Qualcomm Settles with Apple, Improving Dividend Safety Outlook

Qualcomm (QCOM) shareholders received good news yesterday: the chip maker and Apple agreed to drop all litigation, sending Qualcomm's stock surging more than 20%.

In February 2019 we outlined the significant legal risks Qualcomm's core licensing business faced. I recommend skimming our note for more background on the situation, but essentially Qualcomm was accused by Apple and others of abusing its monopolistic position in wireless chips and charging excessive royalty rates.

As we noted, the stakes were high:

In February 2019 we outlined the significant legal risks Qualcomm's core licensing business faced. I recommend skimming our note for more background on the situation, but essentially Qualcomm was accused by Apple and others of abusing its monopolistic position in wireless chips and charging excessive royalty rates.

As we noted, the stakes were high:

"Should Qualcomm reach a favorable resolution with the FTC and Apple later this year, the firm's dividend will very likely remain on solid ground. However, if its lucrative [licensing] segment is forced to change its ways and Apple continues withholding its royalty payments, then Qualcomm may need to reduce its dividend to a level that is more in line with its lower cash flow run rate going forward."

Qualcomm's new agreement resolves all disputes with Apple and reduces the risk that the chip maker's licensing business model will be forced to significantly change. Apple inked a six-year licensing agreement and will continue paying royalties to Qualcomm. A multi-year chipset supply deal was reached, too.

The settlement also includes a one-time payment from Apple to Qualcomm. Apple had withheld over $7 billion of royalties from Qualcomm during its multi-year legal dispute, so it appears Qualcomm will finally receive at least some of this much-needed cash.

After four consecutive years of profit declines, Qualcomm expects this deal will cause its earnings to eventually increase by approximately $2.00 per share, or more than 50%, as product shipments ramp.

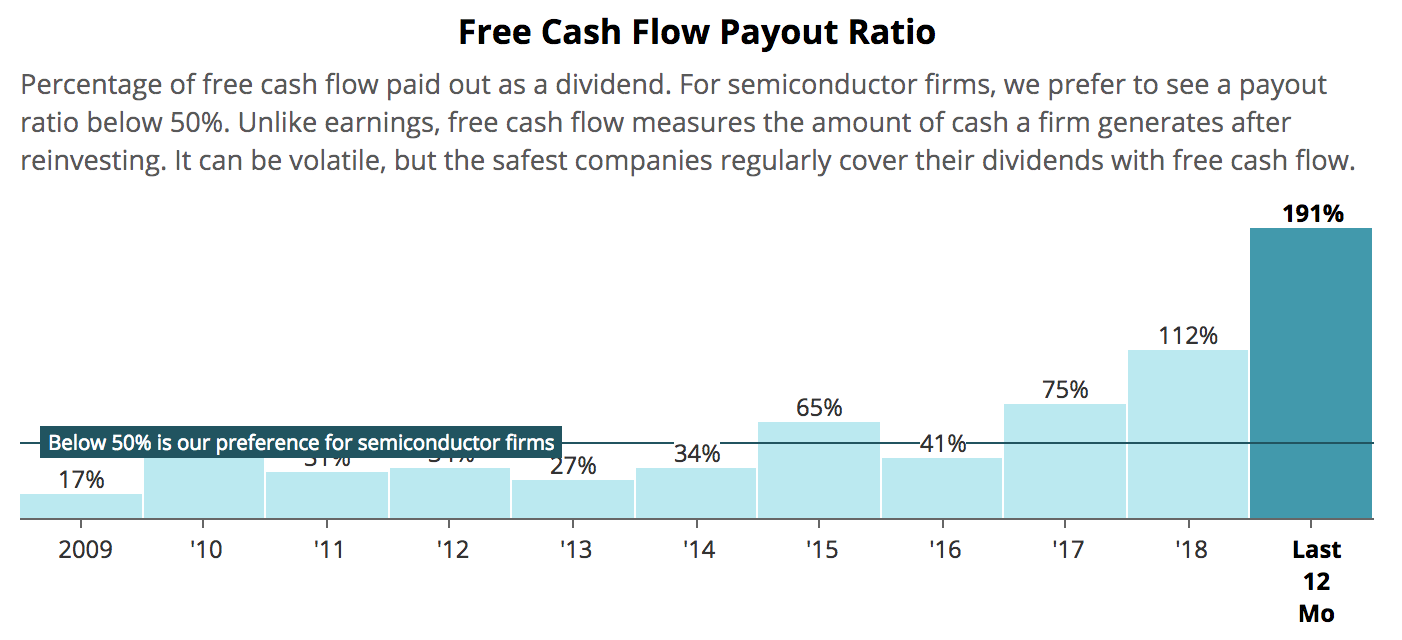

Incremental earnings of $2.00 per share works out to about a $2.8 billion increase in profits. For perspective, Qualcomm's free cash flow fell short of covering its dividend by nearly $2 billion over the past year, resulting in a 191% free cash flow payout ratio.

So while the timing of this cash flow boost is still unknown, it should ultimately put the company's dividend, which will cost close to $3 billion this year, on much stronger ground as Qualcomm's payout ratio falls comfortably below 100%.

That should come as a relief to income investors, but Qualcomm's stock price jump is more a reflection of investors' relief that the firm's lucrative licensing business and dominant market position will likely remain largely intact.

Qualcomm is not completely out of the woods yet since we are still waiting for a ruling on its Federal Trade Commission (FTC) antitrust trial, which wrapped up at the end of January 2019. The risk is that U.S. regulators could still force Qualcomm to change its licensing practices to line up with industry norms under the fair, reasonable, and non-discriminatory, or FRAND, practices.

In such an outcome, the earning power of Qualcomm's licensing business, which historically has generated 80% of company-wide profits, could be significantly reduced.

However, investors might believe that Apple would not have reached an agreement with Qualcomm if an adverse outcome was likely in the FTC antitrust trial. The iPhone maker would have greater leverage over the firm in that scenario.

Additionally, the fact that Apple even reached an agreement to continue paying Qualcomm royalties suggests the chip maker's licensing practices are still capable of being fair and reasonable in a free market system.

With that said, outcomes of high-profile legal cases are difficult to forecast, so the FTC still poses some risks to Qualcomm's business. However, it appears increasingly likely that any possible licensing disruption or settlement will not be as bad as investors had feared. Only time will tell.

More good news surfaced shortly after Qualcomm's agreement with Apple, when Intel announced plans to exit the 5G smartphone modem market, essentially ceding the business to Qualcomm.

Intel began supplying Apple with modem chips back in 2017, when the legal dispute with Qualcomm began escalating, and eventually became Apple's only supplier when it completely replaced Qualcomm.

Intel's withdrawal from this market suggests it believes Qualcomm will now remain the dominant player in smartphone modem chips, especially as 5G handsets begin taking over the market in the future.

The Wall Street Journal summarized the situation well:

The decision by Intel removes a major rival to Qualcomm for a critical component in the new generation of mobile handsets expected to dominate the market over the next several years...

Intel’s withdrawal, meanwhile, leaves only a handful of competitors to Qualcomm for 5G modems, which are small chips that manage connection and the transfer of data between smartphones and cell towers. Only a few other companies have 5G modems in the pipeline...

So not only are investors cheering the cash infusion from the Apple-Qualcomm deal and the lower risk posed by the FTC antitrust trial, but Intel's withdrawal from modem chips for smartphones suggests Qualcomm's technology will remain dominant for the next generation of handsets.

What does this all mean for Qualcomm's dividend safety and valuation appeal?

From a dividend safety perspective, Qualcomm's outlook has improved with business set to ramp back up with Apple, its largest customer. As we previously discussed, Qualcomm's dividend should once again soon be more than covered by the firm's free cash flow generation.

Meanwhile, the one-time payment from Apple to Qualcomm will ensure that the company has plenty of cash to maintain a very strong balance sheet and continue its share repurchase program.

However, the FTC's antitrust case is a lingering concern. While the deal with Apple and Intel's withdrawal from smartphone modem chips suggest a potentially favorable outcome, Qualcomm could still be forced to pay a multi-billion dollar settlement or change its licensing practices.

Even in the deal with Apple, few specifics were given. Will Qualcomm's royalty rate on smartphones fall significantly from its current level of $7.50 per unit? How large of a one-time payment is Apple making? Do royalty rates decline over the multi-year licensing agreement?

For these reasons, along with our conservative approach to income investing, Qualcomm retains a "Borderline Safe" Dividend Safety Score for now, but its outlook has improved following the Apple deal.

Once we have more clarity on the antitrust case filed by the FTC and terms of the Apple deal, the company's Dividend Safety Score will likely be upgraded to our "Safe" bucket (60+ points), assuming a reasonable outcome that does not significantly alter Qualcomm's licensing practices.

From a valuation perspective, Qualcomm shares trade at a forward P/E ratio of 13.7, if you add $2.00 per share to the current consensus EPS estimate. That's below the Technology sector's P/E ratio of 18.8, as well as Qualcomm's five-year average multiple of 14.2.

Should Qualcomm return to sustainable top and bottom line growth, the stock could be attractive, especially given the firm's unique technology portfolio and strong market share position.

However, it's still hard to paint a rosy picture of growth given Qualcomm's dependence on smartphones.

Global smartphone shipments actually declined about 3% in 2018, according to the International Data Corporation (IDC). While shipments are expected to grow at a low single-digit pace in 2019 and beyond, driven by emerging markets and potential around 5G, the days of double-digit volume growth are long gone.

Since Qualcomm already has a dominant market share in this low-growth market, the best it can do is maintain its positioning. The other lever behind the company's revenue growth is pricing. Given the legal disputes and antitrust concerns Qualcomm has fought in recent years, plus the smartphone market's sluggish growth, it's hard to imagine the company increasing its royalty rates.

Perhaps 5G handsets will allow for higher royalty rates, but that seems unlikely given the pressures on the company and Intel's withdrawal from the market. We don't yet know the royalty terms Apple agreed to, and the FTC could also alter Qualcomm's licensing practices to make incremental growth more difficult.

Essentially, Qualcomm looks like a mature cash cow with reasonable valuation expectations. If the company can put the last of its major legal challenges behind it with the FTC trial, then its dividend safety profile will look quite solid as well. For income-focused investors, that's likely enough to justify continuing to hold the stock, assuming you are comfortable with the size of your position.

Just remember that the spike in Qualcomm's share price only demonstrates how much the company had to lose in its battle with Apple. The stakes remain high with the FTC case as well, although the probability of a worst-case outcome seems to have diminished somewhat.

We should know more later this year, including more specific details on the Apple deal (QCOM's next earnings release is on May 1), and will update Qualcomm's dividend safety profile accordingly.