Meredith's Dividend Safety Score Downgraded to Borderline Safe due to Time Acquisition Challenges

On September 5, Meredith (MDP) issued weak guidance for the year ahead. The company's leverage profile and payout ratio will now remain elevated for longer than we expected, and execution risk has also increased.

As a result, we downgraded Meredith's Dividend Safety Score from Safe to Borderline Safe. Meredith's dividend still seems unlikely to be cut for now and the stock's sharp sell-off feels like a bit of an overreaction, but the company's margin for error has shrunk.

Let's take a closer look at Meredith's outlook and dividend profile.

In January 2018, Meredith bought Time Inc. for $3.2 billion, closing the biggest acquisition in the company’s history.

To understand just how significant this acquisition was, consider that Meredith's current market cap sits near $1.5 billion. Meredith's pre-Time adjusted EBITDA also totaled just $362 million. Buying Time represented a transformational change for the business.

Time was a multi-platform media company with well-known magazine brands such as People, InStyle, Real Simple, Southern Living, and Travel + Leisure. However, the company was far from a prized asset.

When Meredith bought the business, Time's print advertising revenue was falling more than 20% year-over-year. Management saw opportunity to improve the performance of Time's print and digital assets.

But Meredith was most excited about the potential to generate $400 million to $500 million in annual cost synergies within two years of closing the deal by reducing public company and duplicative expenses, consolidating real estate and vendor contracts, and squeezing out efficiencies across circulation, fulfillment, and other shared activities.

As of August 2018, management believed Meredith could achieve $1 billion in adjusted EBITDA in fiscal 2020 (July 2019 - June 2020). In February 2019, management remarked that "as we look out, we believe that we're going to hit that $1 billion goal, no matter what, worst case by fiscal 2021."

As a result, we downgraded Meredith's Dividend Safety Score from Safe to Borderline Safe. Meredith's dividend still seems unlikely to be cut for now and the stock's sharp sell-off feels like a bit of an overreaction, but the company's margin for error has shrunk.

Let's take a closer look at Meredith's outlook and dividend profile.

In January 2018, Meredith bought Time Inc. for $3.2 billion, closing the biggest acquisition in the company’s history.

To understand just how significant this acquisition was, consider that Meredith's current market cap sits near $1.5 billion. Meredith's pre-Time adjusted EBITDA also totaled just $362 million. Buying Time represented a transformational change for the business.

Time was a multi-platform media company with well-known magazine brands such as People, InStyle, Real Simple, Southern Living, and Travel + Leisure. However, the company was far from a prized asset.

When Meredith bought the business, Time's print advertising revenue was falling more than 20% year-over-year. Management saw opportunity to improve the performance of Time's print and digital assets.

But Meredith was most excited about the potential to generate $400 million to $500 million in annual cost synergies within two years of closing the deal by reducing public company and duplicative expenses, consolidating real estate and vendor contracts, and squeezing out efficiencies across circulation, fulfillment, and other shared activities.

As of August 2018, management believed Meredith could achieve $1 billion in adjusted EBITDA in fiscal 2020 (July 2019 - June 2020). In February 2019, management remarked that "as we look out, we believe that we're going to hit that $1 billion goal, no matter what, worst case by fiscal 2021."

Yesterday, Meredith's fiscal 2020 guidance seemed to put that goal out of reach for the foreseeable future. The company's guidance called for just $640 million to $675 million in adjusted EBITDA in the year ahead.

Not only is that well below management's initial aspirations, but it also represents a 4% to 9% decline compared to fiscal 2019's adjusted EBITDA of $706 million.

Analysts had expected Meredith's fiscal 2020 EBITDA to grow about 8% to reach $760 million, so management's guidance also missed their mark significantly.

Meredith's CEO Tom Harty placed the blame squarely on Time:

"The patient was a little sicker than we expected when we acquired it."

Time's performance deviated from management's expectations in several ways.

First, the firm's print ad revenue fell more than 20% during 2018 (the first year Meredith owned the business), resulting in a couple hundred million dollars of revenue losses. Meanwhile, Time's digital revenue was about flat in 2018, while management had anticipated growth.

Management also encountered far more low-margin magazine subscriptions inside the legacy Time brands than the company expected. Time had used aggressive pricing actions to stabilize its circulation, so Meredith needs to work on acquiring more profitable subscriptions.

These three factors (weak print performance, digital not growing, low-margin subscriptions) accounted for over $350 million of EBITDA decline from management's original acquisition plan calling for $1 billion in EBITDA.

As a result, investors lost confidence in management's capital allocation skill, and the massive size of this acquisition has strained the company's financial health.

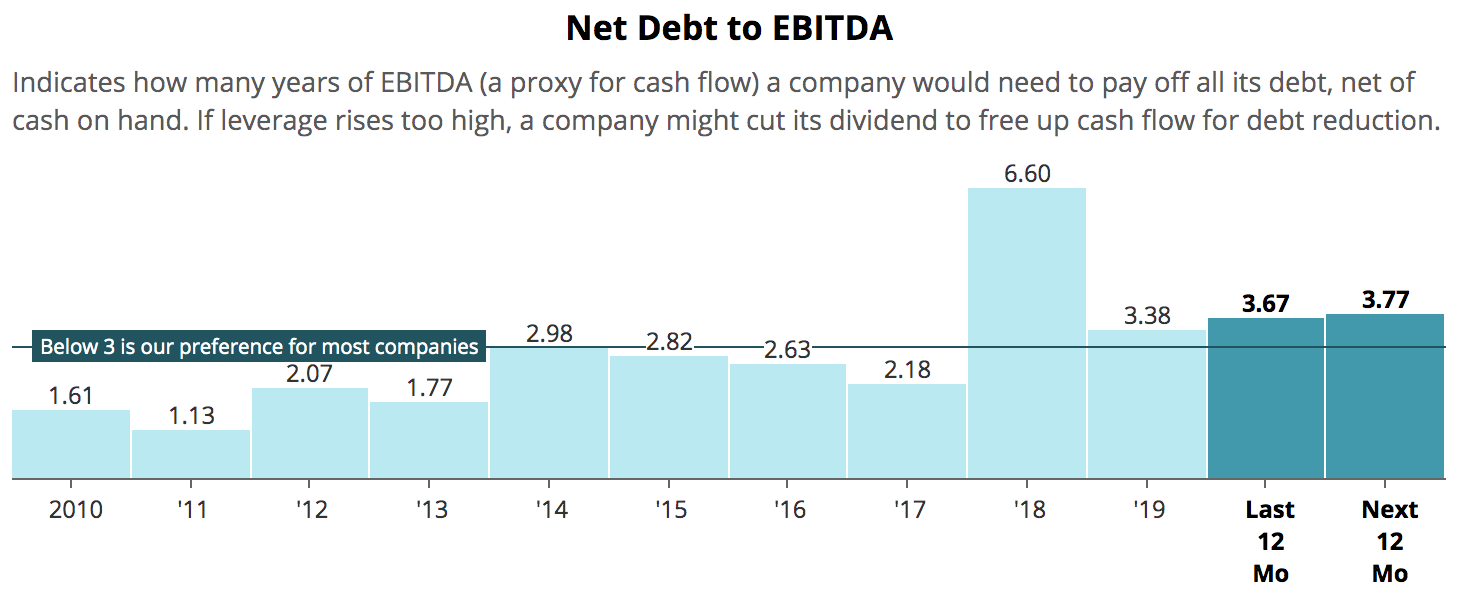

Meredith's total book debt rose from about $700 million to more than $3 billion to acquire Time, sending its leverage ratio above its long-term norm. Management has prioritized deleveraging, selling off non-core Time assets and directing excess cash flow toward debt reduction (book debt is down to $2.3 billion today).

However, Meredith's leverage ratio remains well above the 2.0 level management has said it would like run the business around. With fiscal 2020 adjusted EBITDA now expected to decline, Meredith's leverage profile will remain elevated.

By management's measurement, which appears to exclude operating lease debt, Meredith's leverage stood at 3.3 as of June 30, 2019. The company hopes to pay down another $150 million to $175 million of debt in fiscal 2020, implying leverage will finish next year between 3.1 and 3.3.

To get the business back to 2.0 times leverage, Meredith would need to either reduce debt by $1 billion (about 40% of its total debt) or increase its adjusted EBITDA by about $500 million (representing an 80% increase).

Unfortunately, Meredith's reduced profit outlook leaves little retained cash flow for debt reduction. The company generated about $200 million in free cash in fiscal 2019. Management's guidance calls for adjusted EBITDA to decline by $35 million to $65 million next year.

Therefore, while there are some other moving parts to consider (e.g. working capital fluctuations), it seems conservative to ballpark Meredith's fiscal 2020 free cash flow between $140 million and $170 million.

Meredith's common stock dividend consumes $100 million annually, but it's also on the hook for around $60 million in preferred dividends related to the preferred stock it issued to help finance its acquisition of Time.

In other words, it seems likely that most of the company's free cash flow will go toward dividends next year, making deleveraging via internally generated cash flow harder to accomplish. (Meredith still holds some non-core assets it will sell, using the proceeds for debt reduction.)

But it would probably take another step down in the company's earning power to put the dividend on the rocks. Not only has Meredith paid uninterrupted dividends for more than 70 years, a streak it would like to maintain, but the majority of the company's voting power is held by Meredith's founding family.

They want their dividends to continue rolling in, and if management believes fiscal 2020 marks the low point for the firm's cash flow generation, then it's hard to see the payout getting axed.

In its May 2019 quarterly filing with the SEC, the latest available, Meredith also issued this supportive statement (emphasis added):

"We expect cash on hand, internally generated cash flow, and available credit from financing agreements will provide adequate funds for operating and recurring cash needs (e.g., working capital, capital expenditures, debt repayments, and cash dividends) into the foreseeable future."

With that said, Meredith needs to prove it's not a melting ice cube. Returning to cash flow growth is critical, and the company is showing some signs of progress.

On the Time integration front, through the end of fiscal 2019 Meredith realized $430 million of cost synergies and sees a "clear path" to $565 million in its first full two years of operating the combined business. That's better than the initial target management had in mind when the deal closed.

More importantly, Meredith appears to be finally stabilizing Time's ad business. It took the company much longer to turn around performance with the legacy Time brands, forcing Meredith to begin fiscal 2020 at a much lower profit point than originally expected.

Print advertising at Time's legacy titles were declining more than 20% when Meredith acquired them, but they delivered low single-digit growth last quarter. Time's portfolio is finally performing similar to the Meredith portfolio.

In fiscal 2020, Meredith expects comparable print ad revenue for the combined portfolio to be down in the mid-single digits, consistent with the firm's historical performance over the last eight years. Digital ad revenues are expected to be up in the mid-single digit range, providing overall stability.

This would be welcome news, though it remains to be seen how much of Time's lost advertising business Meredith can recover going forward in an increasingly competitive digital world.

The company also faces challenges improving the profitability of Time's legacy subscriptions by upping their prices at renewal or acquiring new higher-margin customers. Management expects consumer-related revenues to decline next year due largely to the loss of lower-margin Time subscribers.

Overall, Meredith appears to have significantly overpaid for Time's assets, which performed much worse out of the gate than management expected. As a result, Meredith's near-term earning power has been materially reduced, management has lost credibility, and Meredith's debt load looks even more daunting, causing investors to hammer the company's valuation.

Meredith appears to have stabilized the ad revenue performance of Time's brands for now. However, management's weak cash flow guidance for next year means Meredith's leverage profile and payout ratio will run uncomfortably high, resulting in a Borderline Safe Dividend Safety Score until these trends reverse.

There is more to Meredith's business than print advertising (22% of revenue), digital ads (12%), and magazine and book subscriptions (22%), but the stock will likely remain a show-me story for the foreseeable future as the media industry continues its fast pace of change.

Conservative investors may want to stay on the sidelines until management has had more time to improve the performance of Time, deleverage the balance sheet, and demonstrate that Meredith can profitably grow its digital media assets to more than offset the headwinds pressuring traditional print magazines.

If I held shares of Meredith, I'd probably give management a little more time to demonstrate whether or not they can right the ship. We will continue monitoring Meredith's situation, and I recommend investors interested in the stock review our full overview of Meredith here.