Royal Bank of Canada: Paying Dividends Every Year Since 1870

With roots tracing back to the 1860s, Royal Bank of Canada (RY), or RBC, is one of the oldest and largest banks in the world. The firm is well-diversified across businesses, geographies, and client segments, serving 16 million customers across Canada, the U.S., and more than 30 other countries.

RBC operates through five business segments:

- Personal & Commercial Banking (49% of earnings): provides a broad suite of financial products and services to individuals and businesses for their banking, investing, and financing needs. Offerings include home mortgages, personal loans, checking and savings accounts, mutual funds, credit cards, auto financing, and commercial loans.

- Capital Markets (22% of earnings): RBC is one of the top 10 largest investment banks in the world with with core markets across Canada, the U.S. and the U.K./Europe.

- Wealth Management (18% of earnings): a top 5 wealth manager by assets, RBC offers a suite of investment, trust, banking, credit, and other wealth management solutions and asset management products retail investors and institutional clients.

- Insurance (6% of earnings): provides a wide range of life, health, home, auto, travel, creditor, and wealth accumulation solutions.

- Investor and Treasury Services (5% of earnings): provides asset, transaction banking, treasury, and other services to safeguard client assets.

In total, net interest income (i.e. lending) accounts for 42% of the bank's revenue, with non-interest income activities such as M&A advice, investment management, insurance products, and custodial services accounting for the other 58%.

By geography, approximately 62% of RBC's revenue is derived from Canada, followed by the U.S. (23%) and international markets (15%).

RBC has paid dividends to shareholders every year since 1870, boasting one of the longest track records in the market.

Business Analysis

Banking is largely a commodity product, with consumers and businesses seeking access to dependable financing at the lowest interest rate possible. Banks with the largest low-cost deposit bases (i.e. cheap sources of funding to use for lending), most efficient operations, and conservative risk management practices tend to be best off.

RBC checks all of these boxes but also benefits from generating over 60% of its revenue in Canada, where the banking sector is especially favorable. Canada's banks are known for their stability, even sailing through the global financial crisis with relative ease (no Canadian banks failed or required government bailouts).

In fact, Canada hasn't had a banking crisis since 1840, largely due to strict regulations that cement the largest banks as an effective oligopoly. According to Department of Finance Canada, the country's six largest banks command more than 90% of market share, resulting in substantial pricing power and a more rational competitive environment.

RBC checks all of these boxes but also benefits from generating over 60% of its revenue in Canada, where the banking sector is especially favorable. Canada's banks are known for their stability, even sailing through the global financial crisis with relative ease (no Canadian banks failed or required government bailouts).

In fact, Canada hasn't had a banking crisis since 1840, largely due to strict regulations that cement the largest banks as an effective oligopoly. According to Department of Finance Canada, the country's six largest banks command more than 90% of market share, resulting in substantial pricing power and a more rational competitive environment.

This concentration of power is partly driven by Canadian regulators who have set strict underwriting and credit standards, while also forcing banks to eat more of their own cooking. For example, Canadian banks are required by law to hold more loans (including mortgages) on their own books, rather than securitize (i.e. sell) them to third parties. As a result, lending practices tend to be more conservative.

Home mortgages, which account for nearly 50% of RBC's total loans, also require a minimum downpayment of 5%, and any mortgage without at least 20% down payment requires default insurance. Mortgage interest is also not tax deductible in Canada, reducing the incentive for consumers to borrow and delay repayments.

Besides mortgage rules, stricter credit score lending standards are also in place because the Canadian government requires mortgage loan insurance when a home buyer has less than a 20% downpayment. These conservative practices are one reason why Canadian banks suffered far less than many other financial institutions in 2008-2009.

Besides mortgage rules, stricter credit score lending standards are also in place because the Canadian government requires mortgage loan insurance when a home buyer has less than a 20% downpayment. These conservative practices are one reason why Canadian banks suffered far less than many other financial institutions in 2008-2009.

When combined with their impressive scale and geographic diversification across the country, Canada's largest banks enjoy durable competitive advantages, despite offering similar products and prices.

These behemoths enjoy some of the lowest cost sources of funding (massive deposit bases paying little interest), have thousands of retail locations across the country to cheaply acquire new customers, and have expanded their operations into hundreds of different product lines to continue growing. Smaller rivals struggle to compete with the giants' prices, services breadth, and reputation.

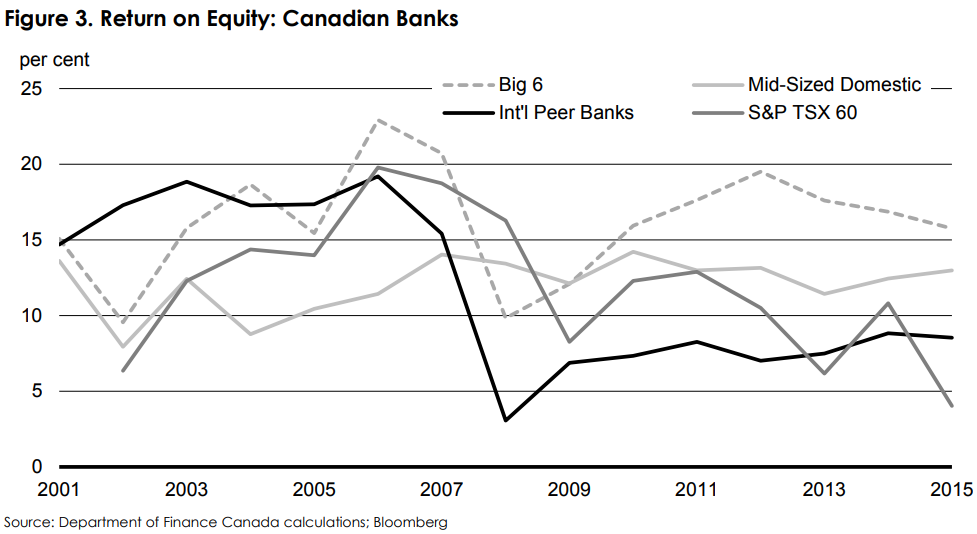

As you can see below, Canada's big six banks (the dashed line) have generated solid profitability throughout all types of economic environments for many years. They have also earned a superior return on equity compared to smaller Canadian banks, international peers, and the corporate sector overall.

RBC is a particularly strong bank since it boasts the largest branch network, the most ATMs, and one of the largest mobile sales networks across Canada. Thanks to its substantial distribution network, RBC enjoys No. 1 or No. 2 market share positions in all key categories of Canadian retail banking, including personal lending, credit cards, long-term mutual funds, and business loans.

Not only can the firm cross-sell various transaction accounts, investments, and borrowing products across its large base of customers to drive higher recurring revenue over time, but its sticky retail business has also resulted in one of the biggest personal and business deposit bases in the industry.

This low-cost deposit base provides cheap financing for RBC's lending operations, helping the bank earn a healthy spread on the loans it makes even when long-term interest rates remain low.

RBC's balance sheet is another strength. The bank's capital levels are maintained well above minimum regulatory requirements to ensure the firm can weather any economic storm and remain solvent (i.e. not need a bailout). RBC also earns a solid AA- credit rating from Standard & Poor's.

Outside of its lending operations, RBC is dominant in asset management and investment banking. For example, the firm is the 10th largest global investment bank by fees and a top-five wealth manager globally. Management hopes to expand these businesses going forward, especially in the U.S. market which has a population nearly nine times the population of Canada.

All told, RBC expects its continued efforts to result in at least 7% annual EPS growth over the medium term. Dividend growth will likely track earnings growth.

Overall, Royal Bank of Canada is one of the world's best run, most conservative, and most profitable banks. The firm's disciplined management team, leading market share positions, low-cost deposit base, and diversified portfolio all help ensure that RBC remains a dominant force in banking for many years to come.

However, all banks have certain risks that investors need to be aware of.

Key Risks

First, note that as a Canadian company, RBC pays its dividend in Canadian dollars. This creates some currency risk in that a stronger U.S. dollar might decrease the effective dividend amount for American shareholders, at least in the short term (each quarterly dividend is converted from Canadian dollars to U.S. dollars when it is paid, based on prevailing exchange rates).

In addition, like all Canadian stocks, U.S. RBC investors face a 15% foreign dividend tax withholding. Tax treaties between the U.S. and Canada allow U.S. investors to potentially recoup this withholding, but it can be a complicated and lengthy amount of paperwork at tax time.

As for risks to the bank itself, there are several to consider. Like all banks, Royal Bank of Canada's earnings are tied to the financial health of the economies in which it operates, with Canada being the most important.

Compared to America, Canada's economy is more dependent on the volatile mining, oil, and gas industries, which are tied to cyclical commodity prices. Canadian consumers are also highly indebted, and some investors worry about a potential property bubble in the country (RBC has higher exposure to home mortgages than the other major Canadian banks).

Fortunately, higher loan default rates seem very unlikely to put RBC at risk of failure. For example, in 2008, 2009, and 2016 (oil crash), the bank's earnings fell 13%, 26%, and 6%, respectively. Throughout these challenging economic times, the bank remained highly profitable, and its dividend payout ratio never exceeded 42%.

However, RBC's dividend was frozen during the financial crisis, so investors owning even the best Canadian banks need to be prepared for potential dividend freezes in future downturns.

Besides the bank's sensitivity to economic cycles and the Canadian housing market, RBC also faces regulatory risks. Canadian and U.S. regulators can raise banks' capital requirements, potentially lowering their profitability in an effort to reduce systemic risk. Such actions could slow the bank's earnings growth and make it difficult for RBC to hit its 16% return on equity target.

However, RBC's lean operations, impressive scale, and diversified mix of products and services likely position it better than almost all of its peers in such a scenario. Overall, barring a black swan type of scenario, Royal Bank of Canada seems unlikely to actually lose money due to economic headwinds or regulatory changes due to its conservative banking practices.

Besides the bank's sensitivity to economic cycles and the Canadian housing market, RBC also faces regulatory risks. Canadian and U.S. regulators can raise banks' capital requirements, potentially lowering their profitability in an effort to reduce systemic risk. Such actions could slow the bank's earnings growth and make it difficult for RBC to hit its 16% return on equity target.

However, RBC's lean operations, impressive scale, and diversified mix of products and services likely position it better than almost all of its peers in such a scenario. Overall, barring a black swan type of scenario, Royal Bank of Canada seems unlikely to actually lose money due to economic headwinds or regulatory changes due to its conservative banking practices.

Closing Thoughts on Royal Bank of Canada

U.S. banks violated the trust of their shareholders (and their customers) by taking extreme risks that nearly destroyed the global financial system a decade ago. And since banks are highly opaque and complex institutions, some investors prefer to avoid the sector entirely.

With that said, Canadian banking is a different business that could appeal to even some conservative dividend investors. Strict regulatory oversight and an explicit oligopolistic mandate from the government have created enduring competitive advantages for Canada's biggest banks.

As the largest player, RBC enjoys a number of strengths including excellent economies of scale, a very conservative balance sheet, disciplined loan underwriting standards, strong market share positions, access to cheap capital, and numerous opportunities for long-term growth.

As the largest player, RBC enjoys a number of strengths including excellent economies of scale, a very conservative balance sheet, disciplined loan underwriting standards, strong market share positions, access to cheap capital, and numerous opportunities for long-term growth.

Royal Bank of Canada seems likely to be one of the most resilient banks during the next economic downturn. Given the bank's shareholder-friendly culture, RBC could be a dividend growth stock to consider for investors who are comfortable accepting some of the murkier risks inherent to the banking industry.