Iron Mountain's Slump Reflects Company's Low Margin for Error

Shares of Iron Mountain (IRM) are down more than 7% today following a downgrade from Bank of America Merrill Lynch analyst Michael Funk.

Citing a sharp slump in the price of recycled paper, Funk believes that Iron Mountain will be forced to reduce its 2019 guidance, which calls for 2-2.5% organic sales growth and EBITDA growth of about 3-4%.

The REIT next reports results on August 1, so it will be a few weeks until we have a formal update from management. However, the market is clearly anxious about this risk.

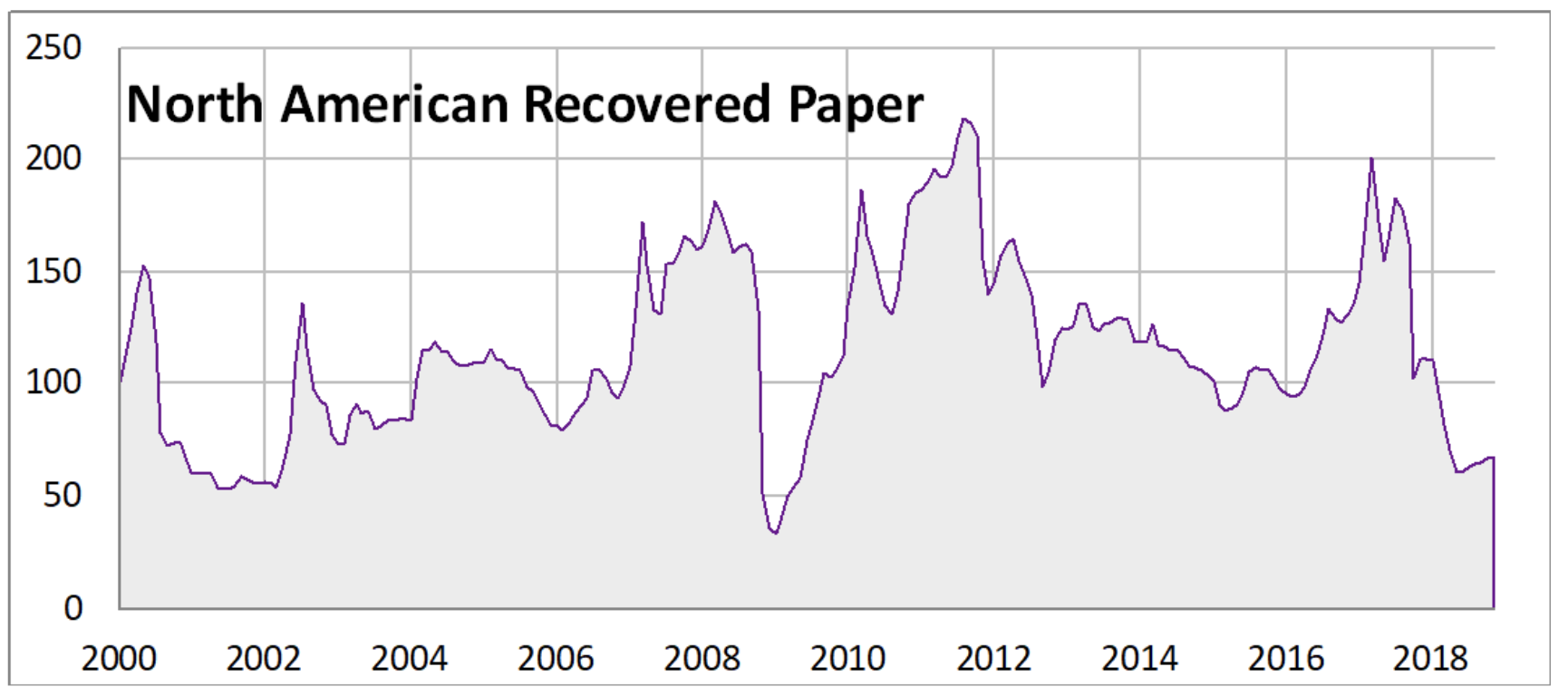

Part of Iron Mountain's business is sensitive to the price of paper since it generates some revenue from selling shredded paper to recyclers. The company warned about this risk factor in its 2018 annual report:

Citing a sharp slump in the price of recycled paper, Funk believes that Iron Mountain will be forced to reduce its 2019 guidance, which calls for 2-2.5% organic sales growth and EBITDA growth of about 3-4%.

The REIT next reports results on August 1, so it will be a few weeks until we have a formal update from management. However, the market is clearly anxious about this risk.

Part of Iron Mountain's business is sensitive to the price of paper since it generates some revenue from selling shredded paper to recyclers. The company warned about this risk factor in its 2018 annual report:

"In particular, our secure shredding operations generate revenue from the sale of shredded paper to recyclers. As a result, significant declines in the cost of paper may negatively impact our revenues and results of operations, and increases in other commodity prices, including steel, may negatively impact our results of operations."

Securing shedding services accounted for 10% of Iron Mountain's 2018 revenue, or about $420 million. Not all of this is tied to paper sales, as the firm's customers also pay it for providing the service of shredding their sensitive documents.

Given the relatively small size of this business, plus the volatile nature of recycled paper prices (see below; depressed prices could prove short-lived), it's surprising to see Iron Mountain's stock drop so sharply on this downgrade.

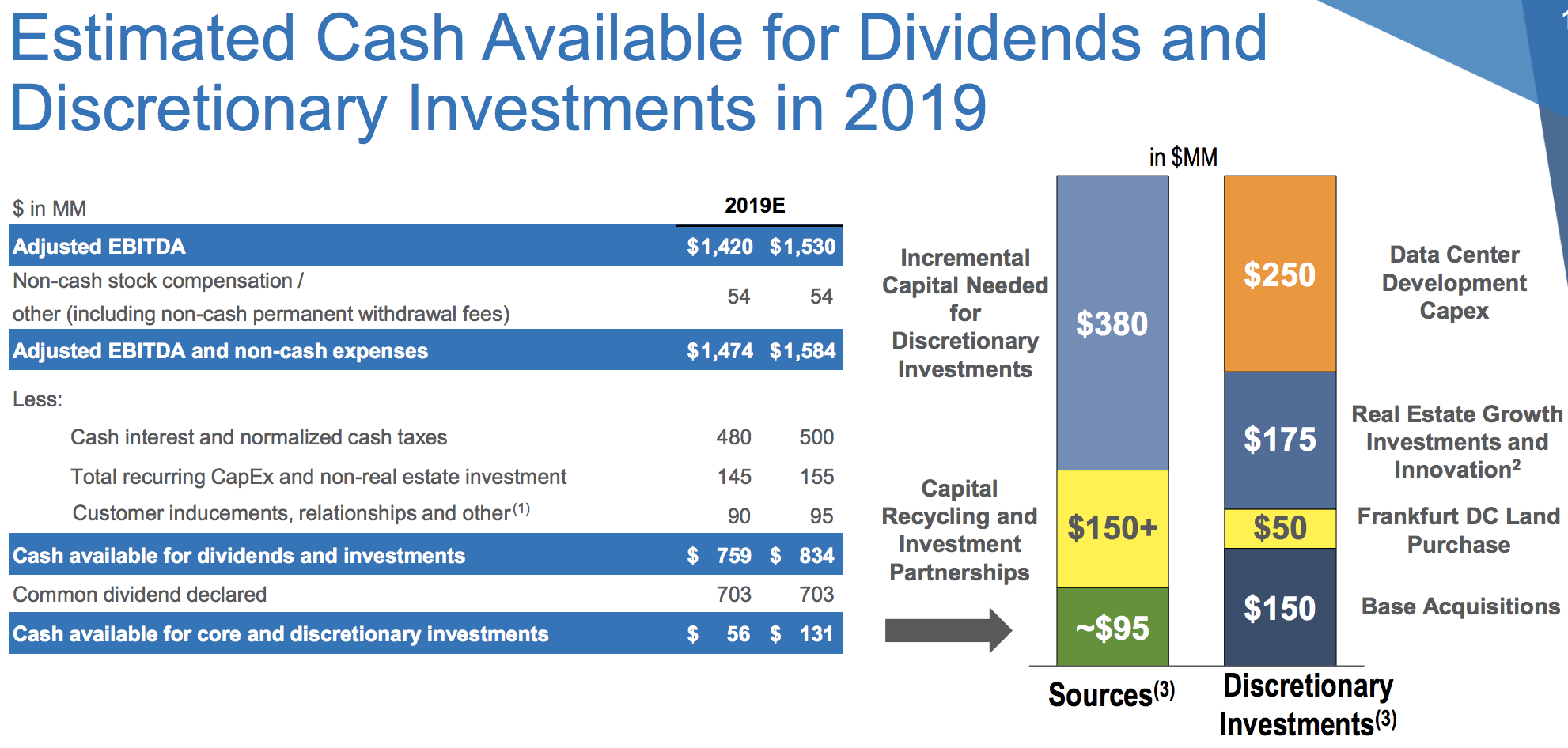

I think the stock's weakness reflects Iron Mountain's limited financial flexibility and slim margin for error. Based on the company's guidance issued in April 2019, Iron Mountain expects to retain about $95 million in cash flow this year after paying around $700 million in dividends and investing to maintain its business.

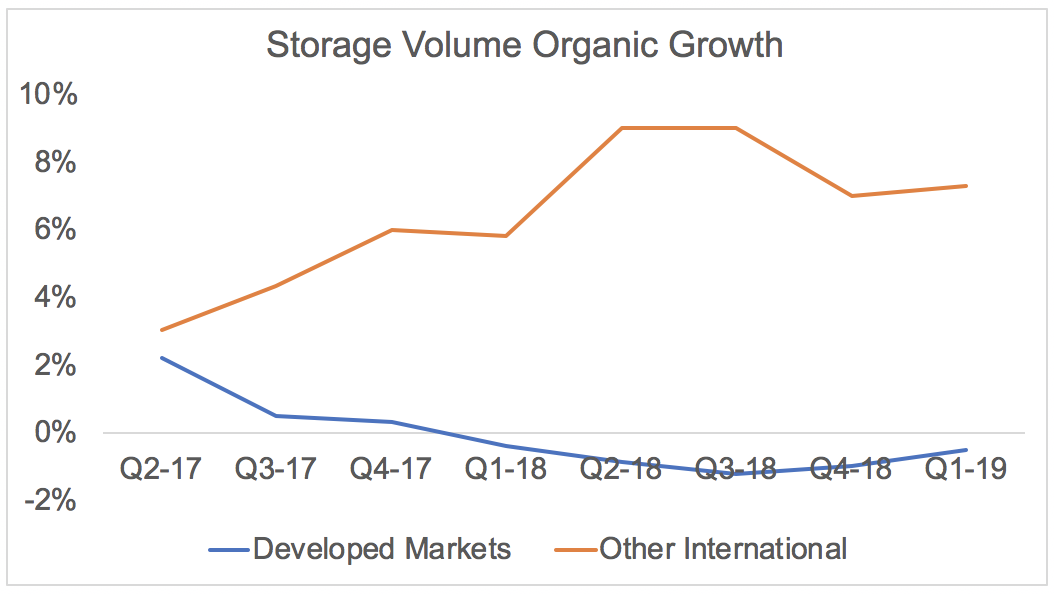

However, the firm realizes that its lucrative storage business in North America is somewhat of a shrinking ice cube. You can see organic volumes have declined for more than a year, driven by the continued rise of digital documents.

Physical document storage remains a cash cow, but management wants to gradually reposition Iron Mountain's business mix into growth markets. Data centers are a big focus, and developing this capital-intensive business isn't cheap.

As you can see below, Iron Mountain's planned discretionary investments in 2019 total $625 million, well above the $95 million in retained cash flow it projects to have after paying dividends. The company's payout ratio sits near 80%, which provides limited ability to internally fund growth projects given the magnitude of investments Iron Mountain is pursuing.

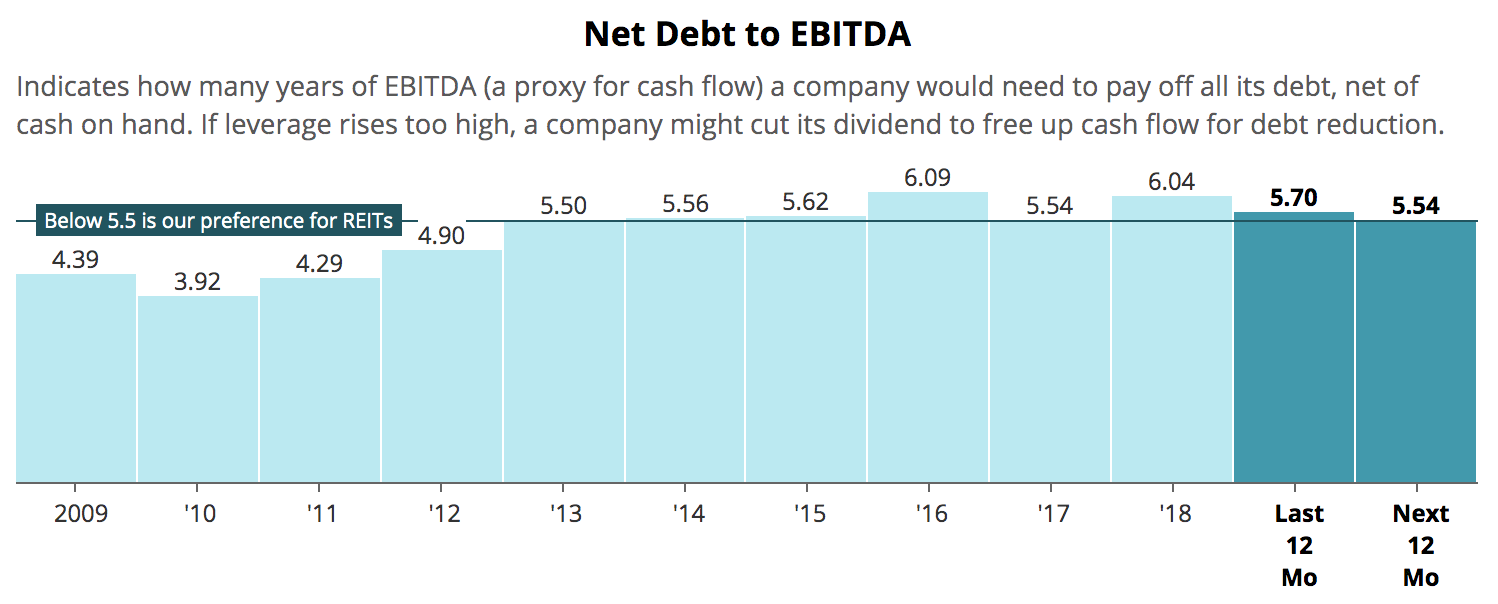

Instead, the company is banking on organic EBITDA growth allowing it to borrow more without increasing its leverage ratio. For example, a company with a 5x leverage ratio could theoretically borrow $500 million more without raising its leverage ratio if its EBITDA also increased by $100 million.

However, falling paper prices could reduce Iron Mountain's EBITDA growth this year, potentially wiping out a portion of its retained cash flow and making it even more difficult for the firm to deleverage while funding all of its discretionary investment opportunities.

In such a scenario, the company would have to either dial back some of its discretionary investments or figure out how to raise even more capital to fill the gap.

Issuing substantial equity to fill the gap is unlikely given Iron Mountain's low valuation. The REIT could instead look to sell off additional non-core assets or potentially take on more debt, though that would at least temporarily increase its leverage again.

In March 2019, Standard & Poor's said it would likely downgrade Iron Mountain's BB- credit rating if its leverage ratio rose to 6.0, which is not far above its current level. The market is probably concerned about this possibility.

Essentially, pressure keeps rising for Iron Mountain to grow its way back to a healthier balance sheet and payout ratio. The firm's $700 million annual dividend commitment makes it harder for Iron Mountain to invest for the future without compromising its access to affordable capital.

Due to some of these challenges, which justify Iron Mountain's Borderline Safe Dividend Safety Score, we made the following comments in our April 2019 report on the company:

"If the firm's leverage keeps creeping up, perhaps due to growth investments that fail to deliver their expected returns, then Iron Mountain could find itself under greater pressure to protect its credit rating and keep its borrowing costs down...

While Iron Mountain has a solid core business that produces reliable cash flow, the REIT's sub-investment grade credit rating, high cost of capital, and lack of significant retained cash flow relative to its growth budget reduce its margin for error.

Until the company has improved its leverage profile, conservative income investors may want to look elsewhere for yield, sticking with dividend payers which possess stronger balance sheets and better control over their long-term growth plans."

Those comments remain true today, especially if Bank of America Merrill Lynch's prediction is correct that Iron Mountain's EBITDA (and therefore its deleveraging progress) will take a hit due to the sharp decline in paper prices.

What does this all mean for the dividend? Unless Iron Mountain was at risk of a credit rating downgrade or something was going wrong with its growth projects, storage business, or capital recycling efforts, a dividend cut would still be surprising at this stage.

The company also does not have any meaningful debt maturing until 2023, and on June 27, 2019, Moody's even revised Iron Mountain's outlook to stable from negative.

With that said, today's price reaction to an analyst downgrade driven by a small piece of Iron Mountain's business shows the fine line the company is walking.

The firm needs to generate stable results from its storage business while earning a healthy return on its investments to grow its EBITDA and deleverage over time. Failure to accomplish this would likely result in significant downside risk, regardless of how "cheap" the stock might look today.

Lower paper prices could mean 2019 will be a more difficult year for the firm, but for now they don't appear to be a structural or substantial enough headwind to cause us to change our long-term outlook or Borderline Safe Dividend Safety Score for the stock. We will monitor the company's next earnings report on August 1 and provide an update if anything material changes.

Overall, until Iron Mountain's leverage and payout ratio reach safer levels, conservative income investors may want to continue looking elsewhere for yield. Investors holding the stock need to be comfortable with Iron Mountain's risk profile as well as their position sizes.