Tanger's Dividend Safety Profile Downgraded to Borderline Safe Due to Weak Results Across Key Tenants

In March 2019, I published a note reviewing Tanger's dividend safety. In my concluding remarks, I had stated the firm's dividend still looked safe, but investors needed to watch the performance of Tanger's tenants (emphasis added):

Tanger's operating results have significantly deteriorated in recent years, driven largely by its exposure to troubled apparel retailers. While Tanger's dividend still appears reasonably safe based on the information we know today, investors considering the stock need to closely monitor the health of Tanger's tenants going forward.

While additional retailer bankruptcies are already baked into management's 2019 guidance, it's hard to say whether this headwind is cyclical (a few over-leveraged and poorly managed apparel retailers) or secular (e-commerce and shifting consumer shopping preferences reducing the appeal of outlets)...

For now, management can continue paying the dividend. Tanger even raised its payout by 1.4% in February 2019. However, investors should not expect any meaningful growth during this turnaround. And if the environment for Tanger's apparel-focused retailers does take another leg down, then the firm's Dividend Safety Score would very likely be downgraded to a "Borderline Safe" rating.

Due to continued deterioration across some of its biggest tenants, Tanger's Dividend Safety Score is now being downgraded from our Safe rating to Borderline Safe.

While the firm's dividend still does not appear to be at risk of an imminent cut, Tanger's cash flow outlook seems likely to worsen with no quick or easy path to recovery.

Until this situation stabilizes and reverses, which may not happen due to the structural challenges hurting many apparel retailers, Tanger's Dividend Safety Score will remain below our Safe rating.

So why the change now?

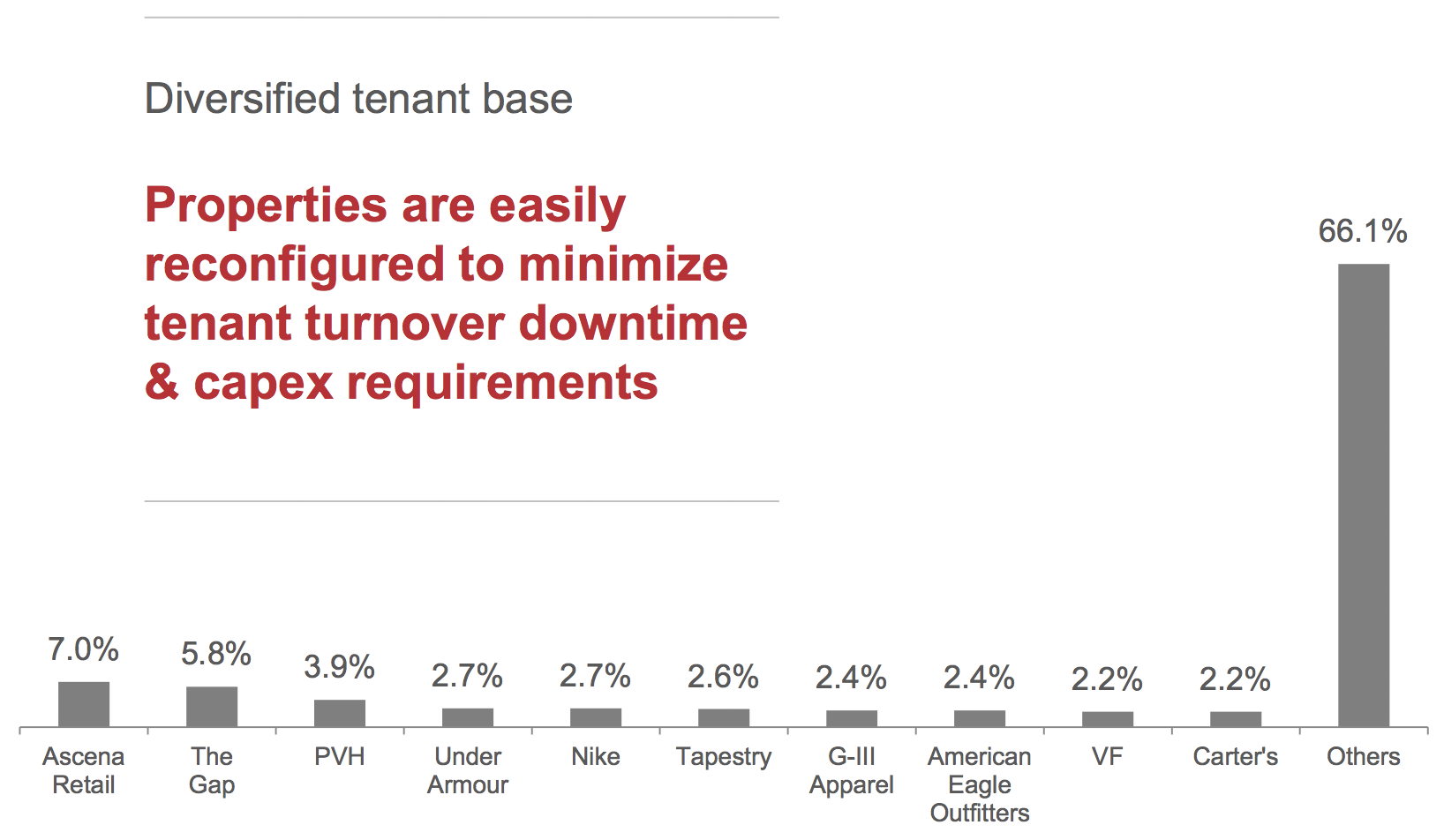

In recent weeks, new information came out on Tanger's three largest tenants – Ascena Retail (ASNA), The Gap (GPS), and PVH (PVH) – which collectively accounted for 16.7% of the firm's first-quarter 2019 revenue.

On May 30, The Gap (5.8% of rent) reported earnings that sent its stock tumbling 10%. Gap's global same-store sales declined a whopping 10%, its biggest fall since 2016 and substantially worse performance than the 4% drop it reported in the first quarter of 2018.

Management reiterated plans to close about 230 of the firm's 3,335 company-owned stores in the next two years, including about 130 locations near the end of this year. Even more closures could prove necessary if this type of performance persists.

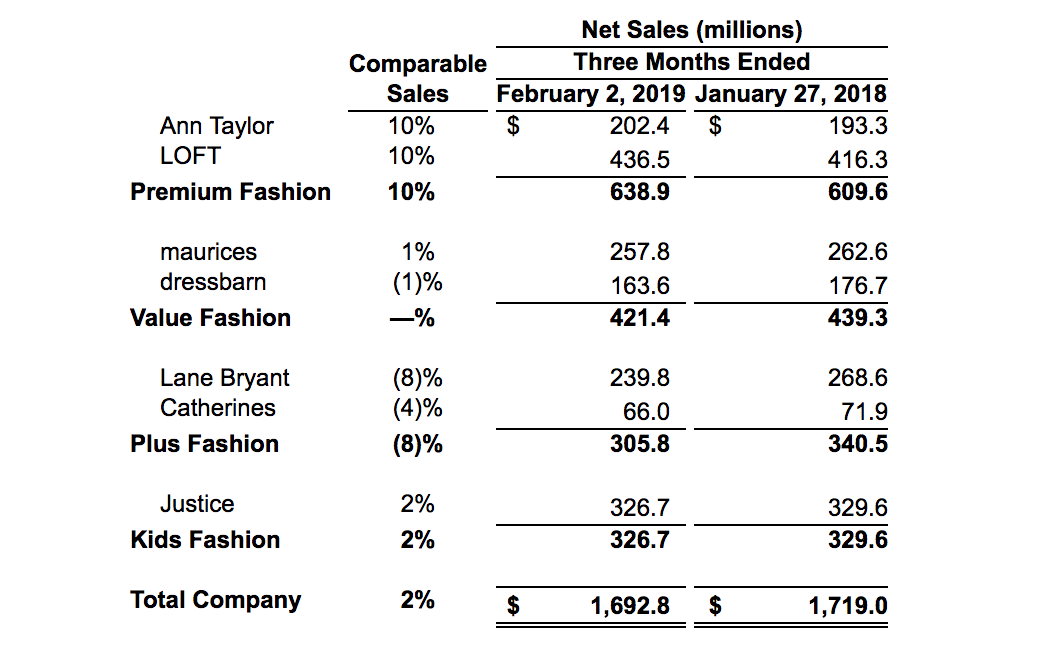

Ascena (7.0% of rent) last reported earnings in March, ringing up a large operating loss despite delivering 2% same-store sales growth. On May 20, Ascena announced plans to close its Dressbarn concept, which generated about 10% of its revenue. Dressbarn shops can be found in 22 of Tanger's 40 locations, and these are yet more stores that will need to eventually be filled by new tenants.

Ascena's business with Tanger goes beyond Dressbarn to include Ann Taylor and LOFT, which are performing well. However, Lane Bryant, which saw comparable sales fall 8% last quarter, is also in 24 of Tanger's 40 outlets. Some of these stores could be at higher risk of being closed in the future, too.

Finally, PVH (3.9% of rent), the owner of Calvin Klein and Tommy Hilfiger brands, slashed its profit guidance earlier this week. Its shares have lost nearly 30% in May. The firm's North American retail businesses experienced a surprising 4% comparable sales decline, driven by weaker traffic.

Basically, since my note in March, the retail climate appears to have taken another leg down, which I said could trigger a downgrade to Tanger's Dividend Safety score. Of course, management teams are attributing their weak results to factors such as "colder, wetter weather" (Gap), the stronger U.S. dollar hurting international tourism (PVH), and other one-off issues.

If that's true, then there wouldn't necessarily be much to worry about. Results will eventually bounce back, and the issues plaguing Tanger's tenants will have proven to be transitory in nature; the firm's long-term investment thesis and dividend safety outlook would remain intact.

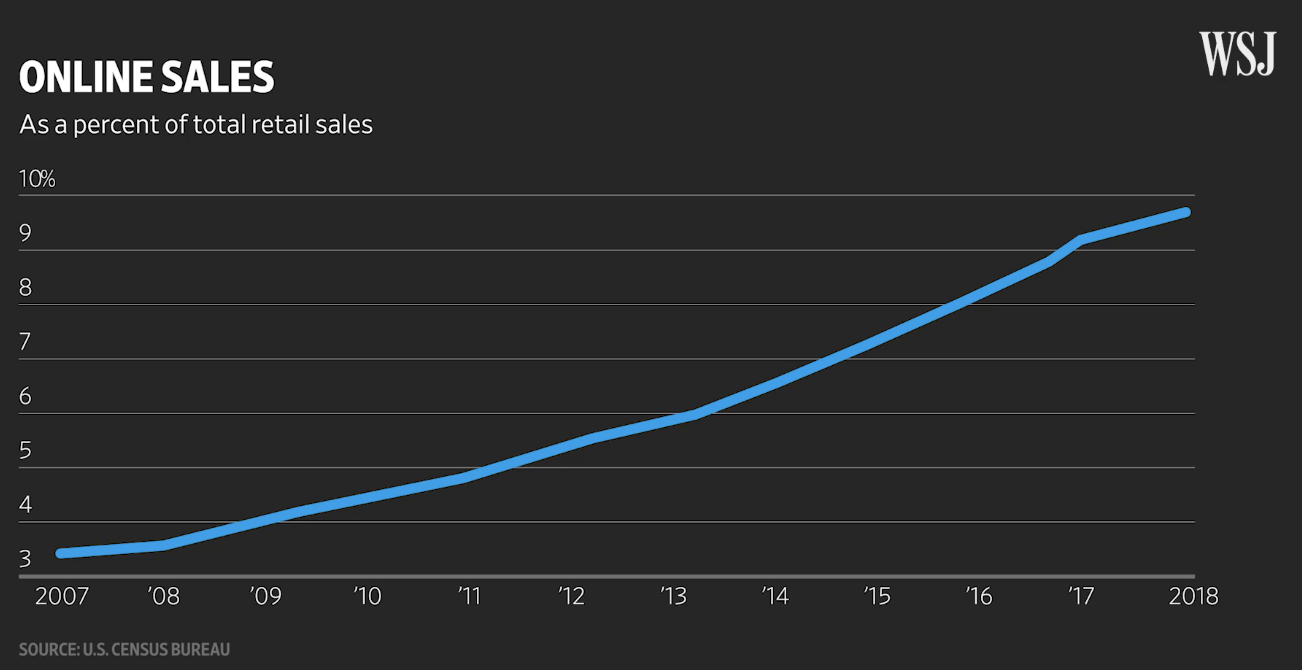

However, with the economy remaining strong and the labor market tight, you have to wonder if there is more to the story. After all, the e-commerce trend is not slowing down.

In fact, per the U.S. Census Bureau, e-commerce sales in the first quarter of 2019 accounted for 10.2% of total sales, up from 4.5% in the first quarter of 2011.

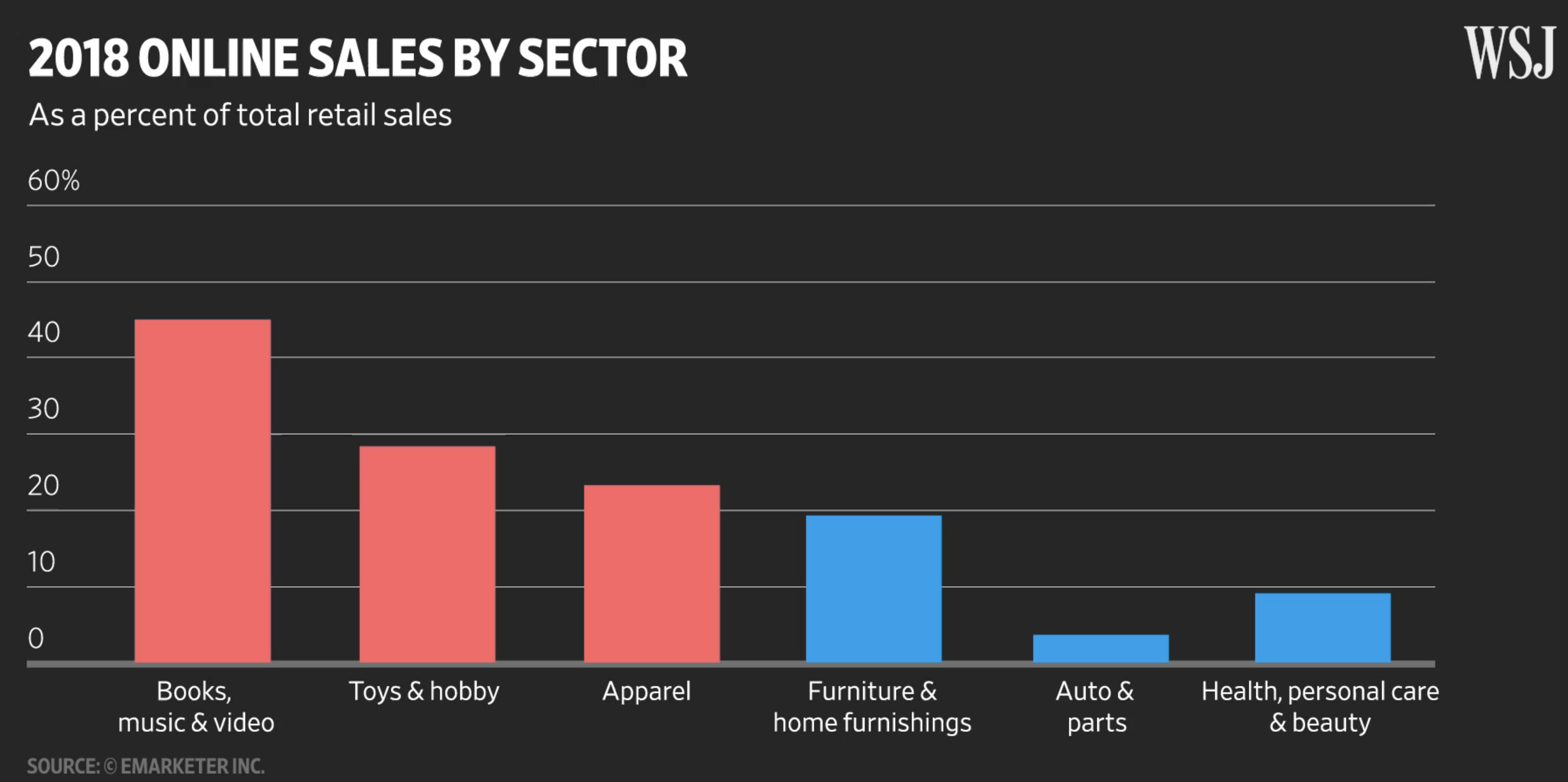

Apparel, the core focus of Tanger's tenants, has been one of the hardest hit sectors, with online sales accounting for over 20% of its total retail sales.

The big questions are how high the mix of online apparel sales will ultimately become, how quickly it will get there, and whether or not traditional brick-and-mortar retailers can figure out how to effectively leverage that channel.

As this plays out, Tanger will have to either work with or replace struggling tenants, hoping to quickly fill its stores with retailers that have greater staying power in an increasingly online world.

And that's assuming the outlet center model remains viable in the long term. Either way, should the pace of store closures accelerate, Tanger's occupancy rate and profitability will come under greater pressure.

As of its last earnings report in early May, Tanger's 2019 guidance called for same-center net operating income to be down 2% to 2.75% this year, reflecting the impact of 2018 store closures and projected 2019 store closures of up to 200,000 square feet (1.4% of Tanger's total square footage).

However, that assumption could prove to be overly optimistic. For example, Ascena's recent decision to shut down Dressbarn could alone result in over 80,000 square feet of closures (Dressbarn is in 22 Tanger locations; most of Tanger's stores are 4,000 square feet).

As we discussed in March, visibility isn't great across Tanger's tenants either. The firm reported that its top 25 tenants generated 57.6% of its rent in 2018, but it does not disclose the retailers who are responsible for the remaining 42.4% of its business.

If Tanger's biggest players have continued struggling to adapt to the new retail world, it's reasonable for investors to feel worried about the outlook for the firm's smaller apparel-focused tenants.

Earlier this year, for example, Gymboree and Charlotte Russe filed for bankruptcy. Both of these retailers are in Tanger's portfolio, accounting for just over 1% of its total square footage. However, neither of these customers were disclosed in Tanger's annual report.

Before reviewing Tanger's financials, I want to shed a little more light on how our Dividend Safety Score system works in cases like this (get a more complete behind-the-scenes look at our guiding principles here).

As you might know, our Dividend Safety Score system is quantitatively driven. A company's most important financial metrics (payout ratio, leverage, etc.) usually paint a clear picture of its overall health and ability to maintain its dividend, well in advance of a dividend cut announcement.

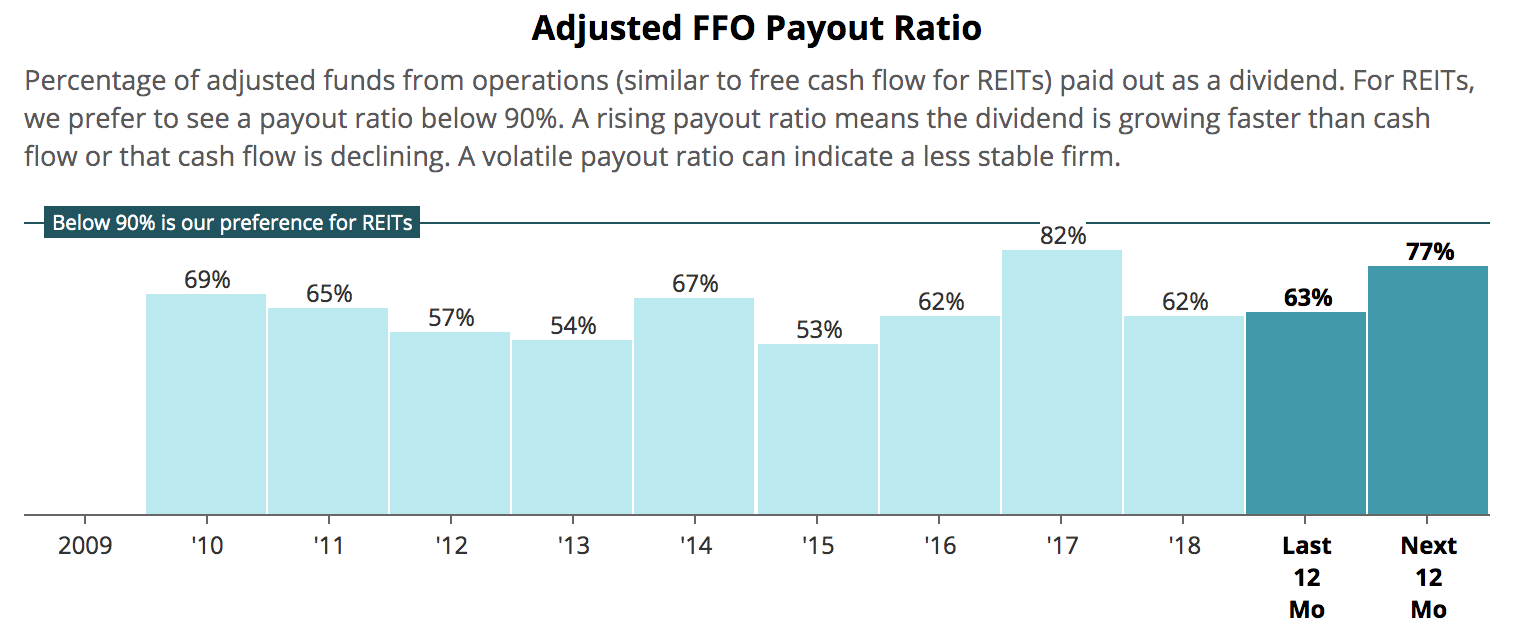

In Tanger's case, its headline financial metrics continue to look decent. For example, even after announcing the sale of four of its shopping centers in early April, which took away 5.1% of its net operating income, the firm's adjusted FFO payout ratio is expected to remain below 80% over the next year.

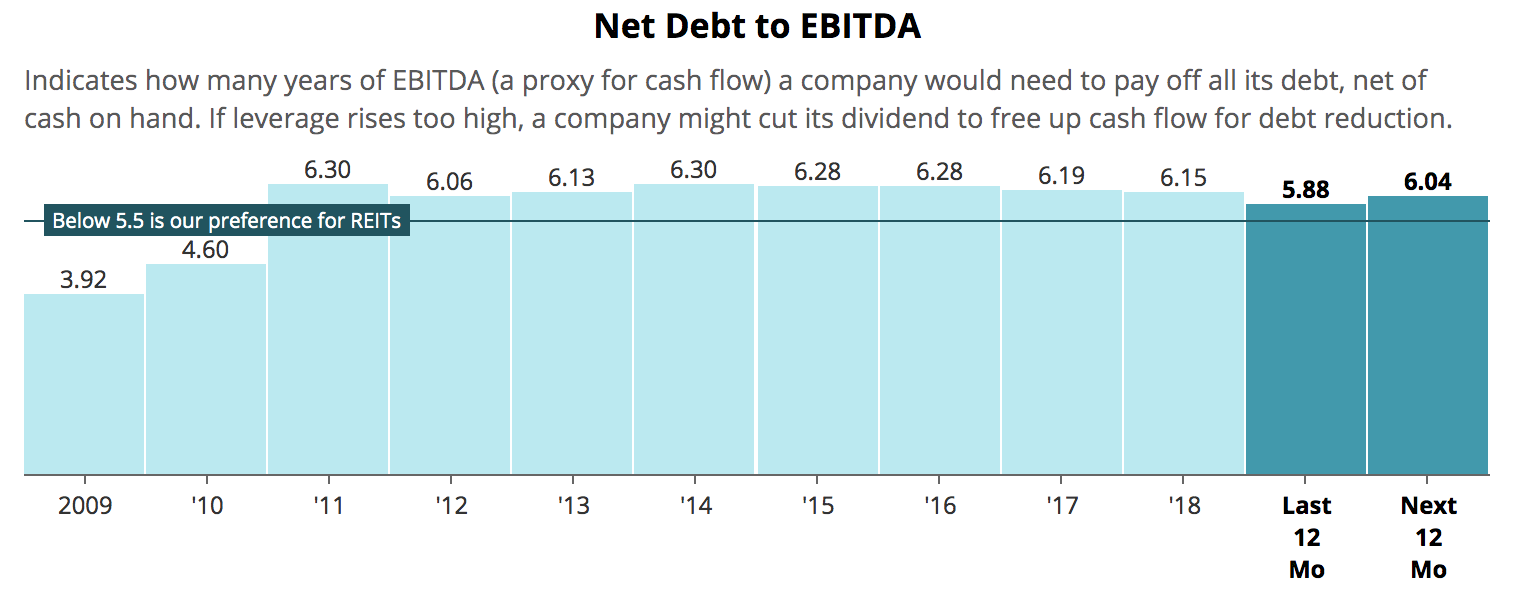

Meanwhile, Tanger's balance sheet continues to look good. The firm maintains investment grade credit ratings from Standard & Poor's and Moody's, and it has $585 million in unused credit capacity (for context, Tanger's annual EBITDA is about $270 million, and its dividend costs roughly $131 million). Tanger also does not have any major debt maturities until late 2023.

However, some companies possess risks that go beyond the latest financials. In Tanger's case, we've seen that some of its top tenants, along with the greater brick-and-mortar retail space in general, have stumbled for yet another quarter as e-commerce continues disrupting the sector.

Tanger works with many different retailers and none accounts for more than 7% of its rent, diversifying away some tenant-specific risk. But its business model remains concentrated on the challenged space of brick-and-mortar apparel retail.

With disruption (and rising store closures) looking more permanent, Tanger's occupancy level, rent rates, and cash flow could come under even greater pressure, and potentially for much longer than management and analysts currently expect.

We prefer to have a scoring a system that takes a conservative, long-term view of risk. Therefore, until we have greater clarity that these growing headwinds won't push Tanger's payout ratio and leverage metrics to riskier levels over the next couple of years, a Borderline Safe rating is more appropriate for the company.

Again, an imminent dividend cut seems unlikely. Only 3% of Tanger's leases expire in 2019 (moves up to 13% in 2020), no major debt comes due until 2023, the firm continues generating a substantial amount of cash flow, capital expenditures required to refill a closed store are minimal, and management is not looking to meaningfully grow the business in this environment.

In other words, outside of a wave of store closures or a potential desire to maintain a higher credit rating (see our March note for more on Moody's negative outlook revision), for now there is no obvious or pressing need to reduce the dividend in order to free up cash.

On its earnings conference call several weeks ago, management unsurprisingly remained supportive of the payout as well:

Tanger works with many different retailers and none accounts for more than 7% of its rent, diversifying away some tenant-specific risk. But its business model remains concentrated on the challenged space of brick-and-mortar apparel retail.

With disruption (and rising store closures) looking more permanent, Tanger's occupancy level, rent rates, and cash flow could come under even greater pressure, and potentially for much longer than management and analysts currently expect.

We prefer to have a scoring a system that takes a conservative, long-term view of risk. Therefore, until we have greater clarity that these growing headwinds won't push Tanger's payout ratio and leverage metrics to riskier levels over the next couple of years, a Borderline Safe rating is more appropriate for the company.

Again, an imminent dividend cut seems unlikely. Only 3% of Tanger's leases expire in 2019 (moves up to 13% in 2020), no major debt comes due until 2023, the firm continues generating a substantial amount of cash flow, capital expenditures required to refill a closed store are minimal, and management is not looking to meaningfully grow the business in this environment.

In other words, outside of a wave of store closures or a potential desire to maintain a higher credit rating (see our March note for more on Moody's negative outlook revision), for now there is no obvious or pressing need to reduce the dividend in order to free up cash.

On its earnings conference call several weeks ago, management unsurprisingly remained supportive of the payout as well:

"As we progress through 2019, we will remain thoughtful in our capital allocation decisions. We continue to generate free cash flow and have a well-covered dividend with a 61% FFO payout ratio for the first quarter.

We don't anticipate a meaningful increase in CapEx spend to complete our planned leasing and, therefore, we feel comfortable in our ability to maintain a strong balance sheet, with low leverage and with the safety of our dividend...

We want to be sure that the dividend is safe and we maintain appropriate coverage ratios."

Just like we said in March, only time will tell if the challenges that continue plaguing many apparel retailers turn out to be cyclical or secular. However, evidence continues to mount that these issues are here to stay and could materially affect Tanger's short- and long-term outlook.

As conservative investors, we prefer to own businesses that have more in their control and are better aligned with secular themes working in their favor. The apparel retail space does not meet those objectives given its fast pace of change and the rise of online shopping.

With that said, Tanger's new Borderline Safe rating is not necessarily reason to sell the stock if you remain comfortable with the risks and uncertainties discussed above, as well as your position size. The market's expectations for Tanger have obviously become a lot lower over the past year, and these are tough judgement calls to make.

We will continue monitoring Tanger's results and report on any material events as it adapts its portfolio and tenant base to the shifting apparel retail landscape.