.png)

Opioid Lawsuits Unlikely to Affect Johnson & Johnson's Dividend Safety

Opioids are a class of drug that includes prescription pain relievers such as OxyContin and Vicodin, synthetic opioids such as fentanyl (similar to morphine but much more potent), and illegal drug heroin.

In 2017 the U.S. Department of Health and Human Services (HHS) declared a public health emergency to address the national opioid crisis. The HHS believes pharma companies caused a boom in opioid prescriptions throughout the 1990s and 2000s by reassuring healthcare providers that patients would not become addicted to these pain killers.

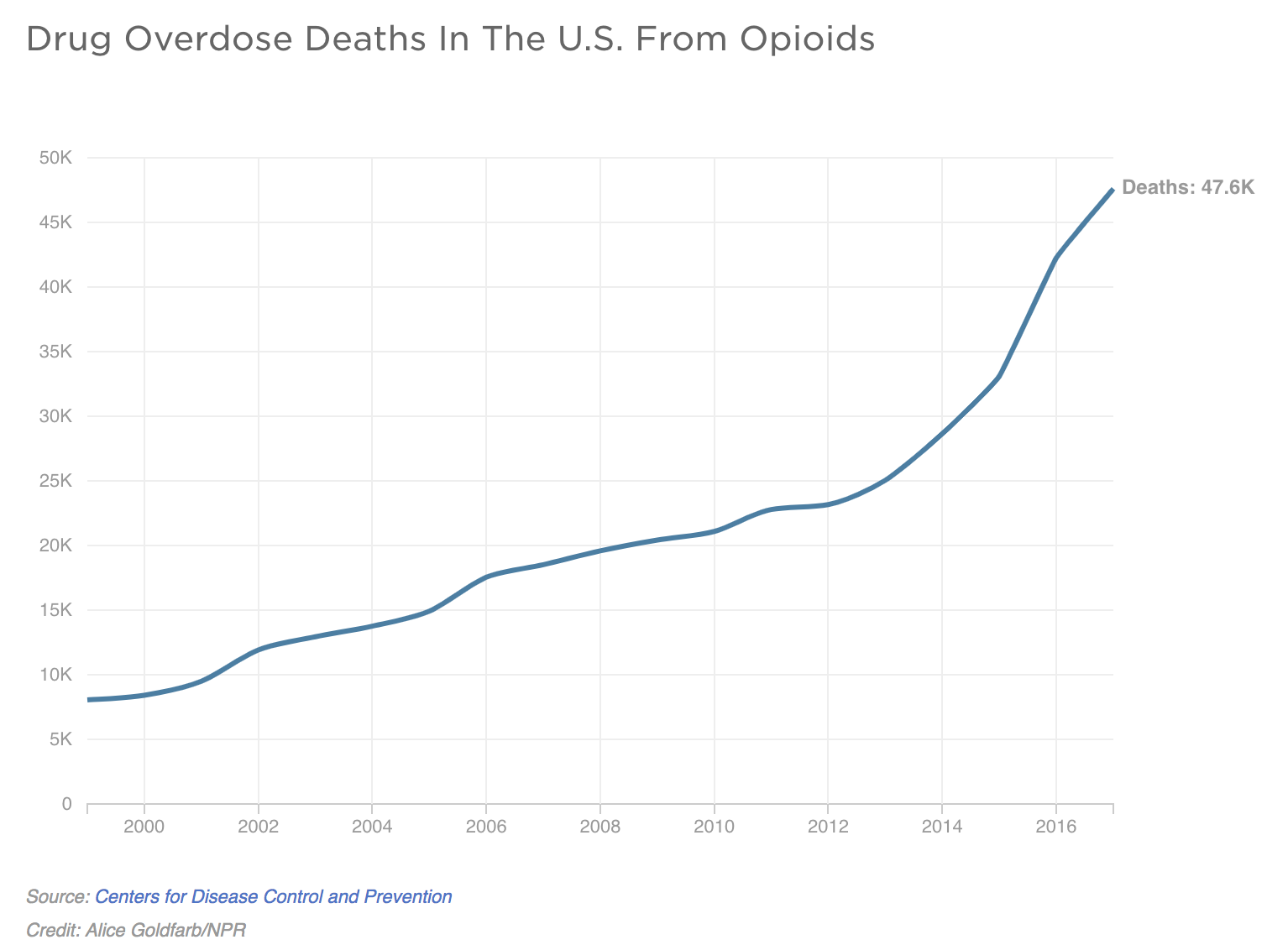

Increased prescriptions of opioid medications have resulted in an estimated 2.1 million people developing an opioid use disorder, and drug overdose deaths from opioids have skyrocketed in recent years to more than 45,000 in 2017 alone (though only about 17,000 were due to prescription opioids).

In 2017 the U.S. Department of Health and Human Services (HHS) declared a public health emergency to address the national opioid crisis. The HHS believes pharma companies caused a boom in opioid prescriptions throughout the 1990s and 2000s by reassuring healthcare providers that patients would not become addicted to these pain killers.

Increased prescriptions of opioid medications have resulted in an estimated 2.1 million people developing an opioid use disorder, and drug overdose deaths from opioids have skyrocketed in recent years to more than 45,000 in 2017 alone (though only about 17,000 were due to prescription opioids).

According to the National Institute on Drug Abuse, The Centers for Disease Control and Prevention estimates that the total "economic burden" of prescription opioid misuse alone in the United States is $78.5 billion a year, including the costs of healthcare, lost productivity, addiction treatment, and criminal justice involvement.

Who is responsible for this costly public health crisis? That's the question courts are trying to answer today. The medical supply chain is incredibly complex, and plenty of finger-pointing is going on.

Johnson & Johnson (JNJ) is by far the largest company in the crosshairs. Since 2014, J&J and other pharma businesses have been named in more than 2,000 lawsuits brought forward by various state and local governments related to the marketing of opioids.

The first major case, filed by the Oklahoma Attorney General, went to trial this week, causing shares of Johnson & Johnson to fall as much as 5.5% yesterday. The other two defendants named in the case (Purdue Pharma and Teva) settled with the state earlier this year for a combined $355 million, leaving J&J to fight this litigation on its own.

The stakes appear high, as they usually do with lawsuits targeting major issues and huge companies. Oklahoma's Attorney General blames J&J for helping create an excessive supply of addictive opioid medications, resulting in a "public nuisance" expected to cost the state between $12.7 billion and $17.5 billion to abate over the next two to three decades.

That's a lot of cash, and Oklahoma is obviously just one of many states filing similar lawsuits. It's easy to see why the market feels a little jittery about J&J's eagerness to fight this battle rather than agree to a settlement deal.

However, Johnson & Johnson realizes that this case will likely set a precedent for future opioid lawsuits. Management is presumably confident the firm will be cleared in this matter.

The company alleges it controlled a minuscule share of the opioid painkiller market in Oklahoma and is "being blamed for the bad acts of other drugmakers," according to SF Gate.

Johnson & Johnson's involvement does seem relatively limited compared to Purdue Pharma and Teva. According to the Wall Street Journal, J&J makes Duragesic, a fentanyl patch the firm claims was never widely abused, and in 2015 it divested opioid painkiller Nucynta.

Johnson & Johnson also owned two businesses (one was sold by 2016) that made some raw materials and ingredients used in other drug companies' painkillers, so Oklahoma's Attorney General blames J&J as enabling other addictive drugs to be sold.

However, management says the firm's operations were tightly regulated and simply followed federal guidelines throughout its production process. Instead, a surge in illegal opioids were a key driver behind overdose deaths.

No one knows how this case will play out, but a ruling is expected this summer, likely by late July or August. However, as Wall Street Journal reporter Sara Randazzo notes, "Nothing would be legally binding in terms of this one judge, and Oklahoma's decision wouldn't have to be followed by other courts."

Earlier this year a similar "public nuisance" lawsuit (public nuisance is the only claim against J&J in Oklahoma) issued by North Dakota against opioid maker Purdue Pharma, the maker of leading painkiller OxyContin, was thrown out by County District Judge James Hill. In is order he explained that:

Who is responsible for this costly public health crisis? That's the question courts are trying to answer today. The medical supply chain is incredibly complex, and plenty of finger-pointing is going on.

Johnson & Johnson (JNJ) is by far the largest company in the crosshairs. Since 2014, J&J and other pharma businesses have been named in more than 2,000 lawsuits brought forward by various state and local governments related to the marketing of opioids.

The first major case, filed by the Oklahoma Attorney General, went to trial this week, causing shares of Johnson & Johnson to fall as much as 5.5% yesterday. The other two defendants named in the case (Purdue Pharma and Teva) settled with the state earlier this year for a combined $355 million, leaving J&J to fight this litigation on its own.

The stakes appear high, as they usually do with lawsuits targeting major issues and huge companies. Oklahoma's Attorney General blames J&J for helping create an excessive supply of addictive opioid medications, resulting in a "public nuisance" expected to cost the state between $12.7 billion and $17.5 billion to abate over the next two to three decades.

That's a lot of cash, and Oklahoma is obviously just one of many states filing similar lawsuits. It's easy to see why the market feels a little jittery about J&J's eagerness to fight this battle rather than agree to a settlement deal.

However, Johnson & Johnson realizes that this case will likely set a precedent for future opioid lawsuits. Management is presumably confident the firm will be cleared in this matter.

The company alleges it controlled a minuscule share of the opioid painkiller market in Oklahoma and is "being blamed for the bad acts of other drugmakers," according to SF Gate.

Johnson & Johnson's involvement does seem relatively limited compared to Purdue Pharma and Teva. According to the Wall Street Journal, J&J makes Duragesic, a fentanyl patch the firm claims was never widely abused, and in 2015 it divested opioid painkiller Nucynta.

Johnson & Johnson also owned two businesses (one was sold by 2016) that made some raw materials and ingredients used in other drug companies' painkillers, so Oklahoma's Attorney General blames J&J as enabling other addictive drugs to be sold.

However, management says the firm's operations were tightly regulated and simply followed federal guidelines throughout its production process. Instead, a surge in illegal opioids were a key driver behind overdose deaths.

No one knows how this case will play out, but a ruling is expected this summer, likely by late July or August. However, as Wall Street Journal reporter Sara Randazzo notes, "Nothing would be legally binding in terms of this one judge, and Oklahoma's decision wouldn't have to be followed by other courts."

Earlier this year a similar "public nuisance" lawsuit (public nuisance is the only claim against J&J in Oklahoma) issued by North Dakota against opioid maker Purdue Pharma, the maker of leading painkiller OxyContin, was thrown out by County District Judge James Hill. In is order he explained that:

"Purdue has no control over its product after it is sold to distributors, then to pharmacies, and then prescribed to customers...The state’s effort to hold one company to account for this entire, complex public health issue oversimplifies the problem."

Similarly, in early 2019 a judge in Delaware dismissed a public nuisance claim against Purdue. So J&J appears to have some valid reasons to believe the public nuisance claim it faces in Oklahoma should be thrown out, or at least the amount of abatement costs should be significantly reduced.

We should know a little more this summer, but the bigger trial is set for October 2019 in Ohio. Over 1,900 federal cases have been coordinated in this litigation, so the stakes will presumably be much higher. Again, it's hard to say how a favorable or adverse ruling in Oklahoma would affect the potential outcomes for the next trial.

Lawsuits come with the territory of investing in many pharmaceuticals companies and chemical manufacturers. Case outcomes are rarely predictable, so it's important to invest in large, diversified businesses that generate excellent cash flow and have strong balance sheets. I like owning companies that can work through almost any worst-case scenario thrown at them.

Johnson & Johnson continues to possess those qualities. The firm generates around $9 billion in annual free cash flow after paying dividends and holds over $15 billion in cash on its balance sheet (a very low net debt to leverage ratio below 1.0).

For context, in our December 2018 note reviewing the talc powder lawsuits against J&J, we observed the three largest drug lawsuit settlements of all time, according to consumer justice attorneys Saunders & Walker:

We should know a little more this summer, but the bigger trial is set for October 2019 in Ohio. Over 1,900 federal cases have been coordinated in this litigation, so the stakes will presumably be much higher. Again, it's hard to say how a favorable or adverse ruling in Oklahoma would affect the potential outcomes for the next trial.

Lawsuits come with the territory of investing in many pharmaceuticals companies and chemical manufacturers. Case outcomes are rarely predictable, so it's important to invest in large, diversified businesses that generate excellent cash flow and have strong balance sheets. I like owning companies that can work through almost any worst-case scenario thrown at them.

Johnson & Johnson continues to possess those qualities. The firm generates around $9 billion in annual free cash flow after paying dividends and holds over $15 billion in cash on its balance sheet (a very low net debt to leverage ratio below 1.0).

For context, in our December 2018 note reviewing the talc powder lawsuits against J&J, we observed the three largest drug lawsuit settlements of all time, according to consumer justice attorneys Saunders & Walker:

- GlaxoSmithKline: $3 billion in 2012 for selling antidepressants for uses unapproved by the FDA

- Pfizer: $2.3 billion in 2009 for illegally marketing a pain killer

- J&J: $2.2 billion in 2009 for promoting certain drugs for unapproved uses by the FDA

Looking across all industries, the largest settlement in U.S. history occurred in 1998 when four tobacco giants agreed to pay out more than $125 billion over 20-plus years (an average of about $7 billion annually) to cover medical costs for smoking-related illnesses. Only four other settlements have ever exceeded $5 billion.

In other words, regardless of whether you look at settlements in the drug industry or across all companies, even in a worst-case scenario it's hard to imagine J&J being on the hook for more than the $9 billion in annual free cash flow it generates after paying dividends, not to mention the cash hoard it has on its balance sheet.

With that said, billions of dollars directed towards settlements, penalties, and other legal costs is an unfortunate use of capital. Management could otherwise use those funds to invest more into the business to grow earnings faster, make strategic acquisitions, or return more cash to shareholders in the form of higher dividends and buybacks.

Until the ultimate liabilities from the opioid and talc powder lawsuits become clearer, these issues could remain an overhang on Johnson & Johnson's stock performance. However, it's hard to imagine them threatening the firm's long-term outlook or ability to pay safe and growing dividends.

We will continue monitoring any material developments with these cases and provide updates accordingly. For now, we plan to sit tight with the Johnson & Johnson shares we hold in our Conservative Retirees portfolio.