Oxy's Dividend Safety Score Downgraded to Borderline Safe on Unexpected Capex Reduction

Occidental Petroleum (OXY) reported earnings on November 4, and beleaguered CEO Vicki Hollub kept trying to say all the right things:

- Oxy's investments will generate 10+% returns at $40 per barrel oil

- Anadarko cost synergies are on track

- Protecting Oxy's dividend is still the top priority

- The firm's $10 billion to $15 billion divestiture goal will be reached soon

- Oxy set numerous new production records

Management even used the word "excited" nine times on Oxy's conference call, but investors have been much less enthusiastic, sending Oxy's stock falling about 10% over the last two days. (For the sake of comparison, Exxon and Chevron combined to state they were "excited" just once on their latest earnings calls.)

If everything was going as well as Ms. Hollub suggested, then you wouldn't expect management to cut their capital spending further to preserve cash. But that's exactly what Oxy announced, reducing its 2020 capex guidance by nearly 20%.

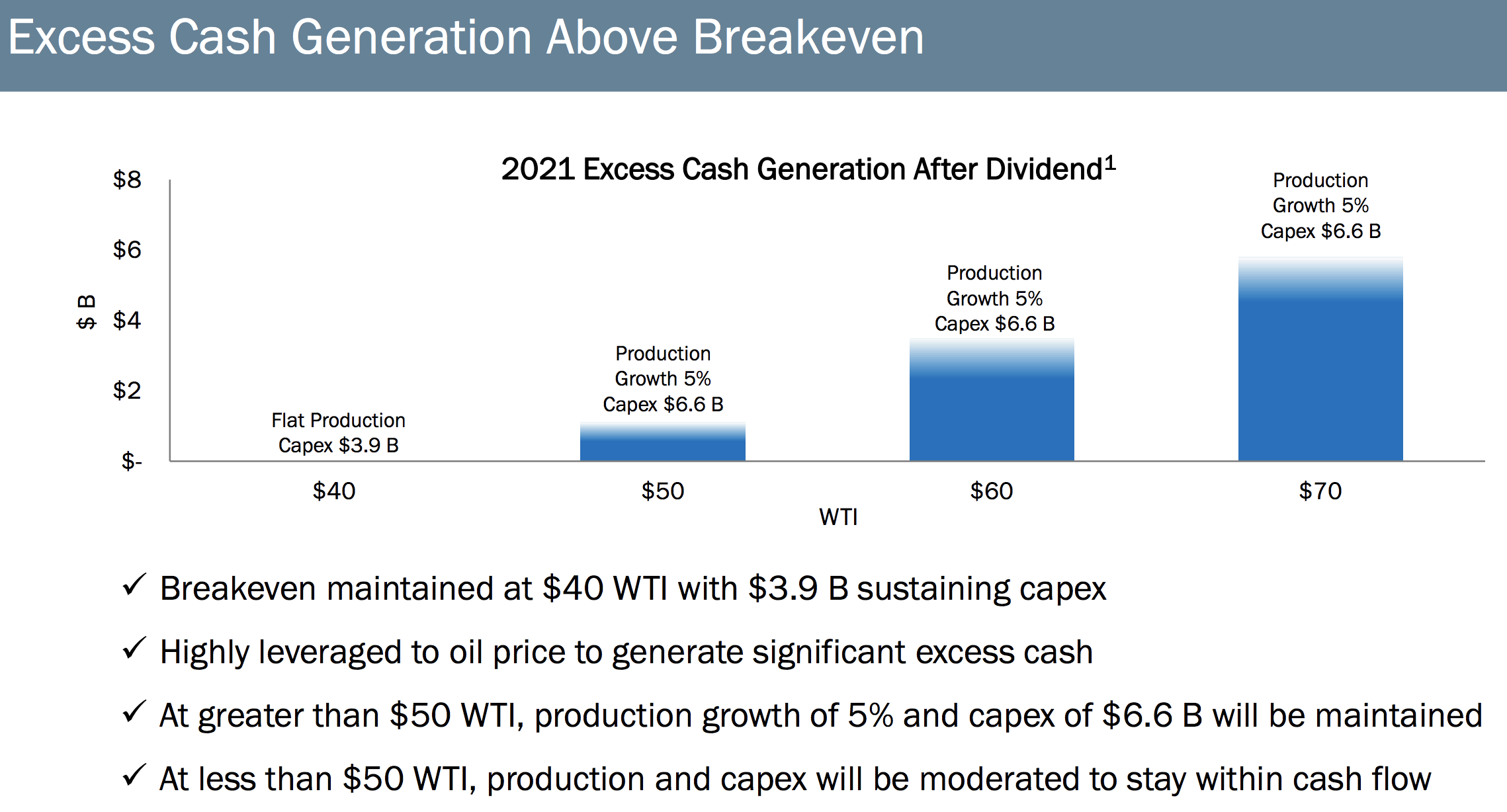

Oxy is now budgeting 2020 capex between $5.3 billion and $5.5 billion, down from initial plans of $6.6 billion (see below). Making matters worse, the price of oil remains above $50 per barrel, which is what management's prior guidance had anticipated.

Production growth in 2020 is now expected to be just 2% compared to earlier projections of 5%, which management still hopes to attain in 2021 and beyond with a $6.6 billion annual capex budget, depending on oil prices.

An unexpected spending cut suggests that Oxy sees a need to take debt reduction even more seriously for some reason. Receiving full value for its asset divestitures could be proving difficult, for example.

Or perhaps the growth opportunities management anticipated when buying Anadarko aren't as great as the team thought. After all, Oxy expects its Permian shale output growth to slow to just 5% in 2020.

Either way, this is a disappointing development. Oxy's near-term risk of a dividend cut still seems quite low given the firm's strong liquidity (no 2020 debt maturities; over $5 billion of cash on hand; supportive oil price environment).

Lower capital spending next year also boosts Oxy's free cash flow in the short term, but the dividend's outlook beyond 2020 has become fuzzier.

As we discussed in September, Oxy's then Safe Dividend Safety Score was fragile. Following the company's spending guidance cut this week, which suggests parts of management's plan may not be meeting internal expectations, we are downgrading the firm's Dividend Safety Score to Borderline Safe.

From a financial perspective, here are Oxy's major cash drains in 2020:

- Common stock dividends: $2.8 billion

- Preferred stock dividends: $0.8 billion

- 2020 capital expenditures: $5.4 billion

Basically, before Oxy can pay down its $40-plus billion in debt, it has about $9 billion of obligations to meet, assuming the firm intends to prioritize its current dividend as management has strongly expressed.

In the year ahead analysts expect the combined company to generate about $12.5 billion in EBITDA, a proxy for cash flow.

Therefore, assuming stable oil and gas prices, Oxy's cash flow should comfortably cover its dividend and capex needs next year, with perhaps $2 billion to $3 billion in excess free cash flow that can be used for debt reduction.

The bad news is that Oxy's pile of debt is so large that it would take many years to return the business to a safer leverage ratio at that pace.

At Oxy's current EBITDA run rate, for example, the company would need to pay down more than $20 billion of debt just to return to a leverage ratio of 2.0 (we prefer leverage to sit below 1.5 for oil producers). That's why management is aggressively divesting "non-core" assets to raise cash for deleveraging.

Oxy's excess cash flow could quickly evaporate during this multiyear deleveraging period if the price of oil drops. The company disclosed in its earnings presentation that its annualized cash flow changes by $260 million for every $1 per barrel change in oil prices.

If oil fell from its current level near $56 per barrel to $46, then Oxy's cash flow would be expected to decline $2.6 billion. That would wipe out all excess free cash flow the firm would have for deleveraging.

Oxy believes it can reduce capital spending to "sustaining levels" within six months if necessary, suggesting that additional capex cuts (about $1.5 billion to $2 billion) could help preserve some cash flow for deleveraging if oil prices slump. However, divesting energy assets at reasonable prices would still be difficult.

Until Oxy's debt load is at more manageable levels, it's hard to say how committed to the dividend management would be in such an environment.

Ultimately, an investment in Oxy is a leveraged bet on the price of oil. If oil rallies higher and supports the firm's deleveraging and production growth goals, it wouldn't be surprising to see the stock double and its dividend continue growing.

However, if the price of oil falls meaningfully within the next year or two and the company's unexpected capex reduction is a sign that not everything is going as planned (asset sales, synergies, shale growth opportunities), then Oxy's dividend could find itself on the chopping block to free up cash for faster deleveraging.

Oxy's long-term dividend track record is impressive, but the company is swimming in uncharted waters with an acquisition this large. Conservative investors may want to watch from the sidelines until management has made more progress paying down debt with asset sales and achieving expected synergies, improving Oxy's ability to handle periods of commodity price weakness as it has historically.