Ford: A High Dividend But Uncertainties Linger

Founded in 1903, Ford (F) is one of the largest auto makers worldwide. The company sells a full line of Ford trucks, SUVs, cars, and Lincoln luxury vehicles. Ford also provides financial services and is investing in electrification, autonomous vehicles, and mobility solutions.

Ford's business consists of three segments:

Ford's business consists of three segments:

- Automotive ($5-6 billion of operating profit): North America accounts for about 70% of Ford’s global automotive revenue and earns an operating margin near 8%. Ford’s international auto businesses are unprofitable and include Europe (20% of automotive revenue), Asia Pacific (5%), China (3%), South America (3%), and Middle East & Africa (2%).

- Ford Credit ($2-3 billion of operating profit): the company's financing arm helps customers pay for the vehicles they purchase or lease.

- Ford Mobility (unprofitable): invests in technology focused on driverless cars and mobility services. This division is losing about $1 billion per year as the company remains in the early stages of monetizing these long-term investments.

Business Analysis

The auto business, in general, is a very harsh one due to high levels of global competition, cyclical sales, and extreme capital intensity. Auto manufacturers face a constant need to design, launch, and update their vehicles and factories to remain competitive.

For example, Ford routinely invests about $8 billion annually in research and development to develop or refresh its model lines. Capital expenditures tack on another $7 billion to $8 billion per year to keep Ford's factories humming.

As if these costs, which combine to account for about 10% of Ford's total revenue, weren't enough, over a quarter of Ford's workforce is represented by unions which historically demanded large pensions, free healthcare for life, generous annual raises, and other perks.

The company complied with these demands decades ago when it owned about 30% of the U.S. market in the 1960s. However, Ford eventually rested on its laurels in terms of R&D, allowing foreign automakers to enter the American economy and take share since many of their vehicles offered better reliability and fuel economy. They weren't saddled with Ford's bloated cost structure either.

These issues came to a head during the financial crisis when global auto sales plummeted, bringing America's unprofitable and highly leveraged vehicle makers to their knees. Although Ford did not require a federal bailout like General Motors and Chrysler did since it had mortgaged its assets to improve its liquidity in 2006, the company was far from healthy, sporting a junk credit rating and burning cash.

American auto makers have overhauled their businesses following the financial crisis, closing factories, divesting unprofitable brands, reducing their union workforces, and eliminating tens of billions of debt.

Simply put, the industry has become leaner and more rational. For example, in 2007 when the Big Three (GM, Ford, and Chrysler) built more than half of all vehicles sold in the U.S. car market, they were losing more than $300 per car produced, according to the Wall Street Journal.

Just one decade later, and despite lower market share, the Big Three profited more than $2,500 for every car made in North America.

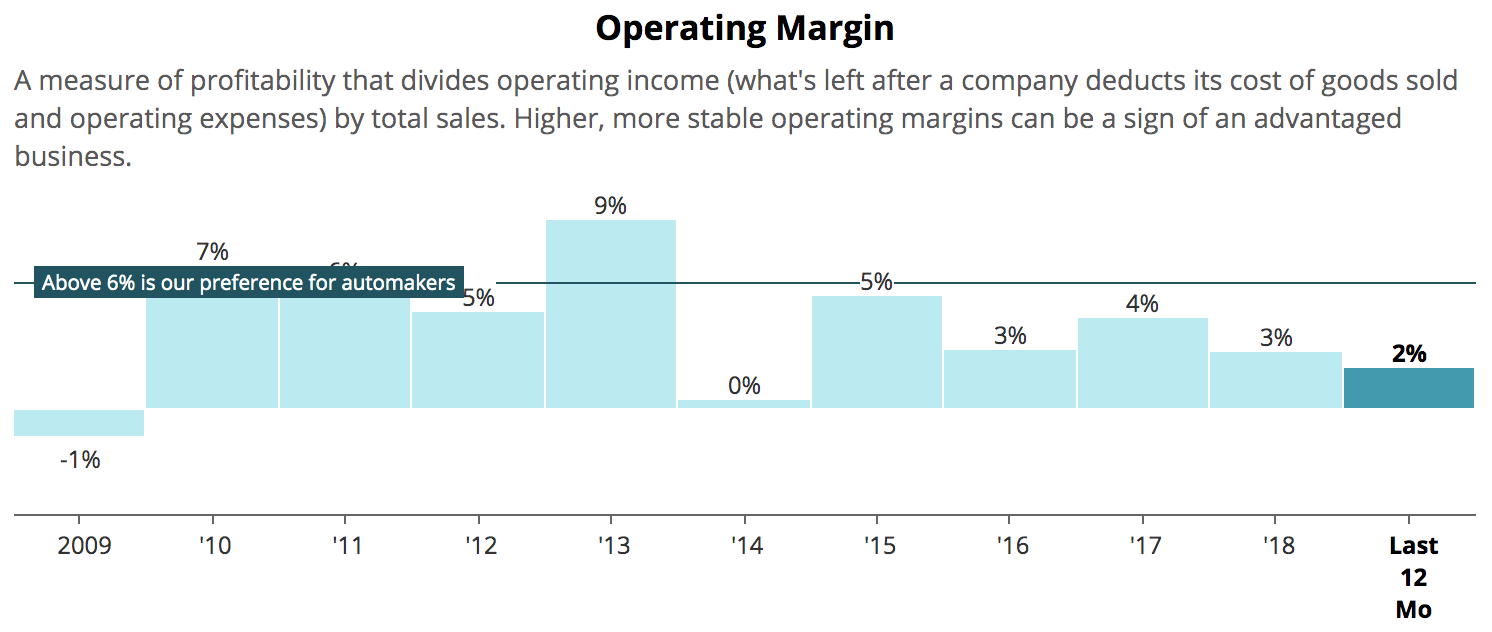

Despite the auto market's continued recovery, Ford has once more fallen on hard times. While General Motors has delivered a mid-single digit operating margin since 2015, Ford's profitability has eroded.

Rivals have invested in new technologies and exited unprofitable businesses, but Ford has failed to keep up. The company has been challenged by market share losses, older and less competitive vehicle designs, and mounting operating losses across its international businesses.

In May 2017, Ford appointed Jim Hackett as its new CEO. Mr. Hackett is implementing a sweeping restructuring plan expected to take out $25.5 billion in cumulative costs through 2022.

In July 2018, Ford outlined a separate multiyear restructuring plan with an expected cash cost of $7 billion over the next three to five years. Management's goal is to turn around Ford's weak profitability in non-North American markets via a major shift in capital allocation priorities.

Specifically, the vast majority of future investments will focus on trucks, SUVs, and commercial vehicles, which represent Ford's strongest and most profitable product lines. Management hopes the firm's redesigned vehicle-development process will begin showing results in the next year.

Ford is also reducing its footprint in Europe, scaling back in South America, and pursuing partnerships with other car makers to help it share the cost of designing new engines and electric vehicles.

By improving the returns of its weakest businesses, Ford hopes to have more capital to deploy in auto markets of the future. For example, Ford intends to invest at least $11 billion in electric vehicles by 2022, and its Mobility division is racking up annual operating losses of about $1 billion as management pours money into connectivity services and self-driving vehicle technologies.

All told, Ford expects that once the restructuring is complete and it has improved its global product mix to focus on more popular and higher-margin products, the firm's company-wide adjusted EBIT margin should roughly double to at least 8% within the next few years.

However, Ford's turnaround plan faces a number of challenges that could threaten the safety of its dividend if progress doesn't go as planned.

Key Risks

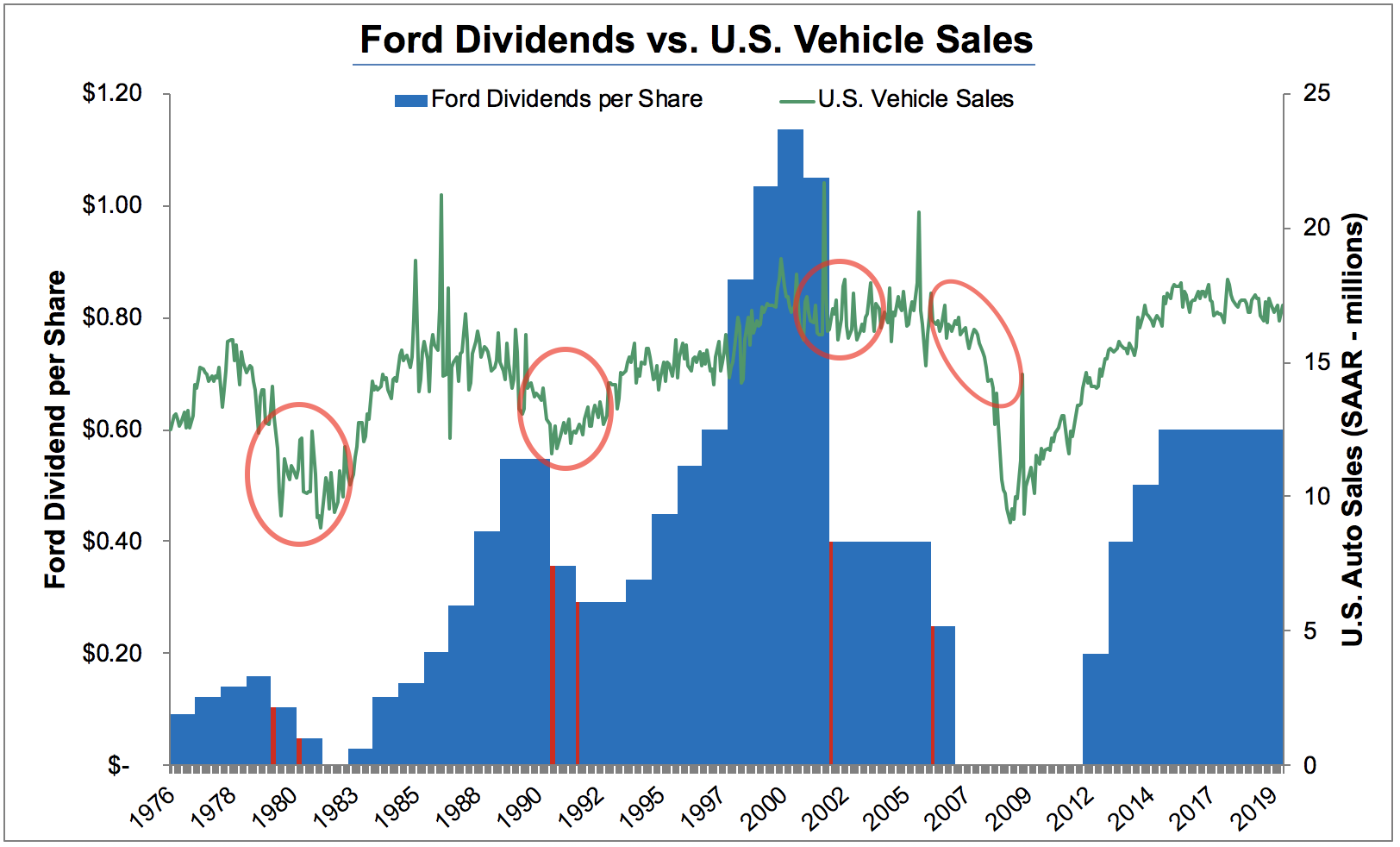

Ford paid out its first dividend in 1956, but the company’s track record leaves a lot to be desired. In fact, since 1980 the company has cut its dividend four times.

The chart below depicts the seasonally adjusted annual rate (SAAR) of U.S. auto sales (green line) and Ford’s total dividends paid (blue bars) from 1976 through late 2019. The red circles denote periods when Ford reduced its dividend and are wrapped around the trend observed in U.S. vehicle sales during those times.

In each case, weak industry conditions drove Ford's dividend reduction.

The chart below depicts the seasonally adjusted annual rate (SAAR) of U.S. auto sales (green line) and Ford’s total dividends paid (blue bars) from 1976 through late 2019. The red circles denote periods when Ford reduced its dividend and are wrapped around the trend observed in U.S. vehicle sales during those times.

In each case, weak industry conditions drove Ford's dividend reduction.

Investors are understandably concerned by Ford's weak operational performance during a period of strong demand for vehicles. The business generated $2.8 billion in adjusted free cash flow in 2018 and expects to do better in 2019.

However, after reducing Ford's free cash flow to account for its cash restructuring costs and pension contributions, the company is not generating enough free cash flow to cover its $2.4 billion annual dividend commitment.

A cyclical downturn would place even greater strain on the business as it works on improving its profitability and makes major investments for the future.

Ford's saving grace has been its strong balance sheet. The company is committed to an investment-grade credit rating and maintains a cash balance and liquidity above its targets of $20 billion and $30 billion, respectively.

Regardless, credit rating agencies aren't thrilled that Ford's weak performance and high restructuring costs are forcing it to pay its dividend using cash on the balance sheet rather than use operating cash flow generated by its business. In fact, in September 2019 Moody's downgraded Ford's credit rating to junk status.

Should management's restructuring plan and vehicle design efforts fail to turn around Ford's cash flow, or perhaps be disrupted by a global downturn in auto sales, then Ford may have to consider cutting its dividend to protect its credit rating from being downgraded at the other agencies.

On Ford's fourth-quarter 2018 earnings call, management stated that the dividend's safety ultimately hinges on the company's ability to improve its cash flow generation in the future. The balance sheet is strong and supports the dividend during this period of investment, but the dividend's safety really depends on management's forward-looking assessment of the company's earning power:

"The balance sheet is very strong, and we deliberately are running the cash and the liquidity at levels that are above our target, in part because we saw this period of lower cash generation on the horizon, and so we've been planning on that. But at the end of the day, what we as a team have to do is deliver stronger operating performance, and that operating performance includes stronger cash flow...

It's not so binary...if we didn't pay the dividend, we've got $25 billion of cash, I mean, it's really a question, it's not that cash level, it's the ability of the business to generate, as we look ahead, positive cash flow. And we think we are going to be able to do that to a degree that is above and beyond what we delivered in 2018." – CFO Bob Shanks

In prior quarters, when talking about the company's restructuring plans, management made comments that were supportive of the dividend as well:

“It's important to highlight that we believe we can fund these cash effects without impinging on our other capital outlays including investments for growth and our regular dividend.”

While the company's strong balance sheet suggests the dividend can be maintained for now even as Ford throws more cash at its restructuring plan, investors need to closely monitor management's efforts to improve the company's operating performance if the dividend is to remain secure in the long term.

Meanwhile, Ford faces both opportunities and potential disruption from the industry's anticipated move towards electric vehicles, self-driving cars, and mobility services such as ridesharing. Ford is pouring a lot of money into these areas, but it's uncertain how big these markets will be, how quickly they will grow, and what market share Ford will achieve.

After all, crosstown rival GM's Cruise Automation appears to be ahead of Ford in driverless cars, and Tesla and Alphabet's Waymo represent savvy competitors as well. With so many large and well-funded rivals to contend with, there is no guarantee that Ford's dreams of winning significant market share in autonomous driving and vehicle management services will ever actually come true.

Meanwhile, Ford faces both opportunities and potential disruption from the industry's anticipated move towards electric vehicles, self-driving cars, and mobility services such as ridesharing. Ford is pouring a lot of money into these areas, but it's uncertain how big these markets will be, how quickly they will grow, and what market share Ford will achieve.

After all, crosstown rival GM's Cruise Automation appears to be ahead of Ford in driverless cars, and Tesla and Alphabet's Waymo represent savvy competitors as well. With so many large and well-funded rivals to contend with, there is no guarantee that Ford's dreams of winning significant market share in autonomous driving and vehicle management services will ever actually come true.

Closing Thoughts on Ford

Ford is largely a “show me” story as management seeks to restore credibility with investors (optimizing Ford’s product portfolio and geographic footprint is no small task), prove itself during the next dip in U.S. vehicle sales, and adapt the company’s business model to a long-term future that could require fewer cars.

At the end of the day, the auto industry is one that is generally not well suited to paying safe and growing dividends. The cutthroat nature of the industry, high capital costs, and cyclical demand trends have resulted in dividend cuts being a common occurrence in the past. When combined with the uncertainty that the industry's business model faces going forward (from autonomous cars), payout cuts could continue to be an issue for weaker players.

At the end of the day, the auto industry is one that is generally not well suited to paying safe and growing dividends. The cutthroat nature of the industry, high capital costs, and cyclical demand trends have resulted in dividend cuts being a common occurrence in the past. When combined with the uncertainty that the industry's business model faces going forward (from autonomous cars), payout cuts could continue to be an issue for weaker players.

While income investors will continue to be attracted to Ford’s high dividend yield, this is still volatile stock that will get whacked during the next downturn – even if the dividend remains safe. Until management shows sustained improvement in Ford's cash flow generation and signs that the firm's investments for the future are working, the company faces a relatively wide range of potential outcomes.

Ford’s stock often looks “cheap” due to these concerns, but an investment in the carmaker is not for the faint of heart. Conservative investors, especially those focused on capital preservation, are likely better served avoiding this stock, or at least keeping it as a relatively small position as part of a well-diversified portfolio.