Why Kraft Heinz Remains a Speculative Dividend Stock

Kraft Heinz (KHC) shares plunged 9% yesterday after the packaged food maker reported weak first-half earnings results. Organic sales declined 1.5%, adjusted EPS fell 24%, and management pulled 2019 guidance.

We previously reviewed the challenges Kraft Heinz's business is facing. Underinvestment in product development and marketing, fading brands, and too much debt are some of the key issues. For more information, please see our past notes here:

We previously reviewed the challenges Kraft Heinz's business is facing. Underinvestment in product development and marketing, fading brands, and too much debt are some of the key issues. For more information, please see our past notes here:

- Kraft Heinz's Turnaround Struggles Come to a Head (February 2019)

- A Review of Kraft Heinz's Struggling Turnaround (November 2018)

As investors may recall, in February 2019 Kraft Heinz took a $15 billion impairment charge to write down the value of its Kraft natural cheese and Oscar Mayer cold cuts, two of its larger businesses. Management also chopped the dividend by 36% to accelerate deleveraging.

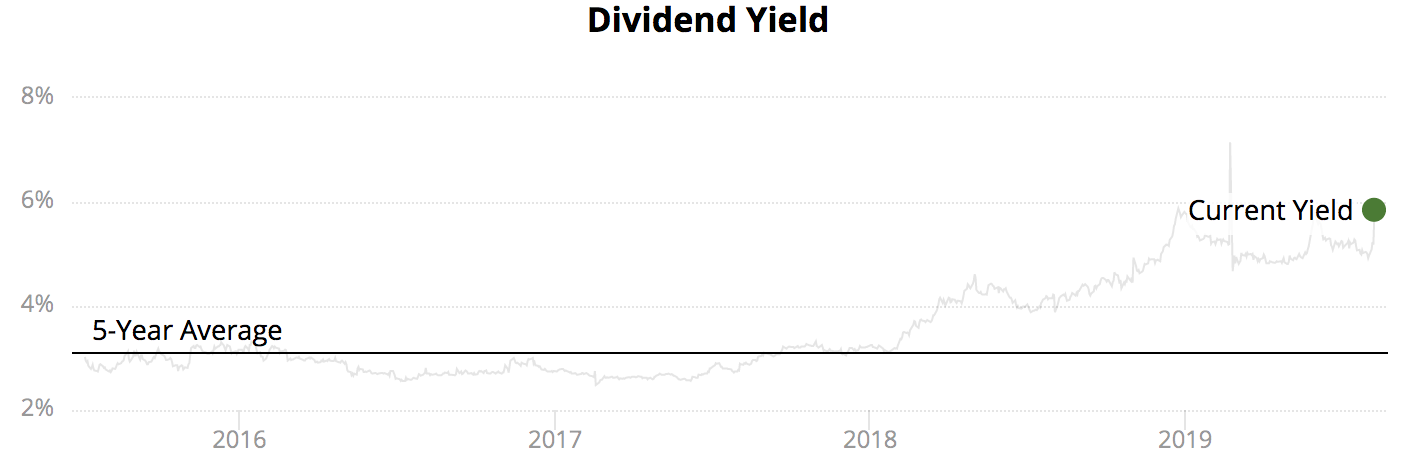

Even with a smaller payout, Kraft Heinz's continued struggles have sent its dividend yield to about 6%, causing some income investors to wonder if another cut could be around the corner.

Unless the company's performance improves over the next year, a second dividend cut could be in the cards.

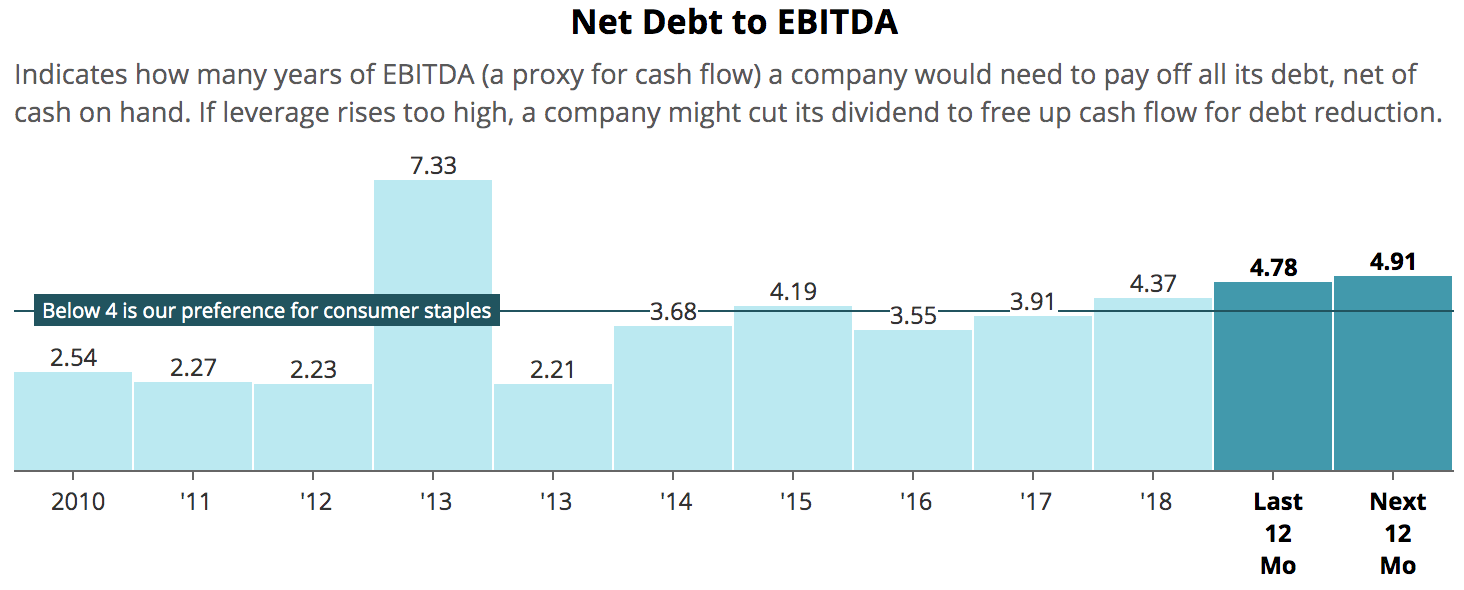

The main reason is leverage. On its latest earnings call, Kraft Heinz emphasized its strong commitment to maintaining an investment grade rating.

"We absolutely remain committed to our investment grade credit rating."

– CEO Miguel Patricio

"We are committed to our investment grade rating." – CFO David Knopf

In June 2019, Standard & Poor's downgraded the company's credit rating to BBB-, its lowest investment grade rating. At the time, Standard & Poor's expected Kraft Heinz's leverage to improve to below 4x within the next 18 to 24 months.

The rating agency's base-case forecast did not anticipate a "substantial drop" in the company's rebased EBITDA, which, "in conjunction with the $1.1 billion annual dividend cut, should enable Kraft Heinz to repay debt and strengthen credit metrics."

Standard & Poor's said it could lower Kraft Heinz's rating to junk status if its profitability weakened and its leverage remained above 4x:

"Although not expected over the next two years, we could lower the rating if profitability weakens significantly due to increased competition or a renewed shift in consumer demand away from the company's products to on-trend brands or private label offerings. Profits could also fall due to an inability to manage input cost volatility, including labor, commodities, and freight and energy expenses. We could also lower the rating if we anticipate the company will sustain adjusted leverage above 4x..."

The company's latest earnings report didn't inspire much confidence in Kraft Heinz's ability to deleverage as quickly as Standard & Poor's would like to see.

Kraft Heinz previously guided for 2019 EBITDA between $6.3 billion and $6.5 billion. Through the first half of the year adjusted EBITDA totaled $3 billion, putting the company on pace to achieve only $6 billion in 2019 unless trends improve significantly in the second half.

Combined with management's decision to pull their 2019 guidance, it seems likely that Kraft Heinz's leverage this year will remain elevated and well above the 4x threshold S&P eventually wants to see met.

Management remains committed to Kraft Heinz's current dividend for now, citing the firm's solid free cash flow generation:

"We are committed to our investment grade rating and we firmly believe that our business today generates sufficient free cash flow to support both delevering organically over time as we've committed as well as to support the current dividend payout that we have. On top of that we have taken actions as you know earlier this year to accelerate the delevering by reducing our dividend and successfully divesting India beverages and Canada cheese businesses..." – CFO David Knopf

However, there is plenty of uncertainty beyond the next couple of quarters that could cause the firm's stance to change. Management decided to remove their 2019 EBITDA guidance in part because they didn't want to set public short-term profit targets while they worked on long-term strategic priorities.

Kraft Heinz hired Miguel Patricio to serve as its new CEO in April 2019. Mr. Patricio worked for two decades at Anheuser-Busch InBev, another 3G Capital business (and one that also cut its dividend in the last year to accelerate deleveraging).

He most recently served as AB InBev's Global Chief Marketing Officer from 2012 to 2018. Similar to Kraft Heinz, the beer maker has struggled with volume growth in the U.S. Mr. Patricio has experience navigating turnaround situations, and his background focusing on growth seems like a fit for Kraft Heinz's needs.

Mr. Patricio is developing what he said is "a new strategic agenda for the next three to five years." To learn about the business faster, he decided to take on Kraft Heinz's U.S. President role on an interim basis. America represents 70% of the company, so he hopes this will help him understand the firm's consumers and customers quickly.

Management will share more of its approach to the strategic agenda over the coming quarters and expects to complete its work by the end of the year. In early 2020 Kraft Heinz plans to share its conclusions with investors.

As we said in our February 2019 note, "it's not an easy task to turnaround a business this large." Most turnarounds have a low success rate, and many of Kraft Heinz's brands remain in the crosshairs of changing consumer trends and rising private label competition.

In fact, in the company's annual report filed in June 2019 management called out nearly a dozen major brands with an elevated risk of having their values written down if their outlooks don't improve:

"Brands with a heightened risk of future impairments had an aggregate carrying amount of $29.3 billion at December 29, 2018 and included: Kraft, Philadelphia, Oscar Mayer, Velveeta, Miracle Whip, Planters, A1, Cool Whip, Stove Top, ABC, and Quero." – Kraft Heinz 10-K

For context, $29.3 billion represents nearly 30% of Kraft Heinz's total assets, so these brands represent a major component of the company's net worth. With organic sales and adjusted profits falling, Mr. Patricio will be pressed for time to identify and correct problems hampering the company's growth. Some of these brands appear to be in secular decline and unlikely to reverse course.

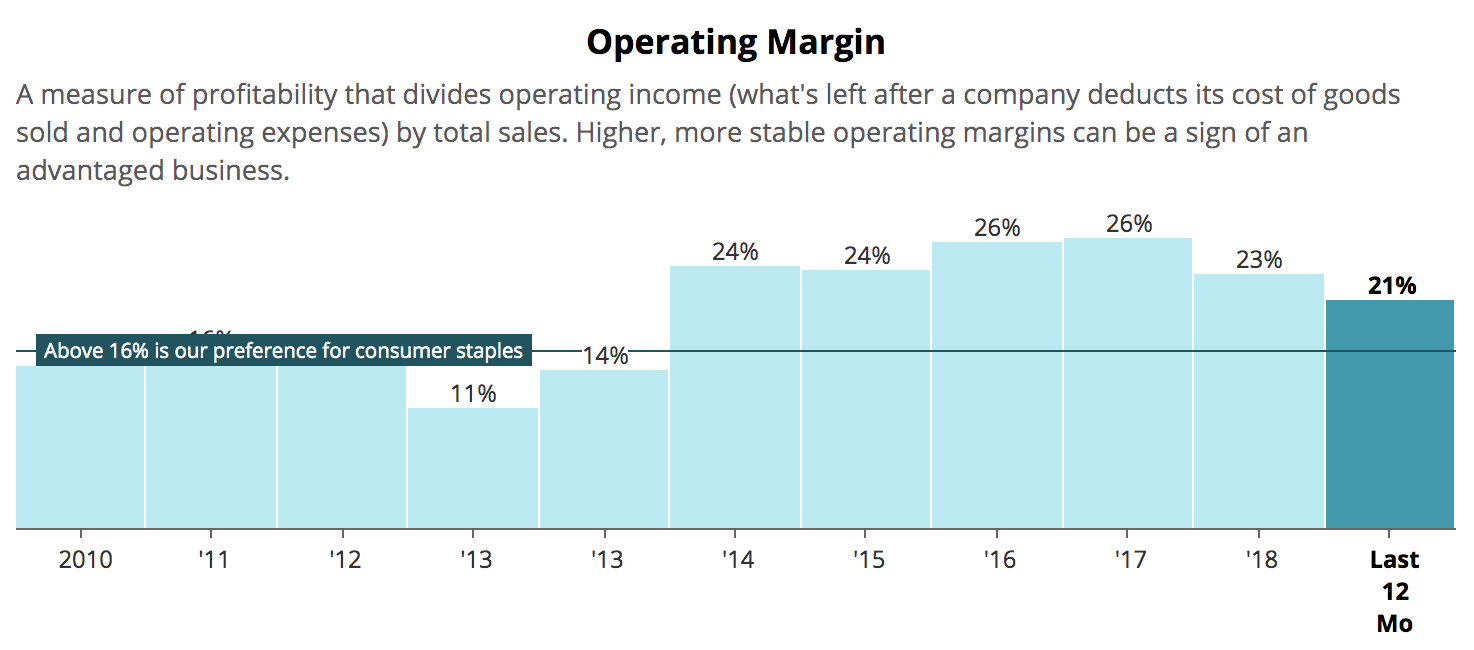

Meanwhile, investors are left wondering what a sustainable margin looks like for this business. Kraft Heinz's operating margin has already fallen 500 basis points since fiscal 2017 due to cost inflation, higher fixed costs to support growth, and lagging price increases.

However, a 21% margin still towers above the profitability of General Mills (18%), Kellogg (13%), Conagra Brands (17%), and the rest of Kraft Heinz's peer group. To make its products more competitive and relevant with consumers, the firm will likely need to step up its level of strategic investments.

Unless management finds other areas of the business where it can squeeze out further efficiencies, higher spending could weigh on Kraft Heinz's profitability and EBITDA, once again putting pressure on its leverage profile and credit rating.

Looking at the second half of 2019, management expects "to see an improvement in year-over-year top and bottom-line growth rate versus what we saw in the first half." However, the company also sees risk from further reductions in retailer inventory levels and accelerating commodity costs it had not anticipated at the start of the year.

Retailer inventory reductions suggest Kraft Heinz is losing shelf space to private label products and more relevant offerings from its rivals. Meanwhile, calling out commodity inflation indicates that management is not confident in the firm's ability to implement large enough price increases to protect its profitability.

Combined with management's decision to pull guidance, these are signs that Kraft Heinz's turnaround may have yet to find a bottom and will take time with no guarantee of long-term success. Due to its high leverage and declining profitability, Kraft Heinz needs to improve its performance in the next year to protect its credit rating.

Otherwise, another 30% to 50% dividend cut seems possible. Yesterday Standard & Poor's acknowledged that Kraft Heinz's EBITDA missed its estimates and also raised the possibility of a dividend cut if business trends don't strengthen.

For these reasons, Kraft Heinz remains a speculative dividend stock that conservative income investors should probably avoid. While expectations continue to appear low due to increased uncertainty about the firm's long-term outlook, Kraft Heinz faces a wide range of potential outcomes.

Changing the momentum of a business this large won't be easy. As we've said in past notes, our preference would be to move on to companies with safer, faster-growing dividends and clearer paths to profitable growth.

Changing the momentum of a business this large won't be easy. As we've said in past notes, our preference would be to move on to companies with safer, faster-growing dividends and clearer paths to profitable growth.