event for unitholders. Conservative income investors should probably avoid MPLX, at least until Marathon provides an update on its strategic review.