Management Shakeup Further Dims GE's Dividend Outlook

On October 1, GE announced it was firing CEO John Flannery after just 14 months in the top office. That's compared to 20- and 16-year tenures for Jack Welch and Jeffrey Immelt, respectively.

The surprise news sent shares up 13% at one point because the new CEO, Lawrence Culp, had a great track record as CEO of industrial rival Danaher (DHR). In fact, from 2000 to 2014 Danaher's shares rose 500% under his watch. (GE's share price declined more than 50% during the same time period.)

However, every major management change comes with its own risks, including potential changes in corporate strategy which is why this news likely heightens the risk of yet another dividend cut at this beleaguered industrial giant.

Let's take a closer look at GE's managerial change and what it means for the company stock going forward.

The surprise news sent shares up 13% at one point because the new CEO, Lawrence Culp, had a great track record as CEO of industrial rival Danaher (DHR). In fact, from 2000 to 2014 Danaher's shares rose 500% under his watch. (GE's share price declined more than 50% during the same time period.)

However, every major management change comes with its own risks, including potential changes in corporate strategy which is why this news likely heightens the risk of yet another dividend cut at this beleaguered industrial giant.

Let's take a closer look at GE's managerial change and what it means for the company stock going forward.

A New and Proven CEO, But Troubled Turnaround Plan Remains In Effect

As CEO of Danaher, Culp was famous for buying undervalued, underperforming industrial assets from other companies and then turning them around.

However, while Culp brings hope of an eventually successful GE turnaround because he's a company outsider (joined GE board in April 2018), it's important to note that he likely won't be able to use the same strategy for this fallen industrial conglomerate.

However, while Culp brings hope of an eventually successful GE turnaround because he's a company outsider (joined GE board in April 2018), it's important to note that he likely won't be able to use the same strategy for this fallen industrial conglomerate.

That's because most analysts expect that Culp will likely continue Flannery's latest strategic plan, which was unveiled in June 2018 and came after the company's 50% dividend cut in November of 2017.

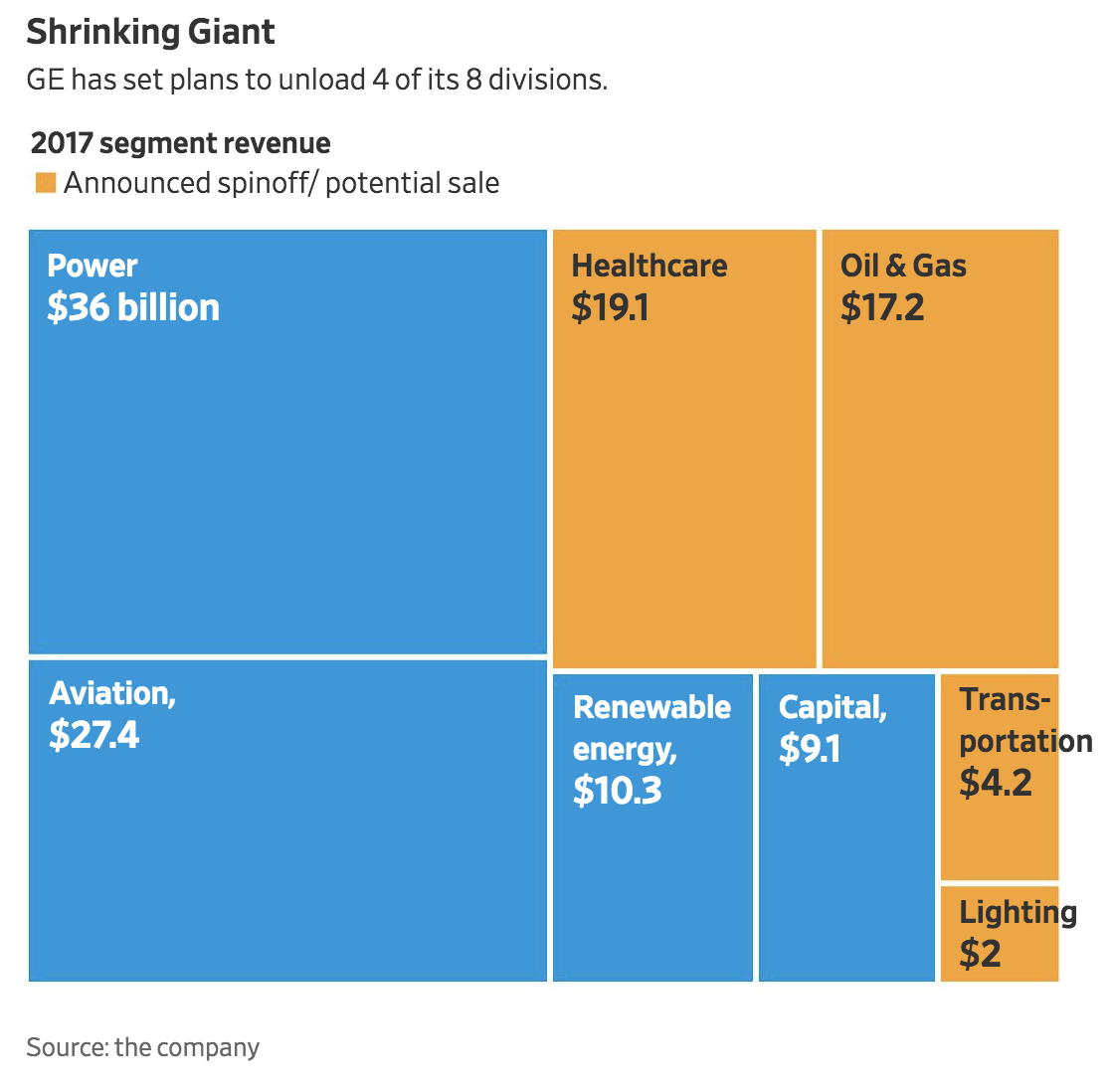

Specifically, GE is focused on shedding assets to shrink its focus to producing jet engines, power generation equipment, and wind power turbines. The company also plans to hold onto the remaining part of GE Capital that finances customer purchases for these divisions.

Essentially, the firm's plan to divest assets, including a spin-off of GE Healthcare in 2019, and try to ring out as much manufacturing and development synergies as it can from its turbine businesses, is likely to still be in effect under Culp. That's because GE's massive debt burden (more on this in a moment) makes new acquisitions very challenging.

Specifically, GE is focused on shedding assets to shrink its focus to producing jet engines, power generation equipment, and wind power turbines. The company also plans to hold onto the remaining part of GE Capital that finances customer purchases for these divisions.

Essentially, the firm's plan to divest assets, including a spin-off of GE Healthcare in 2019, and try to ring out as much manufacturing and development synergies as it can from its turbine businesses, is likely to still be in effect under Culp. That's because GE's massive debt burden (more on this in a moment) makes new acquisitions very challenging.

If GE's long-term strategy is likely to remain in effect, then GE's prospects as a dividend growth stock remain murky, with another dividend cut all but assured.

GE's Dividend Remains Under Pressure and an Eventual Cut Is Inevitable

Along with the announcement of its new CEO, GE dropped an unpleasant bit of news on investors. Back in June (the firm's latest strategic update), GE warned that its previous free cash flow guidance of $6 billion to $7 billion for 2018 was likely to come in at the low end of guidance.

When announcing the firing of Flannery, the company completely abandoned that guidance, which means that industrial free cash flow is now all but certain to come in under $6 billion this year. Note that today GE's dividend costs it $4.2 billion annually, so that means the firm's free cash flow payout ratio for 2018 was already going to be at least 70%, and now it could even exceed 100% depending on the magnitude of the reduction in cash flow that management will soon clarify.

When announcing the firing of Flannery, the company completely abandoned that guidance, which means that industrial free cash flow is now all but certain to come in under $6 billion this year. Note that today GE's dividend costs it $4.2 billion annually, so that means the firm's free cash flow payout ratio for 2018 was already going to be at least 70%, and now it could even exceed 100% depending on the magnitude of the reduction in cash flow that management will soon clarify.

The cash flow shortfall is largely due to continued troubles at GE Power (electrical turbine division), which has been facing numerous problems including oversupply and falling pricing power due to an accelerating switch to clean energy. Despite its size, GE is not the leader in this power turbines or in wind power.

Meanwhile, the spin-off of its attractive GE Healthcare business, plus the sale of its transportation and lighting business (as well as its 62.5% stake in oil service giant Baker Hughes), means that GE's revenue will decline by more than 30% going forward, and that's assuming it can eventually stabilize GE Power.

Why is GE spinning off its attractive healthcare business? Simply put, the company faces a lot of financial pressure due to a number of terrible capital allocation decisions that were made over the years.

That included overpaying for assets like buying Alstrom's power and grid unit for $10.6 billion in 2015. This deal was GE's largest industrial acquisition ever, but along with the CEO replacement announcement, the company stated it was writing off $23 billion in goodwill, almost all from GE Power.

Effectively, GE is taking a one-time $23 billion non-cash charge because it's admitting that nearly all of its power acquisitions over the years have been failures that it overpaid for.

That included overpaying for assets like buying Alstrom's power and grid unit for $10.6 billion in 2015. This deal was GE's largest industrial acquisition ever, but along with the CEO replacement announcement, the company stated it was writing off $23 billion in goodwill, almost all from GE Power.

Effectively, GE is taking a one-time $23 billion non-cash charge because it's admitting that nearly all of its power acquisitions over the years have been failures that it overpaid for.

It's also worth noting that the new GE Healthcare is being spun off with $18 billion in debt and pension obligations. Thus in order to eliminate a significant amount of debt, the company is giving up a business that generated about 30% of its operating cash flow in 2017.

Culp told investors during his hiring press conference that "we will be working very hard in the coming weeks to drive superior execution, and we will move with urgency. We remain committed to strengthening the balance sheet including deleveraging."

GE previously stated it hopes to reduce its debt by $25 billion by the end of 2020, which would lower its industrial division’s net debt to EBITDA leverage ratio from 3.5x to less than 2.5x. Monetizing some of its assets and unloading some of its liabilities on its healthcare spin-off will help.

Culp told investors during his hiring press conference that "we will be working very hard in the coming weeks to drive superior execution, and we will move with urgency. We remain committed to strengthening the balance sheet including deleveraging."

GE previously stated it hopes to reduce its debt by $25 billion by the end of 2020, which would lower its industrial division’s net debt to EBITDA leverage ratio from 3.5x to less than 2.5x. Monetizing some of its assets and unloading some of its liabilities on its healthcare spin-off will help.

This focus on drastically cutting debt is needed because GE has over $100 billion in interest bearing liabilities, $30 billion in unfunded pension liabilities, and a $15 billion insurance reserve shortfall which was announced in January 2018. With only a couple billion dollars of free cash flow remaining after paying dividends each year, those figures are even more daunting.

After news of the company's write-down, S&P downgraded GE's debt from A- to BBB+. Moody's also put the company on a negative outlook (possible downgrade coming), citing concerns over falling cash flows and continued high debt and pension liabilities.

In a rising rate environment, such large debt burdens could make it hard for GE to reinvest in growing its remaining core businesses while maintaining any sort of meaningful dividend. That's particularly true given if GE Power does not see a significant turnaround for several more years.

After news of the company's write-down, S&P downgraded GE's debt from A- to BBB+. Moody's also put the company on a negative outlook (possible downgrade coming), citing concerns over falling cash flows and continued high debt and pension liabilities.

In a rising rate environment, such large debt burdens could make it hard for GE to reinvest in growing its remaining core businesses while maintaining any sort of meaningful dividend. That's particularly true given if GE Power does not see a significant turnaround for several more years.

Back in June, Flannery warned investors that "given the typically lower payout ratios in the health-care industry this [healthcare spinoff] will likely lead to a reduction in the aggregate GE dividend at that time."

Given the much smaller size of GE's future cash flow, investors can likely expect anywhere from a 15% to 35% dividend cut once that spin-off occurs (see our June 2018 note for more details). But what about the potential for another dividend cut before the spin-off?

With a new CEO at the helm and the distressed state of GE's balance sheet and cash flow situation, there is always the risk that another dividend cut might be announced soon.

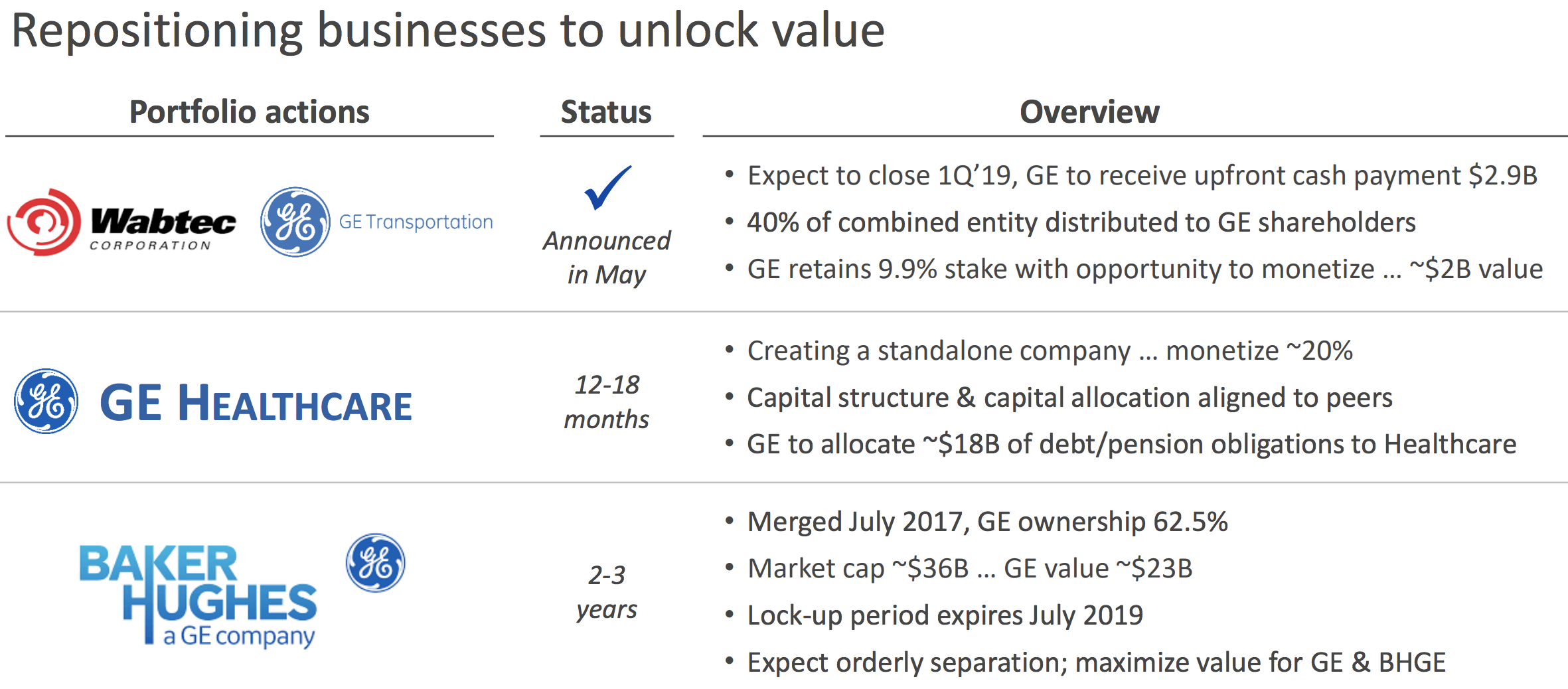

On the bright side, GE has several levers it can pull to improve its financial situation while attempting to maintain its dividend. For example, asset sales are expected to provide much-needed cash:

Given the much smaller size of GE's future cash flow, investors can likely expect anywhere from a 15% to 35% dividend cut once that spin-off occurs (see our June 2018 note for more details). But what about the potential for another dividend cut before the spin-off?

With a new CEO at the helm and the distressed state of GE's balance sheet and cash flow situation, there is always the risk that another dividend cut might be announced soon.

On the bright side, GE has several levers it can pull to improve its financial situation while attempting to maintain its dividend. For example, asset sales are expected to provide much-needed cash:

- Sale of distributed power business (closing Q4 2018) will net over $1 billion

- Recent sale of IT healthcare business for $1.1 billion

- Transportation sale/spin-off (Wabtec deal) will provide $2.9 billion in cash and $1.9 billion in stock that can be sold to pay down debt

Also keep in mind that GE has said it plans to sell off 20% of the shares of GE Healthcare that it will own after spinning off the healthcare division. This action will provide billions of dollars that can further chip away at the company's large debt pile.

And while GE Power is struggling, and GE Renewable Energy is too small to significantly move the needle for several years, GE Aviation is a crown jewel, with at least 50% market share in narrow body and wide body jet engines.

Since GE aviation will account for about 70% of the company's post spin-off/divestiture profits, this thriving (but cyclical) business could mean that GE won't have to cut its dividend ahead of the GE healthcare spin-off.

However, given the company's disappointing cash flow, credit rating pressure, mountain of debt, uncomfortably tight payout ratio, complicated non-GAAP accounting measures, and leadership change intended to accelerate the company's turnaround, a more significant cut to the dividend would provide much greater breathing room and not be surprising at this point.

Since GE aviation will account for about 70% of the company's post spin-off/divestiture profits, this thriving (but cyclical) business could mean that GE won't have to cut its dividend ahead of the GE healthcare spin-off.

However, given the company's disappointing cash flow, credit rating pressure, mountain of debt, uncomfortably tight payout ratio, complicated non-GAAP accounting measures, and leadership change intended to accelerate the company's turnaround, a more significant cut to the dividend would provide much greater breathing room and not be surprising at this point.

Closing Thoughts on GE's New Leadership

GE's business deterioration over the past decade has been epic, with the company shedding $500 billion in market cap since its all-time high in 2000. Poor management decisions, including devoting tens of billions of dollars to buybacks and disastrous acquisitions, plus continued overhang from GE Capital's legacy insurance products, have all combined to necessitate one of the most drastic corporate restructurings in American history.

Under the more proven leadership of Lawrence Culp, GE appears to have a better chance of eventually turning around its three remaining core turbine businesses. That being said, investors need to realize that GE's troubles are far from over. This is an extremely complicated business with intertwined operations that won't be easy to optimize, even for Culp who did not have much experience with divestitures while at Danaher.

Furthermore, while the healthcare spin-off and asset sales will likely be complete in 2019, it could take several years for GE Power to stabilize its revenues and cash flow. Meanwhile, the company's large debt burden and unfunded pension liabilities, in conjunction with lower credit ratings in a rising rate environment, could weigh on the safety and long-term growth prospects of its dividend, which will almost certainly be reduced in 2019 following the healthcare spin-off.

At the end of the day, GE remains a speculative income stock. Under new leadership, a more severe reset of the dividend is certainly a possibility given the state of the business. The company next reports results on October 30, when Culp will share his "initial observations" on GE. However, more details are not expected until early 2019, so dividend investors will likely be kept in suspense for now.

Furthermore, while the healthcare spin-off and asset sales will likely be complete in 2019, it could take several years for GE Power to stabilize its revenues and cash flow. Meanwhile, the company's large debt burden and unfunded pension liabilities, in conjunction with lower credit ratings in a rising rate environment, could weigh on the safety and long-term growth prospects of its dividend, which will almost certainly be reduced in 2019 following the healthcare spin-off.

At the end of the day, GE remains a speculative income stock. Under new leadership, a more severe reset of the dividend is certainly a possibility given the state of the business. The company next reports results on October 30, when Culp will share his "initial observations" on GE. However, more details are not expected until early 2019, so dividend investors will likely be kept in suspense for now.